Deloitte Sees Considerable Slowdown In US Economic Growth Outlook

Table of Contents

Deloitte's Revised Growth Projections

Deloitte has significantly lowered its GDP growth projections for the coming quarters, citing several contributing factors. This downward revision represents a significant shift from previous forecasts and necessitates a reassessment of economic strategies.

Lower GDP Forecasts

- Previous Forecast (Q3 2024): [Insert previous Q3 2024 GDP growth forecast from Deloitte's previous report]

- Revised Forecast (Q3 2024): [Insert Deloitte's revised Q3 2024 GDP growth forecast] This represents a [Percentage] point decrease.

- Previous Forecast (Q4 2024): [Insert previous Q4 2024 GDP growth forecast from Deloitte's previous report]

- Revised Forecast (Q4 2024): [Insert Deloitte's revised Q4 2024 GDP growth forecast] This represents a [Percentage] point decrease.

- Previous Forecast (Q1 2025): [Insert previous Q1 2025 GDP growth forecast from Deloitte's previous report]

- Revised Forecast (Q1 2025): [Insert Deloitte's revised Q1 2025 GDP growth forecast] This represents a [Percentage] point decrease.

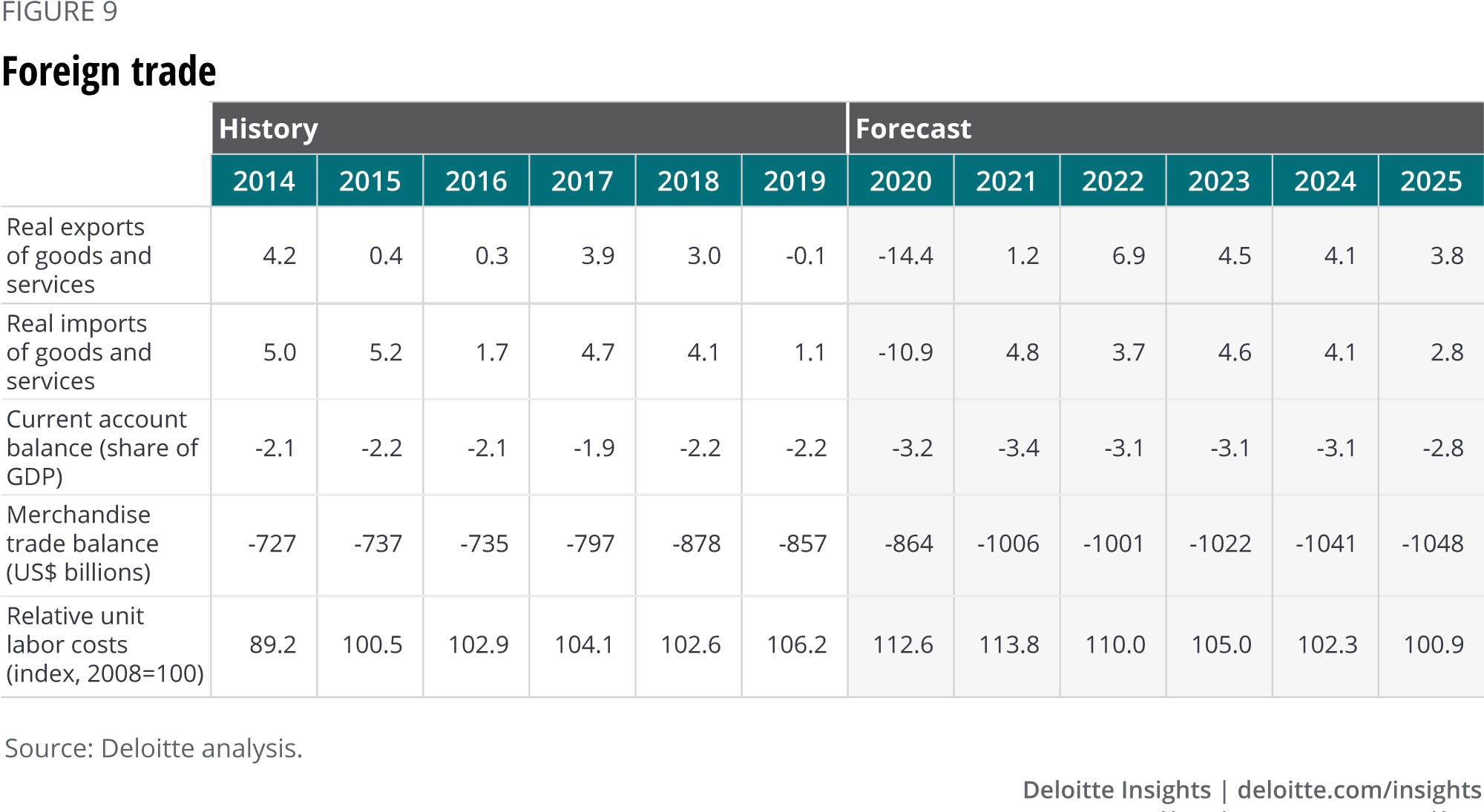

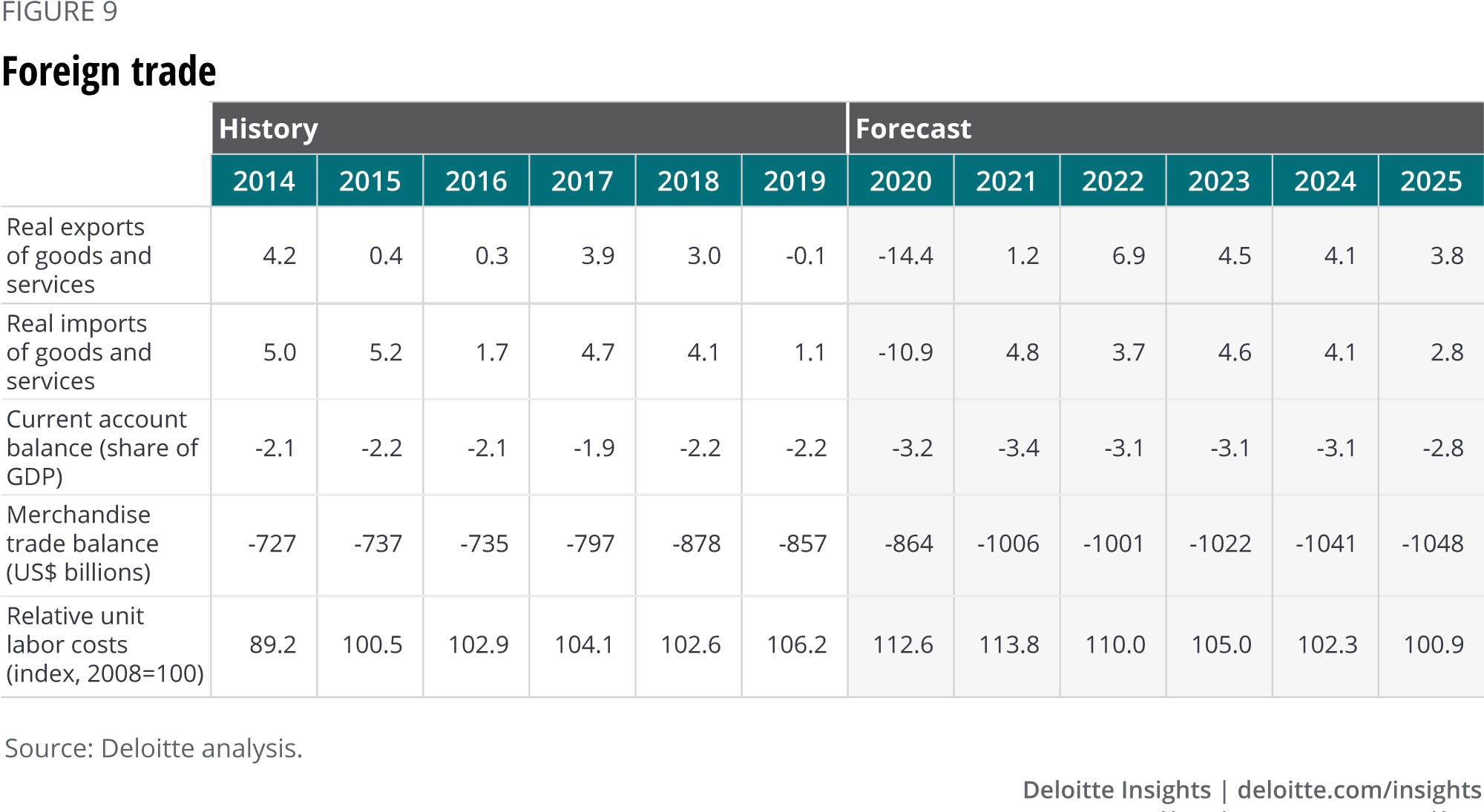

Deloitte's methodology likely involves analyzing various economic indicators, including consumer spending, business investment, government spending, and net exports. These factors are weighted and modeled to arrive at the GDP projection. The lowered forecasts signal a potential weakening of the US economy, potentially leading to slower job growth and reduced consumer confidence.

Key Factors Driving the Slowdown

Several interconnected factors contribute to Deloitte's prediction of a significant slowdown in US economic growth. These factors act synergistically, exacerbating the overall economic challenges.

Inflationary Pressures

Persistent inflation continues to erode consumer spending power and business investment, dampening overall economic activity.

- Rising Energy Costs: Increased energy prices directly impact production costs for businesses and increase household expenses, reducing disposable income.

- Supply Chain Disruptions: Ongoing global supply chain issues contribute to higher prices for goods and services.

- Wage Growth: While wages are increasing, they often lag behind inflation, resulting in a decline in real wages and reduced consumer purchasing power.

Inflation directly impacts GDP growth by reducing consumer demand and business investment. When prices rise faster than incomes, consumers buy less, and businesses invest less, leading to a slowdown in economic activity.

Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are impacting borrowing costs and slowing economic activity.

- Federal Funds Rate Increase: The Federal Reserve has increased the federal funds rate by [Insert percentage points] since [Start date].

- Impact on Housing Market: Higher mortgage rates have cooled the housing market, reducing construction activity and home sales.

- Impact on Business Investment: Increased borrowing costs make it more expensive for businesses to invest in expansion and new equipment, hindering growth.

Higher interest rates increase the cost of borrowing, making it more expensive for businesses and consumers to finance purchases. This reduced spending contributes directly to a slowdown in economic growth.

Geopolitical Uncertainty

Global instability and the ongoing war in Ukraine contribute to economic uncertainty and dampen investment.

- Global Supply Chain Disruptions: The war in Ukraine has further exacerbated global supply chain disruptions, impacting the availability and cost of goods.

- Energy Market Volatility: The conflict has caused significant volatility in global energy markets, impacting energy prices worldwide.

- Increased Risk Aversion: Geopolitical uncertainty leads to increased risk aversion among investors, reducing investment in both domestic and international markets.

Geopolitical events create uncertainty, making businesses hesitant to invest and consumers hesitant to spend, resulting in a negative impact on US economic growth.

Sector-Specific Impacts of the Slowdown

Deloitte's report likely details the varied impacts of the economic slowdown across different sectors.

Consumer Spending

Inflation and rising interest rates are significantly impacting consumer confidence and spending.

- Reduced Retail Sales: Expect to see slower growth or declines in retail sales across various sectors.

- Impact on Hospitality: The hospitality industry is particularly vulnerable, with potential for reduced travel and dining out.

- Potential Job Losses: Reduced consumer spending will likely lead to job losses in retail, hospitality, and related sectors.

Business Investment

The challenging economic climate is expected to reduce business investment.

- Decreased Capital Expenditures: Businesses are likely to postpone or reduce investments in new equipment and technology.

- Reduced Expansion Plans: Companies may delay or cancel expansion plans due to economic uncertainty.

- Impact on Innovation: Reduced investment could hamper innovation and long-term economic growth.

Employment Market

Deloitte's report will likely offer insights into job growth and unemployment rates.

- Slower Job Growth: Expect to see slower job growth compared to previous periods.

- Potential Unemployment Increase: Some sectors may experience job losses due to reduced demand.

- Shift in Employment Sectors: The slowdown might lead to a shift in employment from certain sectors to others.

Conclusion

Deloitte's report underscores a significant slowdown in US economic growth, driven by persistent inflation, rising interest rates, and geopolitical uncertainty. These factors create a challenging economic environment impacting consumer spending, business investment, and employment. Understanding this revised outlook on US economic growth is crucial for businesses and consumers to adapt their strategies. Staying informed about updates on the US economic growth forecast, by regularly reviewing Deloitte’s reports and other leading economic indicators, is vital for proactive financial planning and investment decisions.

Featured Posts

-

Plan Your Happy Day February 20 2025

Apr 27, 2025

Plan Your Happy Day February 20 2025

Apr 27, 2025 -

Us China Trade War Bill Ackmans Long Term Perspective

Apr 27, 2025

Us China Trade War Bill Ackmans Long Term Perspective

Apr 27, 2025 -

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025 -

Pne Ag Ad Hoc Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Ad Hoc Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Blue Origins Launch Scrubbed Details On The Vehicle Subsystem Issue

Apr 27, 2025

Blue Origins Launch Scrubbed Details On The Vehicle Subsystem Issue

Apr 27, 2025