Examining Canada's Fiscal Policies: A Path To Responsibility

Table of Contents

Government Spending and Program Efficiency

Government spending in Canada encompasses a wide range of sectors, including healthcare, education, defense, and various social programs. Analyzing the efficiency of these programs is critical for ensuring fiscal responsibility. While many programs are vital, there's room for improvement in resource allocation and cost-effectiveness. Efficient government programs are essential for maximizing the impact of taxpayer dollars.

- Examples of potentially inefficient programs: Overlapping mandates between different government departments, outdated administrative processes, and a lack of performance measurement in certain programs.

- Potential cost-cutting measures: Streamlining administrative processes, leveraging technology for improved service delivery, and implementing rigorous performance evaluations to identify and eliminate redundancies.

- Suggestions for improved program delivery: Investing in data-driven decision-making, enhancing inter-departmental collaboration, and focusing on outcome-based funding models.

The pursuit of efficient government programs is paramount for fiscal responsibility in Canada. Careful scrutiny of government spending, combined with strategic improvements, can unlock significant cost savings without compromising essential services.

Tax Policy and Revenue Generation

The Canadian tax system plays a vital role in generating revenue needed to fund government programs and services. Evaluating the effectiveness of this system is crucial for maintaining fiscal sustainability. Different tax rates impact various income brackets and businesses differently, requiring careful consideration to balance revenue generation with economic growth.

- Analysis of current tax rates: Examining the progressive nature of the Canadian tax system, analyzing the impact of various tax brackets on income distribution, and evaluating the effectiveness of corporate tax rates in encouraging investment.

- Proposed changes: Potential reforms could include simplifying the tax code, addressing tax loopholes, and exploring alternative taxation models to ensure fairness and efficiency. Debate continues about the optimal balance between direct and indirect taxation.

- Impact on economic growth: Understanding the relationship between tax rates and economic activity is crucial. High tax rates could potentially stifle investment, while excessively low rates may limit government revenue. The challenge lies in finding the optimal balance.

- Potential for tax evasion and avoidance: Strengthening tax enforcement mechanisms and closing loopholes are essential to prevent revenue loss and ensure a fair and equitable system.

Canadian tax policy directly impacts fiscal sustainability. Well-designed tax reforms are needed to ensure sufficient revenue generation while promoting economic growth and minimizing tax avoidance.

Managing Canada's National Debt

Canada's national debt, while manageable, warrants careful attention. The current level of debt and its impact on future economic growth necessitate effective debt management strategies. High national debt levels can constrain future government spending and limit the ability to respond to economic downturns or social needs.

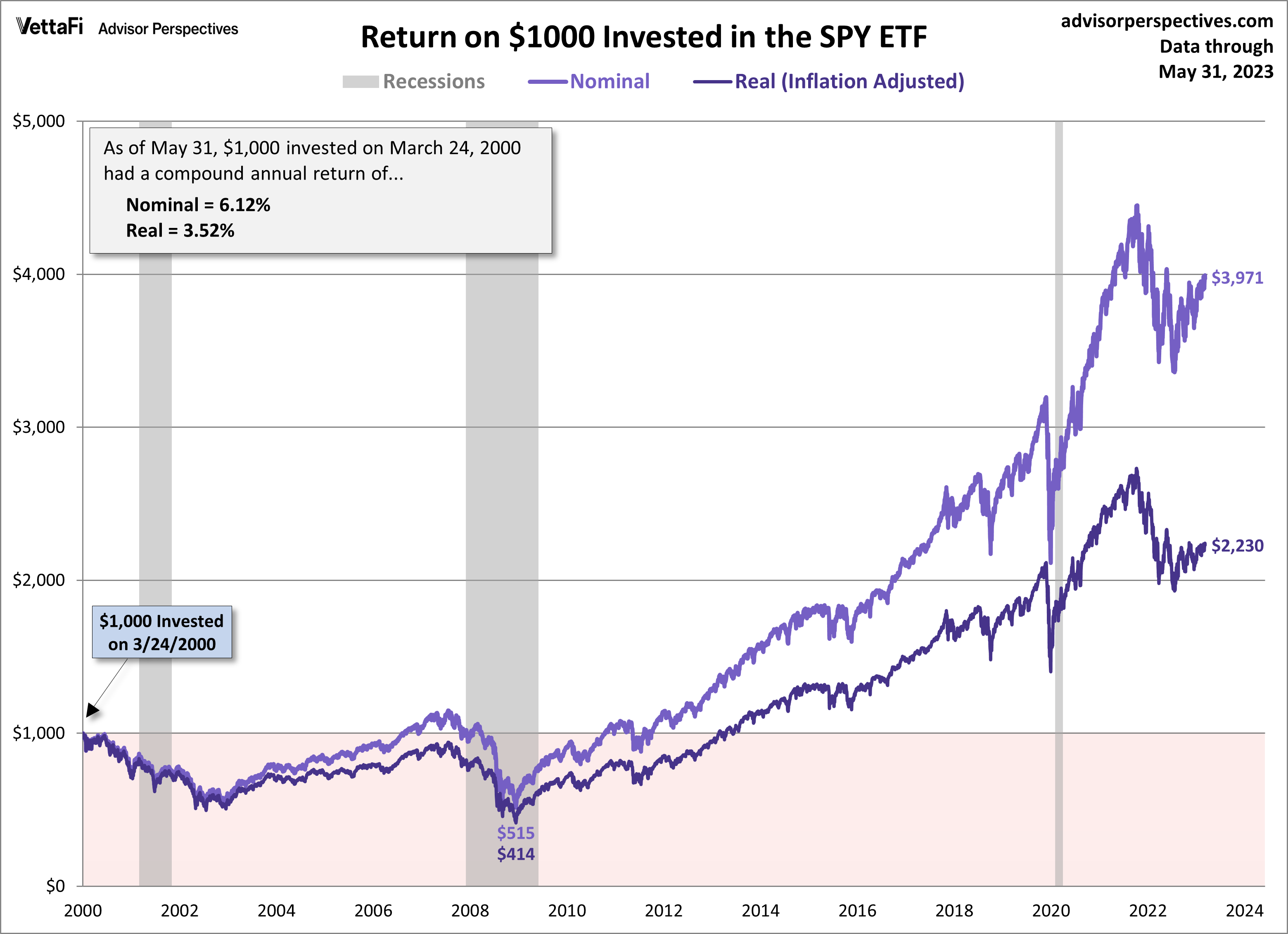

- Current debt levels: Tracking the debt-to-GDP ratio provides a key indicator of Canada's fiscal health. This ratio shows the relationship between the country’s debt and its economic output.

- Debt-to-GDP ratio: Maintaining a sustainable debt-to-GDP ratio is crucial for long-term economic stability. A high ratio can signal financial vulnerability and limit future policy options.

- Strategies for debt reduction: Increased revenue generation through effective tax policies, coupled with controlled government spending, are key strategies for reducing the national debt. Prioritizing high-impact programs and eliminating wasteful spending are vital.

- Potential risks of high debt: High debt levels can lead to increased interest payments, crowding out private investment, and reducing the government's capacity to respond to economic shocks.

The Role of Fiscal Policy in Economic Growth

Fiscal policy plays a significant role in influencing economic growth in Canada. Stimulative fiscal policies, such as increased government spending or tax cuts, can boost economic activity in the short term. However, austerity measures, involving reduced spending or increased taxes, can have contrasting effects.

- Examples of successful fiscal policies: Targeted infrastructure investments that stimulate employment and economic activity, tax incentives for innovation and business investment.

- Examples of unsuccessful fiscal policies: Overly expansionary fiscal policies that lead to inflation or unsustainable debt levels, poorly targeted social programs that fail to achieve their intended objectives.

- Long-term impact on economic growth: Sustainable fiscal policies that balance spending with revenue generation are crucial for fostering long-term economic growth and stability.

Conclusion: A Call for Responsible Fiscal Management in Canada

This examination of Canada's fiscal policies highlights the crucial need for responsible fiscal management. Balancing government spending, optimizing tax policies, and effectively managing the national debt are vital for securing Canada's economic future. The challenges are significant, but opportunities exist to improve efficiency, enhance revenue generation, and promote sustainable economic growth. We need ongoing dialogue and debate to ensure Canada's fiscal health. We urge readers to learn more about Canada's fiscal policies and engage in informed discussions to build a more prosperous future for Canada. Let’s work together to improve Canada's fiscal health and create responsible Canadian fiscal policies for generations to come.

Featured Posts

-

Stock Market Data Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025

Stock Market Data Dow S And P 500 And Nasdaq April 23rd

Apr 24, 2025 -

Goldsteins Dead Cat Metaphor Understanding Ted Lassos Unexpected Revival

Apr 24, 2025

Goldsteins Dead Cat Metaphor Understanding Ted Lassos Unexpected Revival

Apr 24, 2025 -

Secret Service Closes White House Cocaine Investigation

Apr 24, 2025

Secret Service Closes White House Cocaine Investigation

Apr 24, 2025 -

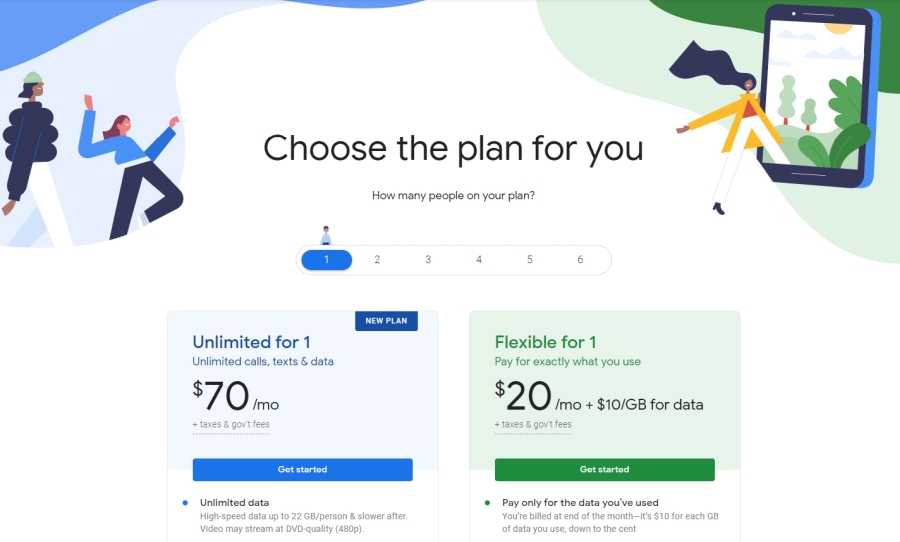

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025 -

Pope Francis Papal Ring Its Fate After His Death And The Reason Behind It

Apr 24, 2025

Pope Francis Papal Ring Its Fate After His Death And The Reason Behind It

Apr 24, 2025