High Stock Market Valuations: A BofA Analyst's Take On Investor Concerns

Table of Contents

Factors Contributing to High Stock Market Valuations

Several key factors have contributed to the current environment of high stock market valuations. Understanding these factors is crucial for assessing the market's future trajectory.

Low Interest Rates

Historically low interest rates have significantly impacted stock market valuations. This low interest rate environment has made traditional fixed-income investments, like bonds, less attractive.

- Impact on bond yields: Lower interest rates directly translate to lower bond yields, making them less appealing to investors seeking returns.

- Increased demand for equities: As a result, investors have flocked to higher-yielding assets like stocks, driving up demand and pushing valuations higher.

- Effect on the present value of future earnings: Low discount rates, a consequence of low interest rates, increase the present value of future corporate earnings, further boosting stock prices. This means future profits are worth more today, making companies appear more valuable.

Keywords: Low interest rate environment, bond yields, equity valuations, present value, discounted cash flow.

Strong Corporate Earnings

Robust corporate earnings have provided a strong foundation for supporting high stock valuations. Many companies have reported impressive growth, fueled by various factors.

- Examples of strong-performing sectors: Technology, healthcare, and consumer staples have been among the best-performing sectors, contributing significantly to overall market performance.

- Impact of technological advancements: Technological advancements have enabled companies to increase efficiency, expand into new markets, and improve profitability.

- Influence of mergers and acquisitions (M&A): Increased M&A activity has also played a role, with larger companies acquiring smaller ones to expand their market share and boost earnings.

Keywords: Corporate earnings growth, sector performance, technological disruption, M&A activity, earnings per share (EPS).

Quantitative Easing and Monetary Policy

Central bank policies, particularly quantitative easing (QE), have had a significant influence on market valuations.

- Effects of quantitative easing (QE): QE programs involve central banks injecting liquidity into the financial system by purchasing assets, which increases the money supply.

- Impact of money supply on asset prices: This increased money supply often finds its way into asset markets, driving up prices, including stock prices.

- Potential for inflation: However, a significant increase in the money supply can lead to inflation, which could ultimately negatively impact stock valuations.

Keywords: Quantitative easing, monetary policy, money supply, inflation risk, asset price inflation, interest rate hikes.

Investor Concerns Regarding High Stock Market Valuations

Despite the positive factors driving high valuations, several concerns remain for investors.

Valuation Metrics

Key valuation metrics paint a mixed picture. While some companies are justified in their high valuations due to strong fundamentals, others may be overvalued.

- Interpretation of different valuation ratios: Metrics such as the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and market capitalization need to be analyzed carefully in context, considering industry averages and company-specific factors.

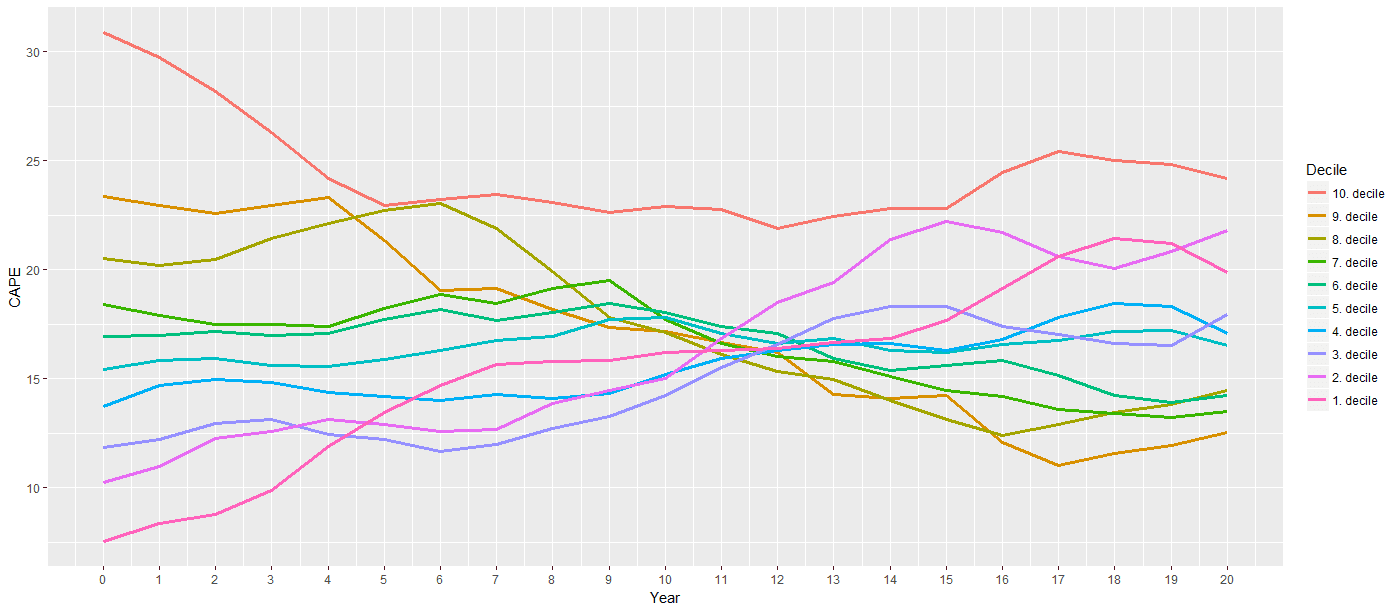

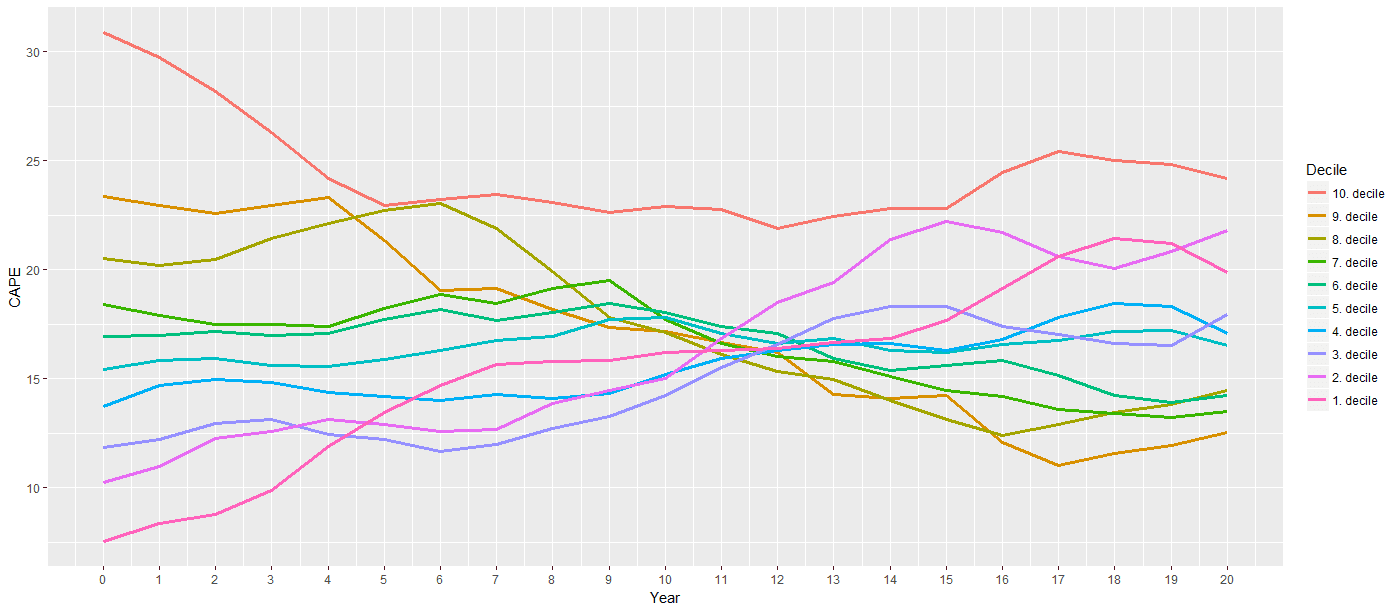

- Comparison to historical averages: Comparing current valuation multiples to historical averages can provide insights into whether current valuations are unusually high.

- Potential for overvaluation: High valuations relative to historical averages or industry peers raise the possibility of overvaluation, increasing the risk of a market correction.

Keywords: P/E ratio, Price-to-Sales ratio, Market capitalization, Valuation multiples, Overvaluation, PEG ratio.

Potential for Market Correction

High valuations inherently increase the risk of a market correction. A sudden drop in prices could significantly impact investor portfolios.

- Triggers for a market correction: Rising interest rates, geopolitical instability, or unexpected economic downturns could all act as triggers for a correction.

- Potential impact on investor portfolios: A market correction can lead to substantial losses, particularly for investors holding highly valued stocks.

Keywords: Market correction, market volatility, risk management, portfolio diversification, geopolitical risk, recession risk.

BofA Analyst's Perspective

While specific BofA analyst reports are proprietary, generally, analysts acknowledge the high valuations but may offer different perspectives on their sustainability. They might highlight sectors they believe are less prone to a correction or suggest strategies for mitigating risk.

- Summary of BofA's market outlook: BofA's outlook might emphasize selective investment opportunities within the current market conditions, focusing on companies with strong fundamentals and sustainable growth prospects.

- Potential investment strategies suggested by the analyst: Analysts might suggest a more cautious approach, advocating for a diversified portfolio with exposure to defensive sectors or alternative asset classes.

- Consideration of different asset classes: BofA analysts likely recommend carefully considering the allocation of assets across various classes (stocks, bonds, real estate, etc.) to balance risk and return.

Keywords: BofA analyst report, market outlook, investment strategy, asset allocation, portfolio management, defensive stocks.

Strategies for Navigating High Stock Market Valuations

Investors can adopt several strategies to navigate the challenges presented by high stock market valuations.

Diversification

Diversification across different asset classes is crucial for mitigating risk.

- Examples of asset classes: Bonds, real estate, commodities, and alternative investments can offer diversification benefits.

- Benefits of a diversified portfolio in a volatile market: A well-diversified portfolio is less susceptible to significant losses during market corrections.

Keywords: Portfolio diversification, asset allocation strategy, risk mitigation, bonds, real estate, commodities, alternative investments.

Value Investing

Focusing on undervalued stocks can offer attractive returns in a high-valuation market.

- Identifying undervalued companies: Thorough fundamental analysis is essential for identifying companies whose stock prices don't fully reflect their intrinsic value.

- Importance of fundamental analysis: Analyzing a company's financial statements, competitive landscape, and management team is crucial for identifying undervalued opportunities.

- Long-term investment approach: Value investing typically involves a long-term perspective, allowing investors to ride out market fluctuations and benefit from the eventual appreciation of undervalued assets.

Keywords: Value investing, fundamental analysis, stock selection, undervalued stocks, long-term investment, intrinsic value.

Risk Management

Implementing robust risk management strategies is paramount.

- Setting stop-loss orders: Stop-loss orders help limit potential losses by automatically selling a stock when it reaches a predetermined price.

- Regularly reviewing portfolio performance: Regular monitoring allows investors to identify potential issues and adjust their strategies accordingly.

- Adjusting investment strategy based on market conditions: Adaptability is key; investors should be prepared to adjust their strategies based on changing market conditions and expert opinions.

Keywords: Risk management, stop-loss orders, portfolio review, investment strategy adjustment, market volatility, risk tolerance.

Conclusion

High stock market valuations present both opportunities and risks for investors. Understanding the factors driving these valuations, along with potential risks and the perspectives of analysts like those at BofA, is crucial for making informed investment decisions. By employing strategies like diversification, value investing, and careful risk management, investors can navigate this challenging market environment effectively. Remember to stay informed and adapt your investment approach based on evolving market conditions and expert opinions on high stock market valuations. Conduct thorough research and consider consulting a financial advisor before making any investment decisions. Understanding and managing the risks associated with high stock market valuations is key to long-term investment success.

Featured Posts

-

Aaron Judges 2025 On Field Goal The Push Up Revelation

Apr 28, 2025

Aaron Judges 2025 On Field Goal The Push Up Revelation

Apr 28, 2025 -

Abu Dhabi 2024 Key Projects Real Estate Growth Ai Initiatives And Future Plans

Apr 28, 2025

Abu Dhabi 2024 Key Projects Real Estate Growth Ai Initiatives And Future Plans

Apr 28, 2025 -

Denny Hamlin Michael Jordans Support And The Power Of Criticism

Apr 28, 2025

Denny Hamlin Michael Jordans Support And The Power Of Criticism

Apr 28, 2025 -

Michael Jordan And Denny Hamlin A Winning Partnership

Apr 28, 2025

Michael Jordan And Denny Hamlin A Winning Partnership

Apr 28, 2025 -

Ai Digest Transforming Repetitive Documents Into A Poop Podcast

Apr 28, 2025

Ai Digest Transforming Repetitive Documents Into A Poop Podcast

Apr 28, 2025