5 Key Actions To Secure A Role In The Private Credit Boom

Table of Contents

Network Strategically Within the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is crucial for securing a role, opening doors to unadvertised positions and providing invaluable insights.

Attend Industry Events and Conferences

Networking is paramount in private credit. Industry events and conferences offer unparalleled opportunities to connect with key players.

- Networking events: These smaller gatherings provide a more intimate setting for building relationships.

- Conferences focused on private credit: Events like SuperReturn and others provide access to senior professionals and the latest industry trends.

- Alternative lending conferences: Broaden your network by attending events that cover related finance areas.

Face-to-face interactions are invaluable. Use these events to learn about current trends in private credit investing, exchange business cards, and follow up with meaningful conversations.

Leverage Online Professional Networks

Online platforms are powerful networking tools. A strong online presence can significantly boost your job prospects.

- LinkedIn: Maintain a professional, updated profile highlighting your private credit expertise and experience. Actively engage in relevant groups and discussions.

- Industry-specific forums: Participate in online communities dedicated to private credit, sharing insights and engaging with other professionals.

- Online communities: Use platforms like Reddit or specialized forums to connect with peers and learn from their experiences.

Remember, your LinkedIn profile is often the first impression recruiters get. Showcase your skills and knowledge effectively.

Informational Interviews

Informational interviews are powerful tools for gaining industry insights and building relationships.

- Reaching out to professionals: Identify individuals working in private credit and politely request a brief informational interview.

- Asking insightful questions: Prepare thoughtful questions demonstrating your genuine interest and understanding of the industry.

- Showing genuine interest: Focus on learning from their experiences rather than directly asking for a job.

These conversations provide invaluable knowledge and can lead to unexpected opportunities.

Develop Specialized Skills and Knowledge in Private Credit

Possessing the right skills is essential for success in private credit. Employers seek candidates with a blend of technical expertise and industry knowledge.

Master Financial Modeling and Analysis

Proficiency in financial modeling and analysis is crucial. Employers highly value candidates with these skills.

- Advanced Excel skills: Demonstrate mastery of Excel functions relevant to financial modeling, including data manipulation and analysis.

- Financial modeling techniques: Develop expertise in creating and interpreting complex financial models, including discounted cash flow (DCF) analysis.

- Credit analysis: Sharpen your ability to assess creditworthiness, predict default probabilities, and manage credit risk.

- Valuation methods: Understand various valuation methodologies used in private credit transactions.

Strong financial modeling skills are the backbone of successful private credit investments.

Understand Legal and Regulatory Frameworks

Navigating the legal and regulatory aspects of private credit is crucial.

- Private credit regulations: Familiarize yourself with relevant regulations and compliance requirements.

- Compliance: Understand the importance of adhering to regulatory guidelines to minimize legal risks.

- Legal aspects of lending: Gain a solid understanding of the legal framework governing private credit transactions.

This knowledge protects the firm from legal issues and enhances the investor’s confidence.

Enhance Your Understanding of Specific Asset Classes

Specialization within private credit can increase your competitiveness.

- Direct lending: Understand the intricacies of lending directly to companies.

- Mezzanine financing: Learn about providing subordinated debt financing.

- Distressed debt: Develop expertise in investing in debt securities of financially troubled companies.

- Real estate debt: Gain knowledge of lending secured by real estate assets.

Consider obtaining relevant certifications like the CFA charter to enhance your credibility.

Tailor Your Resume and Cover Letter to Private Credit Roles

Your resume and cover letter are your first impression. Tailoring them to specific roles is vital.

Highlight Relevant Experience

Showcase achievements and skills relevant to private credit.

- Quantifiable achievements: Use numbers to demonstrate your impact in previous roles.

- Relevant keywords: Incorporate keywords commonly used in private credit job descriptions.

- Showcasing skills: Highlight skills such as financial modeling, credit analysis, and due diligence.

Even if your experience is from a different industry, focus on transferable skills.

Use Targeted Keywords

Optimize your application materials for Applicant Tracking Systems (ATS).

- Keywords: Use relevant keywords like "private credit," "direct lending," "credit analysis," "financial modeling," "distressed debt," and "mezzanine financing."

- ATS optimization: Structure your resume and cover letter to maximize the chances of your application being flagged by ATS.

This ensures your application doesn't get overlooked by automated systems.

Showcase Your Understanding of the Industry

Demonstrate genuine interest in private credit.

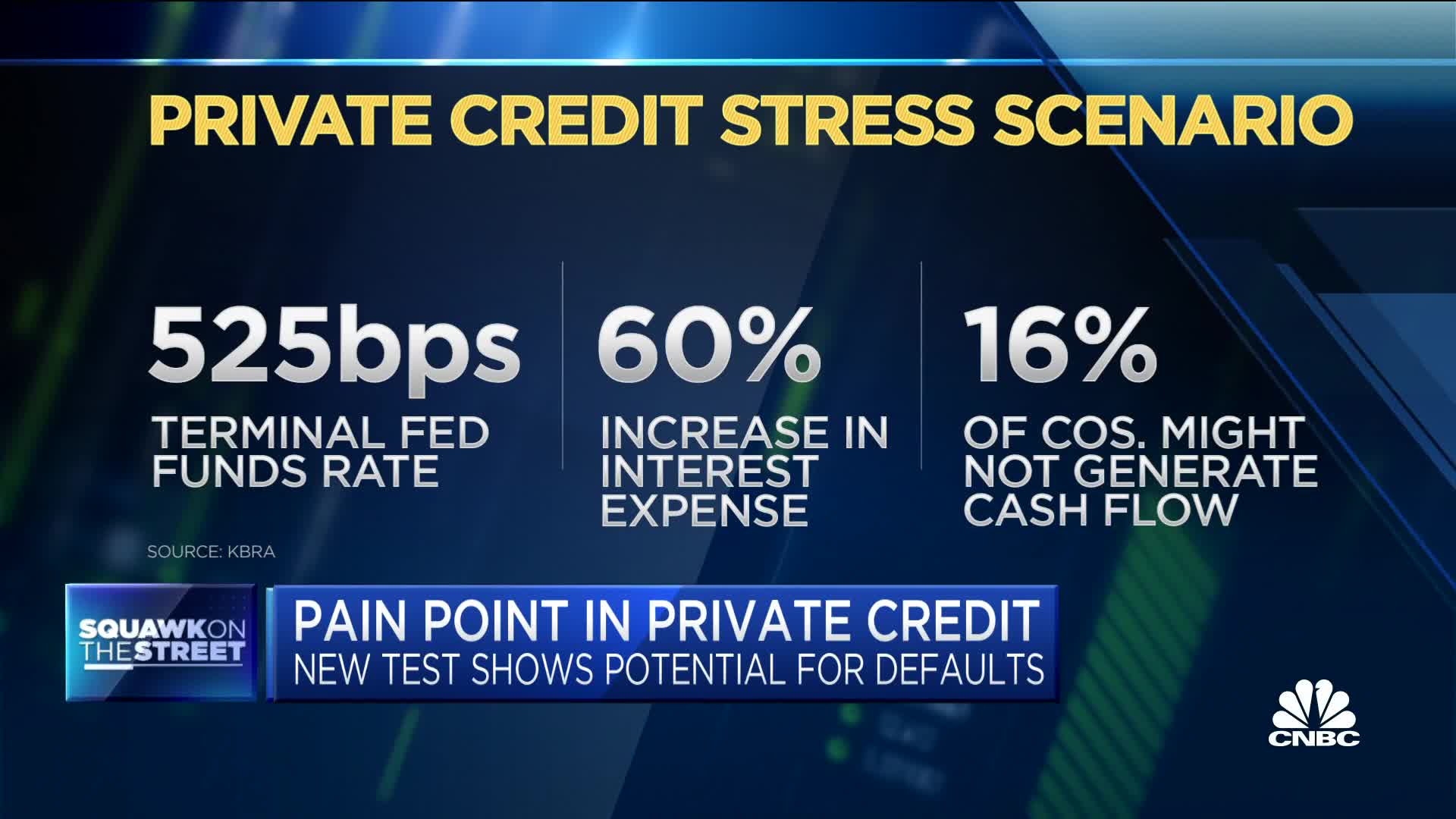

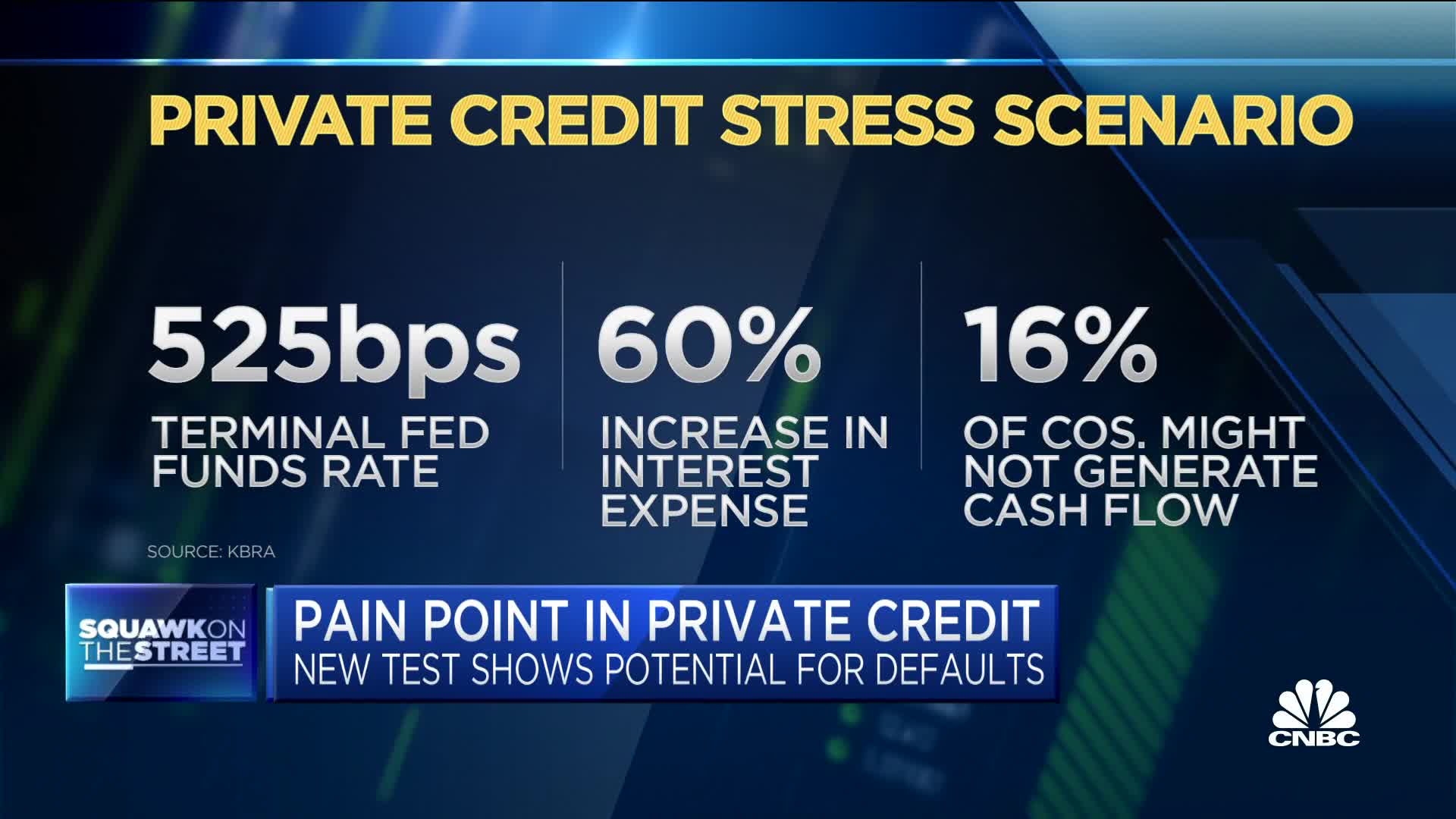

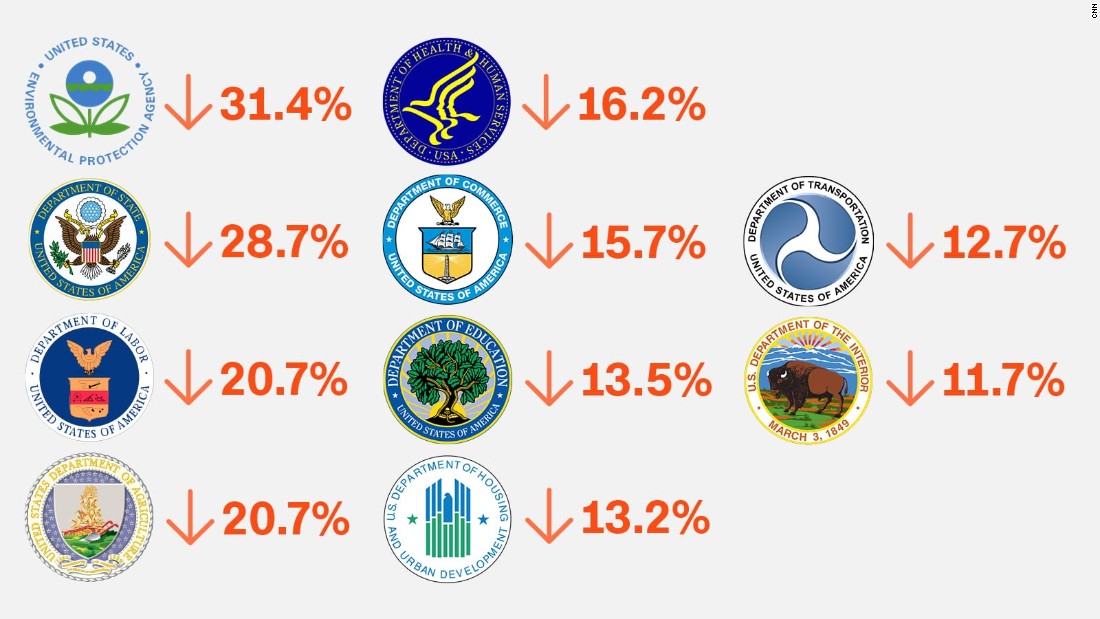

- Market trends: Show awareness of current market trends and challenges within the private credit industry.

- Specific firms: Mention specific private credit firms that interest you, demonstrating research and targeted interest.

- Sector interest: Clearly express your passion for the private credit industry.

Show that you’ve done your homework.

Ace the Private Credit Interview Process

The interview is your chance to shine. Preparation is crucial for success.

Prepare for Technical Questions

Expect detailed questions about your technical skills and knowledge.

- Financial modeling questions: Prepare for questions about financial modeling techniques and your ability to interpret results.

- Credit analysis case studies: Practice analyzing credit risk and making lending decisions based on limited information.

- Industry knowledge questions: Demonstrate your understanding of current market trends and regulatory changes in private credit.

Practice answering these questions using the STAR method.

Practice Behavioral Interview Questions

Demonstrate your soft skills and experience.

- STAR method: Use the STAR method (Situation, Task, Action, Result) to structure your answers and highlight your achievements.

- Situational questions: Prepare for hypothetical scenarios requiring problem-solving skills and decision-making ability.

- Teamwork and problem-solving: Highlight examples showcasing collaboration, effective communication, and adaptability.

Behavioral questions assess your personality fit for the company culture.

Ask Thoughtful Questions

Asking insightful questions demonstrates your interest and engagement.

- Investment strategy: Ask about the firm's investment strategy, target markets, and current portfolio.

- Team dynamics: Inquire about the team's structure, working style, and opportunities for professional development.

- Future plans: Ask about the firm's growth plans, future investment areas, and career progression opportunities.

Thoughtful questions show you are genuinely interested in the opportunity.

Consider Further Education or Certifications

Continuous learning is beneficial in this dynamic field.

MBA Programs

An MBA can significantly enhance your prospects.

- Top MBA programs: Research MBA programs with strong finance specializations and connections to the private credit industry.

- Private equity focus: Consider programs with specific tracks in private equity or alternative investments.

MBAs provide comprehensive training and networking opportunities.

Industry Certifications

Certifications enhance your credibility and expertise.

- CFA: The Chartered Financial Analyst designation.

- CAIA: The Chartered Alternative Investment Analyst designation.

These demonstrate dedication and expertise to potential employers.

Online Courses and Workshops

Stay updated with online resources.

- Online courses: Platforms like Coursera, edX, and others offer courses in private credit and related areas.

- Specialized training: Look for workshops focusing on private credit modeling, credit analysis, or other specific skills.

Continuous learning is crucial in a constantly evolving market.

Conclusion

The private credit boom presents a unique opportunity for ambitious professionals. By strategically networking, developing specialized skills, tailoring your application materials, acing the interview process, and considering further education, you can significantly increase your chances of securing a rewarding role in this exciting field. Don't miss out on this incredible opportunity – take action today to pursue your career in the world of private credit. Start implementing these five key actions and begin your journey to success in the booming private credit market!

Featured Posts

-

Tornado Season And Trumps Budget Cuts A Dangerous Combination

Apr 24, 2025

Tornado Season And Trumps Budget Cuts A Dangerous Combination

Apr 24, 2025 -

Post Roe America How Over The Counter Birth Control Changes The Game

Apr 24, 2025

Post Roe America How Over The Counter Birth Control Changes The Game

Apr 24, 2025 -

Recent Death Fuels Concerns Years Of Shark Activity At Israeli Beach

Apr 24, 2025

Recent Death Fuels Concerns Years Of Shark Activity At Israeli Beach

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Emergency Whats Next

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Emergency Whats Next

Apr 24, 2025 -

Saudi India Oil Refinery Partnership A Major Development

Apr 24, 2025

Saudi India Oil Refinery Partnership A Major Development

Apr 24, 2025