Bank Of Canada Rate Cut Speculation Rises On Dismal Retail Sales Data

Table of Contents

Dismal Retail Sales Figures Fuel Rate Cut Speculation

The recently released retail sales report revealed a concerning decline in consumer spending, significantly fueling speculation about an imminent Bank of Canada interest rate cut. This downturn represents a major setback for the Canadian economy, raising serious questions about the strength of the recovery. The numbers paint a stark picture:

- Percentage decrease in retail sales: A [insert percentage]% decrease in retail sales was recorded in [insert month, year], significantly exceeding analyst predictions of a [insert percentage]% decline.

- Specific sectors most impacted: The automotive sector experienced the most substantial drop, followed by furniture and home improvement retailers, reflecting weakening consumer confidence and potentially signaling a broader economic slowdown.

- Comparison to analyst predictions: The actual decline surpasses the consensus forecast among economists, suggesting the economic situation might be even more precarious than initially anticipated.

- Contributing factors: Persistently high inflation, coupled with previously implemented interest rate hikes by the Bank of Canada, has severely impacted consumer purchasing power, contributing to this significant decrease in retail sales.

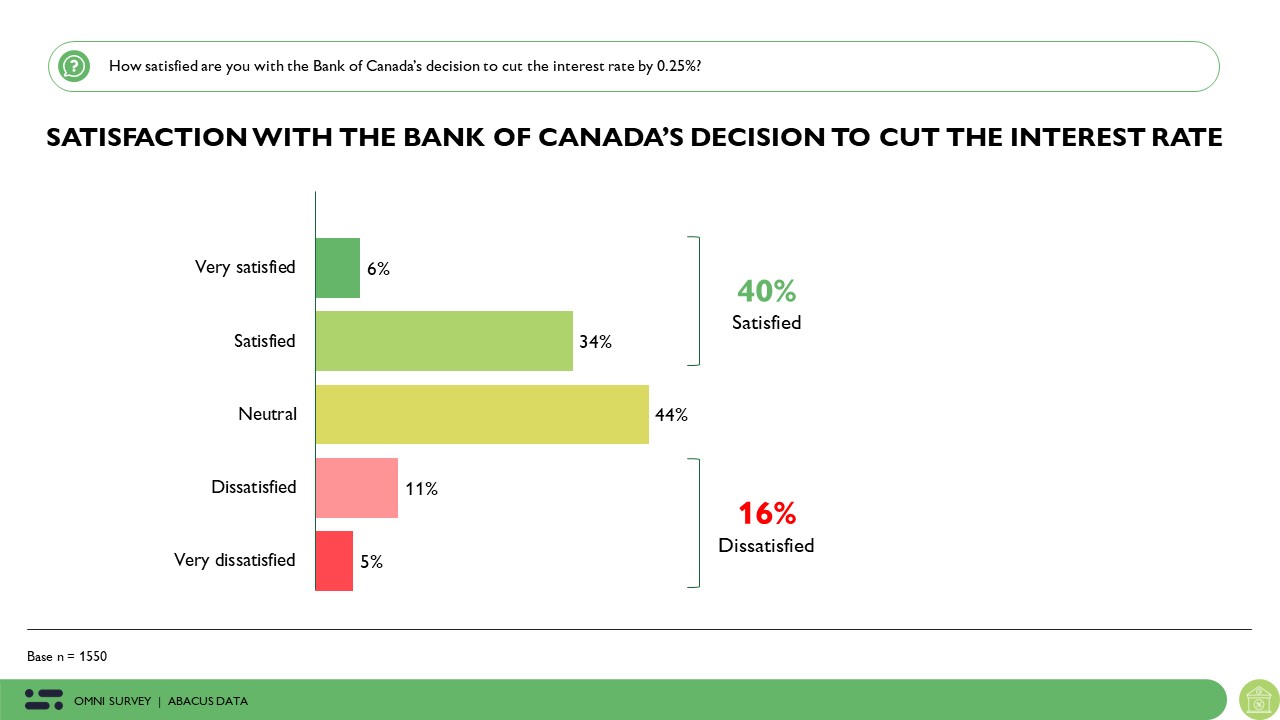

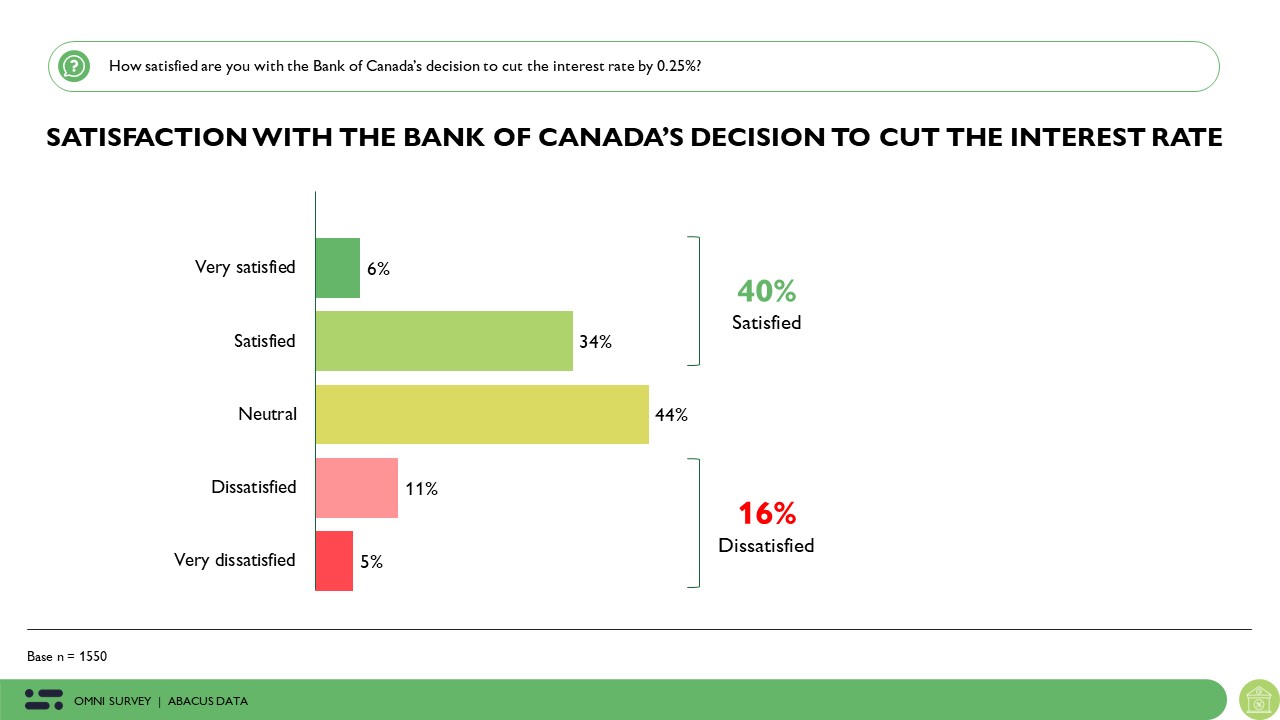

Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's current monetary policy stance is crucial in understanding the likelihood of a rate cut. The BoC has been actively managing inflation through a series of interest rate increases in recent months. However, the recent retail sales figures challenge their current approach:

- Current interest rate level: The current benchmark interest rate stands at [insert current interest rate]%, a significant increase from [insert previous interest rate]%.

- Bank of Canada's inflation target: The BoC targets an inflation rate of [insert inflation target]%. However, current inflation remains stubbornly above this target, creating a delicate balancing act for policymakers.

- Recent statements from Bank of Canada officials: Recent statements from BoC officials have been cautiously optimistic, highlighting the need to carefully monitor economic data before making any further interest rate decisions. However, the negative retail sales data may force a reevaluation of this stance.

- Recent economic forecasts: The Bank of Canada's latest economic forecasts suggest [insert summary of recent forecast, highlighting relevant elements like GDP growth projections, inflation predictions, and overall economic outlook]. The dismal retail sales data will likely necessitate a revision of these forecasts.

Market Reactions and Analyst Predictions

The weak retail sales figures and the subsequent increase in Bank of Canada rate cut speculation have sent ripples through financial markets:

- Changes in the Canadian dollar exchange rate: The Canadian dollar has experienced [insert description of change in the CAD exchange rate], reflecting market uncertainty.

- Movement in Canadian bond yields: Bond yields have [insert description of change in bond yields], suggesting investors are anticipating a potential rate cut.

- Expert opinions on the likelihood of a rate cut: Leading economists are divided. Some believe a rate cut is inevitable given the weak retail sales data and softening economic indicators. Others argue that the BoC will remain cautious, prioritizing inflation control over stimulating economic growth. [Insert quotes from prominent economists and financial analysts with links to sources].

- Discussion of potential timing of a rate cut: If a rate cut is implemented, many analysts speculate it could occur as early as [insert potential timing], depending on upcoming economic data releases and the BoC's assessment of the situation.

Potential Implications of a Rate Cut

A Bank of Canada interest rate cut would have significant implications, both positive and negative:

- Impact on consumer spending and borrowing: A rate cut could stimulate consumer spending by making borrowing cheaper and more accessible. This could help to boost economic activity.

- Effect on inflation: However, lowering interest rates could also exacerbate inflationary pressures, potentially undermining the BoC's primary mandate.

- Influence on the Canadian dollar: A rate cut could weaken the Canadian dollar relative to other currencies, potentially impacting exports and imports.

- Potential risks associated with a rate cut: The risk of fueling inflation is substantial. Furthermore, a rate cut might signal a lack of confidence in the economy's ability to recover organically, potentially negatively impacting investor sentiment.

Conclusion

The unexpectedly weak retail sales figures have significantly increased speculation that the Bank of Canada will be forced to cut interest rates. This decision presents a complex challenge, balancing the need to stimulate economic growth with the ongoing threat of inflation. The potential implications are far-reaching, impacting consumer spending, the Canadian dollar, and the overall health of the Canadian economy. The coming weeks will be crucial in determining the Bank of Canada's next move. Stay informed about the evolving situation surrounding Bank of Canada interest rates and their potential impact on the Canadian economy. Continue to monitor our website for updates on future Bank of Canada rate cut speculation and analysis of the Canadian economic landscape. Regularly check for further analysis on Bank of Canada rate decisions and their market effects.

Featured Posts

-

Lab Owners Guilty Plea Faked Covid 19 Test Results During Pandemic

Apr 28, 2025

Lab Owners Guilty Plea Faked Covid 19 Test Results During Pandemic

Apr 28, 2025 -

2000 Yankees Diary Posadas Homer Silences The Royals Surge

Apr 28, 2025

2000 Yankees Diary Posadas Homer Silences The Royals Surge

Apr 28, 2025 -

Chaos And Confusion Before Weezer Bassists Wife Shooting Lapd Video Shows Details

Apr 28, 2025

Chaos And Confusion Before Weezer Bassists Wife Shooting Lapd Video Shows Details

Apr 28, 2025 -

Bubba Wallaces Phoenix Crash Brake Failure Causes Wall Impact

Apr 28, 2025

Bubba Wallaces Phoenix Crash Brake Failure Causes Wall Impact

Apr 28, 2025 -

Le Bron James Responds To Richard Jefferson On Espn

Apr 28, 2025

Le Bron James Responds To Richard Jefferson On Espn

Apr 28, 2025