Live Stock Market Updates: Dow Futures, Dollar, And Trade War Concerns

Table of Contents

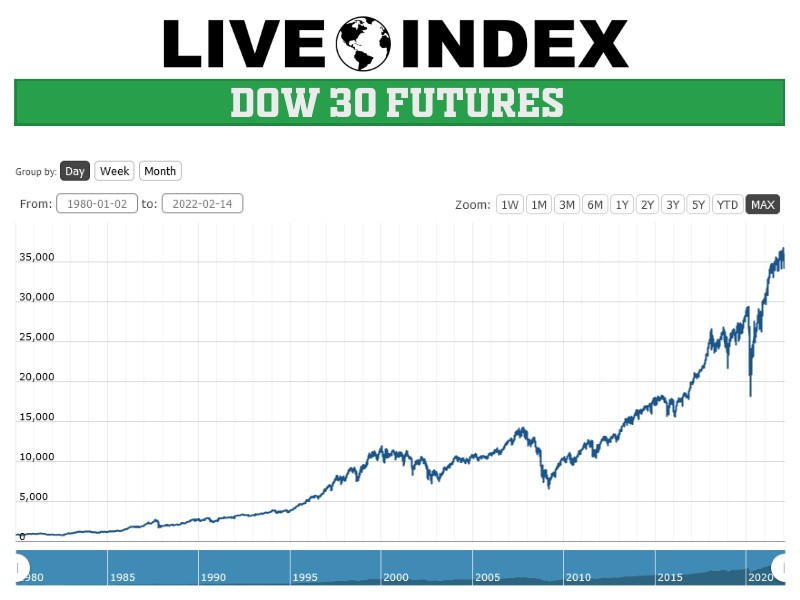

Dow Futures: A Leading Indicator

Dow futures are contracts to buy or sell the Dow Jones Industrial Average (DJIA) at a specific price on a future date. They serve as a powerful predictor of market performance because they reflect investor sentiment and expectations before the actual opening of the stock market. Understanding Dow futures is key to interpreting live stock market updates and making informed investment decisions.

-

How Dow Futures Contracts Work: Dow futures contracts are traded on exchanges like the Chicago Mercantile Exchange (CME). They allow investors to speculate on the direction of the DJIA without directly owning individual stocks. A rise in Dow futures generally indicates optimism, while a decline suggests pessimism.

-

Impact on Investor Sentiment: Positive Dow futures movements often boost investor confidence, leading to increased buying activity and potential market rallies. Conversely, negative futures can trigger selling pressure and market declines. Analyzing these trends offers valuable live stock market updates.

-

Technical Analysis Tools: Traders employ various technical analysis tools to interpret Dow futures trends. These include moving averages (to identify trends), support and resistance levels (to predict price reversals), and various chart patterns. Monitoring these tools provides real-time live stock market updates.

-

Recent Dow Futures Movements: For example, a recent surge in Dow futures following positive economic data might signal an upcoming market upswing. Conversely, a sharp drop in futures after disappointing earnings reports could indicate a potential market correction. Staying abreast of these movements is crucial for effective live stock market updates.

The US Dollar's Influence on Global Markets

The US dollar's status as the world's reserve currency significantly impacts global markets. Its strength or weakness directly influences international trade, investment flows, and the performance of multinational companies. Understanding these dynamics is critical when analyzing live stock market updates.

-

Correlation Between Dollar Strength and Import/Export Prices: A strong dollar makes US imports cheaper and US exports more expensive. This affects companies involved in international trade, influencing their profitability and, consequently, their stock prices. This is a major factor in live stock market updates.

-

Impact on Multinational Companies: Multinational corporations with significant overseas operations are particularly vulnerable to dollar fluctuations. A weakening dollar can boost their earnings reported in US dollars, while a strengthening dollar can have the opposite effect. This is a key aspect to consider for live stock market updates.

-

Interest Rate Changes and the Dollar: Changes in US interest rates significantly impact the dollar's value. Higher interest rates tend to attract foreign investment, strengthening the dollar, while lower rates can weaken it. Following interest rate announcements provides critical live stock market updates.

-

Recent Dollar Movements: For instance, a strengthening dollar might negatively impact US exporters' stocks while positively influencing stocks of companies that primarily import goods. Keeping an eye on these movements provides important live stock market updates.

Trade War Uncertainty and its Market Impact

Trade tensions and tariffs create significant uncertainty and volatility in the stock market. Different sectors are affected differently depending on the specifics of trade disputes. This is an important component of comprehensive live stock market updates.

-

Impact on Specific Industries: Tariffs on imported goods can significantly impact industries like agriculture (soybeans, for example) and technology (semiconductors). Conversely, trade agreements can create opportunities for certain sectors. These events provide significant live stock market updates.

-

Effects of Trade Negotiations: Trade negotiations and agreements can lead to periods of heightened volatility as markets react to the ongoing developments. Positive developments can lead to market rallies, while negative outcomes can spark declines. Tracking these developments allows for more informed live stock market updates.

-

Investor Sentiment and Trade War Headlines: Investor sentiment is highly sensitive to trade war headlines and news. Negative news can trigger risk aversion and selling pressure, while positive news can boost confidence and lead to increased investment. This greatly influences live stock market updates.

-

Companies Significantly Impacted: Companies directly involved in industries affected by tariffs or trade disputes often experience significant stock price fluctuations. Monitoring these companies provides critical live stock market updates.

Analyzing the Interplay of Factors

The three factors discussed above – Dow futures, the US dollar, and trade war concerns – are interconnected and influence each other. Understanding their interplay is crucial for interpreting live stock market updates.

-

Strong Dollar and Dow Futures: A strong dollar, in the context of trade disputes, can negatively impact Dow futures if it hurts US export-oriented companies represented in the DJIA.

-

Trade War Uncertainty and Dow Futures: Trade war uncertainty can negatively influence investor behavior, leading to lower Dow futures prices as investors become more risk-averse.

-

Combined Effect Scenarios: For example, a weakening dollar combined with easing trade tensions might lead to a rise in Dow futures as investor confidence improves and US exporters benefit. Analyzing these combined effects provides insightful live stock market updates.

Conclusion

Staying informed on live stock market updates is essential for making sound investment decisions. By monitoring key indicators like Dow futures, the US dollar's performance, and the evolving landscape of trade wars, investors can better anticipate market movements and mitigate risk. Regularly checking for updated live stock market updates and analysis allows for more informed decision-making. Don't miss out on crucial live stock market updates – stay informed and make informed investment choices.

Featured Posts

-

Pope Francis His Life His Legacy And A Church Transformed

Apr 22, 2025

Pope Francis His Life His Legacy And A Church Transformed

Apr 22, 2025 -

Florida State University Security Flaw Fuels Student Anxiety Despite Quick Police Action

Apr 22, 2025

Florida State University Security Flaw Fuels Student Anxiety Despite Quick Police Action

Apr 22, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025 -

1 Billion At Stake Harvard And The Trump Administrations Bitter Feud

Apr 22, 2025

1 Billion At Stake Harvard And The Trump Administrations Bitter Feud

Apr 22, 2025 -

Pope Francis A Legacy Of Compassion 1936 2024

Apr 22, 2025

Pope Francis A Legacy Of Compassion 1936 2024

Apr 22, 2025