Analyzing Market Swings: Professional Vs. Individual Investor Behavior

Table of Contents

Market swings are an inherent part of the financial landscape, presenting both lucrative opportunities and significant challenges for investors. Successfully navigating these periods of volatility requires a deep understanding of how different investor groups react. This article explores the key behavioral differences between professional and individual investors during market swings, shedding light on their contrasting approaches to risk, strategy, and market timing. By understanding these distinctions, both types of investors can refine their strategies and improve their chances of long-term success.

Risk Tolerance and Management

Professional Investors

Professional investors, such as those working for hedge funds, institutional investment firms, or wealth management companies, employ sophisticated risk management strategies. Their approach is fundamentally different from that of the average individual.

- Sophisticated Risk Management Techniques: They utilize a range of techniques, including diversification across asset classes (stocks, bonds, real estate, etc.), hedging strategies to mitigate potential losses, and rigorous stress testing of their portfolios to simulate various market scenarios.

- Advanced Analytical Tools: Professionals leverage advanced analytical tools and models to assess and quantify risk, allowing for more precise risk management. This includes quantitative analysis, statistical modeling, and scenario planning.

- Access to Diverse Investment Options: They have access to a broader spectrum of investment options and strategies unavailable to individual investors, such as private equity, derivatives, and complex structured products.

- Long-Term Investment Horizon: Professional investors often operate with a longer-term investment horizon, enabling them to weather short-term market volatility without making impulsive decisions. Their focus is on long-term growth and capital appreciation.

- Example: A hedge fund might use options contracts to hedge against a potential decline in the value of a specific stock or sector, limiting potential losses during a market downturn.

Individual Investors

Individual investors, on the other hand, often demonstrate significantly different behavior during market swings. Emotional responses frequently outweigh rational decision-making.

- Emotional Responses to Market Swings: Fear and greed are powerful emotions that significantly impact individual investor behavior. Market drops can trigger panic selling, while rallies can lead to overconfidence and excessive risk-taking.

- Limited Risk Management Resources: Individual investors often lack the resources, expertise, and tools to effectively manage risk. This can lead to poorly diversified portfolios and an increased vulnerability to market downturns.

- Influence of Market Noise: They are more susceptible to the influence of market noise, rumors, and short-term trends, often leading to rash decisions based on incomplete information.

- Shorter-Term Investment Horizons: Many individual investors have shorter-term investment horizons, making them more sensitive to short-term fluctuations and potentially causing them to miss out on long-term growth opportunities.

- Example: An individual investor might panic-sell their stocks during a market correction, realizing losses and missing out on the subsequent rebound.

Investment Strategies and Time Horizons

Professional Investors

Professional investors employ a diverse range of investment strategies, reflecting their access to resources and expertise.

- Diverse Investment Strategies: They utilize strategies including long-term value investing, growth investing, active trading, passive investing (index funds and ETFs), and quantitative analysis to identify undervalued assets or predict market movements.

- Rigorous Research and Due Diligence: Before making investment decisions, they conduct extensive research and due diligence, analyzing financial statements, market trends, and competitive landscapes.

- Access to Exclusive Information: They may have access to exclusive market information, insights from industry experts, and early warnings of potential market shifts.

- Focus on Fundamental Analysis: Professional investors often rely heavily on fundamental analysis, evaluating a company's intrinsic value and long-term growth potential.

Individual Investors

Individual investors' strategies tend to be simpler and often driven by emotional factors.

- Simpler Strategies: Individual investors may rely on simpler strategies like buy-and-hold, dollar-cost averaging, or following popular investment trends, sometimes without a deep understanding of the underlying risks.

- Limited Research Capabilities: They may lack the time, resources, or expertise to conduct thorough research, leading to potentially uninformed investment decisions.

- Emotional Decision-Making: Emotional biases heavily influence their investment strategies, leading to impulsive buying or selling based on fear or greed.

- Focus on Short-Term Gains: Chasing short-term gains can increase risk exposure and lead to suboptimal long-term outcomes.

Market Timing and Reactions to Volatility

Professional Investors

Professional investors approach market timing with a more disciplined and analytical mindset.

- Disciplined Market Timing: They utilize technical and fundamental analysis to identify potential market turning points, aiming to capitalize on opportunities during periods of volatility.

- Capitalizing on Volatility: They are better equipped to identify and capitalize on market opportunities that arise during periods of increased volatility, such as buying undervalued assets during market corrections.

- Active Portfolio Adjustments: They actively adjust their portfolios based on market conditions, implementing rebalancing strategies to maintain their desired asset allocation.

- Sophisticated Trading Strategies: They often employ complex trading strategies, such as arbitrage or options trading, to manage risk and generate returns.

Individual Investors

Individual investors' reactions to market volatility are often driven by emotion rather than rational analysis.

- Emotional Reactions: Fear and panic often dictate their responses to market downturns, resulting in poor investment decisions.

- Susceptibility to Market Timing Errors: They are more likely to make market timing errors, buying high and selling low due to emotional responses rather than objective analysis.

- Inability to Navigate Downturns: They may lack the expertise and resources to effectively navigate market downturns, potentially leading to significant losses.

- Missing Out on Gains: Fear and uncertainty can cause them to miss out on potential gains by avoiding investments during periods of market correction.

Conclusion

Understanding the differences in investor behavior during market swings is crucial for navigating the complexities of the financial markets. While professional investors often display a more disciplined and data-driven approach, individual investors can learn valuable lessons from their strategies. By focusing on developing a well-defined long-term investment plan, implementing a robust risk management strategy, and educating themselves on various investment techniques, individuals can significantly improve their ability to manage market volatility and achieve their financial goals. Start analyzing your own reaction to market swings today and develop a more effective approach to managing your investments and weathering market fluctuations!

Featured Posts

-

Funeral Of Pope Francis A Gathering Of World Leaders

Apr 28, 2025

Funeral Of Pope Francis A Gathering Of World Leaders

Apr 28, 2025 -

Colorado Qb Shedeur Sanders Joins The Cleveland Browns

Apr 28, 2025

Colorado Qb Shedeur Sanders Joins The Cleveland Browns

Apr 28, 2025 -

Qayd Shrtt Abwzby Ytfqd Syr Aleml Wyuhny Frq Aleml Almydanyt

Apr 28, 2025

Qayd Shrtt Abwzby Ytfqd Syr Aleml Wyuhny Frq Aleml Almydanyt

Apr 28, 2025 -

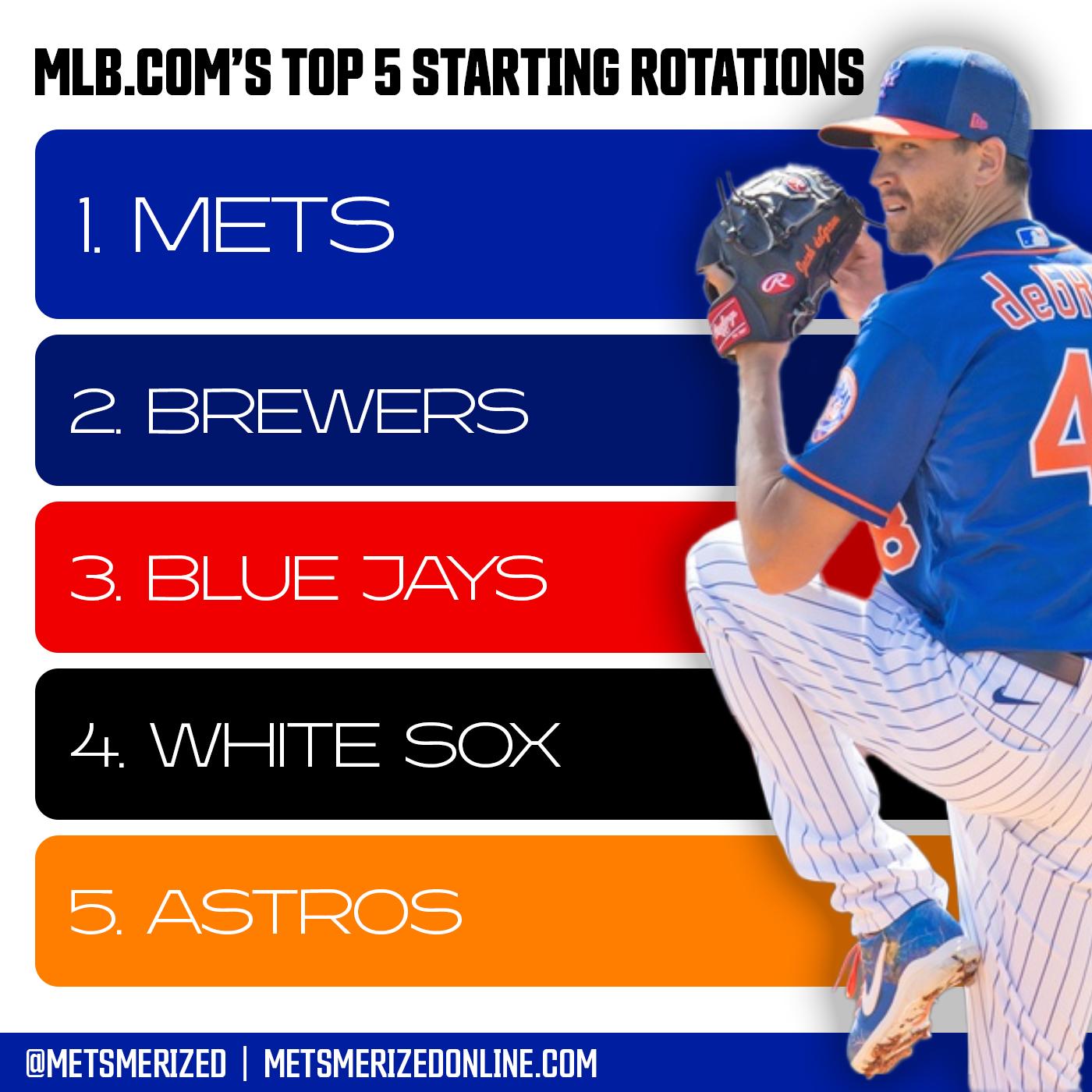

Pitchers Name S Path To A Mets Rotation Spot

Apr 28, 2025

Pitchers Name S Path To A Mets Rotation Spot

Apr 28, 2025 -

Yankees Judge And Cardinals Goldschmidt Lead In Crucial Series Victory

Apr 28, 2025

Yankees Judge And Cardinals Goldschmidt Lead In Crucial Series Victory

Apr 28, 2025