Investor Concerns About Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's overall stance on current stock market valuations is nuanced. While acknowledging that certain sectors appear richly valued, they don't necessarily see the market as drastically overvalued across the board. Their assessment relies on a comprehensive analysis of various valuation metrics, taking into account macroeconomic factors and projected corporate earnings growth.

-

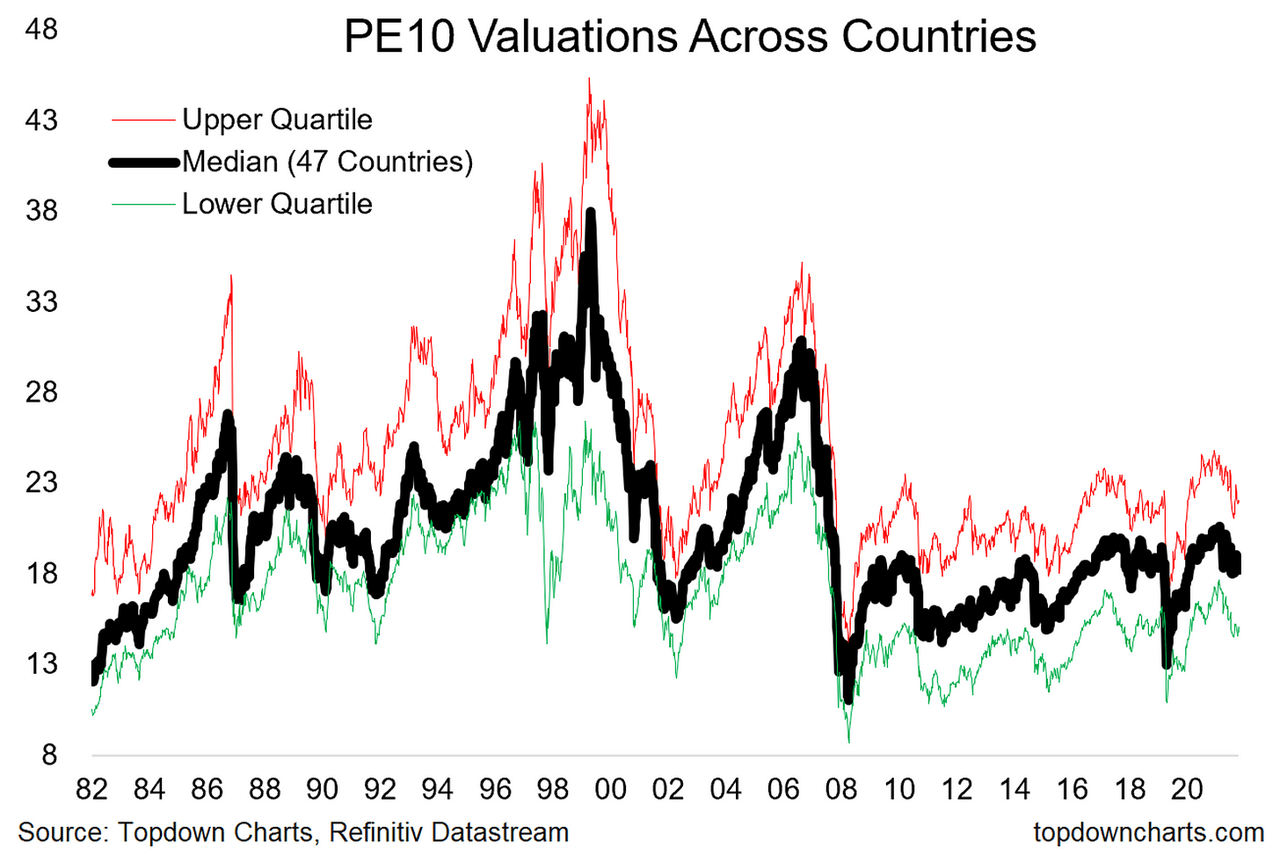

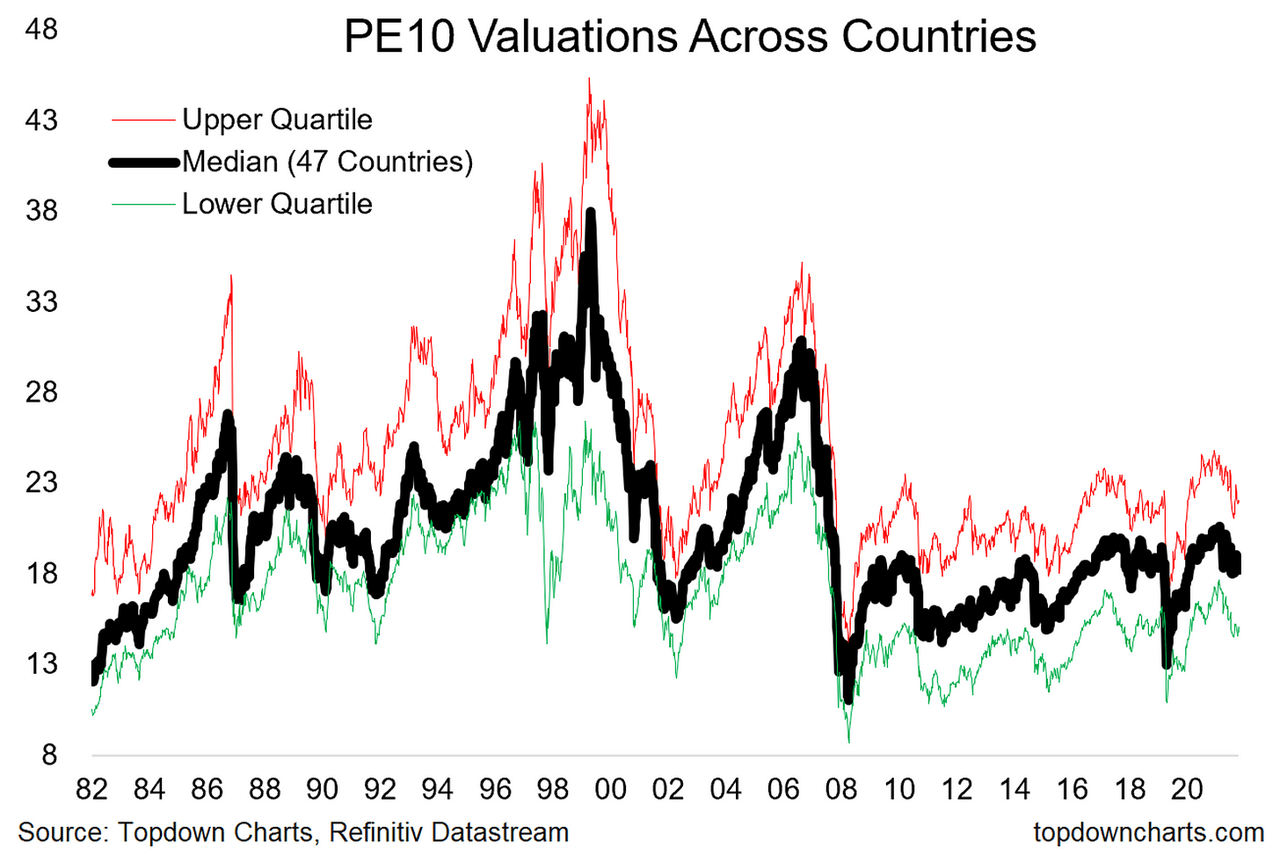

Valuation Metrics: BofA utilizes a range of metrics to gauge market valuations, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and the price-to-sales ratio. They consider these metrics in conjunction with factors like interest rates, inflation, and economic growth forecasts.

-

Overvalued and Undervalued Sectors: Specific sectors identified by BofA as potentially overvalued may vary depending on the report and timeframe. However, past analyses have frequently highlighted certain technology and growth sectors as warranting caution due to high valuations relative to earnings. Conversely, sectors exhibiting robust fundamentals and lower valuations might be seen as relatively attractive opportunities. It's crucial to consult the latest BofA reports for the most up-to-date sector assessments.

-

Reasoning: BofA's reasoning often emphasizes the interplay between current earnings, projected future growth, and prevailing interest rates. High valuations can be justified if future earnings are expected to significantly increase, offsetting the current premium. Conversely, high valuations coupled with slower projected earnings growth raise concerns.

-

BofA Reports: For detailed insights, refer to BofA's regularly published market commentary, investment strategy reports, and research publications available to clients and often summarized in financial news outlets.

Key Investor Concerns Regarding Stock Market Valuations

High stock market valuations naturally trigger several anxieties among investors:

-

Market Correction or Crash: The fear of a significant market downturn is paramount when valuations seem stretched. Investors worry that a correction could wipe out substantial portions of their portfolios.

-

Inflation's Impact: High inflation erodes purchasing power and can negatively impact corporate earnings, making high stock prices less sustainable. Investors are concerned that inflation could trigger a sell-off.

-

Interest Rate Hikes: Interest rate increases by central banks aim to curb inflation but can also impact stock valuations negatively. Higher interest rates make bonds more attractive, potentially diverting investment away from stocks.

-

Earnings Growth Concerns: Investors worry that corporate earnings growth might not keep pace with current stock prices, leading to a decline in valuations. A mismatch between price and earnings is a major source of apprehension.

BofA's Strategies for Navigating High Stock Market Valuations

BofA generally recommends a cautious but not overly pessimistic approach to navigating high stock market valuations. They emphasize the importance of long-term strategies over short-term market timing.

-

Diversification: Diversifying across different sectors and asset classes is crucial to mitigate risk. A balanced portfolio that includes stocks, bonds, and potentially alternative assets can help cushion the impact of market fluctuations.

-

Risk Management: Employing risk management techniques like hedging strategies and setting stop-loss orders can help limit potential losses. These measures provide a safety net against sharp market declines.

-

Undervalued Stock Selection: Focus on identifying potentially undervalued stocks or sectors with strong fundamentals and growth prospects. Thorough fundamental analysis is key.

-

Long-Term Investing: BofA typically advocates for a long-term investment horizon. Short-term market volatility should not dictate long-term investment decisions.

Alternative Investment Options Considered by BofA

Given the current environment of high stock market valuations, BofA might suggest considering alternative investment options to diversify portfolios and potentially reduce risk:

-

Bonds and Fixed-Income Investments: Bonds offer a more stable return profile compared to stocks, providing a counterbalance to equity market risk.

-

Real Estate: Real estate can be a valuable addition to a diversified portfolio, offering potential for capital appreciation and rental income.

-

Commodities: Commodities such as gold, oil, and agricultural products can act as a hedge against inflation and market uncertainty.

-

Other Alternative Assets: This broad category could include private equity, hedge funds, and other less liquid investments that offer potentially higher returns but also carry significant risks.

The Role of Interest Rates in Stock Market Valuations

Interest rates play a significant role in influencing stock market valuations.

-

Inverse Relationship: Generally, there's an inverse relationship between interest rates and stock valuations. Higher interest rates increase the attractiveness of bonds, potentially reducing the demand for stocks and lowering their prices.

-

BofA's Interest Rate Predictions: BofA regularly publishes forecasts on interest rate movements. These predictions are crucial in assessing their outlook on stock market valuations. Rising interest rate projections could lead them to be more cautious about equity valuations.

-

Impact on Valuations: BofA's assessment of stock market valuations is significantly shaped by their view on future interest rate movements. Anticipation of rising rates might lead to a more conservative outlook on equity valuations.

Conclusion

BofA's analysis of current stock market valuations highlights the importance of a balanced and diversified investment approach. While acknowledging concerns about high valuations in certain sectors, they emphasize the need for long-term strategies, risk management, and a thorough understanding of macroeconomic factors, particularly interest rates. Investors should remain aware of the key concerns surrounding high valuations – market corrections, inflation's impact, interest rate hikes, and the potential for earnings growth to lag behind price increases. Understanding these concerns and utilizing the strategies suggested by BofA, such as diversification and careful stock selection, is vital for making informed investment decisions.

Call to Action: Stay informed about the latest insights on stock market valuations from reputable sources like Bank of America to make confident investment choices. Regularly review your portfolio and adjust your investment strategy as needed to mitigate risk and maximize returns in the context of fluctuating stock market valuations.

Featured Posts

-

From Egypt To The Nfl Ahmed Hassaneins Road To The Draft

Apr 26, 2025

From Egypt To The Nfl Ahmed Hassaneins Road To The Draft

Apr 26, 2025 -

The Ethics Of Betting On Natural Disasters The Los Angeles Wildfire Example

Apr 26, 2025

The Ethics Of Betting On Natural Disasters The Los Angeles Wildfire Example

Apr 26, 2025 -

A Geographic Overview Of The Countrys Top Business Hotspots

Apr 26, 2025

A Geographic Overview Of The Countrys Top Business Hotspots

Apr 26, 2025 -

American Battleground A High Stakes Showdown With A Billionaire

Apr 26, 2025

American Battleground A High Stakes Showdown With A Billionaire

Apr 26, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 26, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 26, 2025