New ECB Task Force To Tackle Banking Regulatory Complexity

Table of Contents

The Growing Burden of Banking Regulations

The banking sector operates under a dense thicket of regulations, a landscape significantly complicated by directives like Basel III, the Capital Requirements Regulation (CRR), and the Capital Requirements Directive (CRD). These regulations, while crucial for maintaining financial stability, have inadvertently created a significant regulatory burden. The cost of compliance is substantial, encompassing not only direct expenses such as legal and consulting fees, but also indirect costs like the time and resources dedicated to administrative tasks and the need for specialized expertise.

- Increased administrative burden for smaller banks: Smaller institutions often lack the resources to navigate the complex regulatory landscape as effectively as their larger counterparts, disproportionately impacting their operational efficiency.

- Higher compliance costs potentially impacting profitability: The escalating costs associated with regulatory compliance can directly reduce bank profitability, limiting their capacity for lending and investment.

- Difficulty in navigating conflicting or overlapping regulations: Inconsistencies and overlaps between various regulatory frameworks create significant challenges for banks, leading to confusion and potential non-compliance.

- Need for specialized expertise to ensure compliance: Banks must invest in specialized personnel with deep understanding of financial regulations, further driving up costs.

The ECB Task Force's Mandate and Objectives

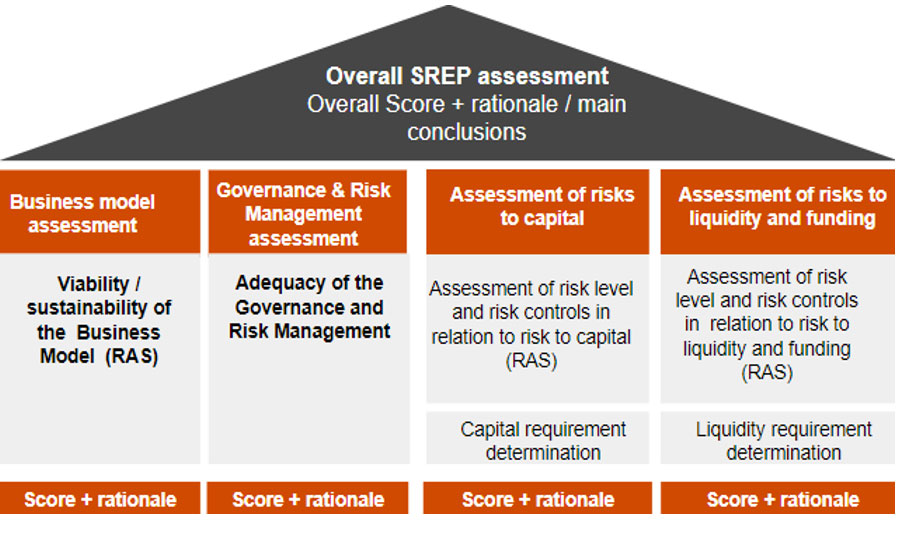

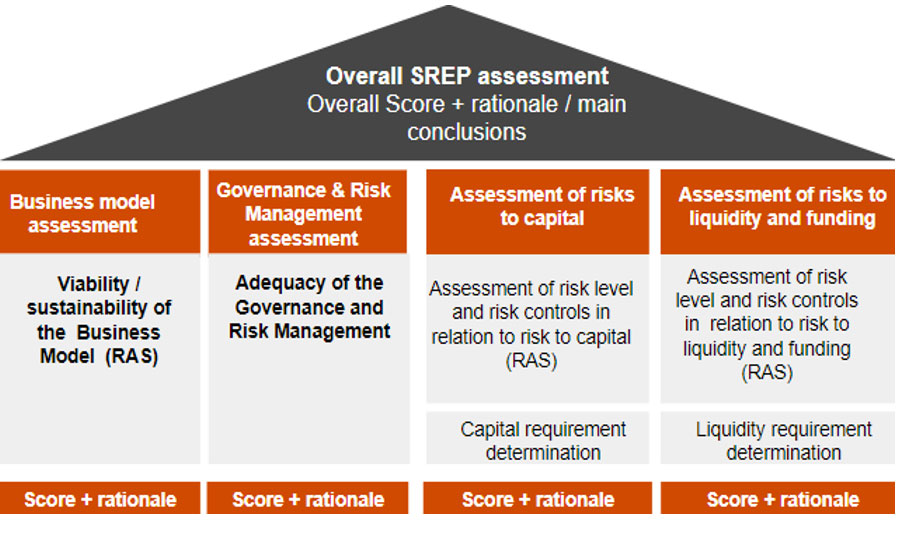

The ECB task force is specifically mandated to address the escalating complexities within the banking regulatory framework. Its primary objectives include identifying areas of inefficiency, proposing concrete measures for simplification, and improving the overall regulatory process. This involves examining existing regulations to identify overlaps and inconsistencies, developing recommendations for streamlining procedures, and enhancing communication and coordination between different regulatory bodies. The task force's composition reflects a commitment to diverse perspectives, bringing together experts from various backgrounds within the ECB and potentially external stakeholders. The timeline for completion is expected to be [Insert Timeline if available], with regular updates anticipated.

- Identify areas of regulatory overlap and inconsistency: A systematic review of existing regulations to pinpoint areas where simplification and clarification are urgently needed.

- Propose measures to simplify and streamline existing regulations: The development of practical recommendations designed to reduce the complexity and administrative burden of compliance.

- Develop recommendations for improving regulatory efficiency: Identifying and addressing bottlenecks and inefficiencies in the regulatory process to improve overall effectiveness.

- Enhance communication and coordination among regulatory bodies: Improving communication and collaboration amongst different regulatory bodies to avoid duplication and promote a more coherent regulatory environment.

Potential Impacts of the Task Force's Work

The successful implementation of the ECB task force's recommendations could yield significant positive impacts across the banking sector and the Eurozone economy. By simplifying regulations and streamlining processes, the task force aims to reduce compliance costs for banks, allowing them to redirect resources towards lending and investment, stimulating economic growth. Increased efficiency and reduced administrative burden will enhance the competitiveness of European banks in the global market. Ultimately, a simplified and more effective regulatory environment is expected to contribute to enhanced financial stability within the Eurozone. However, challenges remain, particularly in achieving consensus amongst diverse stakeholders and ensuring that simplification doesn't compromise the core objectives of financial stability and consumer protection.

- Lower compliance costs for banks, freeing up resources for lending and investment: Reduced compliance costs directly translate into greater capital available for supporting businesses and driving economic expansion.

- Improved efficiency in regulatory processes: Streamlined processes and clearer regulations lead to reduced operational costs and increased efficiency within the banking sector.

- Increased competitiveness for European banks in the global market: A less burdensome regulatory environment improves the competitiveness of Eurozone banks against their international counterparts.

- Enhanced financial stability within the Eurozone: A more efficient and transparent regulatory framework contributes to a healthier and more stable financial system.

- Potential challenges in achieving consensus among stakeholders: Balancing the needs of various stakeholders, such as banks, supervisors, and policymakers, will require careful consideration and compromise.

Addressing Specific Regulatory Challenges

[If detailed information is available on specific regulatory areas targeted by the task force (e.g., capital requirements, reporting standards, data management), expand this section with specific examples of potential simplifications and their anticipated positive outcomes. This section should use relevant keywords like "capital requirements optimization," "simplified reporting standards," "streamlined data management," etc.]

Conclusion

The creation of the ECB task force to tackle banking regulatory complexity represents a significant step towards creating a more efficient and competitive banking environment within the Eurozone. By streamlining regulations and improving supervisory processes, the task force promises to reduce compliance costs, enhance bank profitability, and contribute to greater financial stability. The potential benefits extend beyond the banking sector itself, with positive implications for economic growth and overall prosperity in the Eurozone. Stay tuned for updates on the ECB's efforts to simplify banking regulation and its impact on the future of the Eurozone financial system. Learn more about the ECB's initiatives to reduce banking regulatory complexity and find resources to help navigate the ever-evolving regulatory landscape.

Featured Posts

-

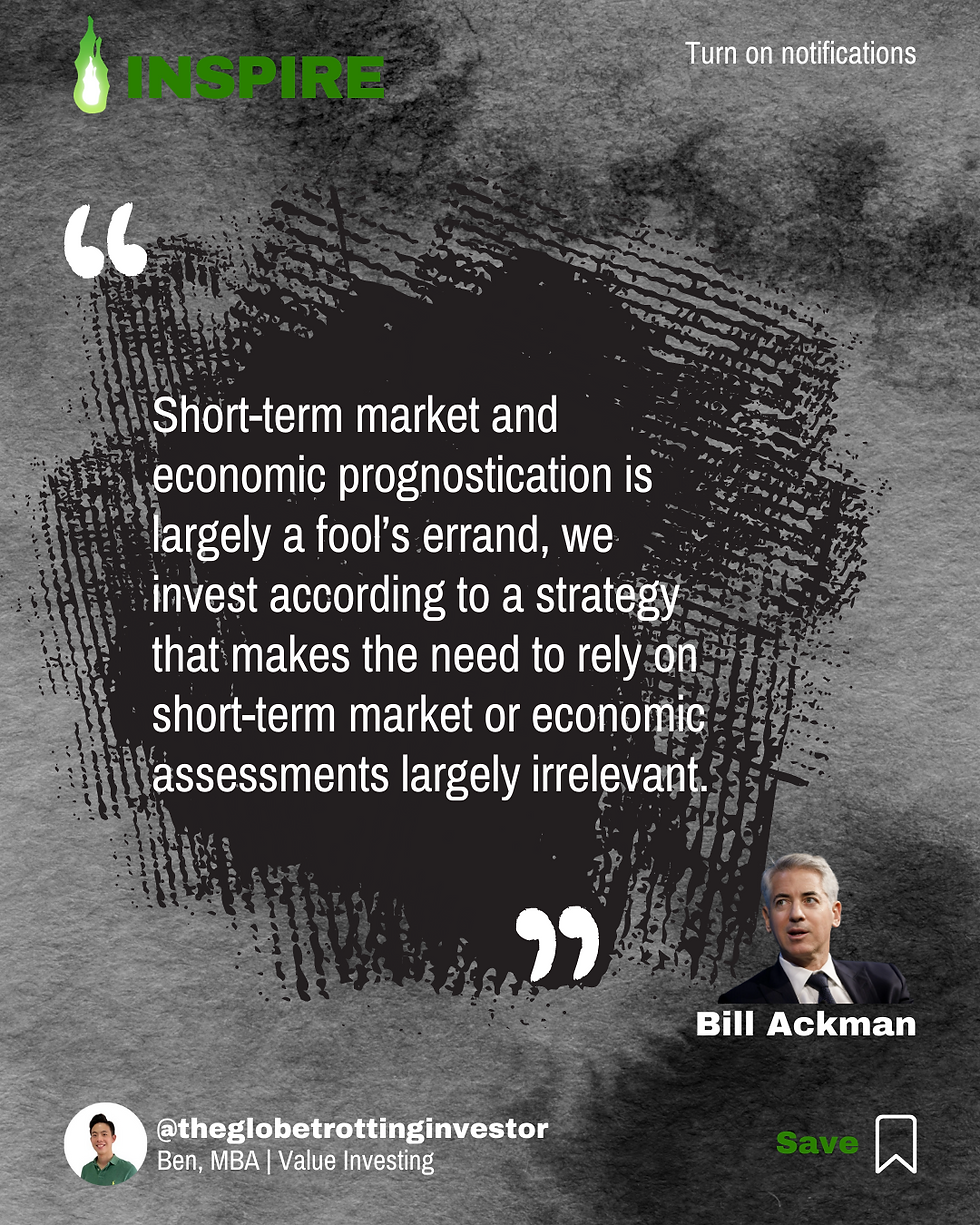

The Us China Trade War A Time Based Analysis By Bill Ackman

Apr 27, 2025

The Us China Trade War A Time Based Analysis By Bill Ackman

Apr 27, 2025 -

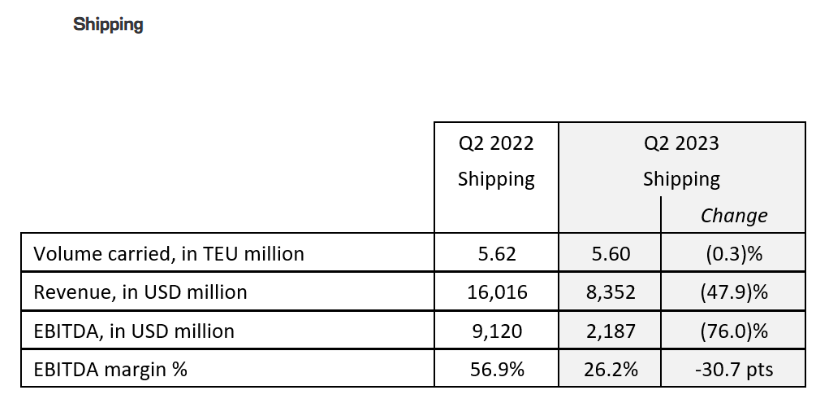

440 Million Turkish Logistics Company Acquired By Cma Cgm

Apr 27, 2025

440 Million Turkish Logistics Company Acquired By Cma Cgm

Apr 27, 2025 -

Trump Forecasts Imminent Trade Deals Within A Month

Apr 27, 2025

Trump Forecasts Imminent Trade Deals Within A Month

Apr 27, 2025 -

Belinda Bencics Postpartum Triumph First Wta Victory

Apr 27, 2025

Belinda Bencics Postpartum Triumph First Wta Victory

Apr 27, 2025 -

Wta Lidera Un Ano De Pago Por Licencia De Maternidad Para Jugadoras

Apr 27, 2025

Wta Lidera Un Ano De Pago Por Licencia De Maternidad Para Jugadoras

Apr 27, 2025