High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Cause for Alarm

BofA's analysis suggests that the current high stock market valuation isn't solely a cause for concern. Several factors contribute to this perspective, offering a more balanced view of the market outlook.

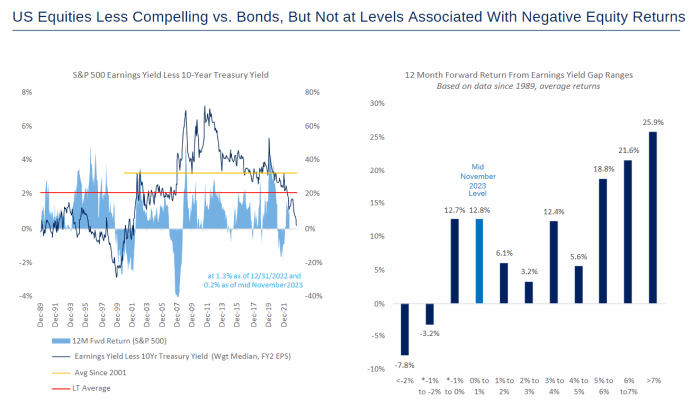

The Role of Low Interest Rates

Historically low interest rates significantly impact stock valuations. These low rates, a result of quantitative easing policies implemented by central banks globally, make bonds less attractive. This drives investors seeking yield into the stock market, pushing up prices and contributing to higher valuations relative to traditional metrics like the price-to-earnings ratio (P/E).

- Quantitative Easing (QE): The injection of liquidity into the market through QE has artificially lowered interest rates, making equities a more appealing investment.

- Low Bond Yields: With low bond yields, investors are less inclined to hold fixed-income securities, further fueling investment in equities.

- The Search for Yield: Investors constantly seek higher returns. With low yields on traditional fixed-income instruments, they are increasingly turning to equities, boosting demand and valuations.

- Potential for Interest Rate Hikes: While low rates currently support higher valuations, the potential for future interest rate hikes could impact stock prices. This is a key factor to monitor for investors.

Strong Corporate Earnings and Profitability

Despite high stock market valuations, many companies are demonstrating strong corporate earnings and profitability. This robust performance justifies, to some extent, the higher price tags.

- Robust Earnings Reports: Many sectors have reported strong earnings, indicating healthy underlying economic activity and sustained consumer demand.

- Innovation and Technological Advancements: Technological advancements and innovation are driving corporate growth in several sectors, supporting higher valuations.

- Supply Chain Improvements: Easing supply chain disruptions have positively affected corporate profitability, contributing to stronger earnings reports.

- Increased Consumer Spending: Healthy consumer spending contributes to the strong performance of many companies, reinforcing the positive outlook for corporate profitability.

Long-Term Growth Potential

BofA maintains a long-term growth perspective, believing that despite current high valuations, the market possesses significant long-term growth potential.

- High-Growth Sectors: BofA identifies specific sectors like technology, renewable energy, and healthcare as possessing high growth potential.

- Long-Term Investment Horizon: Investors are advised to focus on a long-term investment horizon to weather short-term market fluctuations.

- Diversification: A well-diversified portfolio across different asset classes mitigates risk and maximizes long-term growth potential.

Navigating High Stock Market Valuations: Strategies for Investors

While BofA's perspective offers reassurance, investors still need a strategic approach to navigate the current market landscape.

Focus on Long-Term Investment

A long-term investment strategy is crucial to mitigate the impact of short-term market volatility. Reacting to daily market fluctuations is often counterproductive.

- Dollar-Cost Averaging: Regularly investing a fixed amount, regardless of market conditions, reduces the impact of volatility.

- Diversification: Spreading investments across different asset classes and sectors minimizes risk.

- Patience: A long-term perspective is essential, as market corrections are a normal part of the investment cycle.

- Avoiding Panic Selling: Panic selling often leads to losses, while a patient approach allows investors to ride out market downturns.

Strategic Asset Allocation

Careful consideration of asset allocation is paramount based on individual risk tolerance and investment goals.

- Risk Tolerance: Investors should carefully assess their risk tolerance before making investment decisions.

- Investment Goals: Investment goals, such as retirement planning or education funding, shape the appropriate asset allocation.

- Alternative Investments: Incorporating alternative investments, such as bonds or real estate, can help diversify and potentially reduce risk.

- Professional Financial Advice: Seeking professional financial advice is especially beneficial in navigating complex market conditions and creating a personalized investment strategy.

Monitoring Market Indicators

Staying informed about key economic indicators and market trends is vital for making well-informed decisions.

- Reliable Information Sources: Utilize reputable financial news outlets and research reports for data-driven analysis.

- BofA Research: BofA itself provides valuable research and market insights that investors can leverage.

- Critical Thinking: Avoid emotionally driven decisions and instead rely on critical analysis of market data.

- Avoiding Market Hype: Be wary of market hype and focus on fundamental analysis when making investment decisions.

Conclusion

BofA's analysis indicates that while high stock market valuations are present, they don't automatically predict a market crash. Strong corporate earnings, low interest rates, and long-term growth potential contribute to a more balanced view. Investors should adopt a long-term investment strategy, diversify their portfolios, and stay informed about key market indicators. Don't let high stock market valuations trigger panic. Instead, leverage BofA's insights to develop a sound, long-term investment strategy that aligns with your risk tolerance and financial goals. Learn more about navigating high stock market valuations and discover effective investment strategies today!

Featured Posts

-

Selling Sunset Star Highlights Landlord Exploitation Following La Fires

Apr 24, 2025

Selling Sunset Star Highlights Landlord Exploitation Following La Fires

Apr 24, 2025 -

Three Year Data Breach Costs T Mobile 16 Million In Fines

Apr 24, 2025

Three Year Data Breach Costs T Mobile 16 Million In Fines

Apr 24, 2025 -

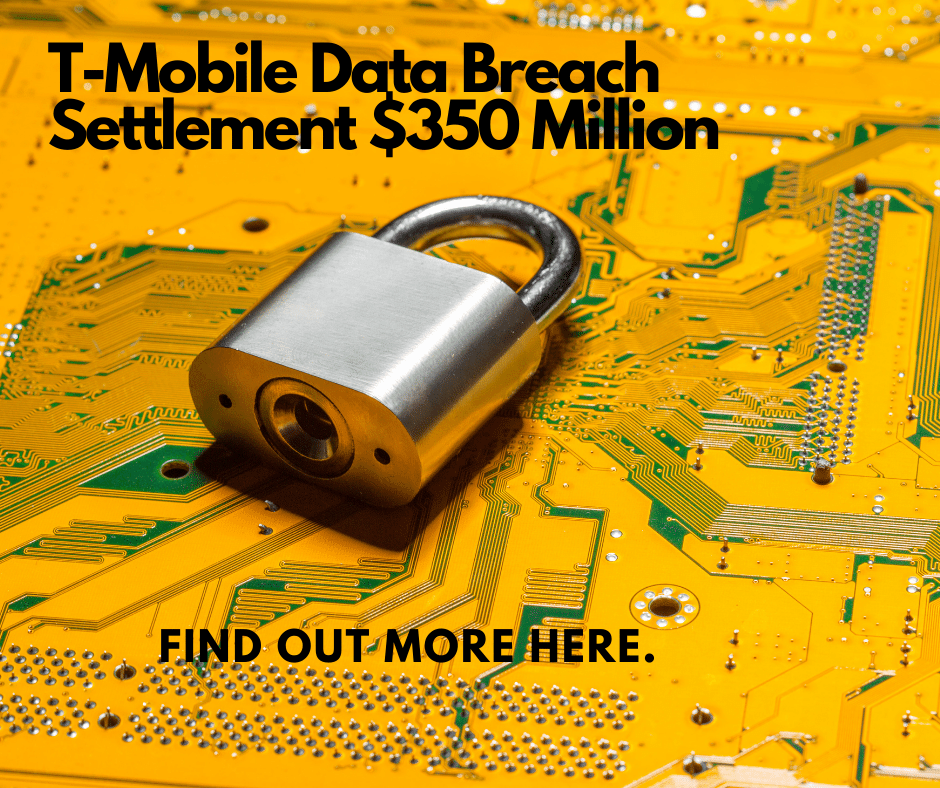

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Lower Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Lower Costs

Apr 24, 2025 -

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 24, 2025

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 24, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025