Investor Concerns About High Stock Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's recent analysis paints a nuanced picture of the current stock market. While acknowledging the elevated valuations across various sectors, they also highlight certain positive economic indicators. Their view is not solely bearish; it acknowledges both the risks and potential opportunities present.

- Economic Factors: BofA cites persistent inflation, rising interest rates implemented by central banks globally to combat inflation, and lingering geopolitical uncertainties (e.g., the war in Ukraine) as significant factors influencing current stock valuations. These factors create uncertainty and impact investor confidence, potentially leading to market corrections.

- Sectoral Analysis: BofA's reports often identify specific sectors as either overvalued or undervalued. For example, they might suggest that certain technology stocks are overvalued based on their price-to-earnings ratios, while energy or infrastructure sectors might be considered relatively undervalued given current market conditions and future projections. These assessments are continuously updated based on ongoing market trends.

- Market Prediction: BofA's forecast often incorporates a range of potential outcomes, acknowledging the inherent uncertainty in predicting future market performance. Their projections usually include a base case, as well as upside and downside scenarios, reflecting the volatility of the current climate. They typically emphasize the importance of adapting investment strategies based on changing market conditions.

These elements feed into BofA's overall market analysis and inform their recommendations to investors.

Key Investor Concerns Highlighted by BofA

BofA acknowledges several key investor concerns stemming from high stock valuations. These anxieties are central to understanding the current market sentiment.

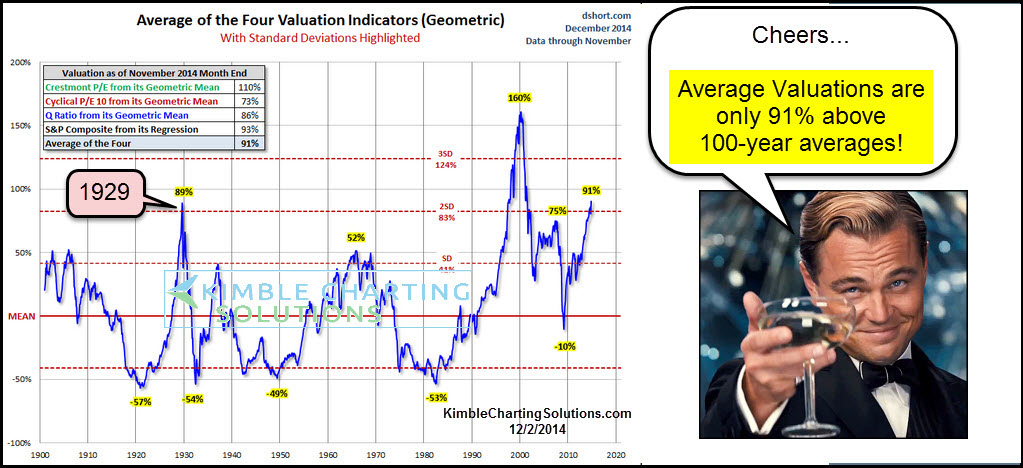

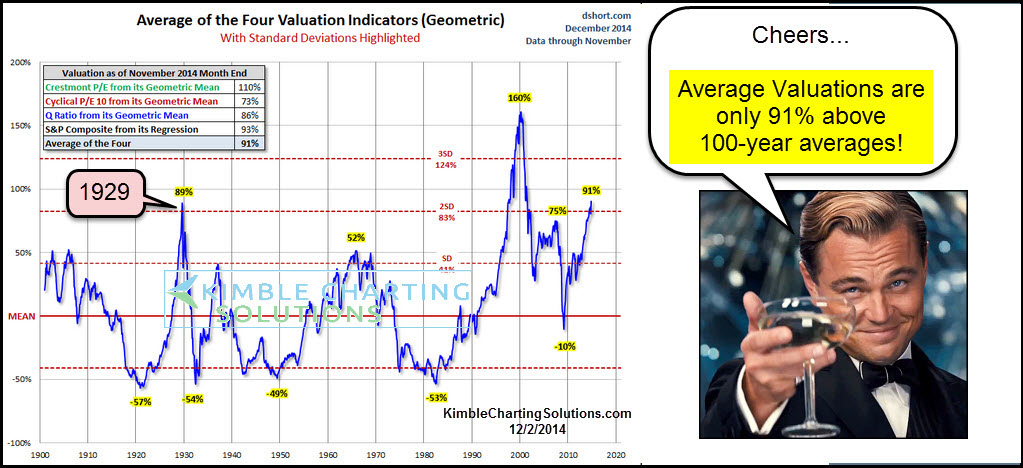

- Market Correction Risk: One primary concern is the potential for a significant market correction. High valuations historically precede market downturns, prompting fears of a substantial pullback. BofA's analysis often quantifies this risk based on historical data and current market indicators.

- Interest Rate Sensitivity: Rising interest rates directly impact stock valuations. Higher rates increase borrowing costs for companies, reducing profitability and potentially leading to lower stock prices. BofA emphasizes the sensitivity of different sectors to interest rate changes in their reports.

- Valuation Bubbles: The concern of specific sectors or the market as a whole existing in a "bubble" – where valuations are detached from fundamental value – is frequently raised. BofA analyses whether current valuations are justified by earnings, growth potential, and other fundamental metrics to determine the existence, or the risk, of such bubbles.

BofA's Strategies and Recommendations for Investors

Navigating the market with high valuations requires a cautious and strategic approach. BofA offers several recommendations:

- Portfolio Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors is a cornerstone of BofA's advice. This strategy aims to mitigate risk and reduce the impact of potential losses in any single sector.

- Sector Selection: BofA's sector-specific analyses guide investors towards potentially undervalued sectors, offering opportunities for growth even in a challenging market. They usually emphasize sectors with strong fundamentals and less sensitivity to interest rate hikes.

- Risk Management: Employing risk management techniques is crucial. This could involve strategies like hedging (using financial instruments to offset potential losses), setting stop-loss orders (automatic sell orders triggered when a stock price drops to a certain level), and carefully managing leverage. BofA emphasizes the importance of aligning investment strategies with each investor's risk tolerance.

Analyzing BofA's Credibility and Potential Biases

It's essential to critically assess BofA's perspective. As a significant financial institution, their views are influenced by various factors.

- Conflicts of Interest: BofA's own investment and trading activities could potentially influence their analysis and recommendations. Understanding this potential conflict of interest is crucial for independent investors.

- Comparison with Other Analysts: Comparing BofA's outlook with the analyses of other reputable financial institutions and analysts provides a more comprehensive perspective and helps identify potential biases. A diversity of viewpoints is critical for informed decision-making.

- Historical Accuracy: Examining the historical accuracy of BofA's market predictions offers insights into their forecasting capabilities. Assessing their track record allows investors to gauge the reliability of their current recommendations.

Conclusion: Navigating Investor Concerns About High Stock Valuations – A Call to Action

BofA's assessment of the current market highlights the significant concerns surrounding high stock valuations, emphasizing risks related to potential corrections, interest rate sensitivity, and the possibility of valuation bubbles. Their recommendations include diversifying portfolios, carefully selecting sectors, and employing robust risk management strategies. However, it's crucial to remember that BofA’s perspective is not without potential biases. Therefore, independent research is vital. Understanding high stock valuations requires a thorough analysis of various perspectives and a careful consideration of your own risk tolerance. We encourage you to conduct your own in-depth research, consider seeking professional financial advice tailored to your individual circumstances, and stay informed about market developments and BofA's ongoing commentary to effectively manage high stock valuation risk. Successfully addressing investor concerns about high stock valuations requires proactive engagement and a well-informed approach.

Featured Posts

-

Office365 Security Failure Leads To Multi Million Dollar Theft

Apr 22, 2025

Office365 Security Failure Leads To Multi Million Dollar Theft

Apr 22, 2025 -

Death Of Pope Francis At 88 A World Mourns

Apr 22, 2025

Death Of Pope Francis At 88 A World Mourns

Apr 22, 2025 -

Military Plans Disclosure Hegseths Signal Chat Controversy

Apr 22, 2025

Military Plans Disclosure Hegseths Signal Chat Controversy

Apr 22, 2025 -

Actors And Writers Strike A Joint Hollywood Shutdown

Apr 22, 2025

Actors And Writers Strike A Joint Hollywood Shutdown

Apr 22, 2025 -

Identifying Prime Business Locations A Map Of Opportunities Across The Country

Apr 22, 2025

Identifying Prime Business Locations A Map Of Opportunities Across The Country

Apr 22, 2025