Private Credit Jobs: 5 Do's And Don'ts To Increase Your Chances

Table of Contents

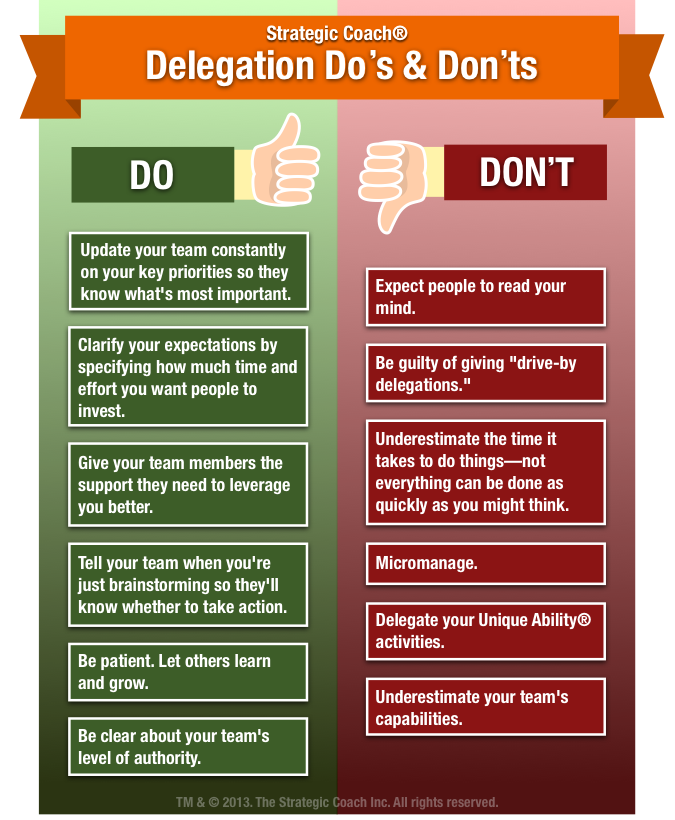

5 DO'S to Land Your Dream Private Credit Job

Do 1: Network Strategically within the Private Credit Industry

Networking is paramount in securing a private credit job. Don't underestimate its power! The private credit industry, much like investment banking and other finance jobs, thrives on relationships.

- Attend industry conferences and events: SuperReturn, smaller industry-specific conferences, and even local finance meetups are excellent venues for connecting with professionals. These events offer networking opportunities and valuable insights into current market trends.

- Leverage LinkedIn effectively: Optimize your LinkedIn profile to highlight your skills and experience in areas like credit analysis and financial modeling. Actively connect with professionals in private credit, engage with their posts, and participate in relevant groups.

- Informational interviews are key: Reach out to people working in private credit, even if you don't know them personally, to request informational interviews. These conversations provide invaluable advice and can open doors to unadvertised opportunities.

- Join relevant professional organizations: Membership in organizations like the CFA Institute, or industry-specific associations, connects you with like-minded individuals and provides access to networking events and resources.

- Cultivate relationships with alumni: If you're a graduate, reach out to alumni working in private credit. They often have a strong sense of community and are willing to help those from their alma mater.

Do 2: Master Essential Private Credit Skills

Private credit firms demand candidates with strong technical skills. Proficiency in specific areas will set you apart.

- Develop strong financial modeling skills: Excel proficiency is a must. Practice building complex financial models, including leveraged buyout (LBO) models, discounted cash flow (DCF) analyses, and other valuation techniques relevant to credit analysis.

- Gain proficiency in credit analysis: Learn how to evaluate credit risk, analyze financial statements, and assess the creditworthiness of borrowers. Understanding covenant compliance and credit scoring is crucial.

- Understand due diligence processes: Familiarize yourself with the steps involved in performing thorough due diligence on potential investments, including legal, financial, and operational aspects.

- Familiarize yourself with different private credit strategies: Learn about various strategies such as direct lending, mezzanine financing, and distressed debt investing. This showcases your understanding of the broader private credit market.

- Hone your presentation and communication skills: You must effectively communicate complex financial information to both technical and non-technical audiences. Practice presenting your analysis clearly and concisely.

Do 3: Tailor Your Resume and Cover Letter to Each Private Credit Job Application

A generic application won't cut it in this competitive market. Each application must be tailored to the specific requirements of the role.

- Highlight relevant experience and skills: Focus on experiences and skills directly related to the job description. Don't include irrelevant information that dilutes your message.

- Quantify your accomplishments: Whenever possible, use numbers to showcase the impact you've made in previous roles. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15%."

- Use keywords from the job description: Incorporate relevant keywords from the job description into your resume and cover letter to improve your chances of getting noticed by applicant tracking systems (ATS).

- Tailor your resume's summary/objective statement: Craft a compelling summary or objective statement that directly addresses the specific requirements and responsibilities outlined in the job posting.

- Proofread meticulously: Errors in grammar and spelling can significantly hurt your chances. Always proofread your application materials carefully before submitting them.

Do 4: Prepare for Behavioral and Technical Private Credit Interview Questions

Thorough preparation is crucial for success in private credit interviews.

- Practice answering common behavioral questions: Prepare answers to common behavioral interview questions such as "Tell me about a time you failed," "Describe a challenging situation you overcame," and "Why are you interested in this role?"

- Prepare for technical questions: Expect questions related to financial modeling, credit analysis, valuation techniques, and current events within the private credit and broader financial markets.

- Research the firm and the interviewers: Demonstrate genuine interest by researching the firm's investment strategy, recent transactions, and the interviewers' backgrounds.

- Prepare insightful questions to ask: Asking thoughtful questions showcases your engagement and allows you to learn more about the firm and the role.

- Mock interviews: Practice with friends or utilize career services to simulate the interview environment and identify areas for improvement.

Do 5: Follow Up After Every Interview for Private Credit Positions

Following up demonstrates your continued interest and professionalism.

- Send a thank-you note: Send a personalized thank-you note to each interviewer within 24 hours of the interview, reiterating your interest and highlighting key discussion points.

- Reiterate your interest and highlight key points: The thank-you note should not just be a generic message, but should mention something specific from the conversation to show you were listening.

- Maintain professional communication: Maintain consistent professional communication throughout the interview process.

- Follow up gently if you haven't heard back: If you haven't heard back within the expected timeframe, a polite follow-up email is acceptable. Be persistent but not pushy.

- Be persistent without being pushy: Remember, persistence is key, but respect the hiring manager's time and avoid excessive follow-up.

5 DON'TS When Applying for Private Credit Jobs

Avoiding these pitfalls will significantly improve your chances.

Don't 1: Neglect Networking Opportunities

Networking is not optional; it’s essential.

- Don't underestimate the power of networking: Many private credit jobs are never publicly advertised. Networking is often the key to uncovering hidden opportunities.

- Don't be afraid to reach out: Don't hesitate to connect with people in the industry, even if you don't have a pre-existing relationship.

- Don't miss opportunities: Attend industry events, conferences, and workshops to meet professionals and learn about new opportunities.

Don't 2: Submit a Generic Resume and Cover Letter

Tailoring your application materials is crucial.

- Don't send the same resume and cover letter: Each application should be customized to reflect the specific requirements and responsibilities of the target role.

- Don't overlook the importance of tailoring: A generic application demonstrates a lack of effort and interest.

- Don't underestimate the power of a well-written cover letter: A strong cover letter allows you to personalize your application and showcase your unique qualifications.

Don't 3: Underestimate the Importance of Technical Skills

Technical skills are fundamental to success in private credit.

- Don't underestimate the importance of mastering financial modeling and credit analysis: These skills are essential for success in the industry.

- Don't neglect to showcase your technical abilities: Highlight your technical skills prominently in your resume and during interviews.

- Don't be afraid to highlight relevant coursework or projects: Showcase any relevant academic projects or coursework that demonstrates your technical skills.

Don't 4: Be Unprepared for Interviews

Preparation is key to a successful interview.

- Don't go into an interview without practicing: Practice your answers to common interview questions to ensure you can articulate your thoughts clearly and concisely.

- Don't fail to research the firm and the interviewers: Thorough research demonstrates your genuine interest in the opportunity.

- Don't forget to ask thoughtful questions: Asking insightful questions showcases your engagement and allows you to gather valuable information.

Don't 5: Fail to Follow Up

Following up demonstrates your continued interest.

- Don't neglect to send thank-you notes: A timely thank-you note strengthens your candidacy and reinforces your interest.

- Don't be afraid to follow up gently: A polite follow-up email is acceptable if you haven't heard back within a reasonable timeframe.

- Don't assume silence means rejection: Persistence often pays off.

Conclusion

Securing a private credit job requires a strategic approach, combining essential skills with effective networking and diligent job searching. By following these do's and don'ts, you'll significantly enhance your chances of success in the competitive world of private credit. Remember to actively network, hone your technical skills, tailor your applications, and prepare thoroughly for interviews. Don't give up on your pursuit of a rewarding career in private credit. Start building your private credit job search strategy today!

Featured Posts

-

Ai Rulebook Showdown Trump Administration Vs European Union

Apr 26, 2025

Ai Rulebook Showdown Trump Administration Vs European Union

Apr 26, 2025 -

Stock Market Valuations Bof As Reasons For Investor Calm

Apr 26, 2025

Stock Market Valuations Bof As Reasons For Investor Calm

Apr 26, 2025 -

False Greenland News A Russian Plot To Increase Tensions Between Denmark And The Us

Apr 26, 2025

False Greenland News A Russian Plot To Increase Tensions Between Denmark And The Us

Apr 26, 2025 -

The Role Of Human Design In The Age Of Ai A Microsoft Perspective

Apr 26, 2025

The Role Of Human Design In The Age Of Ai A Microsoft Perspective

Apr 26, 2025 -

Ray Epps Sues Fox News For Defamation Details Of The January 6th Falsehoods Lawsuit

Apr 26, 2025

Ray Epps Sues Fox News For Defamation Details Of The January 6th Falsehoods Lawsuit

Apr 26, 2025