5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do: Thoroughly Undertake Due Diligence

Due diligence is the cornerstone of successful private debt investment. A thorough process significantly mitigates risk and enhances the potential for strong returns. This involves two critical aspects: credit analysis and legal review.

Credit Analysis is Paramount:

Comprehensive credit analysis of potential borrowers is paramount in the private credit market. This goes beyond simply reviewing financial statements. It demands a deep dive into the borrower's financial health and future prospects.

- Independently verify information provided by borrowers. Don't rely solely on the borrower's self-reported data. Conduct your own independent verification through third-party sources.

- Assess the borrower's management team and their track record. A strong management team with a proven history of success is crucial for a borrower's ability to repay their debt. Analyze their experience, expertise, and overall leadership capabilities.

- Consider stress testing the borrower's financial model under various economic scenarios. Anticipate potential economic downturns and assess the borrower's resilience to adverse conditions. This helps you understand the robustness of your investment.

Keywords: Private debt investment, credit risk assessment, due diligence process

Legal and Structural Review:

Engaging experienced legal counsel is non-negotiable. A thorough legal review safeguards your investment and ensures the transaction is structured appropriately.

- Pay close attention to covenants, security, and other protective measures. These provisions are crucial for protecting your investment in case of default. Ensure they are robust and effectively protect your interests.

- Understand the implications of different legal jurisdictions. If the borrower operates across multiple jurisdictions, the legal complexities increase significantly. Ensure you understand the applicable laws and regulations in each jurisdiction.

- Ensure proper documentation and compliance with all relevant regulations. Maintain meticulous records and adhere to all legal and regulatory requirements throughout the investment process.

Keywords: Legal review, private credit lending, transaction structuring

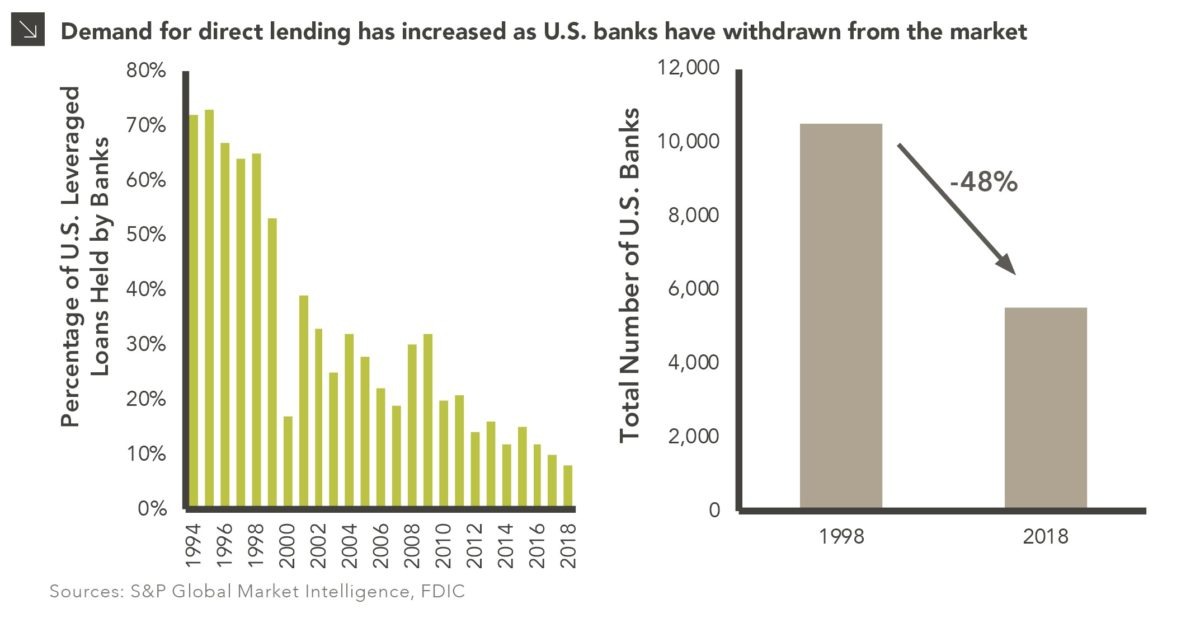

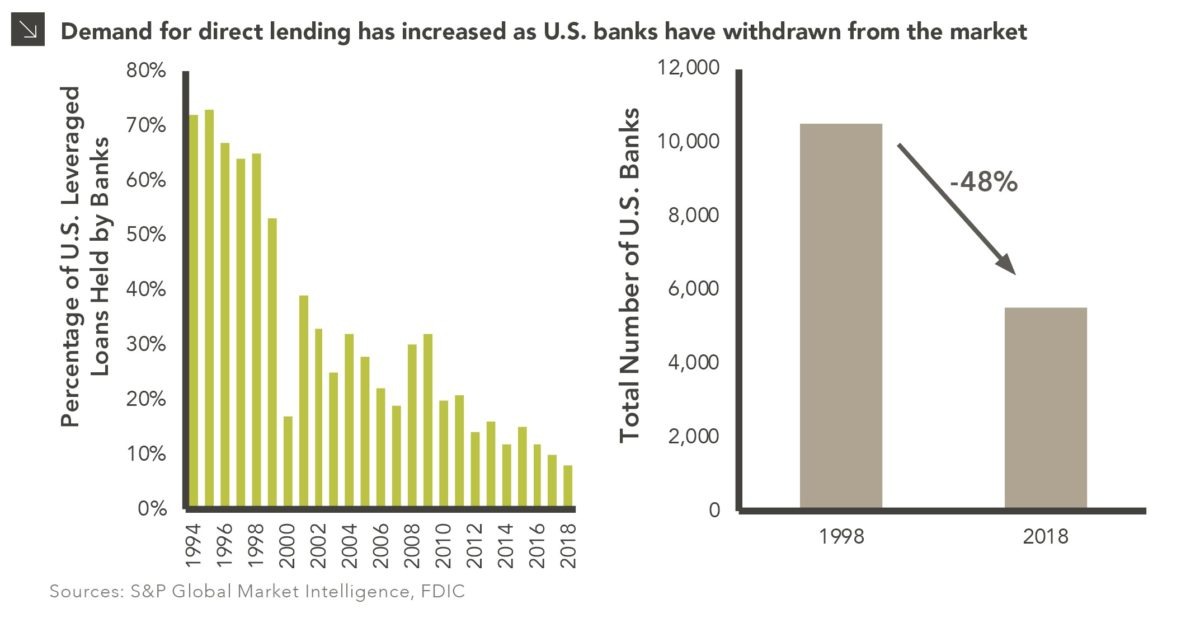

Don't: Neglect Market Research and Trend Analysis

Ignoring market dynamics is a recipe for disaster in the private credit market. Staying informed is crucial for making sound investment decisions.

Understand Market Cycles:

The private credit market is cyclical. Understanding these cycles is essential for timing investments and managing risk effectively.

- Monitor interest rate changes and their effect on borrowing costs. Interest rate fluctuations directly impact borrowing costs and the overall attractiveness of private credit investments.

- Assess the overall credit risk appetite of the market. The market's risk tolerance varies over time. Understanding this helps you determine the appropriate level of risk to take in your investments.

- Identify emerging trends and opportunities. Staying ahead of the curve requires continuous monitoring of market trends and identifying new opportunities.

Keywords: Market analysis, private credit trends, interest rate risk

Overlook Competitive Landscape:

Understanding your competitors is as vital as understanding the market itself. Knowing their strategies and strengths helps you differentiate your approach.

- Identify areas of specialization within the private credit market. Focusing on niche markets can provide a competitive advantage.

- Analyze pricing models and competitive advantages. Understanding pricing dynamics and developing a competitive pricing strategy is critical.

- Understand the strengths and weaknesses of different investment approaches. Different strategies carry different levels of risk and return.

Keywords: Competitive analysis, private credit strategies, market competition

Do: Diversify Your Portfolio

Diversification is a fundamental principle of risk management in any investment strategy, and private credit is no exception.

Spread Risk Across Borrowers and Sectors:

Don't concentrate your investments in a single borrower or sector. Spread your risk across multiple borrowers, industries, and geographies.

- Allocate capital strategically to balance risk and return. Develop a well-defined allocation strategy that aligns with your risk tolerance and return objectives.

- Use a variety of investment vehicles (e.g., direct lending, funds). Different vehicles offer different levels of risk and diversification opportunities.

- Monitor portfolio performance regularly. Track your portfolio's performance and make adjustments as needed to maintain the desired level of risk and return.

Keywords: Portfolio diversification, risk management, private credit investment strategies

Don't: Underestimate the Importance of Relationship Building

In the private credit market, relationships are invaluable. They facilitate deal flow, provide access to information, and enhance risk management.

Network with Sponsors and Borrowers:

Building a strong network is essential for sourcing deals and managing your investments effectively.

- Attend industry events and conferences. Networking events are an excellent way to meet potential partners and learn about new opportunities.

- Build relationships with intermediaries, such as brokers and placement agents. These intermediaries can provide valuable insights and access to deals that might not otherwise be available.

- Cultivate strong relationships with borrowers to foster trust and cooperation. Trust is crucial for managing investments and navigating potential challenges.

Keywords: Networking, private credit relationships, deal sourcing

Do: Employ Sophisticated Risk Management Techniques

Proactive risk management is crucial for success in the private credit market. This involves both pre- and post-investment activities.

Monitor and Manage Risk:

Develop robust processes for monitoring credit risk and responding effectively to potential defaults.

- Implement early warning systems to identify potential problems. Establish systems to detect early signs of borrower distress and take prompt action.

- Have clear exit strategies in place. Develop plans for exiting investments, including potential scenarios such as default or refinancing.

- Regularly review portfolio performance and make adjustments as needed. Continuously assess your portfolio's performance and make necessary adjustments to optimize your risk-return profile.

Keywords: Risk management, private credit defaults, portfolio monitoring

Conclusion:

Succeeding in the private credit market demands a well-defined strategy, incorporating both diligent due diligence and proactive risk management. By following these essential do's and don'ts – from thorough due diligence and portfolio diversification to building strong relationships and employing sophisticated risk management techniques – you'll significantly increase your chances of achieving success in this dynamic and rewarding sector. Start building your expertise today and unlock the potential of the private credit market! Remember, mastering the nuances of private credit investment is key to generating significant returns.

Featured Posts

-

Why Florida A Cnn Anchor Shares His Go To Vacation Destination

Apr 26, 2025

Why Florida A Cnn Anchor Shares His Go To Vacation Destination

Apr 26, 2025 -

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025 -

Ray Epps Sues Fox News For Defamation Details Of The January 6th Falsehoods Lawsuit

Apr 26, 2025

Ray Epps Sues Fox News For Defamation Details Of The January 6th Falsehoods Lawsuit

Apr 26, 2025 -

Open Ai Facing Ftc Probe Concerns Over Chat Gpts Data Practices

Apr 26, 2025

Open Ai Facing Ftc Probe Concerns Over Chat Gpts Data Practices

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025