Further ECB Rate Cuts On The Horizon: Simkus Highlights Trade Risks

Table of Contents

Simkus's Concerns Regarding Trade Risks and ECB Policy

Simkus's position is clear: further ECB rate cuts, while potentially stimulating domestic demand, could exacerbate existing vulnerabilities in the Eurozone's trade sector. He argues that the current economic fragility necessitates a cautious approach to monetary policy. Simkus believes that aggressive rate cuts, without addressing underlying structural issues, risk jeopardizing the Eurozone's already delicate export-oriented industries. His warnings center on several key trade risks:

- Increased vulnerability to global economic shocks: Lower interest rates might incentivize increased borrowing and investment, but this could leave the Eurozone more exposed to external economic downturns. A sudden global recession could have a devastating impact.

- Negative impact on export-oriented industries: A weaker Euro, a potential consequence of further rate cuts, could initially boost exports. However, this advantage could be outweighed by increased import costs and reduced competitiveness in the long run. Industries heavily reliant on exports face significant challenges.

- Potential for currency fluctuations and their effect on trade: Unpredictable currency movements resulting from monetary policy adjustments create uncertainty for businesses engaged in international trade, making long-term planning difficult and increasing risk.

- Risk of deflationary pressures: While aiming to combat inflation, aggressive rate cuts could inadvertently trigger deflation if demand remains weak, leading to a vicious cycle of falling prices and reduced economic activity.

Analysis of the Current Economic Landscape and its Impact on ECB Decisions

The ECB's decision-making process is complex, influenced by a multitude of interconnected economic indicators. These indicators provide crucial insights into the health of the Eurozone economy and guide policymakers' choices regarding interest rates. Currently, the ECB is grappling with:

- Inflation rates and their trajectory: While inflation has shown signs of easing, it remains above the ECB's target, necessitating careful consideration before further rate cuts.

- Unemployment figures: Unemployment levels in the Eurozone provide valuable insights into the health of the labor market and overall economic strength. High unemployment might discourage further rate cuts.

- GDP growth projections: Forecasts for GDP growth across the Eurozone are essential in determining the need for stimulative measures like rate cuts. Weak growth projections might favor further cuts.

- Eurozone economic sentiment: Consumer and business confidence indicators reflect overall economic optimism or pessimism, influencing the ECB's policy response. Low sentiment could suggest the need for stimulus.

These indicators inform the ECB's assessment of whether further rate cuts are justified or would pose an unacceptable risk to the Eurozone's economic stability.

Potential Consequences of Further ECB Rate Cuts

Further ECB rate cuts could yield both positive and negative consequences. The potential outcomes are multifaceted and depend on various factors, including the extent of the cuts and the overall global economic climate.

- Stimulation of economic growth: Lower interest rates could encourage borrowing and investment, boosting economic activity in the short term.

- Increased borrowing and investment: Easier access to credit can stimulate business expansion and job creation.

- Weakening of the Euro: A weaker Euro can make Eurozone exports more competitive globally, but it also increases import costs.

- Increased risk of inflation in the long run: Excessive monetary easing could lead to inflationary pressures down the line.

- Exacerbation of existing trade imbalances: A weaker Euro might worsen trade imbalances with other economic regions.

These potential consequences highlight the delicate balancing act faced by the ECB when considering further rate cuts.

Alternative Monetary Policy Options for the ECB

The ECB is not limited to interest rate cuts. Alternative monetary policy options exist, each with its own set of advantages and disadvantages. These include:

- Quantitative easing (QE) programs: QE involves the ECB purchasing government bonds and other assets to increase the money supply and lower long-term interest rates.

- Targeted lending programs: These programs provide subsidized loans to specific sectors of the economy, encouraging investment and growth in targeted areas.

- Structural reforms to boost economic competitiveness: Addressing underlying structural issues, such as labor market rigidities, can improve the Eurozone's long-term economic prospects independently of monetary policy.

Careful consideration of these alternatives is crucial for the ECB to navigate the current economic challenges effectively.

Conclusion: Further ECB Rate Cuts: Weighing the Risks and Rewards

Simkus's concerns regarding the trade risks associated with further ECB rate cuts are valid and deserve careful consideration. The current economic landscape presents a complex challenge for the ECB, requiring a nuanced approach that balances the need for economic stimulus with the potential for negative consequences. While further ECB interest rate cuts might offer short-term benefits, the potential for long-term damage to the Eurozone's trade sector, coupled with the risk of inflation and currency volatility, necessitates a cautious and comprehensive strategy. Monitoring ECB policy changes and staying informed about the impact of ECB rate cuts is crucial for businesses and investors alike. Continue following economic news and analyses to understand the unfolding situation and its implications for the global economy.

Featured Posts

-

Ariana Grandes Style Evolution Understanding The Professional Choices Behind Her Look

Apr 27, 2025

Ariana Grandes Style Evolution Understanding The Professional Choices Behind Her Look

Apr 27, 2025 -

Pfc To Declare Fourth Dividend For Fy 25 On March 12th Key Details And Analysis

Apr 27, 2025

Pfc To Declare Fourth Dividend For Fy 25 On March 12th Key Details And Analysis

Apr 27, 2025 -

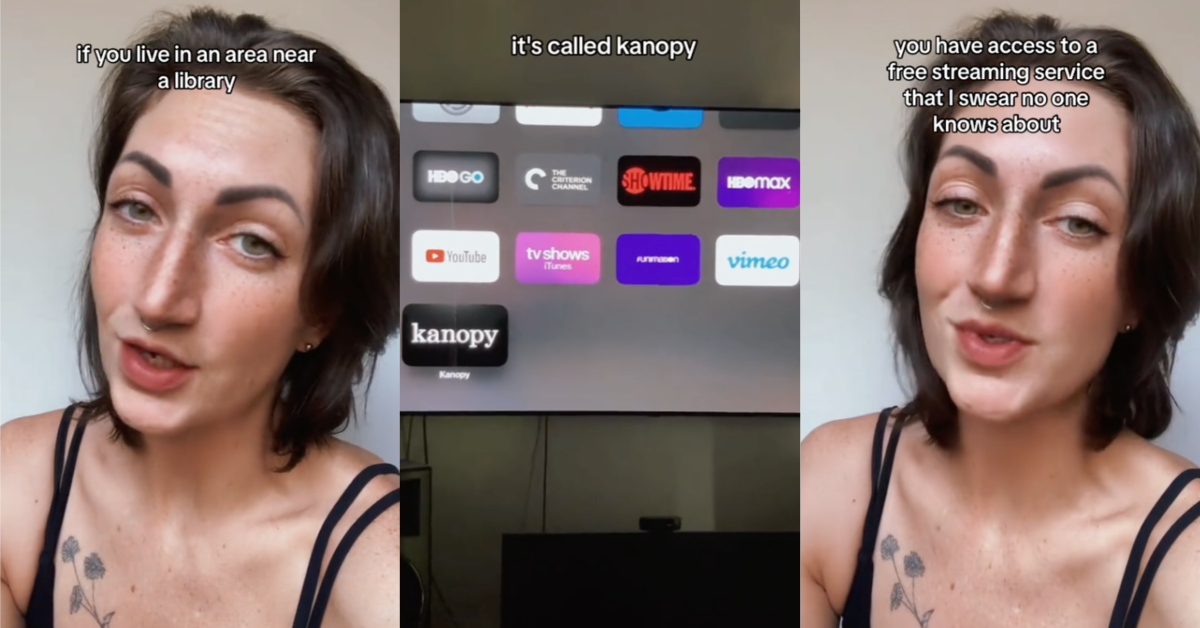

Movies And Shows To Watch On Kanopy A Free Streaming Guide

Apr 27, 2025

Movies And Shows To Watch On Kanopy A Free Streaming Guide

Apr 27, 2025 -

Ramiro Helmeyer Dedication To Fc Barcelonas Glory

Apr 27, 2025

Ramiro Helmeyer Dedication To Fc Barcelonas Glory

Apr 27, 2025 -

Examining The Credibility Of The Cdcs New Vaccine Study Hire Amidst Disinformation Claims

Apr 27, 2025

Examining The Credibility Of The Cdcs New Vaccine Study Hire Amidst Disinformation Claims

Apr 27, 2025