Navigating Market Uncertainty: A Guide For Individual Investors

Table of Contents

Market uncertainty is a constant companion for individual investors. The unpredictable nature of financial markets, punctuated by periods of volatility and dramatic swings, can be daunting. Navigating market uncertainty effectively requires a strategic and proactive approach, one that prioritizes long-term goals over short-term anxieties. This article provides actionable steps and strategies to help you not just survive, but thrive, during periods of market uncertainty. We will explore how to understand market volatility, build a resilient portfolio, and develop a robust long-term investment plan to weather any storm. Understanding and managing market uncertainty is crucial for achieving your financial objectives.

<h2>Understanding Market Volatility and its Causes</h2>

Market volatility refers to the rate and extent of price fluctuations in financial markets. High volatility signifies significant price swings in a short period, creating uncertainty and risk for investors. Several factors contribute to market uncertainty:

- Economic Downturns: Recessions, high unemployment rates, and decreased consumer spending all negatively impact market sentiment, leading to increased volatility.

- Geopolitical Events: International conflicts, political instability, and unexpected global events can trigger significant market reactions and uncertainty. The war in Ukraine, for example, created considerable market uncertainty in 2022.

- Interest Rate Changes: Central bank decisions on interest rates directly influence borrowing costs and investment returns, impacting market behavior and contributing to uncertainty.

- Inflation: Unexpected surges in inflation erode purchasing power and can lead to market corrections as investors adjust their expectations.

The psychological impact of market volatility on investors is substantial. Fear and greed often drive emotional decision-making, leading to impulsive buying or selling that can harm long-term investment goals.

- Examples of recent events causing market uncertainty: The COVID-19 pandemic, the war in Ukraine, and rapid interest rate hikes.

- Key economic indicators influencing market volatility: Inflation rates (CPI, PPI), unemployment rates, GDP growth, and consumer confidence indices.

- Resources for tracking market volatility: Major financial news websites (e.g., Bloomberg, Reuters, Yahoo Finance), stock market indices (e.g., S&P 500, Dow Jones Industrial Average, NASDAQ).

<h2>Building a Diversified Investment Portfolio for Stability</h2>

Diversification is a cornerstone of successful investing, especially when facing market uncertainty. It involves spreading investments across various asset classes to reduce risk. A well-diversified portfolio typically includes:

- Stocks: Offer higher growth potential but also carry higher risk.

- Bonds: Provide relatively stable income and lower risk compared to stocks.

- Real Estate: Can offer diversification and inflation hedging.

- Commodities: Raw materials like gold and oil can act as a hedge against inflation and market downturns.

Asset allocation—the proportion of your portfolio dedicated to each asset class—is critical in managing market uncertainty. A conservative investor might allocate a larger portion to bonds, while a more aggressive investor might favor stocks.

- Examples of diversified portfolio strategies: 60% stocks/40% bonds, a globally diversified equity portfolio, a portfolio incorporating alternative investments.

- Tips for choosing asset classes: Consider your risk tolerance, investment time horizon, and financial goals.

- Resources for portfolio diversification: Robo-advisors (e.g., Betterment, Wealthfront), financial planners.

<h2>Developing a Long-Term Investment Strategy</h2>

A long-term investment perspective is essential for navigating market uncertainty. Short-term fluctuations are inevitable, but focusing on your long-term financial goals helps you avoid emotional reactions to market volatility.

Key strategies for long-term success include:

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of market conditions. This reduces the risk of investing a large sum at a market peak.

- Value Investing: Identifying undervalued assets with the potential for future growth.

Setting realistic financial goals (retirement, education, etc.) and establishing a disciplined investment plan are crucial. Regularly reviewing your progress and making adjustments as needed ensures your strategy remains aligned with your goals.

- Steps to create a long-term investment plan: Define your financial goals, determine your risk tolerance, choose suitable investments, and monitor your progress regularly.

- Examples of long-term investment strategies: Index fund investing, dividend reinvestment plans, real estate investment trusts (REITs).

- Tips for staying disciplined: Automate your investments, avoid checking your portfolio daily, and seek professional advice if needed.

<h2>Managing Risk and Protecting Your Investments</h2>

Effective risk management is crucial during market uncertainty. Understanding your risk tolerance—your comfort level with potential investment losses—is the first step. Strategies for reducing risk include:

- Diversification (as discussed above).

- Hedging: Using financial instruments to offset potential losses.

- Stop-loss orders: Selling an asset automatically when it reaches a predetermined price.

Building an emergency fund—typically 3-6 months of living expenses—provides a financial safety net during market downturns. This prevents the need to sell investments at unfavorable prices during periods of market uncertainty.

- Strategies for reducing investment risk: Diversification, hedging, stop-loss orders, and limiting leverage.

- Methods for building an emergency fund: Setting a savings goal, automating transfers, and cutting unnecessary expenses.

- Importance of regular portfolio review and adjustments: Rebalancing your portfolio periodically to maintain your target asset allocation.

<h2>Seeking Professional Financial Advice</h2>

While this article provides valuable insights, seeking professional financial advice is highly recommended, especially during times of market uncertainty. A qualified financial advisor can provide personalized guidance based on your individual circumstances, risk tolerance, and financial goals. They can help you:

-

Develop a comprehensive investment strategy tailored to your needs.

-

Navigate complex market situations and make informed decisions.

-

Manage risk effectively and protect your investments.

-

Questions to ask a potential financial advisor: Fees, experience, investment philosophy, and client testimonials.

-

Factors to consider when choosing a financial advisor: Credentials, experience, and a good fit with your personality and investment goals.

-

Resources for finding financial advisors: Financial planning organizations, online directories, and referrals from trusted sources.

<h2>Conclusion: Navigating Market Uncertainty Successfully</h2>

Successfully navigating market uncertainty hinges on understanding volatility, building a diversified portfolio, developing a long-term investment strategy, and managing risk effectively. Remember that market downturns are a normal part of the investment cycle. By staying disciplined, avoiding emotional decisions, and seeking professional guidance when needed, you can increase your chances of achieving your long-term financial goals. Don't let market uncertainty paralyze you; instead, use the strategies outlined in this guide to proactively manage your investments and build a resilient financial future. Start navigating market uncertainty today by implementing a well-diversified investment strategy and taking control of your financial future!

Featured Posts

-

Perplexity Ceo On The Ai Browser War Taking On Google

Apr 28, 2025

Perplexity Ceo On The Ai Browser War Taking On Google

Apr 28, 2025 -

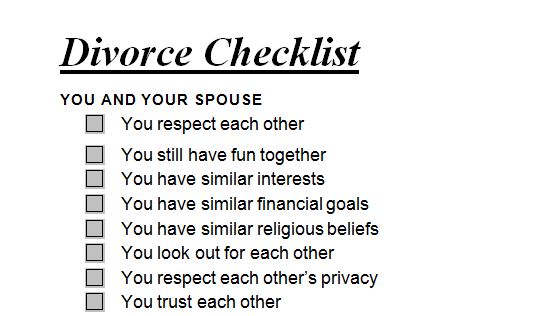

The Silent Divorce Are These Signs Familiar

Apr 28, 2025

The Silent Divorce Are These Signs Familiar

Apr 28, 2025 -

Mets Rotation Battle How A Change Transformed One Pitchers Chances

Apr 28, 2025

Mets Rotation Battle How A Change Transformed One Pitchers Chances

Apr 28, 2025 -

Red Sox Vs Blue Jays Lineups Walker Buehler Starts Outfielder Returns

Apr 28, 2025

Red Sox Vs Blue Jays Lineups Walker Buehler Starts Outfielder Returns

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025