AT&T Sounds Alarm On Extreme VMware Price Hike After Broadcom Deal

Table of Contents

Broadcom's Acquisition and its Impact on VMware Pricing

Broadcom's $61 billion acquisition of VMware, finalized in late 2022, fundamentally altered the market dynamics. This massive deal brought together a leading infrastructure software provider with a prominent semiconductor company, raising immediate questions about the future direction and pricing of VMware's products. The potential motivations behind the subsequent VMware price hike are multifaceted. Broadcom likely seeks to increase profitability following the significant investment in the acquisition, and the consolidation of market power could also contribute to more aggressive pricing strategies.

- Synergy and Consolidation: Broadcom aims to integrate VMware's software with its existing hardware portfolio, creating a more tightly integrated and potentially more expensive, end-to-end solution for enterprise customers. This vertical integration is a core component of their strategy.

- Antitrust Concerns: The deal faced significant antitrust scrutiny, with regulators examining its potential impact on competition within the virtualization and infrastructure software markets. The outcome of these investigations could influence future pricing practices.

- Broadcom's Statements: While Broadcom hasn't explicitly detailed its pricing strategies post-acquisition, its focus on increasing shareholder value suggests that price increases are a key part of its post-merger plan.

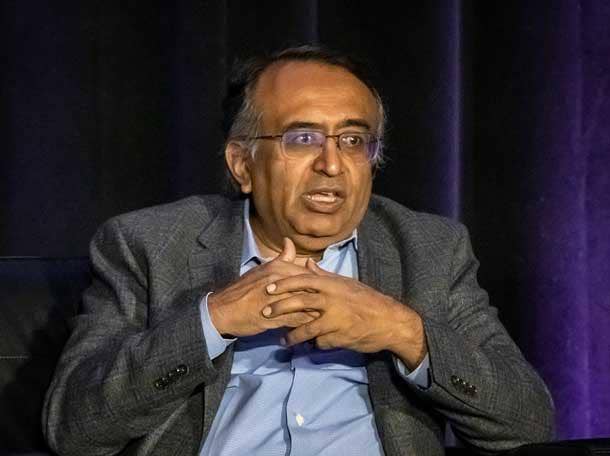

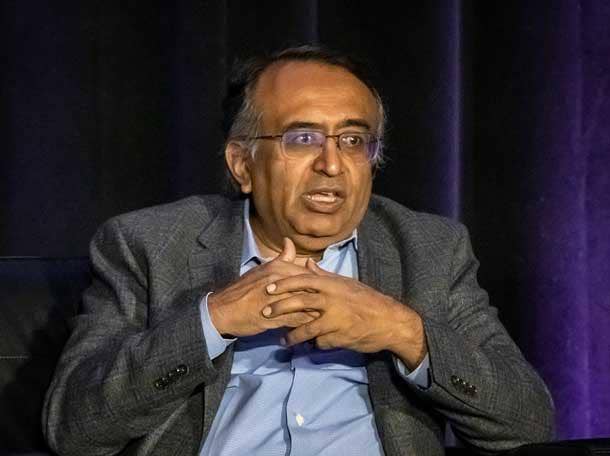

AT&T's Concerns and Public Response

AT&T, a massive VMware customer, has publicly expressed significant concerns over the steep VMware price hike. The financial implications for the company are substantial, potentially adding millions, if not billions, to their annual IT budget. This significant cost increase threatens AT&T's operational efficiency and profitability. The company's public response reflects its attempts to negotiate more favorable terms. AT&T's immense size and market influence gives them significant leverage, but the ultimate outcome of these negotiations remains uncertain. Alternatives AT&T might consider include migrating to competing virtualization platforms or exploring cloud-based solutions.

- Quantifying the Impact: The precise amount of the VMware price hike for AT&T remains undisclosed, but industry analysts suggest it's a significant percentage increase, potentially impacting various VMware products and services.

- Negotiating Power: AT&T's substantial size and spending power gives them a strong negotiating position with Broadcom/VMware. However, the extent of their success remains to be seen.

- Potential Legal Action: While not yet confirmed, some industry experts speculate AT&T might explore legal options if negotiations fail to yield satisfactory results.

Implications for Other VMware Customers

The VMware price hike is not just impacting AT&T; many other large enterprise clients face similar challenges. The vulnerability of businesses heavily reliant on VMware’s technology is now evident. This price increase could trigger a significant industry-wide response, potentially including regulatory intervention or a surge in competition. Companies are likely reevaluating their dependence on VMware and exploring alternative solutions to mitigate the rising costs.

- Vendor Lock-in Vulnerability: Organizations heavily invested in VMware's ecosystem may struggle to quickly switch to alternative platforms due to the cost and complexity involved.

- Cloud Migration Acceleration: The price hike could accelerate the trend towards cloud migration, as companies seek more cost-effective and scalable solutions.

- Industry Backlash and Regulatory Scrutiny: The significant price increase could lead to a public outcry from other affected businesses, potentially prompting regulatory bodies to investigate the pricing practices of Broadcom/VMware.

Future of VMware Pricing and the Enterprise Market

The future trajectory of VMware pricing remains uncertain, but the current situation suggests a potential trend of increased prices in the enterprise virtualization market. This could reshape the competitive landscape, encouraging innovation and the emergence of alternative virtualization solutions. Companies will need to adapt their IT budgeting and strategies accordingly.

- Competitor Growth: Companies like Citrix, Nutanix, and others are poised to benefit from the increased interest in alternative virtualization technologies.

- Innovation and Alternatives: The current situation is likely to spur innovation in the virtualization space, potentially leading to more affordable and flexible solutions.

- Cloud Strategy Re-evaluation: The increased cost of on-premises virtualization will push many companies to re-evaluate their cloud adoption strategies.

Conclusion

The unexpected and significant VMware price hike following Broadcom's acquisition has raised serious concerns across the enterprise tech industry. AT&T's public response highlights the potential financial burden on large companies reliant on VMware’s solutions, triggering a broader discussion on the implications for competition and the future of virtualization. The potential for regulatory intervention and a shift towards alternative solutions, including cloud-based alternatives, is significant. Stay informed on the latest developments regarding this VMware price hike and proactively assess your organization's virtualization strategy. Consider researching alternative virtualization solutions or cloud migration strategies to mitigate potential future price increases and ensure long-term cost efficiency.

Featured Posts

-

Carney On Us Canada Trade A Strategy Of Calculated Patience

Apr 27, 2025

Carney On Us Canada Trade A Strategy Of Calculated Patience

Apr 27, 2025 -

Professional Help And Self Image Ariana Grandes Bold Hair And Tattoo Choices

Apr 27, 2025

Professional Help And Self Image Ariana Grandes Bold Hair And Tattoo Choices

Apr 27, 2025 -

Turkish Logistics Market Sees Major Shift With Cma Cgm Acquisition

Apr 27, 2025

Turkish Logistics Market Sees Major Shift With Cma Cgm Acquisition

Apr 27, 2025 -

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025 -

Sinners Doping Case A Settlement Reached

Apr 27, 2025

Sinners Doping Case A Settlement Reached

Apr 27, 2025