ECB's Simkus: Trade Headwinds May Trigger Two Additional Interest Rate Reductions

Table of Contents

Trade Headwinds and Their Impact on the Eurozone Economy

The Eurozone is facing significant headwinds stemming from the complex and evolving global trade landscape. The ongoing US-China trade war, coupled with the lingering uncertainties surrounding Brexit, has created a climate of increased economic uncertainty. This uncertainty is dampening investment, hindering growth, and affecting key economic indicators.

The impact on the Eurozone is multifaceted:

- Reduced export demand: Trade tensions have led to decreased demand for Eurozone exports, particularly in sectors heavily reliant on international trade.

- Increased uncertainty among businesses: The volatile trade environment makes it difficult for businesses to plan for the future, leading to reduced investment and hiring.

- Potential supply chain disruptions: Trade disputes can disrupt global supply chains, leading to increased costs and delays for businesses.

- Decreased investor confidence: Uncertainty about the future of global trade is discouraging investment in the Eurozone, further dampening economic growth.

These factors are reflected in slowing GDP growth, subdued inflation, and persistent unemployment concerns within the Eurozone. The ripple effect of these trade challenges is impacting various sectors and hindering the overall economic performance of the region.

ECB's Response: The Potential for Two Interest Rate Reductions

In light of these significant challenges, ECB board member Šimkus has hinted at the possibility of two further interest rate reductions. This signals a proactive response from the ECB to combat slowing economic growth and support inflation. The rationale behind this potential move is to stimulate economic activity and counter deflationary pressures.

The current interest rate levels are already at historically low levels, but further reductions could:

- Stimulate economic activity: Lower interest rates make borrowing cheaper for businesses and consumers, encouraging investment and spending.

- Boost lending and investment: Reduced borrowing costs can lead to increased lending by banks and higher levels of investment by businesses.

- Counter deflationary pressures: Lower interest rates can help to increase inflation, which is currently below the ECB's target.

- Support employment: Increased economic activity stimulated by lower interest rates could lead to job creation.

While this strategy is intended to revitalize the Eurozone economy, it's important to note that not all within the ECB are necessarily in agreement with this aggressive approach. There are concerns about the potential downsides of further rate cuts.

Market Reactions and Economic Implications of Potential Rate Cuts

Šimkus's statement regarding potential ECB interest rate cuts has already elicited market reactions. Stock prices have shown some volatility, bond yields have generally fallen, and the Euro exchange rate has experienced fluctuations.

The potential economic consequences of these rate cuts are complex and potentially far-reaching. While the intended effects are positive – increased investment, job creation, and boosted consumer spending – there are potential downsides:

- Impact on borrowing costs: While lower rates benefit some borrowers, they could also put pressure on banks' profitability.

- Effect on consumer spending: Lower interest rates might not automatically translate into higher consumer spending, depending on consumer confidence.

- Influence on investment decisions: While lower rates encourage some investment, others may wait for greater economic clarity.

- Potential for increased government debt: Lower interest rates can make it easier for governments to borrow money, but this could lead to an increase in public debt if not managed responsibly.

The effectiveness of further rate cuts remains to be seen, and there are inherent risks associated with such monetary policy decisions. The ECB will need to carefully monitor the impact of any further cuts and adjust its strategy as needed.

Understanding the Implications of ECB's Potential Double Interest Rate Cut

In summary, significant trade headwinds are posing a considerable threat to the Eurozone economy. ECB board member Šimkus's warning of potential double interest rate cuts underscores the seriousness of the situation. While these cuts aim to stimulate growth and combat deflation, they also carry potential risks, including increased inflation and currency devaluation. The ultimate impact will depend on a complex interplay of factors, including the effectiveness of the rate cuts themselves, and the resolution of global trade uncertainties.

To stay informed on this critical issue and its implications for your investments and the wider economy, keep a close watch on further developments concerning ECB monetary policy, and closely follow any updates on the Eurozone interest rate outlook and the impact of Šimkus’s statement on interest rates. Understanding the ECB's decisions is crucial for navigating the complexities of the current economic climate.

Featured Posts

-

Premier League And Champions League Fifth Spot All But Secured

Apr 27, 2025

Premier League And Champions League Fifth Spot All But Secured

Apr 27, 2025 -

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025 -

Hair And Tattoo Transformations Ariana Grandes Style Evolution And The Search For Identity

Apr 27, 2025

Hair And Tattoo Transformations Ariana Grandes Style Evolution And The Search For Identity

Apr 27, 2025 -

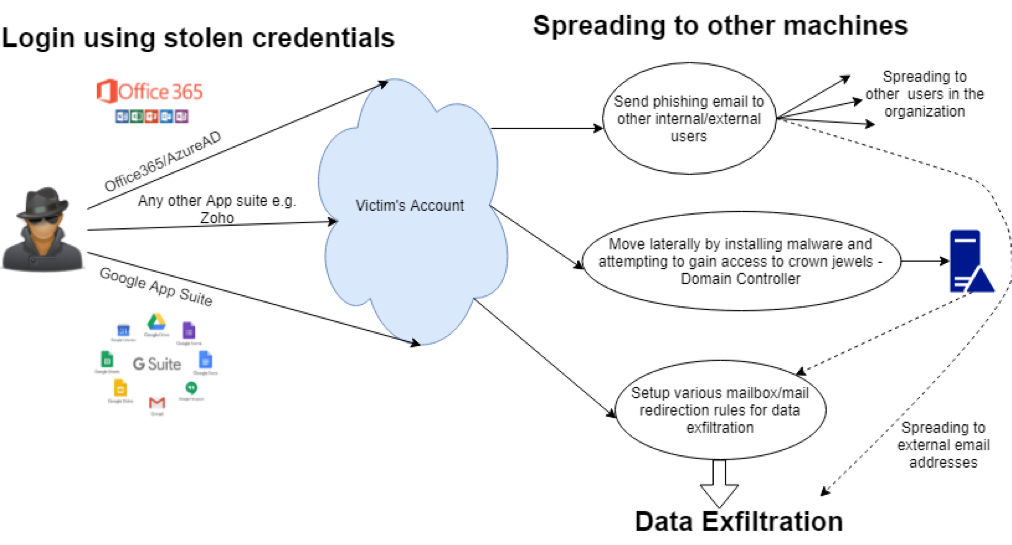

Federal Investigation Millions Lost In Office365 Executive Account Compromise

Apr 27, 2025

Federal Investigation Millions Lost In Office365 Executive Account Compromise

Apr 27, 2025 -

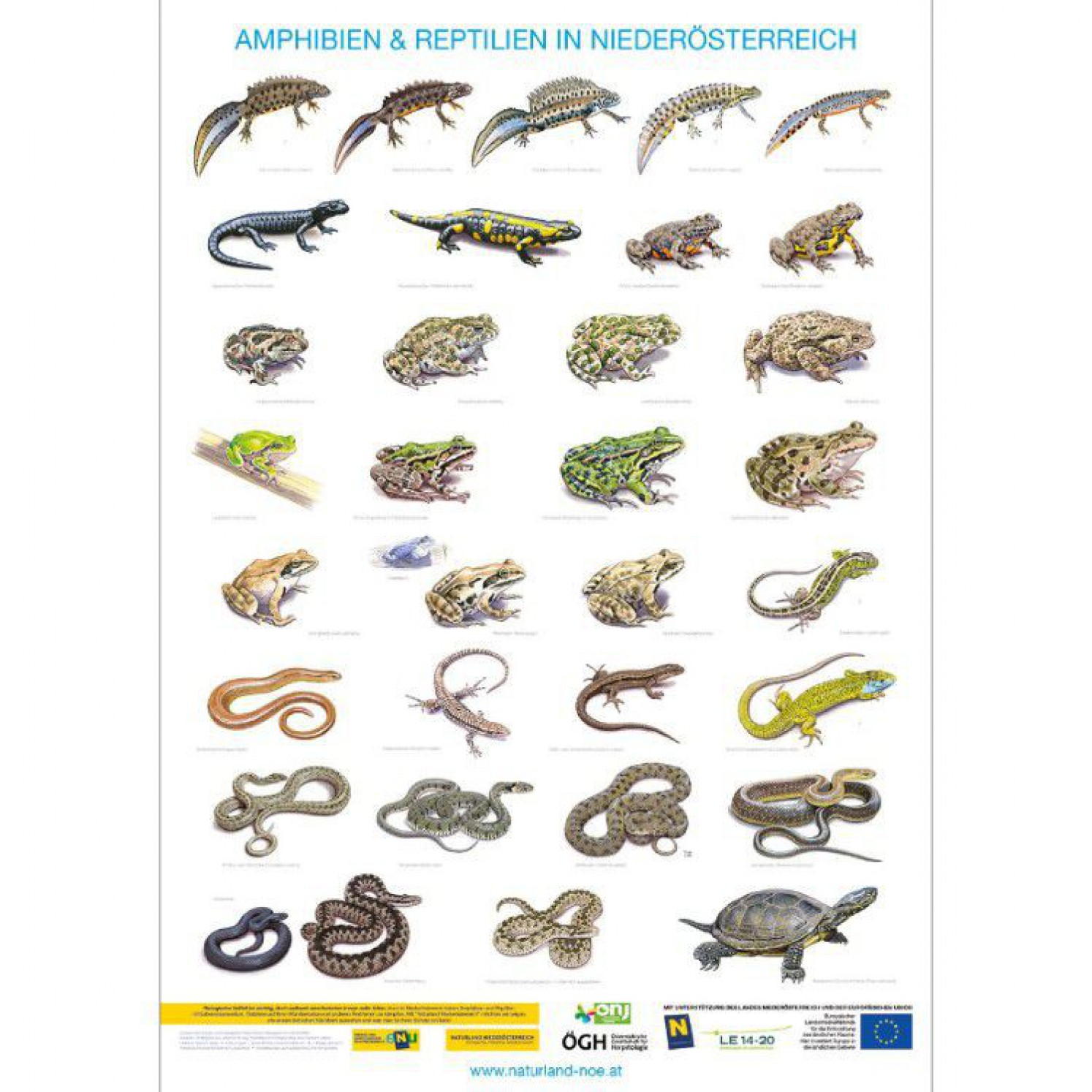

Amphibien Und Reptilien In Thueringen Der Vollstaendige Atlas

Apr 27, 2025

Amphibien Und Reptilien In Thueringen Der Vollstaendige Atlas

Apr 27, 2025