Power Finance Corporation (PFC) FY25 Fourth Dividend: Date, Expectations, And Impact

Table of Contents

Expected Announcement Date of the PFC FY25 Fourth Dividend

Predicting the precise announcement date for the PFC FY25 fourth dividend requires careful consideration of historical trends and recent company developments. PFC typically follows a consistent timeline for dividend announcements, usually aligning with its financial year-end and subsequent board meetings. While an official statement regarding the exact date is yet to be released, we can speculate based on past patterns.

- Past Dividend Announcement Dates: Analyzing past announcements reveals a typical timeframe. [Insert links to relevant news articles or official PFC announcements if available]. This historical data provides a reasonable basis for estimating the upcoming announcement.

- Potential Factors Influencing the Announcement Date: Several factors can influence the final announcement date, including the scheduling of board meetings to approve the dividend, the completion of the company's financial audits, and any unforeseen circumstances.

- Speculation Based on Past Trends: Based on past trends, a reasonable prediction would place the announcement sometime between [Month] and [Month] of [Year]. However, this remains speculation until an official announcement is made.

Expectations for the PFC FY25 Fourth Dividend Amount

Estimating the PFC FY25 fourth dividend amount requires a thorough analysis of the company's financial performance throughout the fiscal year. Key financial indicators will play a crucial role in determining the payout.

- Key Financial Metrics (FY25): Analyzing key metrics such as Earnings Per Share (EPS), net profit, and overall profitability will offer insights into PFC's capacity to distribute dividends. [Insert relevant data and analysis, if available, from reliable financial sources].

- Comparison Table of PFC Dividends from Previous Years: A comparative analysis of PFC's dividend payouts over the past few years can help in establishing a trend and forming realistic expectations. [Insert a comparison table showing previous years' dividends and any relevant percentage changes].

- Potential Range of Dividend Expectations: Based on the analysis of FY25 performance and historical data, a reasonable expectation for the dividend amount might fall within the range of [lower bound]% to [upper bound]% of the face value. [Mention any analyst predictions or forecasts if available, citing sources].

- Impact of Macroeconomic Factors: The overall economic climate and regulatory environment in India also influence dividend decisions. Factors such as interest rates and government policies can impact PFC's profitability and, therefore, the dividend payout.

Market Impact of the PFC FY25 Fourth Dividend

The announcement and subsequent payout of the PFC FY25 fourth dividend will undoubtedly have a significant impact on the market. Investors will closely monitor the situation for its implications.

- Historical Stock Price Reaction: Reviewing how the stock price reacted to previous dividend announcements can offer insights into potential market behavior. [Insert historical data or charts showing past stock price reactions to dividends, if available].

- Potential Investor Sentiment: A higher-than-expected dividend is likely to positively impact investor sentiment, potentially leading to an increase in PFC's stock price. Conversely, a lower-than-expected payout could lead to negative sentiment.

- Impact on the Overall Market Sentiment: The PFC dividend announcement can also influence the broader sentiment towards investments in the Indian power sector. A strong dividend could boost investor confidence in the sector as a whole.

- Attractiveness of PFC as an Investment: The size of the dividend payout will significantly influence PFC's attractiveness as an investment opportunity, especially for income-oriented investors seeking high dividend yields.

Investing Wisely with the Power Finance Corporation (PFC) FY25 Fourth Dividend

In summary, while the precise announcement date and the exact amount of the PFC FY25 fourth dividend remain uncertain, analysis of past trends and financial performance suggests a potential announcement around [Month] to [Month] and a dividend payout within the range of [lower bound]% to [upper bound]%. The dividend's impact on PFC's stock price and the overall market sentiment will depend on the final amount and how it aligns with investor expectations. Staying updated on PFC's official announcements is crucial. Consider the PFC dividend, PFC FY25 dividend payout, and the potential impact on your portfolio before making any investment decisions. Remember to conduct thorough research and consult with a financial advisor before investing.

Featured Posts

-

Perfect Couple Season 2 Confirmed Cast Changes And Source Material Inspiration

Apr 27, 2025

Perfect Couple Season 2 Confirmed Cast Changes And Source Material Inspiration

Apr 27, 2025 -

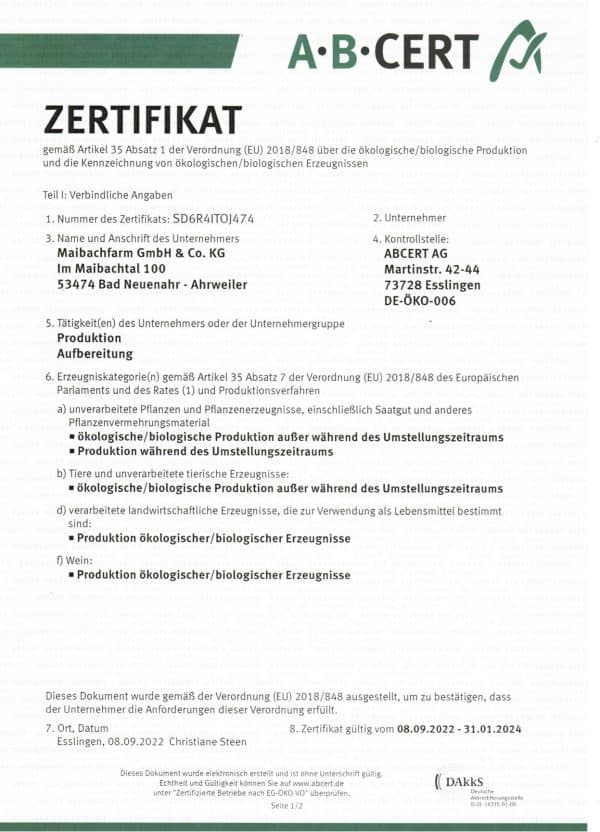

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025 -

Alberto Ardila Olivares Evaluacion De Su Rendimiento Y Capacidad De Marcar Goles

Apr 27, 2025

Alberto Ardila Olivares Evaluacion De Su Rendimiento Y Capacidad De Marcar Goles

Apr 27, 2025 -

Public Health Concerns Anti Vaxxer Leading Autism Study

Apr 27, 2025

Public Health Concerns Anti Vaxxer Leading Autism Study

Apr 27, 2025 -

French Auction Camille Claudel Bronze Sculpture Achieves 3 Million

Apr 27, 2025

French Auction Camille Claudel Bronze Sculpture Achieves 3 Million

Apr 27, 2025