Alterya Acquired By Blockchain Analysis Firm Chainalysis

Table of Contents

Alterya's Capabilities and Chainalysis' Synergies

Alterya brought to the table a powerful arsenal of capabilities specializing in transaction monitoring, risk scoring, and AML/KYC compliance within the blockchain space. Its core functionalities seamlessly integrate with Chainalysis' existing platform, creating a synergistic effect that dramatically enhances investigative power.

- Specialized Technology for Illicit Activity Detection: Alterya's technology excels at identifying suspicious activities on various blockchain networks, flagging potentially illicit transactions that might otherwise go undetected.

- Complementary Technologies: The merger brings together two highly complementary technologies. Chainalysis' broad network surveillance combines with Alterya's deep dive into transaction details, providing a more holistic view of cryptocurrency activity.

- Enhanced Data Analysis and Investigation: The combined technologies empower investigators with more sophisticated data analysis and investigation capabilities, leading to faster and more accurate results.

- Client Benefits: Chainalysis clients will benefit from access to Alterya's advanced features, including improved risk scoring models and streamlined investigative workflows, ultimately leading to better risk mitigation and regulatory compliance.

Implications for Regulatory Compliance and Financial Crime Fighting

The acquisition significantly enhances the ability to detect and prevent various financial crimes, including money laundering and terrorist financing, which increasingly leverage cryptocurrency. This merger strengthens the tools available to combat these illicit activities.

- Improved Regulatory Compliance: The combined capabilities significantly improve regulatory compliance for financial institutions worldwide, helping them meet stringent KYC and AML requirements.

- Enhanced KYC and AML Compliance: The integration of Alterya's technology provides a more comprehensive approach to KYC/AML compliance, enabling financial institutions to better identify and manage high-risk customers and transactions.

- Broadened Service Reach: Chainalysis' already extensive service reach expands further, enabling more organizations globally to benefit from advanced blockchain intelligence solutions.

- Impact on Cryptocurrency Crime Investigations: Investigations into cryptocurrency-based crimes will be significantly expedited and enhanced by the combined analytical power of Chainalysis and Alterya, leading to more effective prosecution.

Enhanced Data Analysis and Investigation Tools

The acquisition promises a significant leap forward in the speed and accuracy of blockchain analysis, offering investigators powerful new tools.

- Improved Data Visualization and Reporting: The combined platform provides enhanced data visualization and reporting capabilities, making complex data easier to understand and interpret.

- More Sophisticated Risk Scoring Models: More sophisticated risk scoring models allow for quicker identification of high-risk transactions and individuals.

- Streamlined Investigative Workflows: Investigative workflows are streamlined, allowing for faster and more efficient analysis of blockchain data.

- Wider Coverage of Blockchain Networks: The combined entity offers wider coverage of various blockchain networks, providing a more comprehensive overview of cryptocurrency activity.

Market Impact and Future of Blockchain Intelligence

The Chainalysis acquisition of Alterya has significant implications for the blockchain analytics market.

- Increased Competition and Innovation: The merger intensifies competition, potentially driving further innovation within the blockchain analytics industry.

- Potential for Consolidation: This acquisition could signal further consolidation within the sector as larger firms seek to acquire smaller, specialized companies.

- Growing Importance of Blockchain Intelligence: The acquisition highlights the ever-growing importance of blockchain intelligence in the fight against financial crime.

- Long-Term Implications for Regulatory Frameworks and Cryptocurrency Adoption: The development of more sophisticated blockchain analytics tools will likely shape future regulatory frameworks and influence the broader adoption of cryptocurrencies.

Conclusion

The Chainalysis acquisition of Alterya marks a substantial advancement in blockchain intelligence, significantly improving capabilities in regulatory compliance, financial crime detection, and data analysis. This strategic move underscores the critical need for robust tools to navigate the complex and ever-evolving cryptocurrency landscape. The combined strength of Chainalysis and Alterya creates a powerful force in combating financial crime and enhancing regulatory compliance.

Call to Action: Learn more about how Chainalysis, with its newly integrated Alterya technology, can empower your organization to proactively manage cryptocurrency risks and strengthen your compliance posture. Contact us today to explore comprehensive blockchain intelligence solutions and fortify your financial crime defense strategy. Discover the power of enhanced blockchain analytics provided by the combined expertise of Chainalysis and Alterya.

Featured Posts

-

Mapping The Rise Of New Business Hubs Across The Nation

Apr 24, 2025

Mapping The Rise Of New Business Hubs Across The Nation

Apr 24, 2025 -

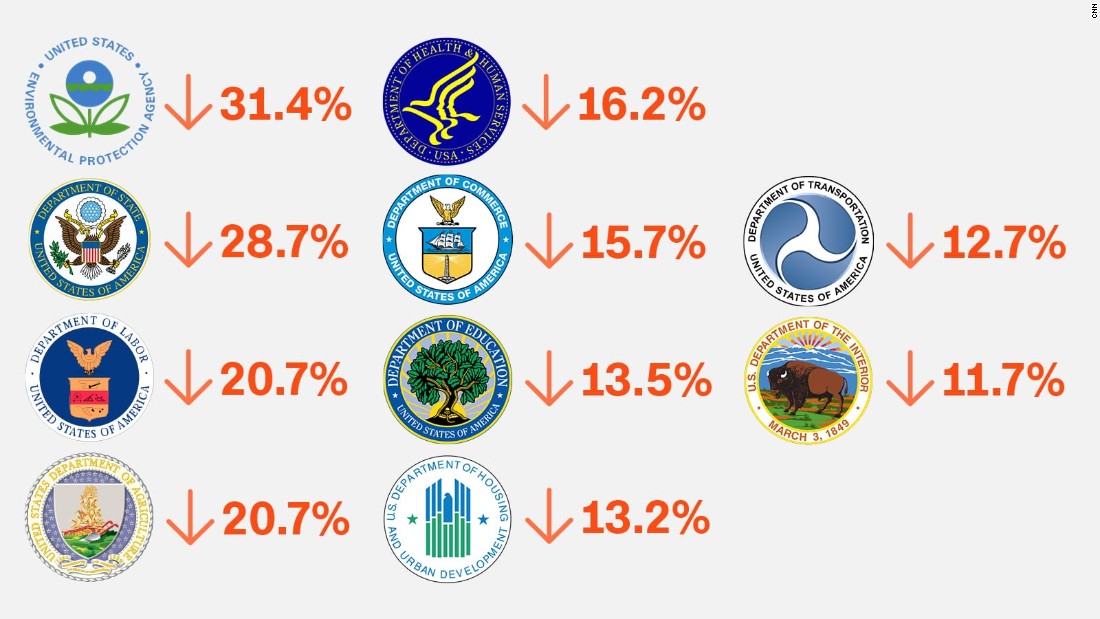

Tornado Season And Trumps Budget Cuts A Dangerous Combination

Apr 24, 2025

Tornado Season And Trumps Budget Cuts A Dangerous Combination

Apr 24, 2025 -

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025

The Impact Of Trumps Budget Cuts On Tornado Preparedness And Response

Apr 24, 2025 -

Remembering Sophie Nyweide Child Actress From Mammoth And Noah Dead At 24

Apr 24, 2025

Remembering Sophie Nyweide Child Actress From Mammoth And Noah Dead At 24

Apr 24, 2025 -

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

Apr 24, 2025

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

Apr 24, 2025