BofA's Reassuring View: Are Stretched Stock Market Valuations Really A Worry?

Table of Contents

BofA's Bullish Stance on Stretched Stock Market Valuations

BofA's analysts maintain a surprisingly bullish stance on current market conditions, despite the seemingly high valuations. Their optimism is rooted in several key arguments.

Key Arguments Presented by BofA

BofA's positive outlook rests on several pillars:

- Strong Corporate Earnings: The bank points to robust corporate earnings reports, indicating that companies are performing well and justifying higher stock prices. They cite consistent growth across various sectors, particularly in technology and consumer staples.

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains surprisingly strong, indicating a healthy economy capable of supporting higher valuations. This is fueled by factors such as a still-strong labor market.

- Future Growth Projections: BofA's models project continued economic growth in the coming years, suggesting that current valuations may be justified by anticipated future earnings. This incorporates factors like technological innovation and global economic recovery.

Specific data points cited by BofA include projected GDP growth of X% for the next year, inflation forecasts averaging Y%, and interest rate predictions remaining relatively stable in the short term. These predictions, detailed in their latest report by analysts [Analyst Name(s)], underpin their bullish sentiment.

Analyzing BofA's Methodology

BofA's analysis utilizes a multi-faceted approach:

- Data Sources: They draw upon a wide range of data sources, including macroeconomic indicators, company financial statements, and consumer sentiment surveys.

- Quantitative Models: Sophisticated quantitative models are employed to project future earnings and economic conditions, factoring in various variables.

- Assumptions: The model relies on several assumptions, including continued technological innovation, moderate inflation, and stable geopolitical conditions.

However, it's important to acknowledge potential limitations: any predictive model is subject to unforeseen events, and the assumptions made might not fully materialize. Furthermore, the reliance on historical data might not perfectly reflect future market behavior.

Counterarguments and Potential Risks to BofA's View

While BofA presents a convincing case, it's crucial to acknowledge counterarguments and potential risks associated with stretched stock market valuations.

The Case for Valuation Concerns

The concern over stretched valuations is valid due to several factors:

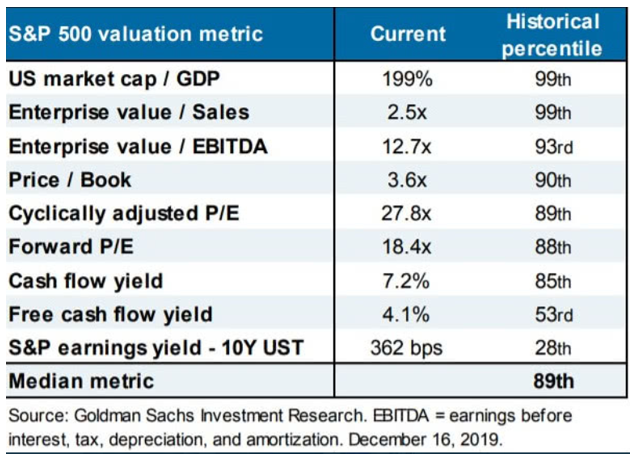

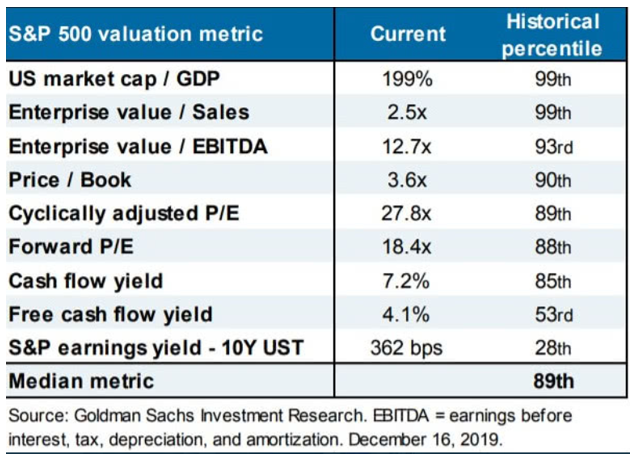

- High Price-to-Earnings Ratios (P/E): Many stocks are trading at historically high P/E ratios, suggesting they are overvalued relative to their earnings.

- Inflationary Pressures: Persistent inflation erodes purchasing power and can impact corporate profitability, potentially leading to lower stock prices.

- Interest Rate Hikes: Increased interest rates raise borrowing costs for businesses and consumers, potentially slowing economic growth and dampening investor sentiment.

- Geopolitical Instability: Geopolitical events can significantly impact market sentiment and lead to volatility.

Data points supporting these concerns include a current average P/E ratio of Z for the S&P 500, an inflation rate of W%, and the recent interest rate increase of X% by the Federal Reserve.

Weighing the Risks and Rewards

| Factor | Bullish View (BofA) | Bearish View |

|---|---|---|

| Economic Growth | Strong, sustained growth driving earnings | Slowdown or recession impacting profitability |

| Inflation | Moderate, manageable inflation | Persistent high inflation eroding purchasing power |

| Interest Rates | Stable or gradual increases | Significant rate hikes dampening investment |

| Geopolitical Risks | Limited impact on overall market performance | Significant geopolitical instability causing turmoil |

The potential for further market growth exists, particularly if BofA's predictions materialize. However, a correction remains a possibility if inflationary pressures intensify, interest rates rise sharply, or unforeseen geopolitical events occur. Investors with a higher risk tolerance and longer investment horizons may be more comfortable with the potential risks. Conversely, risk-averse investors with shorter time horizons may consider more conservative strategies.

Investor Strategies in Light of Stretched Stock Market Valuations

Regardless of one's stance on current valuations, sound investment strategies are crucial.

Diversification and Risk Management

Investors should prioritize diversification and risk management:

- Asset Allocation: Diversify across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk.

- International Diversification: Invest in international markets to reduce dependence on any single economy.

- Stop-Loss Orders: Employ stop-loss orders to limit potential losses on individual investments.

Long-Term Investing vs. Short-Term Trading

The optimal approach depends on your investment timeline:

- Long-Term Investing: A long-term perspective allows investors to ride out market fluctuations and benefit from long-term growth. This approach is better suited to those with a longer time horizon before needing the investment.

- Short-Term Trading: Short-term trading involves more frequent buying and selling, aiming to profit from short-term price movements. However, it carries significantly higher risk.

Conclusion

BofA's optimistic view on stretched stock market valuations presents a compelling counterpoint to prevailing anxieties. Their arguments based on strong corporate earnings, resilient consumer spending, and future growth projections are noteworthy. However, counterarguments highlighting high P/E ratios, inflationary pressures, interest rate hikes, and geopolitical instability deserve careful consideration. Understanding the nuances of stretched stock market valuations is crucial for making informed investment decisions. Conduct your own thorough research, consult with a qualified financial advisor, and develop a well-diversified investment strategy that aligns with your risk tolerance and financial goals. Don't let uncertainty about stretched stock market valuations paralyze you; develop a robust investment strategy today.

Featured Posts

-

Final Days Hudsons Bay Store Closing Sale

Apr 28, 2025

Final Days Hudsons Bay Store Closing Sale

Apr 28, 2025 -

Yukon Mine Manager Faces Contempt Charges Over Refusal To Testify

Apr 28, 2025

Yukon Mine Manager Faces Contempt Charges Over Refusal To Testify

Apr 28, 2025 -

Mets Fall To Twins 6 3 In Crucial Series Matchup

Apr 28, 2025

Mets Fall To Twins 6 3 In Crucial Series Matchup

Apr 28, 2025 -

Abwzby Mntda Alabtkar Fy Mjal Alhyat Alshyt Almdydt Yueqd

Apr 28, 2025

Abwzby Mntda Alabtkar Fy Mjal Alhyat Alshyt Almdydt Yueqd

Apr 28, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025