India's Nifty Index: Understanding The Current Bullish Momentum

Table of Contents

Factors Driving the Nifty's Bullish Run

Several macroeconomic factors are contributing to the Nifty's impressive bullish run. The interplay of these elements creates a positive feedback loop, pushing the index higher.

-

Strong Economic Growth in India: India's robust economic growth, consistently outperforming many global economies, fuels investor confidence and drives corporate profitability. This growth is reflected in various indicators, including GDP growth rates and rising consumer spending.

-

Positive Investor Sentiment: A generally optimistic outlook among domestic and international investors is a key driver. This positive sentiment is fueled by the nation's economic prospects and the belief in India's long-term growth story.

-

Government Policies and Reforms: Pro-business government policies, including infrastructure development initiatives and tax reforms, are creating a favorable environment for businesses to thrive and expand, further boosting the Nifty. Initiatives like "Make in India" and "Digital India" are attracting significant investment.

-

Foreign Institutional Investor (FII) Inflow: Significant inflows of capital from foreign institutional investors demonstrate confidence in the Indian market and contribute significantly to the Nifty's upward trajectory. This influx of foreign capital boosts liquidity and demand for Indian equities.

-

Corporate Earnings Growth: Strong corporate earnings across various sectors are a significant indicator of a healthy economy and reflect positively on the Nifty's performance. Many companies are reporting better-than-expected profits, driving investor interest.

Analyzing Key Sectors Contributing to the Nifty's Rise

Several sectors are significantly outperforming others, propelling the Nifty's rise. Analyzing their individual contributions provides a nuanced understanding of the market’s strength.

-

IT Sector: The Indian IT sector continues to be a major contributor, benefiting from global demand for technology services and software solutions. Strong export revenues and robust order books drive this sector's growth, impacting the Nifty significantly.

-

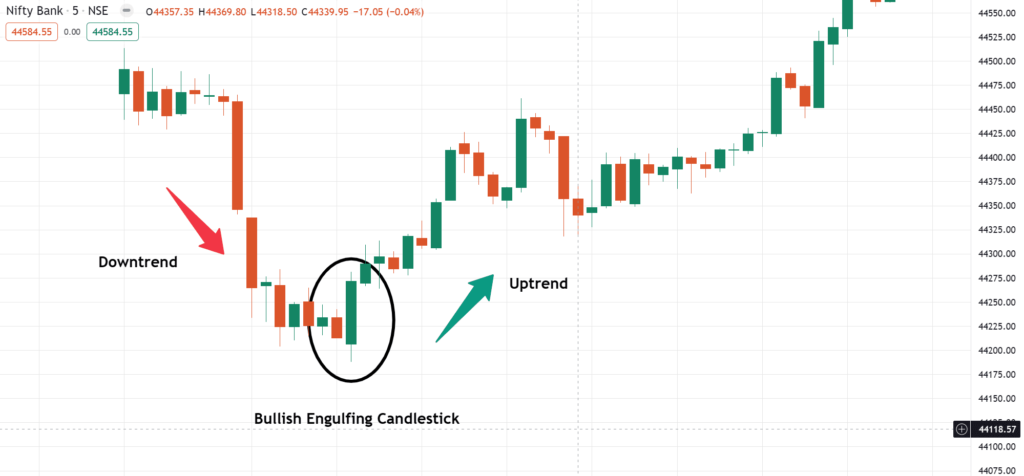

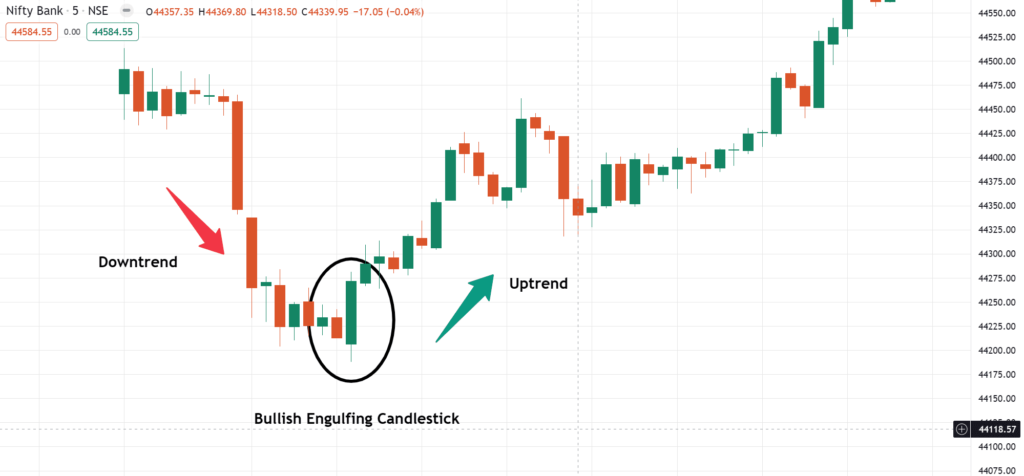

Financial Sector: The financial sector, encompassing banking, insurance, and NBFCs, is also experiencing strong growth, propelled by increased credit demand and government initiatives to improve financial inclusion.

-

Pharmaceutical Sector: The pharmaceutical sector remains resilient, driven by both domestic demand and increasing global exports. The sector's consistent performance contributes positively to the overall Nifty index.

Analyzing the Nifty sectoral indices provides valuable insights into the specific drivers of the overall market growth. This granular analysis helps investors identify promising sectors for targeted investment strategies.

Assessing the Sustainability of the Bullish Trend

While the current bullish trend in the Nifty is impressive, it's essential to assess potential risks and challenges that could dampen the momentum.

-

Global Economic Uncertainties: Global factors, including geopolitical tensions and potential economic slowdowns in major economies, could impact India's growth and, subsequently, the Nifty.

-

Inflation: Persistent inflation could erode investor confidence and potentially lead to interest rate hikes, impacting market valuations. Managing inflation effectively is crucial for sustaining the bullish trend.

-

Geopolitical Risks: Geopolitical instability, both regionally and globally, poses a potential threat to investor sentiment and could lead to market volatility.

-

Nifty Valuation: Analyzing the Nifty's valuation is critical. While the current momentum is strong, overvaluation could make the market susceptible to corrections. A careful evaluation of Price-to-Earnings (P/E) ratios and other valuation metrics is necessary to gauge the sustainability of the current levels.

Investment Strategies for Navigating the Bullish Nifty

Investors looking to capitalize on the Nifty's bullish momentum have several options, each carrying a different level of risk and reward.

-

Investing in Nifty ETFs: Exchange-Traded Funds (ETFs) tracking the Nifty 50 offer a diversified and convenient way to gain exposure to the index. They provide a cost-effective approach to mirroring the Nifty's performance.

-

Mutual Funds: Investing in mutual funds focused on large-cap Indian stocks, many of which hold significant Nifty components, offers professional management and diversification benefits.

-

Individual Stocks: For investors with a higher risk tolerance and more in-depth market knowledge, investing in individual Nifty 50 stocks can offer potentially higher returns but also comes with increased risk.

Remember, diversification and risk management are essential components of any investment strategy. A well-diversified portfolio mitigates the impact of potential market downturns.

Capitalizing on India's Nifty Index Bullish Momentum

The current bullish momentum in India's Nifty 50 index is driven by strong economic growth, positive investor sentiment, supportive government policies, FII inflows, and robust corporate earnings. However, investors must remain aware of potential risks such as global economic uncertainties, inflation, and geopolitical factors. Conducting thorough research and understanding the market dynamics are crucial for making informed investment decisions. Learn more about navigating the bullish momentum of India's Nifty Index and make informed investment choices today!

Featured Posts

-

Nba All Star Game 2024 Notable Players Joining The Celebration

Apr 24, 2025

Nba All Star Game 2024 Notable Players Joining The Celebration

Apr 24, 2025 -

Us Dollar Gains Momentum Against Major Peers Amidst Eased Trump Rhetoric

Apr 24, 2025

Us Dollar Gains Momentum Against Major Peers Amidst Eased Trump Rhetoric

Apr 24, 2025 -

Liberal Policies Explained A Review By William Watson

Apr 24, 2025

Liberal Policies Explained A Review By William Watson

Apr 24, 2025 -

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Tech And Politics

Apr 24, 2025 -

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025