Market Volatility: Are Stock Investors Prepared For More Pain?

Table of Contents

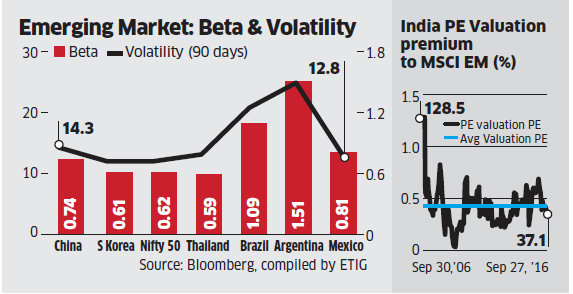

Understanding the Current Market Volatility

Causes of Increased Market Volatility

Numerous factors contribute to the heightened market volatility we're currently experiencing. Understanding these underlying causes is crucial for navigating the turbulent waters of the stock market. Key macroeconomic factors include:

-

Inflationary Pressures: Persistent inflation erodes purchasing power and forces central banks to raise interest rates, impacting borrowing costs for businesses and consumers alike. High inflation often leads to increased market uncertainty and volatility. [Link to relevant inflation data]

-

Interest Rate Hikes: To combat inflation, central banks globally are raising interest rates. Higher rates increase borrowing costs, potentially slowing economic growth and impacting corporate profitability, leading to increased market volatility. [Link to recent interest rate announcements]

-

Geopolitical Risks: The ongoing war in Ukraine, along with other geopolitical tensions, introduces significant uncertainty into global markets. These events can disrupt supply chains, impact energy prices, and generally increase market volatility. [Link to news articles on geopolitical events]

-

Supply Chain Disruptions: Ongoing disruptions to global supply chains continue to impact businesses, leading to increased production costs and price increases, fueling inflation and contributing to market volatility. [Link to articles on supply chain issues]

-

Recessionary Concerns: Fears of a potential recession are weighing heavily on investor sentiment. The possibility of an economic downturn significantly impacts market performance and increases volatility. [Link to economic forecasts]

Impact of Market Volatility on Different Asset Classes

Market volatility doesn't affect all asset classes equally. Understanding these differential impacts is vital for effective portfolio diversification and risk management.

-

Stocks: Equities are generally considered more volatile than other asset classes. During periods of increased market volatility, stock prices can experience significant swings, both upward and downward.

-

Bonds: Bonds are typically considered less volatile than stocks, but they are still susceptible to market fluctuations, particularly when interest rates rise. Rising rates generally lead to falling bond prices.

-

Real Estate: Real estate is generally a less liquid asset and tends to be less volatile than stocks in the short term, but long-term values can still be affected by economic conditions.

-

Commodities: Commodity prices, such as oil and gold, are often sensitive to geopolitical events and economic conditions, experiencing periods of increased volatility.

Effective portfolio diversification, strategic asset allocation, and sound risk management are crucial to navigating market volatility successfully.

Assessing Investor Sentiment and Preparedness

Measuring Investor Confidence

Gauging investor sentiment is crucial for understanding the market's overall health and potential future direction. Several indicators help us measure investor confidence:

-

VIX Volatility Index: The VIX, often called the "fear gauge," measures market volatility implied by S&P 500 index options. A higher VIX indicates increased fear and uncertainty. [Link to VIX data]

-

Investor Surveys: Various surveys gauge investor confidence levels and outlook. These provide insights into the collective sentiment towards the market. [Link to relevant investor surveys]

-

Trading Volumes: High trading volumes can indicate increased market activity and uncertainty, often associated with periods of heightened volatility.

Investor Preparedness Strategies

Investors can employ several strategies to mitigate the impact of market volatility:

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

-

Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of market fluctuations, helps mitigate the risk of buying high and selling low.

-

Hedging Strategies: Employing hedging techniques, such as options or futures contracts, can help protect against potential losses during periods of increased market volatility.

-

Long-Term Investing: Maintaining a long-term investment horizon and avoiding emotional decision-making is crucial for weathering market fluctuations. Short-term market movements should be viewed within the context of a broader investment strategy.

Predicting Future Market Volatility

Challenges in Forecasting Market Volatility

Predicting future market volatility with accuracy is inherently challenging. Economic models have limitations, and unforeseen events (black swan events) can significantly impact market dynamics.

- Unpredictable Events: Unexpected geopolitical events, natural disasters, or technological disruptions can trigger sudden and significant shifts in market volatility.

Potential Scenarios and Their Implications

While predicting the future is impossible, considering different scenarios can help investors prepare:

-

Mild Correction: A relatively mild market correction could see a temporary downturn, followed by recovery.

-

Severe Downturn: A more severe downturn could involve a substantial market decline, potentially leading to a recession. This scenario requires robust risk management strategies.

-

Prolonged Volatility: The current volatility could persist for an extended period, requiring investors to adapt their strategies for a more uncertain environment.

Conclusion

Market volatility is a persistent feature of the investment landscape. Understanding its causes, assessing investor sentiment, and preparing for various scenarios are crucial for successful long-term investing. While predicting future market volatility with precision is impossible, developing a well-diversified portfolio, employing strategies like dollar-cost averaging, and maintaining emotional discipline can significantly enhance resilience during turbulent times. Don't let market volatility catch you off guard. Take control of your investments and prepare for potential future market volatility today! Consider seeking advice from a qualified financial advisor to create a personalized investment plan tailored to your risk tolerance and financial goals. [Link to financial planning resources]

Featured Posts

-

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

Apr 22, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

Apr 22, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 22, 2025

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 22, 2025 -

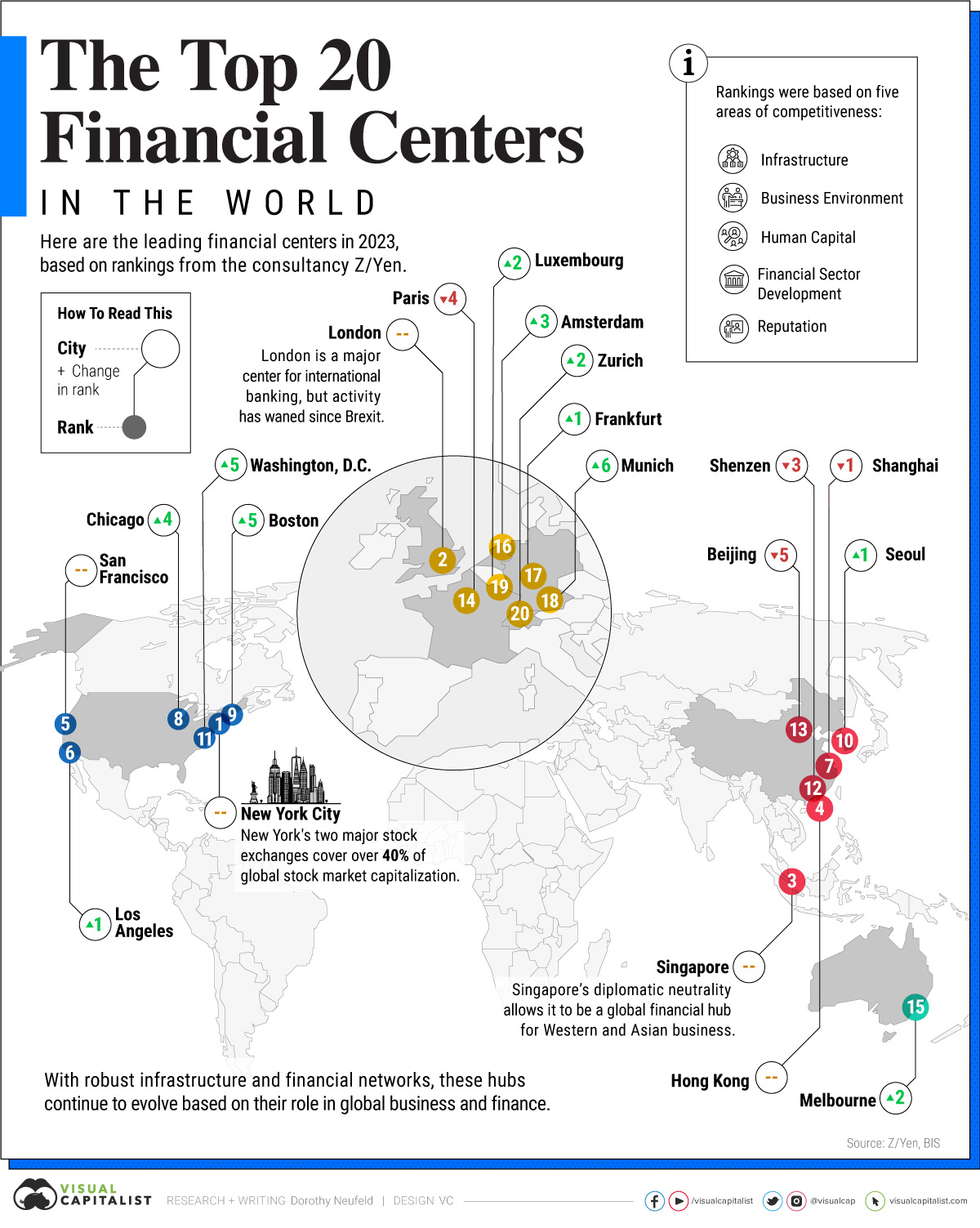

Trumps Trade Actions Risks To Americas Global Financial Dominance

Apr 22, 2025

Trumps Trade Actions Risks To Americas Global Financial Dominance

Apr 22, 2025 -

Rocket Launch Abort Blue Origin Announces Subsystem Problem

Apr 22, 2025

Rocket Launch Abort Blue Origin Announces Subsystem Problem

Apr 22, 2025 -

Joint Us South Sudan Initiative For Deported Citizens Repatriation

Apr 22, 2025

Joint Us South Sudan Initiative For Deported Citizens Repatriation

Apr 22, 2025