China's LPG Market: A Shift Eastward Due To US Trade Policies

Table of Contents

Pre-Trade War Dynamics: China's Traditional LPG Suppliers

Before 2018, China's LPG import landscape was relatively stable. The United States was a significant supplier, alongside Middle Eastern nations and other regional players. The US benefitted from its proximity and established trade relationships, commanding a substantial market share.

-

US market share before trade disputes: The US held a considerable share of the Chinese LPG import market, often exceeding [Insert Percentage if available] before the trade war began. This share was largely due to competitive pricing and efficient logistics.

-

Pricing strategies of US LPG exporters: US exporters often employed competitive pricing strategies, leveraging their domestic production capacity and efficient transportation networks. This competitiveness played a crucial role in their market dominance.

-

Transportation routes and logistics: The relatively short shipping distance between the US and China contributed to lower transportation costs, making US LPG a cost-effective option for Chinese importers. This included established shipping lanes and port infrastructure.

The Impact of US Tariffs and Trade Tensions on China's LPG Imports

The escalation of US-China trade tensions in 2018, marked by the imposition of tariffs and sanctions on various goods, drastically altered the dynamics of China's LPG imports. These trade policies significantly impacted the volume and cost of LPG imports from the US.

-

Timeline of key trade policy changes: [Insert specific dates and details of relevant tariffs and sanctions imposed by the US on LPG or related products]. This timeline should illustrate the progressive impact on LPG imports.

-

Quantification of the drop in US LPG imports: The imposition of tariffs led to a sharp decline in US LPG imports to China. [Insert quantifiable data, e.g., percentage decrease or volume figures]. This drop created a significant supply gap in the Chinese market.

-

Analysis of price increases due to tariffs and reduced supply: The reduced supply from the US, coupled with tariffs, led to increased prices for LPG in the Chinese market. This affected various sectors relying on LPG, influencing consumer and industrial costs.

-

Mention any retaliatory measures from China: China responded with its own retaliatory measures. [Detail any counter-tariffs or trade restrictions imposed by China].

The "Shift Eastward": Emerging LPG Suppliers for China

The reduced US LPG supply compelled China to diversify its import sources. This led to a notable "shift eastward," with increased reliance on suppliers in the Middle East, Russia, and Australia.

-

Increased import volumes from alternative suppliers: [Provide data illustrating the increase in imports from these alternative sources. Compare the volume shifts from the US to the new sources].

-

Comparative analysis of LPG prices from different regions: The shift in sourcing created a dynamic shift in pricing. [Compare LPG prices from the US, Middle East, Russia, and Australia]. This analysis should consider transportation costs and contract terms.

-

Analysis of new pipeline infrastructure and shipping routes: The increased reliance on new suppliers necessitated investments in new infrastructure, including pipelines and expanded shipping routes. This involved challenges and opportunities in logistics.

-

Discussion of long-term contracts and supplier reliability: China has pursued long-term contracts with these new suppliers to ensure a stable and reliable LPG supply. This highlights the importance of geopolitical considerations in securing energy resources.

The Future of China's LPG Market: Implications and Predictions

The realignment of China's LPG market has significant long-term implications. The increased diversification of supply sources enhances energy security, but presents new geopolitical complexities.

-

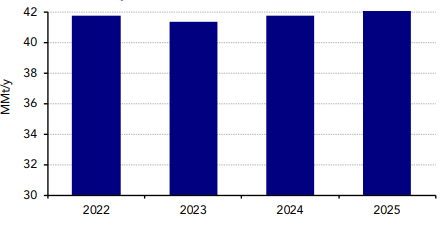

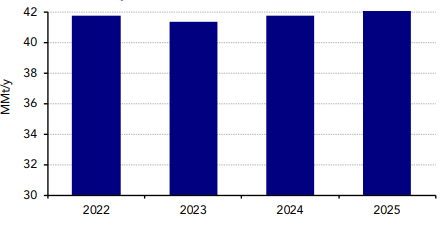

Projected growth in China's LPG demand: [Include projected growth figures for China's LPG demand, based on economic projections and consumption trends]. This will dictate future import needs and supplier relationships.

-

Assessment of the sustainability of current sourcing strategies: The sustainability of the current reliance on alternative suppliers should be evaluated, considering long-term price stability, geopolitical risk, and environmental factors.

-

Potential for further diversification of suppliers: China may further diversify its LPG import sources to mitigate risks associated with reliance on any single supplier or region. This will enhance resilience in the face of future global uncertainties.

-

The role of government policy in shaping future LPG markets: Government policies play a critical role in shaping the future of China's LPG market, influencing import regulations, infrastructure development, and price controls.

Conclusion: Navigating the Shifting Sands of China's LPG Market

The impact of US trade policies on China's LPG market has been profound, resulting in a significant shift towards eastern suppliers. This realignment has implications for China's energy security, economic stability, and international trade relations. The future of the China LPG market hinges on navigating the complexities of this new geopolitical landscape, demanding ongoing diversification of supply sources and strategic partnerships. For further insights into the complexities of China's LPG market and its response to evolving global trade policies, continue your research and stay updated on market developments related to China LPG market and LPG import. Consider subscribing to our newsletter for regular updates on liquefied petroleum gas dynamics.

Featured Posts

-

Increased Tornado Risk During Trump Era Experts Sound The Alarm

Apr 24, 2025

Increased Tornado Risk During Trump Era Experts Sound The Alarm

Apr 24, 2025 -

Steffy Comforts Liam Poppy Warns Finn The Bold And The Beautiful Spoilers February 20

Apr 24, 2025

Steffy Comforts Liam Poppy Warns Finn The Bold And The Beautiful Spoilers February 20

Apr 24, 2025 -

Chalet Girls Unveiling The Reality Of Luxury Ski Resort Life

Apr 24, 2025

Chalet Girls Unveiling The Reality Of Luxury Ski Resort Life

Apr 24, 2025 -

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television

Apr 24, 2025

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television

Apr 24, 2025