India Market Update: Tailwinds Driving Nifty's Strong Performance

Table of Contents

Robust Domestic Consumption Fuels Nifty's Growth

Rising domestic consumption is a significant driver of Nifty's strong performance. This surge in consumer spending is fueled by several key factors:

Rising Disposable Incomes and Spending

Increased disposable incomes, driven by a growing middle class and positive employment trends, are significantly boosting consumer spending.

- Expansion in key sectors: Sectors like Fast-Moving Consumer Goods (FMCG), automobiles, and retail are experiencing significant expansion, directly reflecting this surge in consumer demand. This increased spending power translates into higher sales and profits for companies listed on the Nifty 50, directly contributing to Nifty's strong performance.

- Government initiatives: Government initiatives aimed at boosting rural incomes, such as direct benefit transfers and agricultural subsidies, are further supporting this trend. These initiatives increase the purchasing power of rural populations, a substantial portion of the Indian market.

- Positive consumer confidence: Data on consumer confidence indices and retail sales growth consistently show positive trends, providing concrete evidence supporting the narrative of robust domestic consumption. This sustained optimism fuels further spending and investment.

Infrastructure Development and its Impact

Massive investments in infrastructure projects are creating jobs and stimulating economic activity, indirectly impacting Nifty's performance.

- National Infrastructure Pipeline (NIP): The government's focus on infrastructure projects under the National Infrastructure Pipeline (NIP) is a key driver. This ambitious plan involves substantial investments in roads, railways, ports, and other crucial infrastructure elements.

- Boosting related sectors: Increased government spending on infrastructure boosts related sectors like cement, steel, and construction, many of which are listed on the Nifty 50. This increased activity directly translates into higher stock valuations and contributes to Nifty's overall performance.

- Long-term growth prospects: The long-term impact of these infrastructure investments is substantial. Improved infrastructure enhances connectivity, logistics, and overall economic efficiency, laying a strong foundation for sustained economic growth and further bolstering Nifty's performance in the years to come.

Foreign Institutional Investor (FII) Inflows Boost Market Sentiment

Significant Foreign Institutional Investor (FII) inflows have played a crucial role in boosting market sentiment and contributing to Nifty's strong performance.

Positive Global Sentiment Towards India

Increased confidence in India's economic growth story is attracting significant foreign investment.

- Reasons for increased FII inflows: Several factors contribute to this positive global sentiment, including a positive economic outlook, structural reforms implemented by the government, a relatively stable political environment, and a large and growing consumer market.

- Data on FII investments: Analysis of data on FII investments in recent months and years reveals a consistent upward trend, highlighting the strong investor confidence in the Indian market.

- Competitive advantage: Compared to other emerging markets, India presents a compelling investment proposition due to its relatively strong fundamentals, growth potential, and ongoing reforms.

Strong Corporate Earnings and Profitability

Healthy corporate earnings and improved profitability are further attracting more FII investment.

- Strong corporate performance: Recent corporate earnings reports of Nifty 50 companies demonstrate robust performance across various sectors. This profitability makes Indian equities attractive investments.

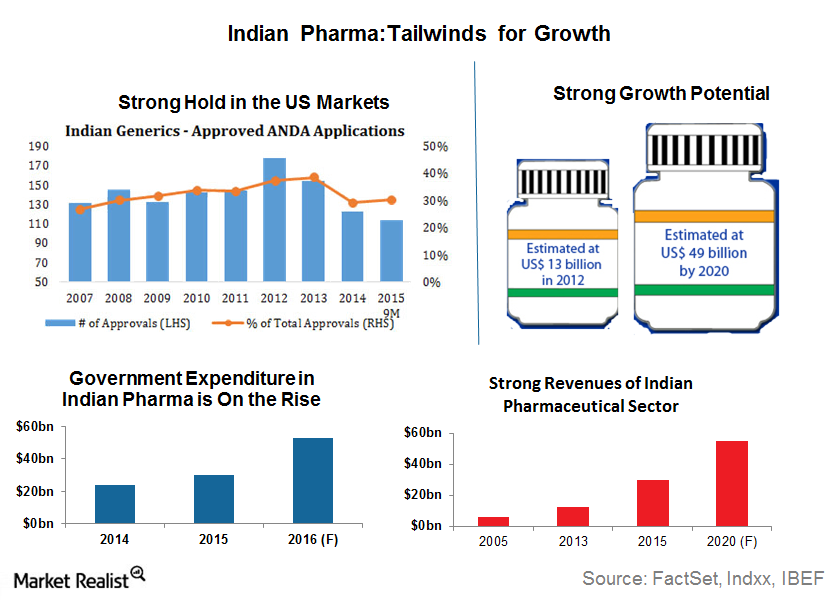

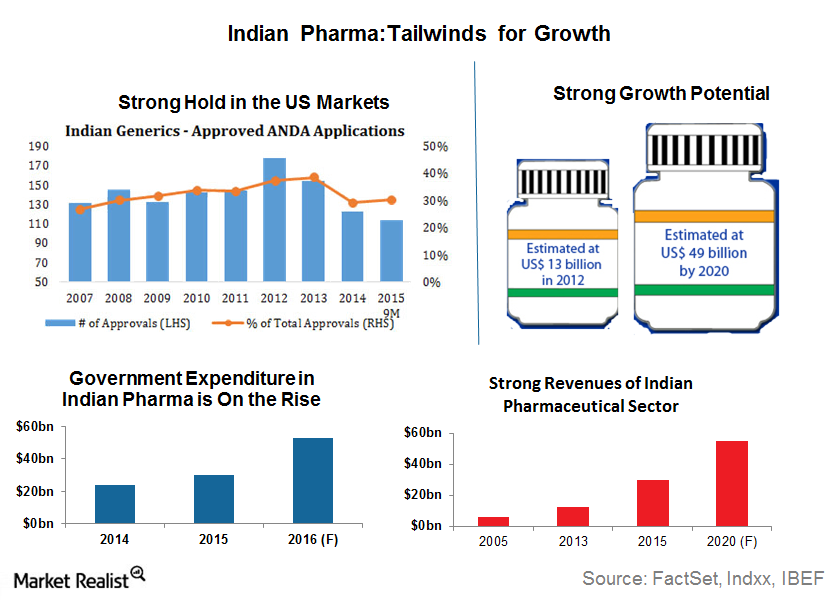

- High-growth sectors: Certain sectors, such as technology, pharmaceuticals, and financials, are showing particularly strong earnings growth, further attracting FII investment.

- Importance of corporate governance: Strong corporate governance practices, transparency, and investor protection measures also play a critical role in attracting foreign investment and contributing to Nifty's strong performance.

Government Policies and Reforms Supporting Nifty's Rise

Pro-business reforms and government initiatives have played a significant role in supporting Nifty's rise.

Pro-Business Reforms and Ease of Doing Business

Government initiatives to improve the ease of doing business in India are creating a more favorable environment for businesses and investors.

- Policy reforms: Specific policy reforms impacting business include deregulation, tax reforms (like the Goods and Services Tax – GST), and labor law reforms. These reforms streamline processes, reduce bureaucratic hurdles, and create a more efficient business environment.

- Improved business environment: The impact of these reforms is evident in improved rankings in ease of doing business indices and increased foreign direct investment (FDI).

- Future policy outlook: Future policy reforms are expected to further boost the market by encouraging more competition, innovation, and investment.

Digital India Initiative and Technological Advancements

The Digital India initiative and rapid technological advancements are contributing significantly to India's economic growth and influencing Nifty's performance.

- Digital transformation: The digitalization of the Indian economy is impacting various sectors listed in Nifty, leading to increased efficiency, improved access to services, and new business opportunities.

- Fintech and technology: The rise of fintech and other technology companies is driving growth, innovation, and attracting significant investment.

- Future technological potential: The potential for technology to further shape the Indian economy and drive future growth remains substantial, contributing positively to Nifty's long-term prospects.

Conclusion

The strong performance of Nifty 50 is a result of a confluence of positive factors, including robust domestic consumption, significant FII inflows, and supportive government policies. These tailwinds suggest a positive outlook for the Indian market. However, it’s crucial to remember that external factors and potential global economic slowdowns could influence future performance. Staying informed about these factors is crucial for effective investment strategies in the Indian market. To learn more about the factors impacting Nifty's strong performance and to stay updated on the latest market trends, continue monitoring our regular India Market Updates. Understanding these drivers is key to navigating the opportunities and challenges presented by Nifty's strong performance.

Featured Posts

-

Live Stock Market Updates Dow S And P 500 And Nasdaq Gains

Apr 24, 2025

Live Stock Market Updates Dow S And P 500 And Nasdaq Gains

Apr 24, 2025 -

Ella Bleu Travolta Od Djevojcice Do Prelijepe Mlade Zene

Apr 24, 2025

Ella Bleu Travolta Od Djevojcice Do Prelijepe Mlade Zene

Apr 24, 2025 -

Golden States Bench Stars Hield And Payton Shine Against Portland

Apr 24, 2025

Golden States Bench Stars Hield And Payton Shine Against Portland

Apr 24, 2025 -

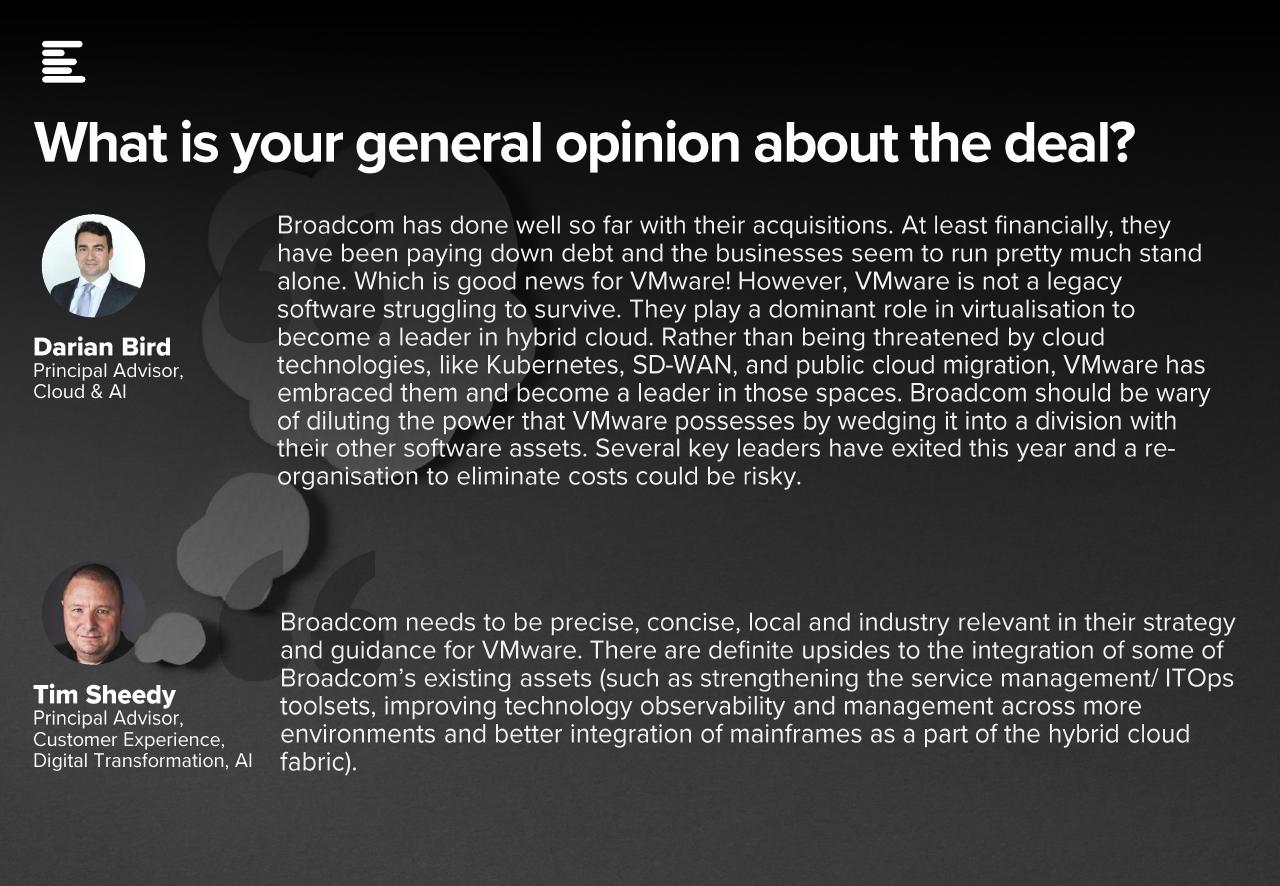

Broadcoms V Mware Acquisition A 1 050 Price Hike For At And T

Apr 24, 2025

Broadcoms V Mware Acquisition A 1 050 Price Hike For At And T

Apr 24, 2025 -

Section 230 And Banned Chemicals An E Bay Case Study

Apr 24, 2025

Section 230 And Banned Chemicals An E Bay Case Study

Apr 24, 2025