Fighting The Richest Man: An American Battleground

Table of Contents

The Concentration of Wealth: A Generational Divide

The widening gap between the rich and the poor isn't just a recent phenomenon; it's a generational issue deeply rooted in how wealth is accumulated and passed down. This concentration of wealth significantly hinders social mobility, creating a system where success is often predetermined by birthright.

Inheritance and the Perpetuation of Wealth

Inherited wealth creates a significant advantage, fueling a cycle of inequality. This inherited wealth allows subsequent generations to avoid the struggles faced by those starting from scratch, perpetuating the existing economic imbalance.

- Examples: The Walton family (Walmart), the Koch brothers, and numerous other dynastic fortunes illustrate the impact of inherited wealth. These families maintain immense power and influence across generations, shaping industries and influencing policy.

- Statistics: Studies consistently show a vast disparity in wealth distribution. The top 1% holds a disproportionate share of national wealth, while the bottom 50% struggles to maintain financial stability. This generational wealth transfer exacerbates existing inequalities.

- Estate Taxes: The debate surrounding estate taxes highlights the tension between preserving inherited wealth and promoting a more equitable society. Lowering or eliminating estate taxes can further concentrate wealth in the hands of a few, hindering social mobility. The role of estate taxes in wealth transfer is a critical point in this discussion. Effective estate taxes can help mitigate the concentration of generational wealth.

The Role of Lobbying and Political Influence

The wealthiest individuals and corporations wield significant political influence, shaping policies that favor their interests. This lobbying power creates an uneven playing field, exacerbating economic inequality.

- Lobbying Efforts: Powerful lobbies representing large corporations and wealthy individuals actively influence legislation on issues like taxation, deregulation, and environmental protection, often to their own benefit and at the expense of the broader population.

- Campaign Finance: Campaign finance reform debates highlight the influence of large donors on political campaigns and elections. Unlimited campaign contributions can give the wealthy disproportionate influence over political outcomes.

- Revolving Door: The revolving door between government and the private sector allows individuals with close ties to wealthy interests to shape policy from both sides, further strengthening the influence of the elite.

The Rise of Populism and the Anti-Elite Sentiment

The growing gap between the rich and the poor fuels a populist backlash against the elite, manifesting in various political movements and social trends. This anti-elite sentiment is reshaping political discourse and influencing policy debates.

The Populist Backlash Against the 1%

Resentment towards the ultra-wealthy is growing, driving populist movements that capitalize on this sentiment. These movements often frame the issue as a struggle between the "people" and the "elite," promising to address wealth inequality.

- Examples: The rise of populist leaders and movements worldwide reflects this growing anti-elite sentiment. These movements often tap into feelings of frustration and disenfranchisement among those left behind by globalization and economic changes.

- Social Media: Social media plays a significant role in amplifying these sentiments, allowing for rapid dissemination of information and the organization of protests and movements challenging the established order. This allows for broader, faster communication around this anti-elite sentiment.

- Political Polarization: This anti-elite sentiment contributes to political polarization, as different groups and parties offer contrasting solutions to address economic inequality.

The Impact on Political Discourse and Policy Debates

The anti-elite sentiment is reshaping the political landscape and influencing policy discussions. Issues like wealth redistribution, taxation, and social safety nets are increasingly central to political debates.

- Policy Proposals: Policy proposals aimed at addressing wealth inequality, including progressive taxation, wealth redistribution, increased minimum wages, and stronger social safety nets, are becoming more central to political platforms.

- Taxation Debates: Debates surrounding taxation are intensifying, with calls for higher taxes on the wealthy and corporations to fund social programs and reduce the budget deficit.

- Minimum Wage and Social Safety Nets: The discussion around a living minimum wage and the strengthening of social safety nets reflect the growing demand for policies that protect vulnerable populations and reduce inequality.

Potential Solutions and Paths Forward

Addressing the issue of "Fighting the Richest Man" requires a multifaceted approach involving progressive taxation, strengthened labor unions, and meaningful campaign finance reform.

Progressive Taxation and Wealth Redistribution

Progressive taxation, where higher earners pay a larger percentage of their income in taxes, is often proposed as a means to address wealth inequality. However, there are arguments for and against its effectiveness.

- Different Models: Various models of progressive taxation exist, each with its own advantages and disadvantages. Finding the right balance that encourages economic growth while reducing inequality is crucial.

- Historical Examples: Historical examples of progressive taxation and their impacts on economic growth and social mobility offer valuable lessons in crafting effective policies.

- Economic Consequences: The potential economic consequences of different progressive tax systems need careful consideration to ensure they stimulate economic growth, rather than hinder it.

Strengthening Labor Unions and Worker Rights

Empowering labor unions and strengthening worker rights are crucial for ensuring fair wages and better working conditions. The decline of union membership has contributed significantly to wage stagnation and increased income inequality.

- Decline of Union Membership: The decline in union membership has left many workers vulnerable to exploitation and has limited their ability to negotiate fair wages and benefits.

- Impact on Worker Wages and Benefits: Stronger unions can help improve worker wages, benefits, and working conditions, narrowing the gap between the rich and the poor.

- Strategies to Empower Workers: Strategies to empower workers include improving unionization efforts, strengthening labor laws, and promoting worker cooperatives and other worker-owned enterprises.

Conclusion

The battle of "Fighting the Richest Man" is a complex and ongoing struggle at the heart of American society. Understanding the concentration of wealth, the rise of populism, and potential solutions is crucial for shaping a more equitable future. Progressive taxation, strengthened labor unions, and meaningful campaign finance reform are essential steps toward leveling the playing field. By engaging in informed discussions and advocating for policy changes, we can all contribute to the fight for a fairer and more just society. Let's continue the conversation about Fighting the Richest Man and work towards building a more equitable America. Let's work together to address the issues of fighting the richest man's influence and create a more just economic system.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Reporting

Apr 26, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Reporting

Apr 26, 2025 -

A Game Stop Preorder My Nintendo Switch 2 Experience

Apr 26, 2025

A Game Stop Preorder My Nintendo Switch 2 Experience

Apr 26, 2025 -

Gambling On Climate Change The Los Angeles Wildfire Predicament

Apr 26, 2025

Gambling On Climate Change The Los Angeles Wildfire Predicament

Apr 26, 2025 -

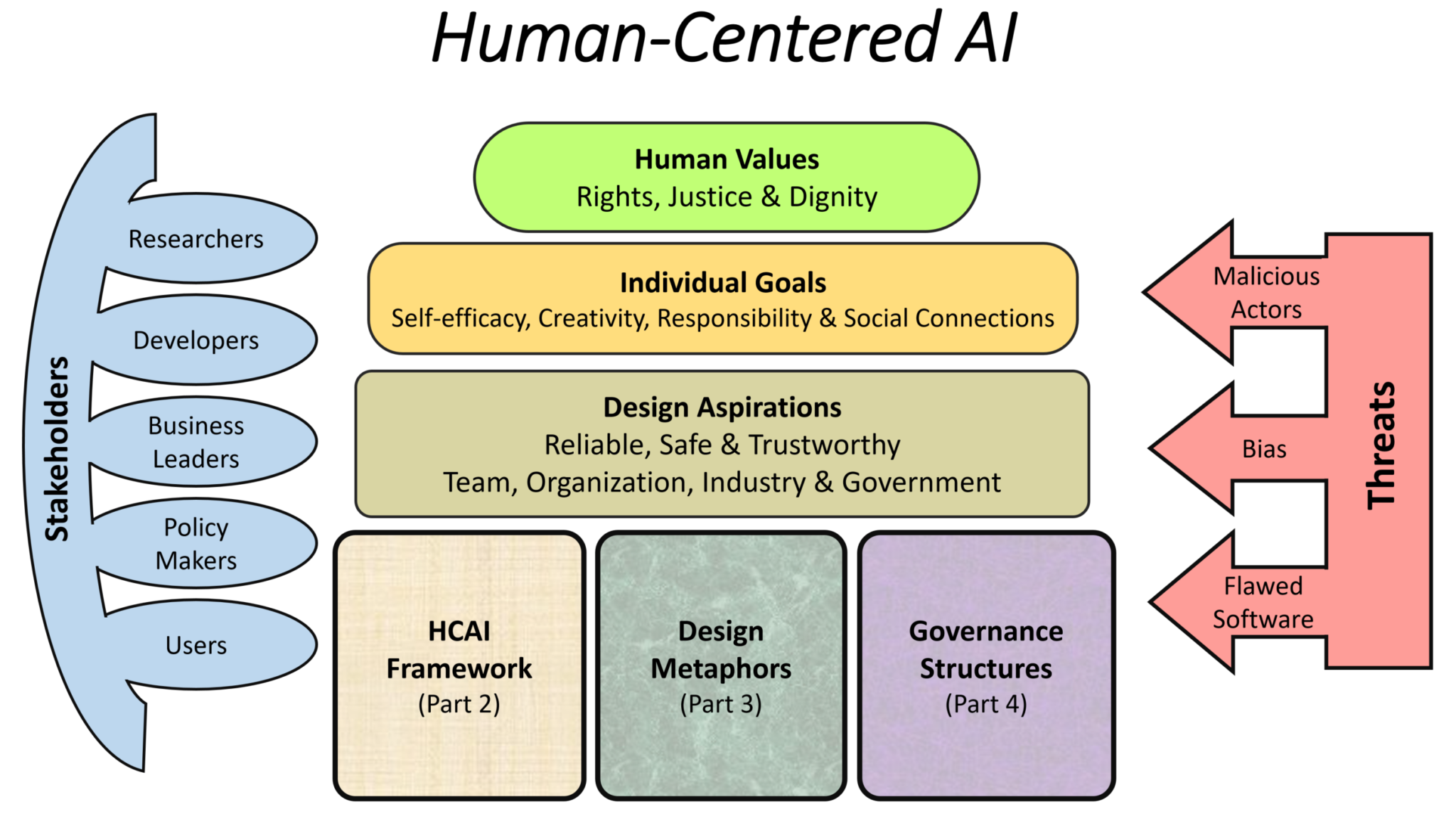

Human Centered Ai Design A Discussion With Microsofts Design Chief

Apr 26, 2025

Human Centered Ai Design A Discussion With Microsofts Design Chief

Apr 26, 2025 -

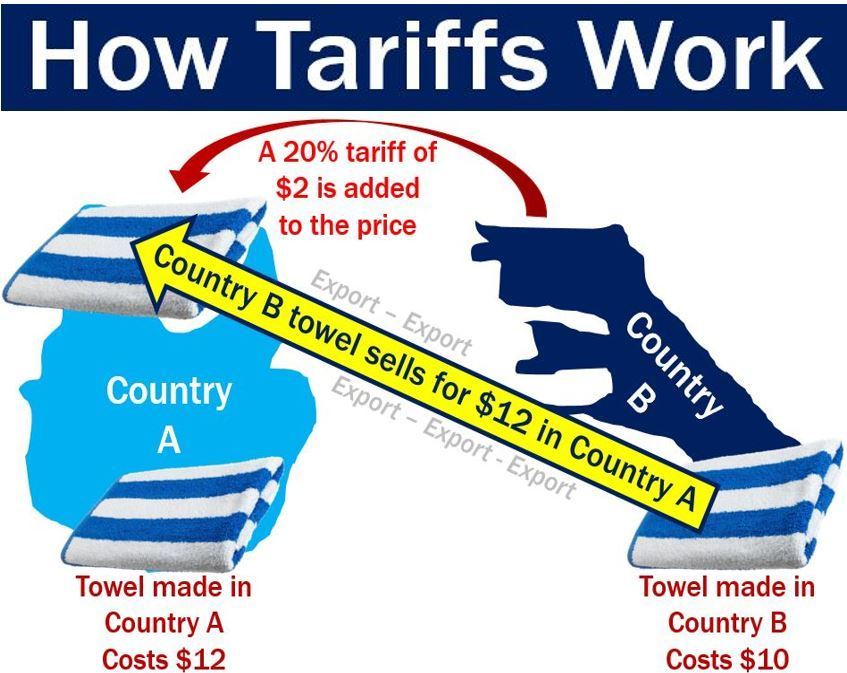

Ceo Concerns Trumps Tariffs And The Impact On Consumers And The Economy

Apr 26, 2025

Ceo Concerns Trumps Tariffs And The Impact On Consumers And The Economy

Apr 26, 2025