Fiscal Responsibility: A Critical Element Of Canada's Vision

Table of Contents

The Importance of Balanced Budgets in Achieving Fiscal Responsibility

A balanced budget, where government revenues equal government expenditures, is a cornerstone of fiscal responsibility. Achieving this balance offers numerous benefits: reduced national debt, improved credit ratings, and increased investor confidence. These, in turn, translate into tangible improvements for Canadians.

- Lower interest payments on government debt: A smaller debt means less money spent on interest payments, freeing up funds for essential services like healthcare and education. This efficient use of taxpayer money is a key aspect of responsible fiscal management.

- Increased capacity for investment in infrastructure and social programs: With reduced debt servicing costs, the government can invest more in crucial infrastructure projects (roads, bridges, public transit) and social programs (healthcare, education, affordable housing), boosting economic growth and improving the quality of life for citizens. This directly contributes to Canada's long-term economic well-being.

- Enhanced economic stability and reduced vulnerability to economic shocks: A fiscally responsible government is better equipped to weather economic downturns. A strong fiscal position provides a buffer against unexpected economic events, minimizing the need for drastic austerity measures.

- Stronger national currency and increased international competitiveness: A government demonstrating fiscal responsibility enjoys increased credibility on the global stage. This strengthens the Canadian dollar and enhances the country's attractiveness to foreign investors. This improved international standing is a significant benefit of prioritizing fiscal responsibility.

However, achieving balanced budgets isn't always straightforward. Economic downturns often necessitate counter-cyclical fiscal policies—government spending increases to stimulate the economy—which can temporarily lead to deficits. The key is to manage these deficits responsibly and return to a balanced budget path as the economy recovers. This requires careful planning and a long-term strategic approach to government finances.

Effective Tax Policies and Revenue Generation for Fiscal Responsibility

Fair and efficient tax systems are vital for generating the revenue needed to fund government services and meet national priorities. A well-designed tax system should:

- Employ a progressive tax system: This ensures that higher earners contribute a proportionally larger share towards public services, promoting equity and social justice. This fairness is crucial for maintaining public trust and ensuring the long-term sustainability of government programs.

- Implement efficient tax collection mechanisms: Minimizing tax evasion and avoidance is essential for maximizing government revenue. Robust enforcement and modernization of tax systems are necessary to achieve this goal.

- Regularly review and update tax policies: Tax laws need to adapt to evolving economic circumstances and societal needs. Regular reviews ensure the system remains fair, efficient, and responsive to changing economic realities.

- Maintain transparency in government spending and revenue allocation: Public trust is paramount. Open and transparent reporting on government revenue and expenditure fosters accountability and ensures public funds are used responsibly. This promotes greater public understanding and engagement.

Transparency and accountability are not merely administrative niceties; they are crucial for maintaining public trust in government. When citizens understand how their tax dollars are spent, they are more likely to support responsible fiscal policies.

Responsible Government Spending and Prioritization for Fiscal Responsibility

Responsible government spending involves prioritizing essential services and long-term investments. This strategic allocation of resources is fundamental to achieving fiscal responsibility. Key areas of focus include:

- Strategic investment in infrastructure: Investing in transportation, healthcare, and education infrastructure provides long-term economic benefits, creating jobs and improving productivity. This type of responsible spending is vital for Canada's future competitiveness.

- Adequate funding for social programs: Healthcare, social security, and education are crucial for a healthy and productive society. Sufficient funding ensures these programs can effectively serve the needs of the population. This commitment to social well-being is an important component of responsible fiscal governance.

- Efficient resource allocation: Maximizing the impact of every dollar spent requires efficient program design and implementation. Regular performance reviews and audits help identify areas for improvement and prevent waste. This efficiency is essential for demonstrating sound fiscal stewardship.

- Regular audits and performance reviews: Independent audits provide assurance that government programs are achieving their intended goals and that public funds are being managed responsibly. This accountability is essential for maintaining public trust.

Balancing competing demands on government resources is a continuous challenge. Evidence-based decision-making—using data and analysis to inform choices—is essential for prioritizing spending effectively.

Transparency and Accountability in Fiscal Management for Fiscal Responsibility

Open and transparent government financial reporting is a cornerstone of fiscal responsibility. Key elements include:

- Public access to government budgets and financial statements: Making this information readily available to the public ensures transparency and allows citizens to scrutinize government spending decisions.

- Independent audits of government accounts: Independent audits provide an objective assessment of government financial practices, identifying potential areas of weakness or irregularity. This unbiased evaluation is vital for maintaining fiscal integrity.

- Strong oversight by parliamentary committees and other independent bodies: These bodies provide crucial checks and balances, ensuring responsible fiscal management and preventing abuse of public funds.

- Clear communication of government financial performance to the public: Regular, clear, and accessible reporting on government finances keeps the public informed and promotes accountability.

Media scrutiny and public engagement play a vital role in promoting fiscal accountability. Citizen participation in budget processes and informed public debate can help shape government priorities and promote responsible spending.

Conclusion

Fiscal responsibility in Canada requires a multifaceted approach encompassing balanced budgets, effective tax policies, responsible government spending, and transparent and accountable fiscal management. Each element is crucial for achieving long-term economic health and prosperity. Ignoring any of these aspects risks undermining Canada's economic stability and future potential.

The pursuit of fiscal responsibility is not merely a matter of economic policy; it's a crucial investment in Canada's future. Let's all advocate for strong and responsible fiscal management to ensure a brighter future for generations to come. Engage in informed discussions about fiscal responsibility and demand accountability from our elected officials. Learn more about how you can contribute to a financially stable Canada through informed participation in the political process. Understanding and promoting fiscal responsibility is a civic duty that benefits all Canadians.

Featured Posts

-

Stonewalling Ends Judge Abrego Garcias Ruling On Us Lawyers

Apr 24, 2025

Stonewalling Ends Judge Abrego Garcias Ruling On Us Lawyers

Apr 24, 2025 -

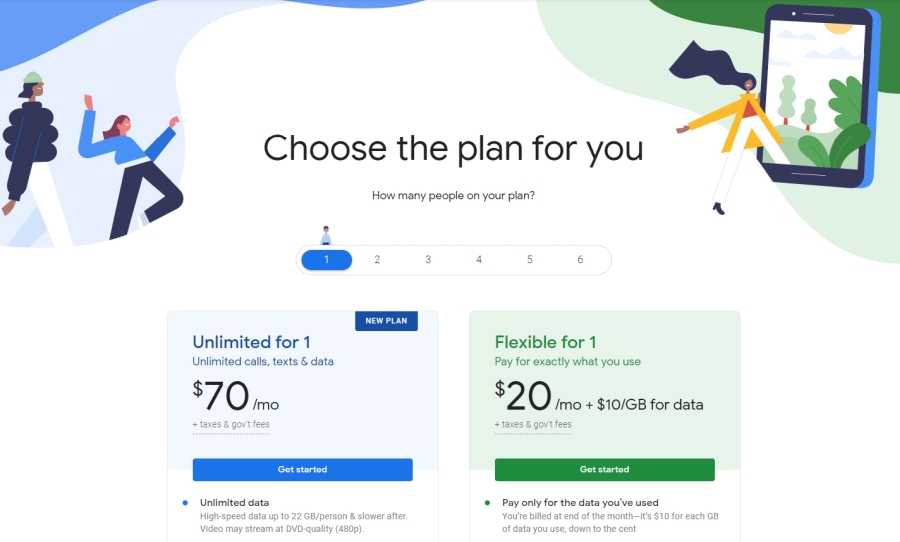

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025

Google Fi Launches Affordable 35 Unlimited Data Plan

Apr 24, 2025 -

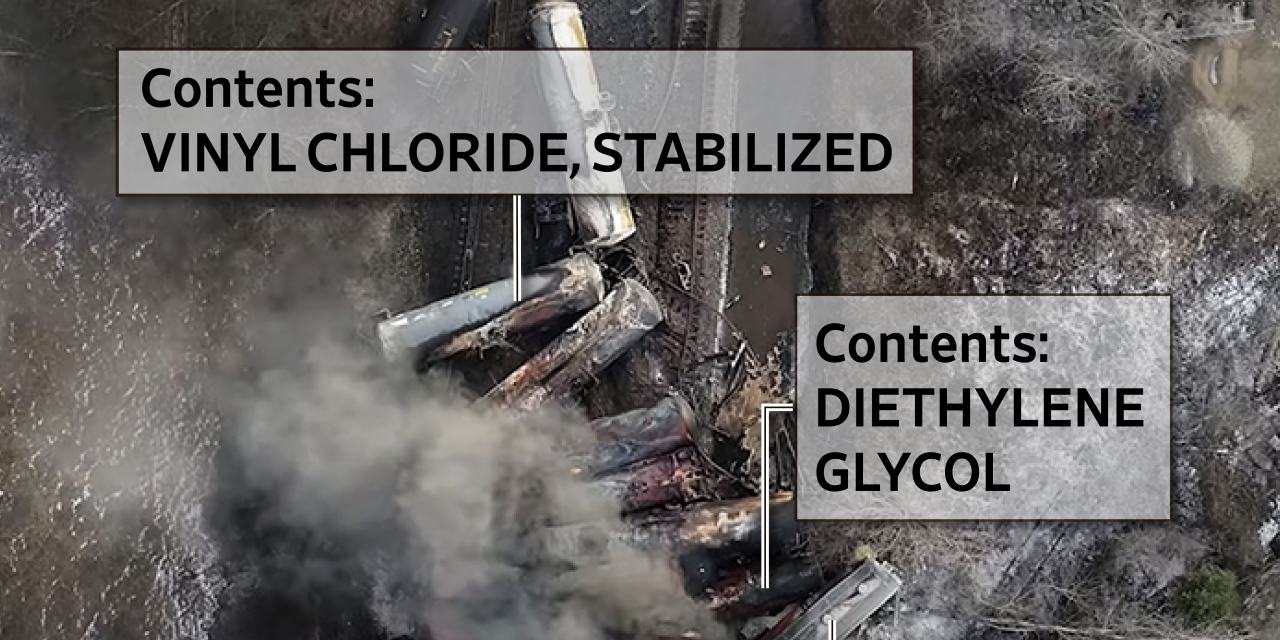

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 24, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 24, 2025 -

Teslas Q1 Profit Plunge Impact Of Musks Political Involvement

Apr 24, 2025

Teslas Q1 Profit Plunge Impact Of Musks Political Involvement

Apr 24, 2025 -

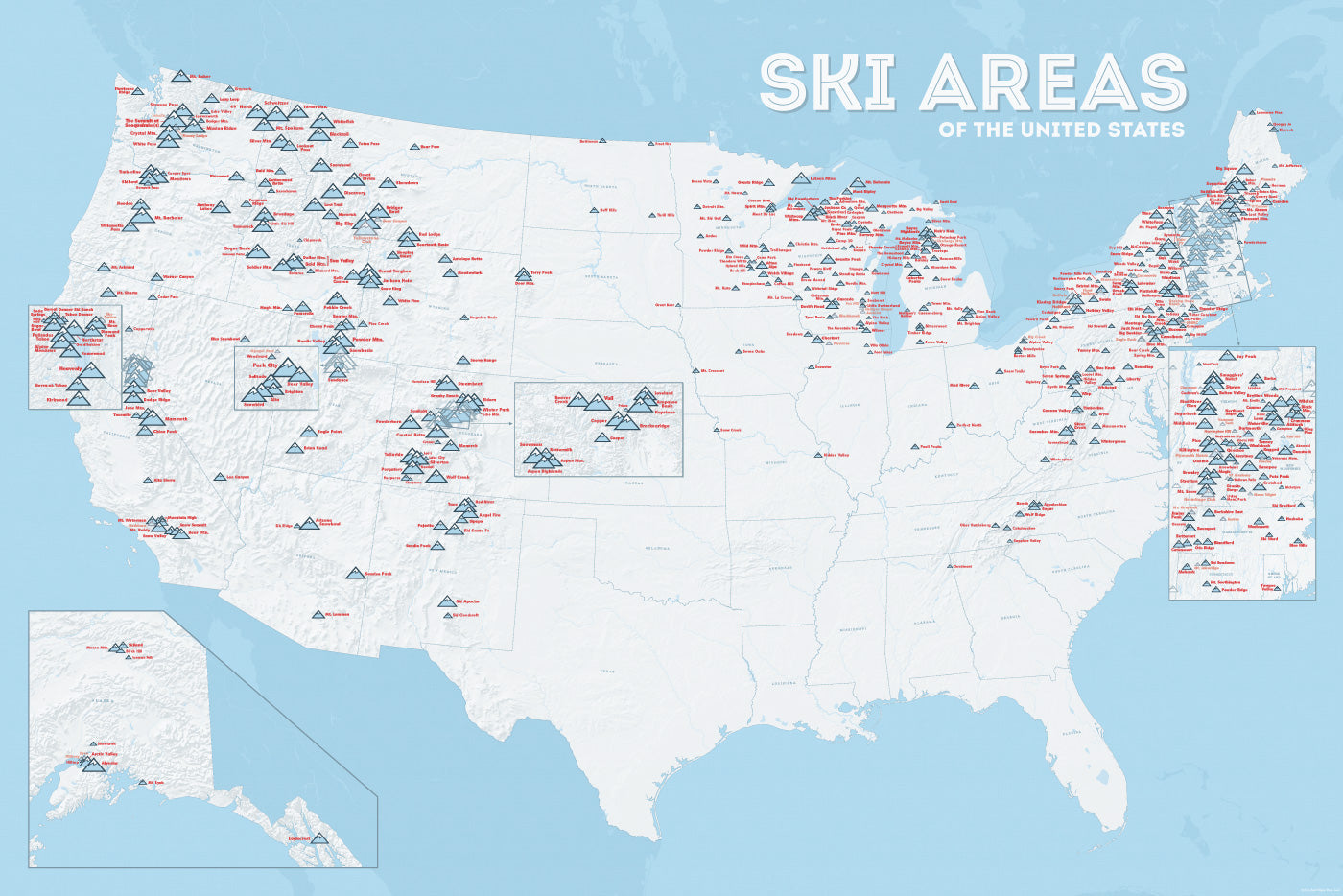

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025