Is Netflix The New Safe Haven For Investors Amidst Big Tech Instability?

Table of Contents

Netflix's Financial Performance and Stability

Revenue Growth and Profitability

Netflix has demonstrated consistent revenue growth and profitability, making it a compelling investment prospect, even amid broader market uncertainty. Let's examine some key figures:

- Year-over-year revenue growth: Netflix consistently reports strong year-over-year revenue increases, exceeding expectations in many quarters. (Specific data points should be inserted here referencing recent financial reports. For example: "In Q2 2024, revenue grew by X%, surpassing analyst predictions.")

- Subscriber growth: While subscriber growth has fluctuated, the overall trend shows a large and still-expanding global subscriber base. (Insert specific data on subscriber numbers and growth rates).

- Profit margins: Netflix maintains healthy profit margins, showcasing efficient operational management and a strong business model. (Include specific data on profit margins).

Compared to some Big Tech companies grappling with significant losses or stagnant growth, Netflix's consistent financial performance offers a degree of stability.

Debt Levels and Cash Flow

Analyzing Netflix's financial health requires examining its debt and cash flow. While Netflix carries debt, its debt-to-equity ratio is (insert data and context, e.g., "relatively manageable compared to industry peers"). More importantly, the company generates substantial cash flow, enabling it to:

- Invest in original content.

- Fund international expansion.

- Weather potential economic downturns.

This strong cash flow position is a critical factor contributing to Netflix's perceived stability as an investment.

Competitive Landscape and Market Position

Market Dominance and Subscriber Base

Netflix enjoys significant market dominance in the streaming industry, boasting a massive global subscriber base.

- Market share: (Insert data on Netflix's market share globally and in key regions). This illustrates Netflix's leading position.

- Subscriber growth: While growth rates may fluctuate, the sheer size of Netflix's subscriber base demonstrates strong brand recognition and customer loyalty. (Insert data on total subscribers and growth trends).

Competition and Emerging Threats

The streaming landscape is fiercely competitive. Key rivals include Disney+, HBO Max, Amazon Prime Video, and others. Netflix faces threats from:

- Increased competition from established players and new entrants.

- Rising content costs.

- Price sensitivity among subscribers.

However, Netflix counters these challenges through:

- Strategic investments in original programming.

- Aggressive international expansion.

- Continuous innovation in its platform and features.

Future Growth Potential and Investment Outlook

Content Strategy and Original Programming

Netflix's investment in original programming is a cornerstone of its strategy. Successful shows and films:

- Drive subscriber acquisition.

- Boost subscriber retention.

- Enhance brand loyalty.

(Include examples of successful Netflix originals and their impact on the platform's growth.) The future direction of Netflix's content strategy will be crucial to its continued success.

International Expansion and Emerging Markets

Netflix's international expansion is a major driver of future growth. Significant growth potential exists in:

- Asia.

- Latin America.

- Africa.

(Include examples of successful international expansion strategies and their impact on subscriber numbers.) However, navigating regulatory hurdles and cultural differences pose challenges.

Diversification Strategies

Netflix is exploring diversification beyond its core streaming business, including:

- Interactive content.

- Gaming.

These efforts aim to broaden revenue streams and reduce reliance on a single revenue source. The success of these diversification strategies will impact Netflix's long-term stability and resilience. (Analyze the potential risks and rewards of these efforts).

Conclusion: Is Netflix a Safe Haven for Investors? A Final Verdict

Netflix presents a compelling case as a relatively stable investment option compared to some other Big Tech companies. Its consistent revenue growth, strong cash flow generation, and significant market share contribute to its perceived resilience. However, fierce competition, content cost pressures, and the challenges of international expansion remain considerable risks. Therefore, while Netflix might offer a degree of safety within the volatile tech landscape, it's not a risk-free investment.

Is Netflix truly a safe haven for investors in the current climate? The answer is nuanced. While it exhibits greater financial stability than some other tech giants, it's not immune to market fluctuations. Before investing in Netflix or any other company, conduct thorough due diligence. Research Netflix's financial reports, analyze market trends, and assess your own risk tolerance. Further reading on "Netflix as a safe haven investment," "Netflix stock analysis," or similar terms will provide deeper insights. Only then can you make an informed decision about whether Netflix aligns with your investment strategy.

Featured Posts

-

Ontarios Internal Trade Reform Loosening Alcohol And Labour Restrictions

Apr 23, 2025

Ontarios Internal Trade Reform Loosening Alcohol And Labour Restrictions

Apr 23, 2025 -

Is William Contreras A Game Changer For The Brewers

Apr 23, 2025

Is William Contreras A Game Changer For The Brewers

Apr 23, 2025 -

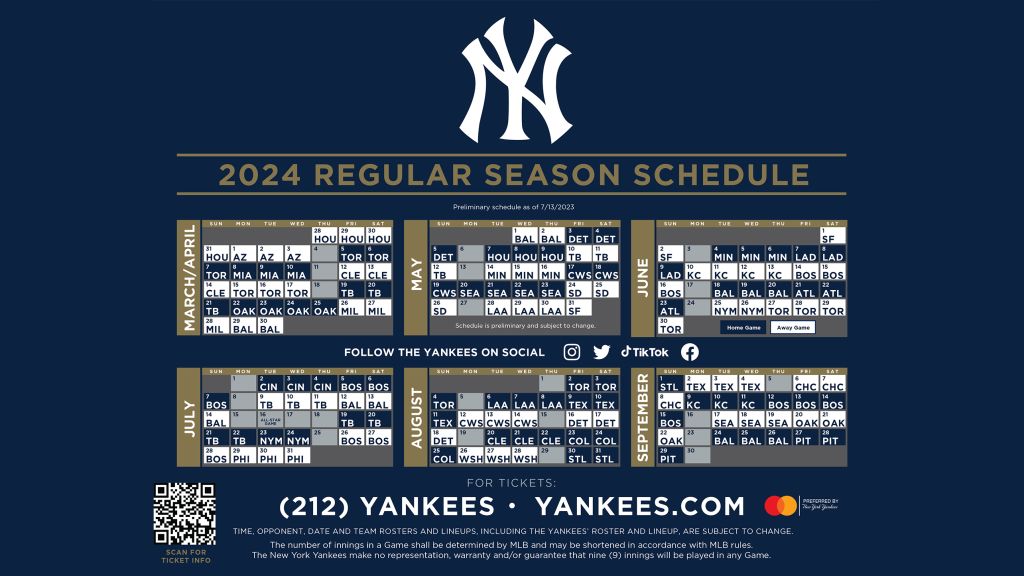

Aaron Judges Historic Night Yankees Set New Home Run Record In 2025

Apr 23, 2025

Aaron Judges Historic Night Yankees Set New Home Run Record In 2025

Apr 23, 2025 -

2025 Yankees Game Highlights 9 Home Runs Judges 3 Hrs Lead The Charge

Apr 23, 2025

2025 Yankees Game Highlights 9 Home Runs Judges 3 Hrs Lead The Charge

Apr 23, 2025 -

Historic Night For The Yankees 9 Home Runs Including 3 By Judge

Apr 23, 2025

Historic Night For The Yankees 9 Home Runs Including 3 By Judge

Apr 23, 2025