Gensol Promoters Face PFC Action Over False Documents In EoW Transfer

Table of Contents

The Allegations Against Gensol Promoters

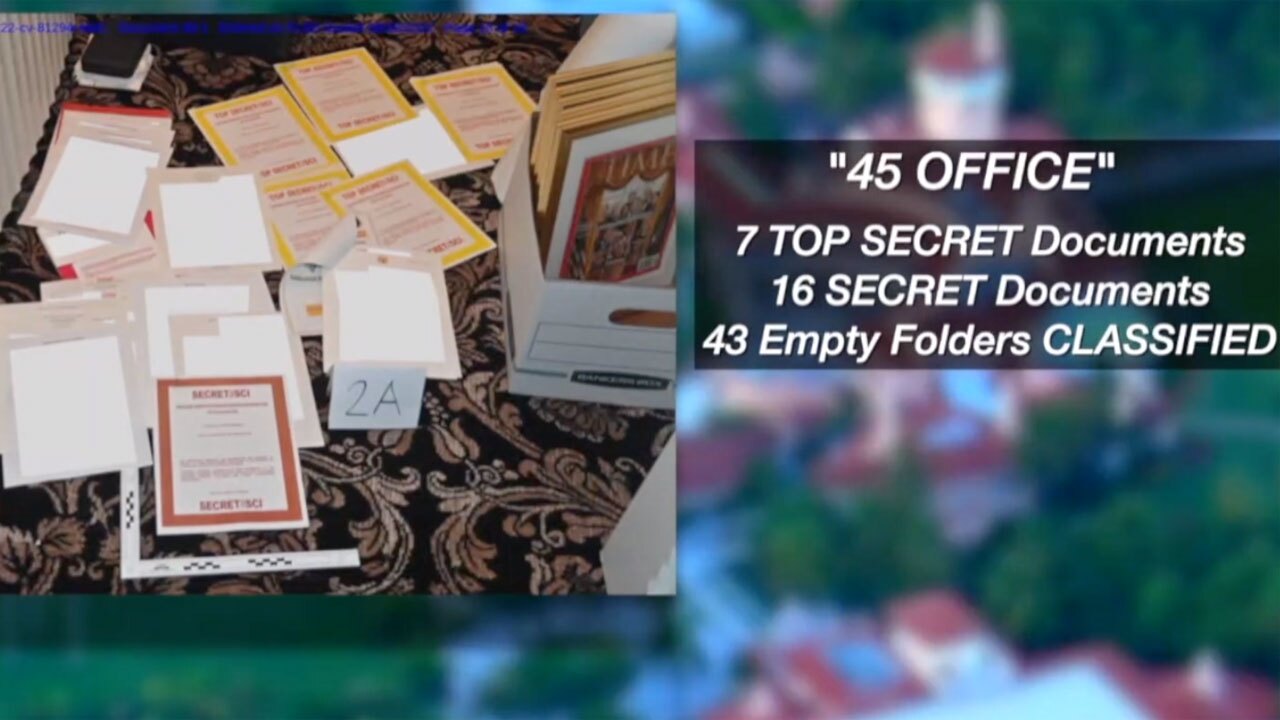

The allegations against Gensol promoters center around the submission of falsified documents during the EoW transfer process. Specific details are still emerging, but reports suggest the false documentation pertains to [ insert specific example of falsified documents, e.g., inflated company valuations, fabricated employee agreements, or misrepresented financial statements ]. The alleged purpose was to [ insert alleged purpose, e.g., secure more favorable terms for the promoters in the EoW transaction, mislead employees about the true value of the company, or defraud investors ]. This misrepresentation, if proven, could have significant financial consequences for Gensol, its employees who participated in the EoW, and potentially external investors involved in related financial arrangements. The PFC's investigation will determine the extent of the deception and its impact.

- Specific examples of falsified documents: [ List specific examples, if publicly available. If not, replace with placeholders like "Inflated asset valuations," "Fabricated profit and loss statements," "False employee share allocation documents." ]

- The alleged purpose behind the falsification: [ Describe the alleged motive. For example, "To artificially inflate the company valuation to benefit the promoters during the EoW transfer," or "To conceal financial difficulties and secure employee participation." ]

- The potential financial implications: Potential penalties, legal fees, reputational damage, and loss of investor confidence.

- The regulatory body involved: The PFC ( Specify the full name of the regulatory body involved ) is leading the investigation and enforcement action.

The PFC's Investigation and Enforcement Action

The PFC's investigation into the Gensol promoters' actions is ongoing. Their process likely involves [ Describe the expected investigative steps, such as reviewing documents, interviewing witnesses, conducting forensic accounting, etc. ]. The evidence gathered will be crucial in determining the validity of the allegations and the appropriate enforcement action. The PFC's actions are based on [ Cite the relevant legal frameworks, statutes, or regulations under which the PFC is operating. ]. While full details of the investigation remain confidential at this stage, the PFC has already taken initial enforcement action.

- Timeline of the investigation: [ Insert the known timeline or a projected timeline if available. ]

- Key findings of the investigation (if publicly available): [ Summarize any publicly released information on the findings. If no information is available, state that and explain why ]

- Details of the enforcement action taken: [ Describe any penalties, fines, or other actions already implemented by the PFC. ]

- The legal grounds for the PFC's actions: [ Specify the relevant laws and regulations that underpin the PFC's actions. ]

Implications for Gensol and the EoW Transfer

This scandal carries severe implications for Gensol. The damage to its reputation and brand image could be substantial, potentially impacting its ability to attract investors and secure future business deals. The immediate impact can be observed in [ Mention any immediate consequences like a stock price drop if Gensol is a publicly traded company ]. The future of the EoW transfer itself remains uncertain, as the validity of the underlying agreements is now under question. The PFC's investigation and any subsequent legal proceedings could further delay or even derail the entire transfer process. Employee morale and confidence have likely been affected, potentially impacting productivity and retention.

- Potential impact on Gensol's share price: [ Explain how the allegations are affecting or might affect the stock price, if applicable. ]

- Damage to Gensol's reputation and brand image: The potential for long-term damage to customer relationships and partnerships.

- The future of the EoW transfer and its feasibility: The uncertainty surrounding the legality of the EoW agreement and the potential for its invalidation.

- Potential legal ramifications for the involved parties: Potential civil and criminal charges for the involved promoters and potentially other individuals within Gensol.

Lessons Learned and Best Practices

This case serves as a stark reminder of the critical importance of thorough due diligence and transparent business practices. Submitting false documents, especially in a sensitive transaction like an EoW transfer, carries severe legal and reputational consequences. Businesses must prioritize robust internal controls, compliance programs, and open communication with all stakeholders. Seeking legal counsel before entering into any significant transaction is also crucial to ensure compliance and minimize risks.

- Importance of verifying all documents: The need for independent verification of all documentation involved in significant transactions.

- Need for robust internal controls and compliance programs: The importance of establishing clear guidelines and procedures for handling sensitive information and financial transactions.

- Importance of transparent communication with stakeholders: Maintaining open communication with employees, investors, and regulatory bodies.

- Seeking legal counsel before any significant transaction: The need for proactive legal advice to prevent and mitigate potential legal risks.

Conclusion

The PFC action against Gensol promoters underscores the severity of submitting false documents in an EoW transfer or any business transaction. The potential penalties, reputational damage, and erosion of trust highlight the need for ethical business conduct and stringent compliance with all relevant regulations. Understanding the implications of false documents in EoW transfers is crucial for preventing future incidents. Stay updated on the ongoing Gensol Promoters case and learn more about preventing similar situations by [link to a relevant resource]. Maintaining transparency and implementing robust due diligence processes are paramount for navigating the complexities of business transactions and avoiding legal repercussions. Follow developments in the Gensol Promoters case and related legal actions to stay informed about this important issue.

Featured Posts

-

Justin Herbert Chargers 2025 Brazil Season Opener Confirmed

Apr 27, 2025

Justin Herbert Chargers 2025 Brazil Season Opener Confirmed

Apr 27, 2025 -

Canadas Trade Leverage A Deeper Look At The Us Deal Delay

Apr 27, 2025

Canadas Trade Leverage A Deeper Look At The Us Deal Delay

Apr 27, 2025 -

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 27, 2025

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 27, 2025 -

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025 -

Pne Ag Ad Hoc Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Ad Hoc Mitteilung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025