71% Net Income Drop For Tesla In Q1: Understanding The Political And Economic Factors

Table of Contents

Macroeconomic Factors Driving the Tesla Q1 Net Income Drop

Several macroeconomic factors contributed significantly to Tesla's disappointing Q1 results. The confluence of these issues created a perfect storm that impacted consumer demand, production costs, and overall profitability.

Global Inflation and Rising Interest Rates

Global inflation continues to erode consumer purchasing power. The impact is particularly pronounced on discretionary spending, such as luxury goods like Tesla vehicles. Higher prices for essential goods leave less disposable income for big-ticket items. Simultaneously, rising interest rates increase borrowing costs for both consumers financing vehicle purchases and businesses needing capital for expansion and operations. This double whammy significantly reduces demand for new vehicles.

- Increased raw material costs: Inflation impacted the cost of raw materials crucial for Tesla's production, including lithium, aluminum, and steel.

- Supply chain disruptions: Inflationary pressures exacerbated existing supply chain vulnerabilities, leading to further delays and increased costs.

- Reduced consumer confidence: Economic uncertainty fueled by inflation and rising interest rates dampened consumer confidence, leading to decreased spending.

Weakening Global Demand for Electric Vehicles

While the EV market continues to grow, the pace of growth has slowed considerably. Tesla is not immune to this weakening demand, facing increased competition and potential market saturation in certain regions.

- Increased competition from other EV manufacturers: Established automakers and new entrants are aggressively expanding their EV offerings, increasing competition for market share.

- Potential for oversupply: The rapid expansion of EV manufacturing capacity globally has led to concerns about potential oversupply in some markets.

- Changing consumer preferences: Consumer preferences are dynamic. Shifting tastes and the emergence of new technologies could impact demand for Tesla's current models.

- Government subsidies and tax credits: The availability and level of government incentives for EV purchases vary significantly across regions, influencing market demand. Changes in these policies can also impact sales.

The Impact of Currency Fluctuations

Tesla operates globally, making it vulnerable to currency fluctuations. A stronger US dollar negatively impacts the company's international revenue when translated back into US dollars. This reduces the profitability of sales in countries with weaker currencies.

- Exposure to currency risk: Tesla's international operations expose it to significant currency risk.

- Impact on manufacturing costs: Currency fluctuations can affect the cost of imported materials and components.

- Pricing strategies for global markets: Tesla must carefully manage pricing strategies in different markets to account for currency fluctuations and maintain competitiveness.

Geopolitical and Political Factors Affecting Tesla's Performance

Beyond macroeconomic trends, geopolitical events and political decisions also played a significant role in Tesla's Q1 performance.

Geopolitical Instability and Supply Chain Disruptions

Global conflicts and political tensions can severely disrupt supply chains, impacting Tesla's access to critical resources and manufacturing capabilities.

- Resource scarcity: Geopolitical instability can restrict access to essential raw materials, impacting production.

- Logistical challenges: Conflicts and political tensions can cause logistical bottlenecks, delaying shipments and increasing transportation costs.

- Disruptions in key manufacturing hubs: Political instability in key manufacturing regions can disrupt production and lead to delays.

Government Regulations and Policies

Governments worldwide are increasingly implementing regulations and policies affecting the EV industry. These policies can impact Tesla's production costs, sales, and overall profitability.

- Tax policies: Changes in corporate tax rates and import tariffs directly affect Tesla's profitability.

- Emission standards: Stricter emission standards necessitate costly investments in new technologies and production processes.

- Subsidies and incentives: Government subsidies and incentives for EV purchases can significantly influence market demand.

- Trade restrictions: Trade wars and protectionist policies can disrupt Tesla's global supply chains and limit market access.

Public Perception and Brand Reputation

Tesla's public image and controversies have also had a noticeable impact on investor confidence and sales. CEO actions and public statements can significantly influence brand perception.

- Negative publicity: Negative news coverage and social media campaigns can damage brand reputation and reduce consumer trust.

- Social media impact: Social media plays a significant role in shaping public opinion, impacting Tesla's brand image.

- Controversies and their financial consequences: Public controversies can negatively affect sales and investor sentiment.

Conclusion

The 71% drop in Tesla's Q1 net income is a multifaceted issue stemming from a confluence of macroeconomic factors, including global inflation, rising interest rates, and weakening EV demand, coupled with geopolitical instability and regulatory hurdles. These challenges highlight the vulnerabilities of even industry leaders in navigating a complex and rapidly changing global landscape.

Call to Action: Understanding the intricacies of the Tesla Q1 net income drop is crucial for investors, industry analysts, and anyone interested in the future of the electric vehicle market. Further research into the specific impacts of these political and economic factors is essential to accurately predict future trends and assess the resilience of Tesla and other EV manufacturers. Stay informed about the ongoing developments impacting the Tesla Q1 net income drop and the broader EV industry.

Featured Posts

-

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Lower Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Lower Costs

Apr 24, 2025 -

After 127 Years Anchor Brewing Company Announces Closure

Apr 24, 2025

After 127 Years Anchor Brewing Company Announces Closure

Apr 24, 2025 -

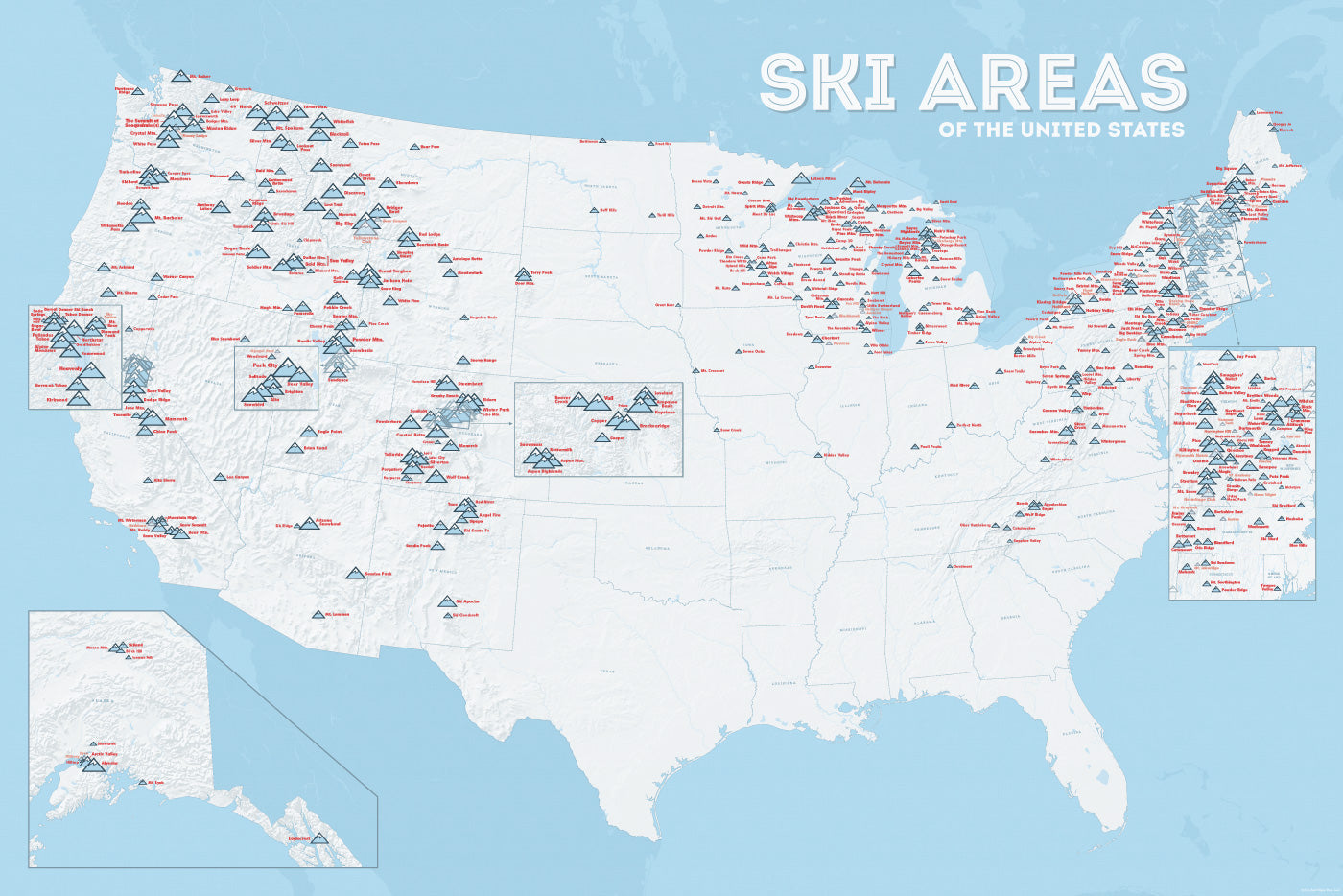

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse A Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Liams Collapse A Fight For Survival

Apr 24, 2025 -

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 24, 2025

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 24, 2025