AbbVie (ABBV) Exceeds Expectations: New Drug Sales Drive Profit Growth

Table of Contents

Strong Performance Driven by Key New Drugs

AbbVie's exceeding expectations is largely attributed to the remarkable success of several key new drugs. These innovative medications have not only captured significant market share but have also driven substantial revenue growth, exceeding initial projections. This robust performance showcases AbbVie's R&D capabilities and its ability to bring successful new treatments to market.

-

Rinvoq (upadacitinib): This JAK inhibitor has demonstrated impressive sales growth, securing a substantial market share in the treatment of rheumatoid arthritis and other inflammatory diseases. Its innovative mechanism of action and strong efficacy profile have contributed significantly to AbbVie's overall performance. (Insert specific sales figures and growth percentages here, e.g., "Rinvoq generated $X billion in sales, representing a Y% year-over-year increase.")

-

Skyrizi (risankizumab): Another key contributor to AbbVie's success, Skyrizi, a highly selective interleukin-23 (IL-23) inhibitor, has achieved strong market penetration in psoriasis and psoriatic arthritis. Its unique mechanism distinguishes it from competitors and positions it for continued growth. (Insert specific sales figures and growth percentages here, e.g., "Skyrizi achieved sales of $Z billion, with a growth rate of W% compared to the previous year.")

-

AbbVie's Oncology Portfolio: AbbVie’s expanding oncology portfolio, encompassing treatments for various cancers, also made a substantial contribution to the exceeding expectations, showcasing the company's strategic investments in this vital therapeutic area. (Provide specific data on sales and growth of key oncology drugs where available).

Financial Highlights: Revenue and Earnings Growth

AbbVie's recent financial report showcases remarkable growth across key metrics, solidifying its position as a leading pharmaceutical company. The company's exceeding expectations is clearly reflected in these impressive figures:

-

Total Revenue: AbbVie reported a total revenue of [Insert actual figure] for the [specify period], representing a [Insert percentage]% year-over-year increase. This substantial growth is directly linked to the strong sales of its newer drugs.

-

Earnings Per Share (EPS): EPS reached [Insert actual figure], demonstrating a [Insert percentage]% year-over-year increase and surpassing analyst consensus estimates. This signifies improved profitability and strong financial health.

-

Profit Margins: AbbVie's profit margins have shown improvement, demonstrating operational efficiency and the positive impact of new drug launches. (Provide specific data on profit margin changes and contributing factors.)

Future Outlook and Investment Implications: AbbVie's Growth Trajectory

AbbVie’s strong performance provides a positive outlook for future growth. The company's robust pipeline of innovative drugs, combined with the continued success of its existing portfolio, positions it for sustained expansion. However, it is important to consider potential risks.

-

Projected Revenue Growth: AbbVie projects a [Insert percentage]% revenue growth for the next fiscal year, driven by the continued success of its key drugs and the anticipated launch of new products.

-

Key Factors Contributing to Future Growth: These include continued market penetration of existing drugs, the successful launch of new products in the pipeline, and potential expansion into new therapeutic areas.

-

Potential Investment Risks: While the outlook is positive, potential risks include competition from other pharmaceutical companies, regulatory hurdles, and the inherent uncertainties of drug development. However, AbbVie’s strong financial position and diverse portfolio help mitigate these risks.

Conclusion: AbbVie (ABBV) Exceeds Expectations: A Strong Investment Opportunity?

In conclusion, AbbVie's (ABBV) exceeding expectations is a testament to its innovative R&D efforts and successful commercialization strategies. The outstanding performance of its new drugs has fueled significant revenue and earnings growth, surpassing analyst forecasts. The promising future outlook, based on a strong pipeline and continued market success, positions AbbVie as an attractive investment opportunity. Learn more about AbbVie (ABBV) and its potential as a growth stock. Analyze the company's performance and consider its position in the pharmaceutical market. Discover how AbbVie's new drug sales drive continued profit growth and what this means for investors. (Include links to relevant financial resources and investor relations pages here).

Featured Posts

-

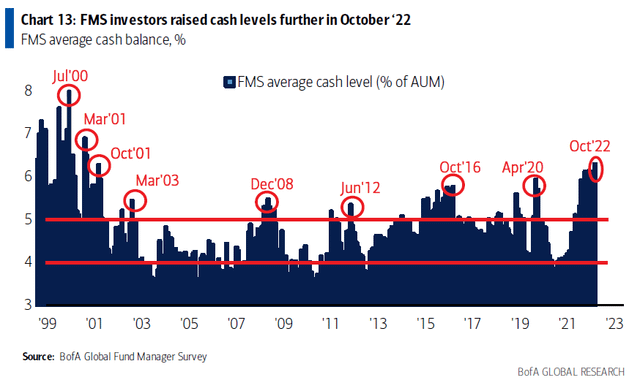

Should Investors Worry About Current Stock Market Valuations Bof A Weighs In

Apr 26, 2025

Should Investors Worry About Current Stock Market Valuations Bof A Weighs In

Apr 26, 2025 -

Jan 6 Hearing Star Cassidy Hutchinson Announces Fall Memoir Release

Apr 26, 2025

Jan 6 Hearing Star Cassidy Hutchinson Announces Fall Memoir Release

Apr 26, 2025 -

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 26, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 26, 2025 -

Open Ai 2024 Streamlined Voice Assistant Creation

Apr 26, 2025

Open Ai 2024 Streamlined Voice Assistant Creation

Apr 26, 2025 -

Palisades Fire Damage A List Of Celebrities Who Lost Homes

Apr 26, 2025

Palisades Fire Damage A List Of Celebrities Who Lost Homes

Apr 26, 2025