Chinese Buyout Firm Weighs Sale Of UTAC Chip Tester

Table of Contents

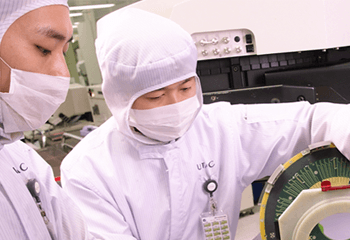

H2: The UTAC Chip Tester: A Key Asset

The UTAC chip tester isn't just another piece of equipment; it represents a significant technological advancement in semiconductor testing. Its capabilities are driving considerable interest in the potential acquisition.

H3: Technological Capabilities:

The UTAC chip tester boasts several key features that set it apart in the competitive market for semiconductor testing equipment. Its high-throughput testing capabilities allow for significantly faster processing of chips, reducing testing times and increasing overall efficiency. Advanced algorithms built into the system enable sophisticated failure analysis, pinpointing defects with unprecedented accuracy. This is particularly crucial for memory testing and logic testing, where even minor flaws can have catastrophic consequences. The system's ability to handle a wide range of chip types also enhances its versatility and appeal to a broader customer base.

- Specific technical specifications: (Insert specific details if available – e.g., testing speed, number of pins, supported chip types). The lack of publicly available data emphasizes the strategic value of the asset.

- Target customer base: Foundries, fabless semiconductor companies, and even research institutions all represent potential clients for the UTAC chip tester.

- Competitive advantages: Faster testing speeds, superior failure analysis, and broader chip compatibility give the UTAC tester a notable edge over competitors.

- Market demand: The consistently growing demand for advanced semiconductor testing equipment ensures a robust market for a high-performing asset like the UTAC chip tester.

H2: Reasons Behind the Potential Sale

The decision by the Chinese buyout firm to consider selling the UTAC chip tester likely stems from a combination of financial and strategic factors.

H3: Financial Strategies:

Private equity firms, by their nature, seek significant returns on investment (ROI). The sale of the UTAC chip tester could represent a lucrative exit strategy, allowing the firm to realize substantial profits from its initial investment. This could be part of a broader portfolio restructuring, enabling the firm to diversify its holdings and allocate capital to more promising investment opportunities. The current economic climate and market conditions likely also play a role in this decision.

- Potential financial benefits: A successful sale could yield significant returns for the buyout firm, exceeding initial investment expectations.

- Market conditions: Favorable market conditions for semiconductor testing equipment could enhance the sale price and make this an opportune moment for the firm.

- Strategic realignment: The sale might reflect a strategic shift in the buyout firm's investment focus towards other sectors or technologies.

- Public statements: (Include any available public statements from the firm or involved parties regarding the potential sale).

H2: Potential Buyers and Market Impact

The potential sale of the UTAC chip tester is attracting considerable interest from various parties, highlighting its strategic value.

H3: Strategic Acquisitions:

Several potential buyers are likely to be vying for the acquisition of this advanced semiconductor testing technology. Established semiconductor equipment manufacturers could seek to bolster their product portfolio and market share. Large technology companies might be interested in integrating the technology into their internal operations or to supply their own production chains. Even competing Chinese buyout firms might see this as an opportunity to gain a significant competitive edge. The resulting M&A activity will undoubtedly reshape the landscape of semiconductor testing.

- Potential buyer profiles: (List potential buyers, e.g., specific companies or types of firms, and their potential motives).

- Impact on market share: The acquisition could significantly alter the market share distribution among semiconductor testing equipment providers.

- Impact on pricing and innovation: The acquisition could affect pricing strategies and potentially accelerate or slow down innovation depending on the buyer.

- Geopolitical implications: The buyer's nationality and the potential impact on global semiconductor supply chains represent significant geopolitical considerations.

H2: Future Outlook and Predictions

The semiconductor testing equipment market is poised for continued growth, despite global economic uncertainties.

H3: Market Trends:

The future of semiconductor testing is inextricably linked to advancements in chip technology and the ever-increasing complexity of integrated circuits. The ongoing miniaturization of chips demands increasingly sophisticated testing equipment. Market growth forecasts consistently point towards a positive outlook, although geopolitical factors and global economic conditions will undoubtedly play a role. Emerging technologies like AI and machine learning are also likely to influence the development and demand for advanced testing solutions.

- Market growth forecast: (Include relevant market research data and projections for the semiconductor testing equipment market).

- Key technological trends: Advancements in AI, machine learning, and high-speed data processing are expected to shape the future of semiconductor testing.

- Potential risks and opportunities: Global economic downturns and geopolitical instability represent potential risks, while technological advancements offer considerable opportunities.

- Expert opinions: (Include relevant expert opinions and predictions if available).

3. Conclusion:

The potential sale of the UTAC chip tester by a Chinese buyout firm represents a significant development within the dynamic semiconductor industry. This transaction will influence market competition, investment strategies, and technological innovation. The identity of the eventual buyer and the resulting impact on the market remain to be seen, but the deal highlights the importance of semiconductor testing equipment and the ongoing consolidation within the sector.

Stay tuned for further updates on this significant Chinese buyout firm transaction and the future of UTAC chip tester technology. Follow us for more insights into the dynamic world of semiconductor acquisitions and investments in the ever-evolving landscape of Chinese private equity and global semiconductor mergers and acquisitions.

Featured Posts

-

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025 -

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Test Results

Apr 24, 2025

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Test Results

Apr 24, 2025 -

Liberal Party Platform A Voters Guide By William Watson

Apr 24, 2025

Liberal Party Platform A Voters Guide By William Watson

Apr 24, 2025 -

Double Trouble In Hollywood The Writers And Actors Joint Strike

Apr 24, 2025

Double Trouble In Hollywood The Writers And Actors Joint Strike

Apr 24, 2025 -

Hisd Mariachi Headed To Uil State Championships After Whataburger Video Goes Viral

Apr 24, 2025

Hisd Mariachi Headed To Uil State Championships After Whataburger Video Goes Viral

Apr 24, 2025