BofA's Analysis: Addressing Concerns About Elevated Stock Market Valuations

Table of Contents

BofA's Key Findings on Elevated Stock Market Valuations

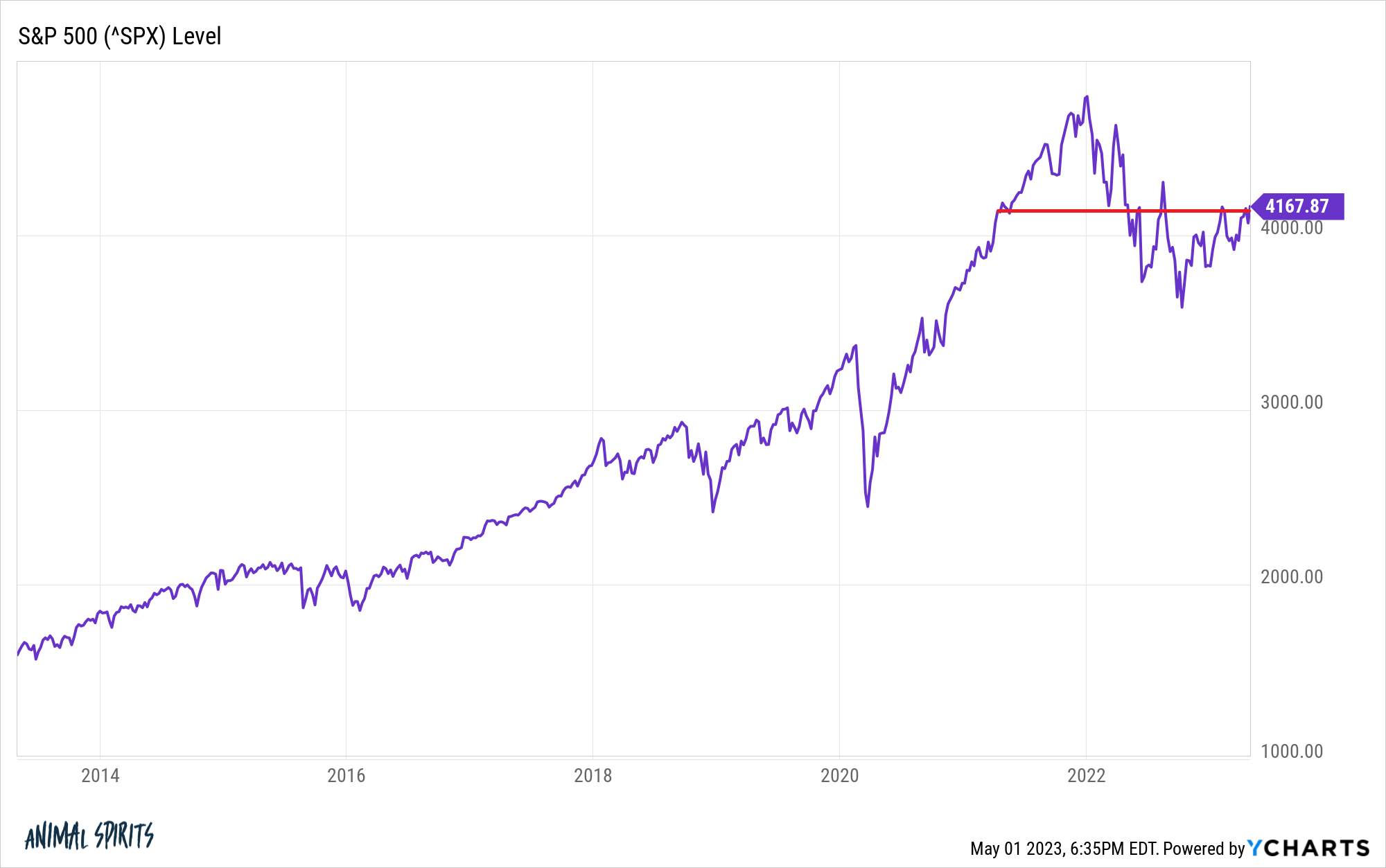

BofA's assessment of current stock market valuations presents a nuanced picture. While acknowledging the elevated levels, their analysis doesn't necessarily signal an immediate crash. Instead, the report highlights a complex interplay of factors justifying, to some extent, the current pricing, while also pointing to potential vulnerabilities.

- Valuation Metrics: BofA's analysis likely employed various valuation metrics, including the Price-to-Earnings ratio (P/E), the Cyclically Adjusted Price-to-Earnings ratio (Shiller PE), and potentially others like Price-to-Sales or Price-to-Book ratios. These metrics provide different perspectives on market valuation, considering historical data and economic cycles.

- Sector-Specific Findings: The report likely identified specific sectors as overvalued or undervalued. For example, technology stocks might be flagged as potentially overvalued due to high growth expectations, while sectors like energy might be viewed as relatively undervalued depending on prevailing commodity prices and economic forecasts.

- Economic Factors: BofA's analysis heavily incorporates macroeconomic conditions. Factors like persistently low interest rates, inflation levels, and GDP growth projections all significantly impact stock valuations. A strong economic outlook generally supports higher valuations, while concerns about inflation or recessionary pressures could lead to downward revisions.

Understanding the Drivers of Elevated Stock Market Valuations

Several factors contribute to the current elevated stock market valuations. Understanding these drivers is essential for assessing the sustainability of the current market conditions.

- Low Interest Rates: Prolonged periods of low interest rates, a common monetary policy response to economic downturns, incentivize investors to seek higher returns in the stock market. This increased demand pushes prices upward.

- Strong Corporate Earnings: Robust corporate earnings and profit growth provide a fundamental justification for higher valuations. Strong fundamentals suggest companies are generating significant returns, supporting higher stock prices.

- Investor Sentiment: Positive investor sentiment and market psychology play a considerable role. Optimism about future economic growth and corporate performance can fuel a rally, driving prices beyond what might be strictly justified by fundamentals.

- Technological Advancements: The rapid pace of technological innovation and disruption creates opportunities for significant growth and attracts substantial investment, supporting higher valuations in technology-related sectors.

- Geopolitical Factors: Global geopolitical events and uncertainties also influence market behavior. Political stability, international trade relations, and geopolitical risks can significantly impact investor confidence and market valuations.

BofA's Assessment of Risk and Potential Market Corrections

Despite the factors supporting current valuations, BofA likely highlights the inherent risks associated with elevated levels.

- Probability of Correction: The report probably assigns a probability to a market correction or downturn. While not necessarily predicting an immediate crash, it likely warns of the increased risk of a significant pullback if certain factors change (e.g., rising interest rates, weakening economic data).

- Risk Mitigation Strategies: BofA likely suggests risk mitigation strategies for investors. These strategies likely include portfolio diversification, hedging techniques (like options strategies), and tactical asset allocation adjustments.

- Catalysts for Correction: The analysis likely identifies potential catalysts for a market correction. These could include unexpected economic shocks, changes in monetary policy, or a significant deterioration in corporate earnings.

Sector-Specific Analysis from BofA (Example: Technology Sector)

BofA's report likely offers a granular view of specific sectors. For example, within the technology sector, the analysis may highlight the valuations of mega-cap tech companies versus smaller, growth-oriented firms, discussing the varying levels of risk associated with each. High growth expectations for AI and related technologies could be a key driver for valuations in this area, while concerns about regulatory scrutiny or a slowdown in consumer spending might offset this.

Implications for Investors and Investment Strategies

BofA's analysis should inform investors' strategic decisions.

- Portfolio Allocation: Investors should adjust their portfolio allocation based on BofA's findings, potentially reducing exposure to overvalued sectors and increasing exposure to undervalued sectors or asset classes.

- Rebalancing Strategies: Regular portfolio rebalancing is crucial to manage risk and capitalize on market fluctuations. This involves selling some assets that have appreciated and buying others that have depreciated to maintain a target asset allocation.

- Alternative Investment Options: Considering alternative investment options, such as bonds or real estate, can provide diversification and mitigate risk associated with elevated equity valuations.

- Long-Term vs. Short-Term: Investors should consider their investment horizon. A long-term perspective might allow them to weather short-term market corrections, while short-term investors need to be more attuned to potential volatility.

Conclusion

BofA's analysis of elevated stock market valuations presents a complex picture. While certain factors justify the current levels to some extent, the inherent risks associated with high valuations remain significant. Understanding the interplay of economic factors, investor sentiment, and sector-specific dynamics is crucial for navigating the current market landscape. BofA’s insights highlight the importance of diversification, risk mitigation strategies, and a well-informed investment approach. Understand the risks and opportunities presented by elevated stock market valuations with BofA's expert analysis and develop a robust investment strategy informed by their insights into current market valuations. (Note: A link to BofA's report would be included here if available.)

Featured Posts

-

Review Razer Blade 16 2025 Ultra High Performance Gaming Laptop

Apr 22, 2025

Review Razer Blade 16 2025 Ultra High Performance Gaming Laptop

Apr 22, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025 -

China And Indonesia Expanding Security Collaboration And Partnerships

Apr 22, 2025

China And Indonesia Expanding Security Collaboration And Partnerships

Apr 22, 2025 -

Post Truce Russias Renewed Assault On Ukraine

Apr 22, 2025

Post Truce Russias Renewed Assault On Ukraine

Apr 22, 2025 -

Understanding The Anti Trump Protests In The United States

Apr 22, 2025

Understanding The Anti Trump Protests In The United States

Apr 22, 2025