Gold Price Record Rally: Bullion As A Safe Haven During Trade Wars

Table of Contents

Understanding the Gold Price Rally

The gold price record rally is undeniable. We've witnessed a dramatic increase in gold prices over the past [Insert timeframe, e.g., year, quarter], fueled by a confluence of factors. [Insert chart or graph showing price increase]. For example, on [Date], gold reached a price of [Price] per ounce, marking a [Percentage]% increase from [Previous period]. This surge is reflected in key gold market indices like the COMEX gold futures, which have also experienced significant gains.

Beyond trade wars, several other elements contribute to this upward trend. Inflationary pressures, weakening currencies (especially the US dollar), and fluctuating interest rates all play a role in increasing gold's appeal. These interconnected factors create an environment where investors seek the stability and security that gold traditionally offers.

- Specific dates of price increases: [List key dates and price points]

- Percentage increase in price: [State the overall percentage increase compared to a relevant baseline period]

- Key gold market indices: COMEX gold futures, LBMA Gold Price

Trade Wars and Their Impact on Global Markets

The current climate of global trade wars is marked by significant uncertainty. Trade disputes between major economies, such as the US and China, [mention specific examples like the US-China trade war, etc.], inject volatility into global markets. This uncertainty erodes investor confidence, leading to a flight from riskier assets like stocks and bonds. The resulting market volatility fuels demand for safe-haven assets, driving up the price of gold.

- Examples of specific trade disputes: [List impactful trade disputes and their consequences]

- Effect on stock markets and other asset classes: [Discuss the negative correlation between gold prices and stock market performance during trade wars]

- Uncertainty fueling safe-haven demand: [Explain the psychological aspects of investor behavior during times of uncertainty]

Gold as a Safe Haven Asset

Throughout history, gold has served as a reliable safe haven during periods of economic and political turmoil. Its inherent properties—scarcity, durability, and universal recognition—make it a unique investment. During trade wars and other crises, investors seek the stability and security that gold provides, viewing it as a hedge against inflation and a store of value.

Unlike paper assets, gold is a tangible asset, offering a sense of security that many investors find appealing. Its historical performance during crises underscores its role as a portfolio diversifier and a reliable preservation of wealth.

- Tangible asset vs. paper assets: [Explain the key differences and the resulting investor sentiment]

- Gold's historical performance: [Cite historical data illustrating gold's performance during past crises]

- Comparison with other safe-haven assets: [Compare gold's performance against US Treasury bonds or other safe haven assets]

Investing in Gold During a Trade War

Several avenues exist for investing in gold during a trade war, each with its own set of advantages and disadvantages. Investors can choose from:

-

Physical gold: Buying and storing physical gold bars or coins offers direct ownership but requires secure storage and insurance.

-

Gold ETFs (Exchange-Traded Funds): These funds track the price of gold, offering easy access and diversification benefits but incurring management fees.

-

Gold mining stocks: Investing in companies involved in gold mining provides leverage to gold price movements but carries higher risk due to company-specific factors.

-

Risks and rewards: [Outline the risk/reward profile for each investment type]

-

Cost considerations: [Discuss storage costs, management fees, premiums for physical gold, etc.]

-

Diversification strategies: [Explain how gold can diversify an investment portfolio and reduce overall risk]

The Future of Gold Prices and Trade Wars

Predicting the future direction of gold prices is inherently challenging, but considering ongoing trade negotiations and the global economic outlook, several scenarios are possible. A resolution to trade disputes could potentially reduce gold's appeal as a safe haven, leading to price stabilization or even a slight decline. However, continued trade tensions and global economic uncertainty could propel the gold price record rally even further.

- Potential outcomes of current trade disputes: [Present plausible scenarios and their likely impact on gold prices]

- Factors influencing future gold prices: [Discuss factors like interest rate changes, inflation rates, and geopolitical events]

- Long-term outlook: [Offer a balanced perspective on gold's long-term potential as a safe-haven asset]

Conclusion: Navigating the Gold Price Record Rally

The recent gold price record rally is a significant event driven by a combination of factors, most notably escalating trade wars and their impact on global market uncertainty. Gold's enduring role as a safe-haven asset is once again evident. Understanding this role is crucial for investors seeking to protect their portfolios during times of economic instability. To navigate this dynamic market, carefully consider your risk tolerance and explore diverse investment strategies involving gold. Learn more about investing in gold and how it can contribute to a well-diversified portfolio by researching further resources from reputable financial advisors and publications. The ongoing gold price record rally presents both challenges and opportunities; informed decision-making is key.

Featured Posts

-

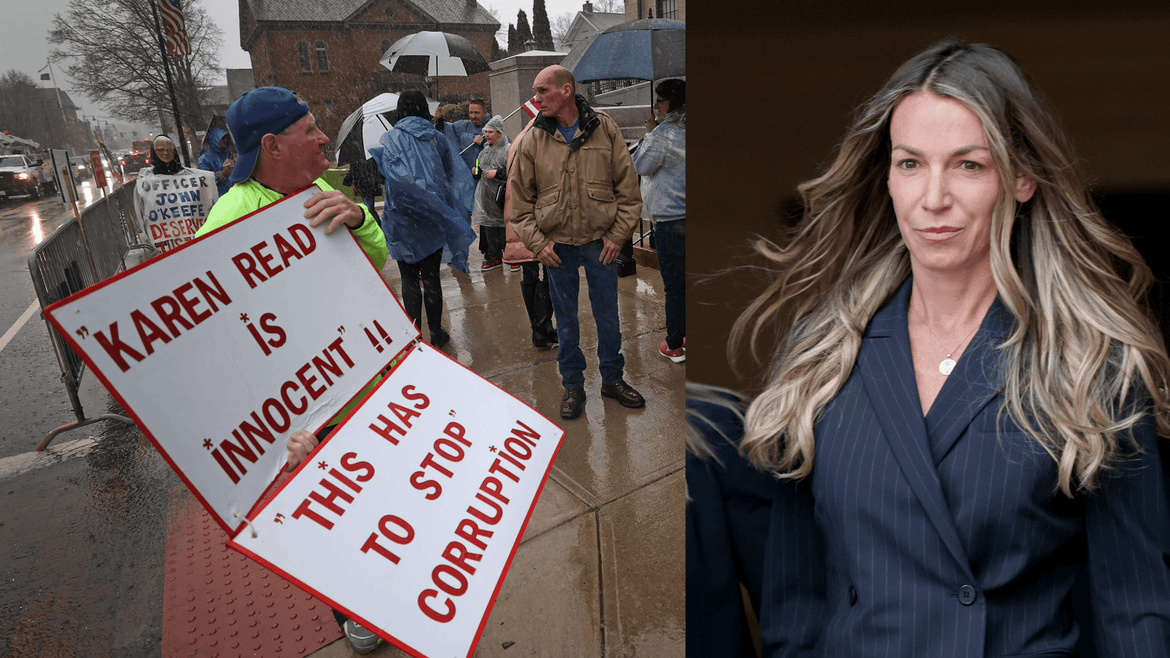

A Timeline Of Karen Reads Murder Trials

Apr 26, 2025

A Timeline Of Karen Reads Murder Trials

Apr 26, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 26, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 26, 2025 -

Nfl Draft First Round Green Bays Opening Night

Apr 26, 2025

Nfl Draft First Round Green Bays Opening Night

Apr 26, 2025 -

The Role Of Human Design In The Age Of Ai A Microsoft Perspective

Apr 26, 2025

The Role Of Human Design In The Age Of Ai A Microsoft Perspective

Apr 26, 2025 -

Significant Increase In Us Port Fees To Impact Auto Carrier By 70 Million

Apr 26, 2025

Significant Increase In Us Port Fees To Impact Auto Carrier By 70 Million

Apr 26, 2025