Higher Bids, Higher Risks: Stock Investors Face Continued Uncertainty

Table of Contents

Inflation's Persistent Impact on Stock Prices

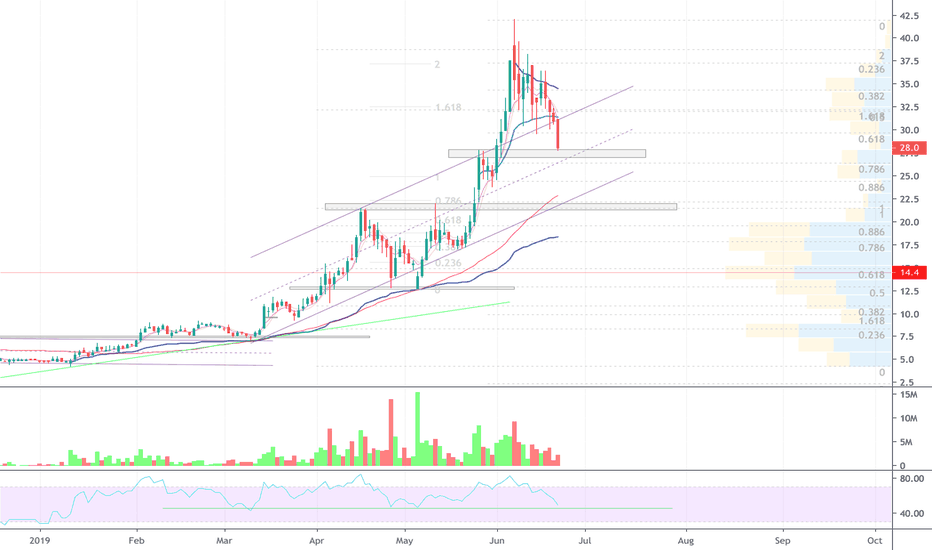

Rising inflation is a significant driver of stock market uncertainty. The keywords here are inflation, stock prices, interest rates, monetary policy, and economic uncertainty. Rising inflation erodes purchasing power, impacting corporate profitability and consumer spending. This creates a ripple effect throughout the economy.

- Rising inflation erodes purchasing power and impacts corporate profitability. Companies face increased costs for raw materials and labor, squeezing profit margins. This can lead to lower earnings and reduced investor confidence.

- Central banks' responses, including interest rate hikes, aim to curb inflation but can slow economic growth. Higher interest rates make borrowing more expensive, potentially slowing down economic activity and impacting corporate investment. This creates a delicate balancing act for central banks.

- Uncertainty around future inflation rates creates volatility in the stock market. Predicting inflation accurately is challenging, leading to market fluctuations as investors react to changing expectations. This volatility increases risk for investors.

- Investors need to carefully assess the inflation outlook for specific sectors and companies. Some sectors, like energy and commodities, may benefit from inflationary pressures, while others, such as consumer staples, might struggle. A thorough analysis is crucial for informed investment decisions.

Inflation affects different sectors differently. Energy companies, for example, often benefit from rising energy prices, while consumer discretionary companies might see decreased demand as consumers become more price-sensitive. Understanding these sector-specific impacts is crucial for managing risk in an inflationary environment.

Geopolitical Instability and its Ripple Effects

Geopolitical instability is another major contributor to stock market uncertainty. Keywords to focus on here include geopolitical risk, stock market volatility, global economy, international relations, and market uncertainty. Ongoing conflicts, sanctions, and trade disputes create uncertainty and disrupt global supply chains. This uncertainty can significantly impact investor confidence and market sentiment.

- Ongoing geopolitical conflicts create uncertainty and disrupt global supply chains. Conflicts can lead to shortages of essential goods, impacting production and increasing prices. This adds another layer of complexity to the already challenging market conditions.

- Sanctions and trade disputes impact international trade and investment flows. Restrictions on trade can disrupt businesses reliant on international markets, affecting their profitability and stock prices.

- Political instability in key regions can significantly affect market sentiment. Uncertainty about political stability in major economies can lead to investor apprehension and market volatility. Investors often react negatively to perceived political risks.

- Investors need to diversify geographically to mitigate geopolitical risks. A well-diversified portfolio that includes assets from different countries and regions can help reduce the impact of geopolitical events on overall portfolio performance.

Recent examples, such as the ongoing conflict in Ukraine and trade tensions between major global powers, highlight the significant impact geopolitical events can have on stock markets worldwide. Understanding these risks and diversifying investments are crucial for mitigating potential losses.

Evaluating Risk and Developing Effective Investment Strategies

Effective risk management is paramount in navigating stock market uncertainty. Keywords to emphasize here are risk management, investment strategies, diversification, portfolio management, and asset allocation. A robust investment strategy should incorporate several key elements.

- Diversification across different asset classes (stocks, bonds, real estate) reduces overall portfolio risk. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce the impact of losses in any single asset.

- Careful due diligence on individual stocks is crucial before investing. Thorough research and understanding a company's financials, competitive landscape, and future prospects are vital before investing.

- Understanding your own risk tolerance is essential in formulating an investment strategy. Are you a conservative investor or are you comfortable with higher risks for potentially higher returns? Knowing your risk tolerance will guide your investment choices.

- Consider professional financial advice to navigate complex market conditions. A financial advisor can provide personalized guidance and help you develop a tailored investment strategy.

The Importance of Long-Term Perspective in Uncertain Markets

Maintaining a long-term perspective is crucial in navigating stock market uncertainty. Keywords include long-term investment, patience, market cycles, and buy-and-hold strategy.

- Short-term market fluctuations should not dictate long-term investment decisions. Don't panic sell during market downturns. Focus on your long-term goals and investment strategy.

- A well-diversified portfolio, coupled with a long-term outlook, can weather market storms. A well-constructed portfolio can withstand short-term volatility and continue growing over the long term.

- Focus on fundamental analysis rather than reacting to daily market noise. Don't let short-term news sway your investment decisions. Analyze the fundamentals of the companies you invest in and stick to your long-term strategy.

Staying disciplined and avoiding emotional decision-making is key to successful long-term investing. Patience and a long-term vision are essential for weathering market downturns and achieving your financial goals.

Conclusion

Higher bids in the stock market often present higher risks due to persistent inflation, geopolitical instability, and overall market uncertainty. Investors need to carefully assess these risks and adapt their strategies accordingly. Don't let market uncertainty deter you from investing. By understanding the risks and adopting a well-defined investment strategy incorporating risk management, diversification, and a long-term perspective, you can navigate higher bids and higher risks in the stock market and potentially achieve your financial goals. Learn more about mitigating risk in today's market by researching effective investment strategies for navigating stock market uncertainty.

Featured Posts

-

Rocket Launch Abort Blue Origin Announces Subsystem Problem

Apr 22, 2025

Rocket Launch Abort Blue Origin Announces Subsystem Problem

Apr 22, 2025 -

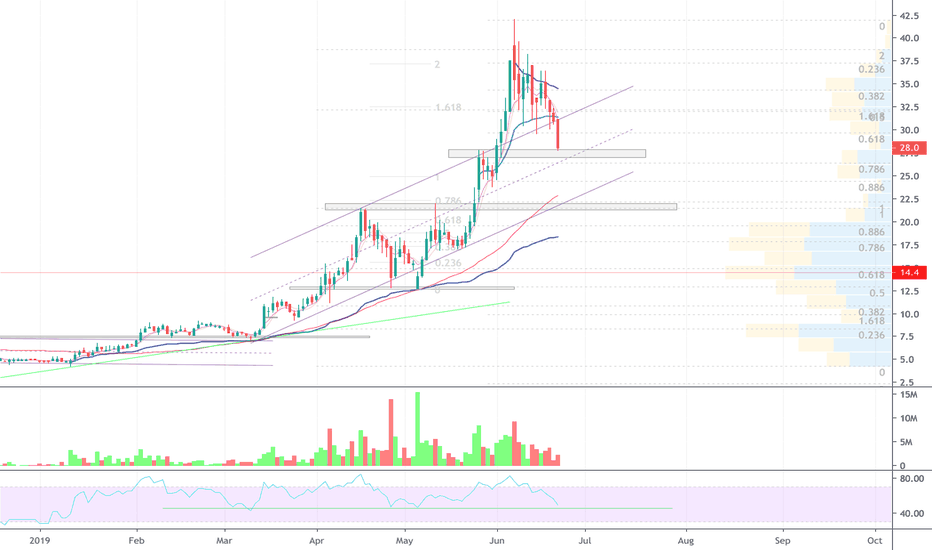

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025 -

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025 -

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025 -

A Timeline Of Karen Reads Murder Convictions And Appeals

Apr 22, 2025

A Timeline Of Karen Reads Murder Convictions And Appeals

Apr 22, 2025