Cantor Fitzgerald In Talks For $3 Billion Crypto SPAC With Tether And SoftBank

Table of Contents

Cantor Fitzgerald's Role and Expertise

Cantor Fitzgerald, a veteran player in global financial markets with a rich history spanning decades, is known for its expertise in capital markets and investment banking. Their involvement in this crypto SPAC brings a level of legitimacy and experience often lacking in the still-emerging cryptocurrency sector. Their existing relationships with institutional investors could be crucial in attracting significant capital for the SPAC. Furthermore, their expertise in navigating complex regulatory landscapes will be invaluable in guiding the SPAC through the often-murky waters of cryptocurrency regulation.

- Experience in capital markets and investment banking: Cantor Fitzgerald possesses decades of experience in facilitating mergers, acquisitions, and public offerings.

- Existing relationships with institutional investors: Their established network provides access to a vast pool of potential investors for the crypto SPAC.

- Potential for providing expertise in navigating regulatory complexities: Cantor Fitzgerald's legal and compliance teams bring crucial knowledge to manage the regulatory challenges inherent in the cryptocurrency industry.

Tether's Controversial Involvement

Tether's participation in the proposed $3 billion crypto SPAC is arguably the most controversial aspect of the deal. While the exact nature of their involvement remains unclear – whether they will be a major investor or simply a strategic partner – their inclusion is bound to attract scrutiny. Tether, the issuer of the USDT stablecoin, has faced ongoing criticism regarding the backing of its reserves. These concerns have raised questions about the stability and reliability of USDT, impacting investor confidence and potentially influencing the perception of the entire SPAC.

- Concerns surrounding Tether's reserves: The lack of complete transparency regarding Tether's reserves has fueled skepticism and regulatory investigations.

- Potential positive and negative impacts of Tether's involvement on the SPAC's success: While Tether's involvement could bring significant capital and market awareness, it could also deter investors concerned about the controversies surrounding the stablecoin.

- Potential regulatory scrutiny: The involvement of Tether will undoubtedly intensify regulatory scrutiny of the SPAC and its future acquisitions.

SoftBank's Strategic Investment

SoftBank, a Japanese multinational conglomerate with a history of significant investments in the technology sector, including several successful bets in the tech and crypto space, is another key player in this proposed deal. Their participation suggests a strong belief in the long-term potential of the cryptocurrency market. SoftBank's strategic investment could provide valuable synergies with existing portfolio companies, creating opportunities for collaboration and market expansion for acquired crypto projects.

- Highlighting SoftBank's past successful investments in the technology sector: SoftBank's track record in identifying and nurturing high-growth technology companies speaks to their investment acumen.

- Discussing potential synergies between SoftBank's portfolio companies and the crypto projects the SPAC might acquire: Cross-promotion and collaborative ventures could significantly benefit acquired crypto companies.

- Analyzing the strategic implications for SoftBank's investment portfolio: This move diversifies SoftBank’s portfolio, establishing a significant presence in a rapidly growing sector.

Potential Implications for the Crypto Market

The success of this $3 billion crypto SPAC could have far-reaching implications for the cryptocurrency market. A significant influx of capital could boost valuations, increase market capitalization, and attract further institutional investment. This deal could also set a precedent for future investments in crypto startups, potentially accelerating the adoption of cryptocurrencies and blockchain technology. However, it could also lead to increased regulatory scrutiny of the entire cryptocurrency industry.

- Potential influx of capital into the cryptocurrency market: A successful SPAC could inject much-needed capital into the crypto ecosystem.

- Effect on crypto valuations and market capitalization: The deal could significantly impact the valuation of existing cryptocurrencies and boost overall market capitalization.

- Potential implications for regulatory oversight: The increased attention on the cryptocurrency market might lead to tighter regulations.

Challenges and Uncertainties

Despite the potential benefits, several challenges and uncertainties surround this ambitious $3 billion crypto SPAC deal. Regulatory hurdles in various jurisdictions could significantly delay or even prevent the deal from closing. The inherent volatility of the cryptocurrency market also poses a considerable risk. The success of the SPAC ultimately hinges on identifying and acquiring promising crypto projects, a task fraught with its own complexities.

- Potential regulatory hurdles in different jurisdictions: Navigating differing regulatory frameworks across various countries could prove to be a major challenge.

- Risks associated with market volatility in the cryptocurrency sector: Fluctuations in cryptocurrency prices could negatively impact the SPAC's investment strategy.

- Potential for delays or failure to close the deal: The complex nature of such a large-scale transaction increases the possibility of delays or failure.

Conclusion: The Future of Cantor Fitzgerald, Tether, and SoftBank's $3 Billion Crypto SPAC

The proposed $3 billion crypto SPAC involving Cantor Fitzgerald, Tether, and SoftBank represents a potentially transformative event for the cryptocurrency landscape. The collaboration of these powerful players could inject massive capital into the crypto market, influencing valuations and potentially shaping future regulatory landscapes. However, the deal is not without its challenges and uncertainties. The success of this venture will hinge on careful navigation of regulatory hurdles and the inherent volatility of the crypto market. Stay tuned for further updates on this $3 billion deal that could redefine the future of crypto investments and the broader financial ecosystem.

Featured Posts

-

Real Estate Activity 65 Hudsons Bay Leases In High Demand

Apr 24, 2025

Real Estate Activity 65 Hudsons Bay Leases In High Demand

Apr 24, 2025 -

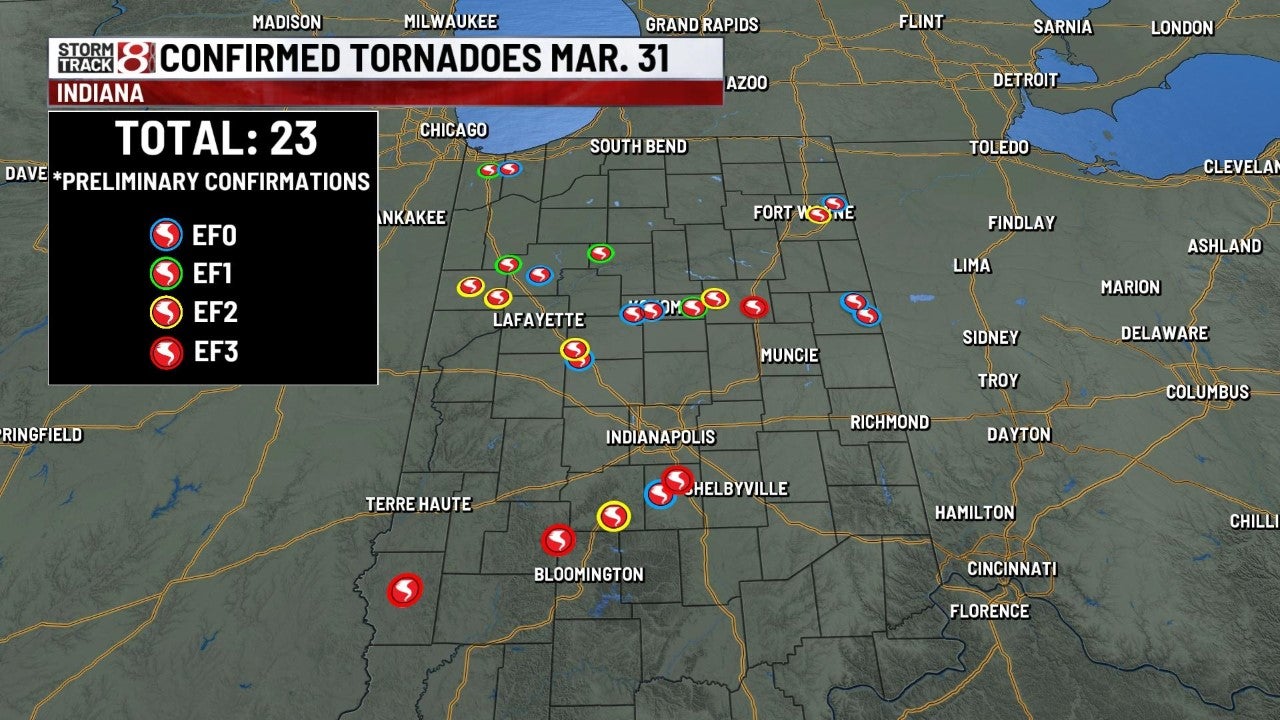

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025

Reduced Funding Increased Danger How Trumps Cuts Impact Tornado Season

Apr 24, 2025 -

The Los Angeles Wildfires And The Growing Problem Of Disaster Betting

Apr 24, 2025

The Los Angeles Wildfires And The Growing Problem Of Disaster Betting

Apr 24, 2025 -

Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025

Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liam And Bills Explosive Argument Ends In Collapse

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liam And Bills Explosive Argument Ends In Collapse

Apr 24, 2025