Netflix Defies Big Tech Slump: Is It A Safe Haven In Uncertain Times?

Table of Contents

Netflix's Recent Financial Performance and Market Position

Revenue Growth and Subscriber Numbers

Netflix's recent quarterly reports paint a mixed picture. While subscriber growth has slowed in some mature markets, the company continues to see expansion in others, driven by a combination of factors. Let's examine the data:

-

Factors Contributing to Growth: Successful new content releases, including hit series and films, have consistently driven subscriber growth. Furthermore, price increases and the recent crackdown on password sharing have also positively impacted average revenue per user (ARPU) and overall revenue.

-

Comparison to Competitors: Compared to other streaming platforms struggling with saturation and competition, Netflix maintains a leading position in terms of global reach and subscriber base. However, the growing competition from Disney+, HBO Max, and others presents a challenge.

-

Areas of Concern: Slower growth in mature markets like North America remains a concern, indicating a need for continued innovation and strategic content acquisition to maintain momentum.

Stock Performance Compared to Tech Sector Peers

Netflix's stock performance has been relatively resilient compared to many of its tech sector peers during the recent downturn. While it has experienced volatility, its performance has been less dramatic than that of some other major tech companies.

-

Stock Price Volatility: Although Netflix's stock price has fluctuated, its volatility has been less pronounced than that of many other tech giants facing harsher market corrections.

-

Investor Sentiment: Investor sentiment towards Netflix remains relatively positive, considering its consistent revenue generation and large subscriber base, even amid a broader market downturn. However, any significant negative news or slowing growth could impact this perception.

-

Analyst Ratings: Financial analysts have provided mixed ratings for Netflix, reflecting both its strengths and the challenges it faces in a competitive and economically uncertain landscape.

Factors Contributing to Netflix's Resilience

Content Strategy and Original Programming

Netflix's massive investment in original programming has been a key driver of its success. By consistently producing diverse, high-quality content, Netflix attracts and retains subscribers globally.

-

Successful Shows and Films: Hits like Stranger Things, Squid Game, and various critically acclaimed films have significantly boosted subscriber numbers and reinforced Netflix's brand image.

-

Global Content Strategy: Netflix tailors its content strategy to different regions, investing in localized productions to resonate with viewers across various cultures and linguistic backgrounds.

-

Competitive Edge: The sheer volume and variety of Netflix's original content gives it a significant competitive edge in the crowded streaming landscape.

Global Reach and International Expansion

Netflix's global presence is another significant factor in its resilience. Its continued expansion into new markets provides substantial growth opportunities.

-

Emerging Markets: Netflix actively targets emerging markets with significant growth potential, although navigating local regulatory environments and cultural preferences presents challenges.

-

Localization Strategies: Successful localization strategies, such as dubbing and subtitling content in multiple languages, are crucial for expanding into new markets and acquiring subscribers.

-

Geographic Growth: Regions like Asia and Latin America continue to show strong growth for Netflix, demonstrating the potential for further international expansion.

Adaptability and Innovation

Netflix's ability to adapt to changing market conditions and its investment in innovation have been instrumental in its continued success.

-

Innovative Features: Features like interactive storytelling and the integration of gaming demonstrate Netflix's commitment to providing a dynamic and engaging user experience.

-

Combating Password Sharing: Netflix's efforts to curb password sharing have directly contributed to improved ARPU.

-

Data-Driven Approach: Netflix uses data analytics to understand viewer preferences, improve content recommendations, and guide its programming decisions.

Risks and Uncertainties

Increased Competition

The streaming market is becoming increasingly crowded, posing a significant challenge to Netflix's dominance.

-

Major Competitors: Disney+, HBO Max, Amazon Prime Video, and Apple TV+ represent major competitors, each with their own compelling content libraries and strategies.

-

Market Saturation: The potential for market saturation in developed countries necessitates innovative strategies for retaining and attracting subscribers.

-

Mitigating Competition: Netflix aims to counter competition through continued investment in original content, technological innovation, and targeted marketing.

Economic Downturn and Consumer Spending

An economic downturn could significantly impact consumer spending, leading to potential subscription cancellations.

-

Economic Sensitivity: Subscription services are often among the first things consumers cut back on during economic hardship.

-

Price Sensitivity: The price sensitivity of Netflix's subscriber base needs careful consideration in the face of potential economic downturn.

-

Weathering Economic Uncertainty: Strategies for mitigating the impact of an economic recession might include offering cheaper subscription tiers or focusing on cost-cutting measures internally.

Regulatory Scrutiny and Geopolitical Risks

Regulatory changes and geopolitical risks pose further uncertainties for Netflix.

-

Regulatory Changes: Government regulations concerning content, data privacy, and taxation vary significantly across different regions, impacting operations.

-

Geopolitical Instability: Political instability or conflicts in specific regions can disrupt Netflix's operations and impact subscriber acquisition.

Conclusion

Netflix's resilience in the face of the broader tech slump is undeniable, fueled by strong content, global reach, and adaptation. While the company has demonstrated significant strength, challenges remain. Increased competition, economic uncertainty, and regulatory risks could impact future performance.

Is Netflix a Safe Haven? The answer is nuanced. While Netflix’s position as a leading streaming service and its proven ability to adapt provide a degree of stability, it’s not immune to market fluctuations. Consider it a potentially strong element within a diversified portfolio, rather than a guaranteed safe haven.

Call to Action: Conduct thorough research into Netflix's financial reports, competitor analysis, and market trends before making investment decisions. Consider whether Netflix, as a potential "Netflix safe haven investment," aligns with your risk tolerance and long-term financial goals. Similarly, evaluate whether Netflix as a "Netflix safe haven for your entertainment budget" justifies its cost in your personal circumstances.

Featured Posts

-

Revealed The Top And Bottom Uk Diy Retailers In 2024

Apr 23, 2025

Revealed The Top And Bottom Uk Diy Retailers In 2024

Apr 23, 2025 -

Historic Night For The Yankees 9 Home Runs Including 3 By Judge

Apr 23, 2025

Historic Night For The Yankees 9 Home Runs Including 3 By Judge

Apr 23, 2025 -

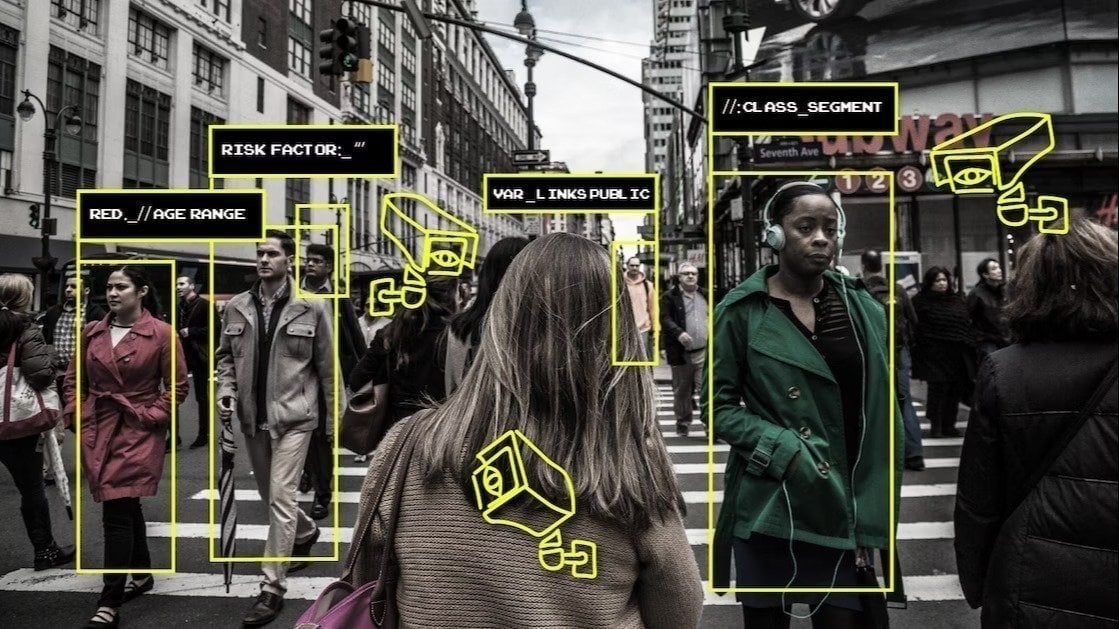

Faster Entry At Target Field Go Ahead With Facial Recognition Technology

Apr 23, 2025

Faster Entry At Target Field Go Ahead With Facial Recognition Technology

Apr 23, 2025 -

Reds Suffer Third Consecutive 1 0 Defeat

Apr 23, 2025

Reds Suffer Third Consecutive 1 0 Defeat

Apr 23, 2025 -

Reds Fall To Brewers 8 2 Chourios Two Home Run Show

Apr 23, 2025

Reds Fall To Brewers 8 2 Chourios Two Home Run Show

Apr 23, 2025