Retail Sales Decline: Economists Anticipate Bank Of Canada Interest Rate Reduction

Table of Contents

The Severity of the Retail Sales Decline

Data and Statistics

Recent data from Statistics Canada paints a concerning picture. Retail sales experienced a [insert percentage]% decline year-over-year in [insert month, year], marking the [insert description, e.g., sharpest drop] in [insert timeframe]. Month-over-month, the decline was even steeper at [insert percentage]%. This isn't just a localized issue; the impact is widespread.

- Clothing and Accessories: Experienced a [insert percentage]% decline, reflecting reduced consumer spending on non-essential items.

- Electronics and Appliances: Showed a [insert percentage]% decrease, possibly due to high prices and reduced consumer confidence.

- Furniture and Home Furnishings: Suffered a [insert percentage]% drop, indicating a slowdown in home renovations and purchases.

The most significant declines were observed in [insert specific regions, e.g., Ontario and British Columbia], highlighting regional disparities in economic performance. These figures clearly illustrate the seriousness of the current retail sales slump.

Impact on Consumer Confidence

The decline in retail sales is inextricably linked to weakening consumer confidence. Rising inflation and increased interest rates have significantly impacted consumer spending habits. Consumers are feeling the pinch, leading to reduced discretionary spending and a focus on essential goods.

- Inflationary Pressures: High inflation erodes purchasing power, leaving less disposable income for non-essential purchases.

- Interest Rate Hikes: Increased borrowing costs associated with mortgages, loans, and credit cards have further constrained consumer spending.

- Consumer Confidence Indices: Surveys like the Conference Board of Canada's Consumer Confidence Index show a clear downward trend, reflecting growing pessimism among Canadian consumers. [Insert specific data and source].

Reasons Behind the Retail Sales Decline

Persistent Inflation

Persistently high inflation is a major culprit behind the retail sales decline. The rising cost of living is forcing Canadians to cut back on spending, particularly on non-essential goods and services.

- Eroding Savings: Inflation erodes the real value of savings, making consumers hesitant to spend.

- Reduced Disposable Income: Higher prices for essential goods like groceries and energy leave less money for discretionary purchases.

- Examples: The price of [insert example, e.g., gasoline] has increased by [insert percentage]%, while [insert example, e.g., food prices] have risen by [insert percentage]%.

High Interest Rates

The Bank of Canada's previous interest rate hikes, aimed at curbing inflation, have inadvertently dampened consumer spending. The increased cost of borrowing makes it more expensive for consumers to finance purchases.

- Mortgage Costs: Higher interest rates lead to increased mortgage payments, reducing disposable income.

- Loan Repayments: The cost of borrowing for other purposes, like car loans or personal loans, has also increased significantly.

- Debt Servicing: Many Canadians are struggling with existing debt, making it harder to manage increased interest payments.

External Economic Factors

Global economic uncertainty further exacerbates the situation. Supply chain disruptions, geopolitical instability, and recessionary fears in other major economies all play a role in impacting Canadian retail.

- Global Supply Chain Issues: Continued disruptions to global supply chains contribute to higher prices and reduced product availability.

- Geopolitical Instability: Uncertainty caused by global conflicts can negatively impact consumer sentiment and investment.

- Recessionary Pressures: Concerns about a potential recession in major global economies, like the US, can reduce demand for Canadian goods and services.

The Bank of Canada's Potential Response

Probability of an Interest Rate Reduction

Given the severity of the retail sales decline and the weakening consumer confidence, many economists predict a reduction in the Bank of Canada's interest rate.

- Analyst Predictions: [Insert quotes from financial analysts and economists regarding the probability of a rate cut].

- Timing and Magnitude: The timing and magnitude of any potential rate reduction remain uncertain, but [insert timeframe and possible percentage] are frequently discussed.

Alternative Monetary Policy Tools

Besides an interest rate reduction, the Bank of Canada may consider other monetary policy tools to stimulate economic activity.

- Quantitative Easing (QE): QE involves the Bank of Canada purchasing government bonds to inject liquidity into the financial system.

- Forward Guidance: Clear communication from the Bank of Canada regarding its future policy intentions can influence market expectations and consumer sentiment.

Economic Indicators to Watch

The Bank of Canada's decision will hinge on several key economic indicators.

- Inflation Rate: A sustained decline in inflation is crucial before the Bank considers interest rate cuts.

- Unemployment Rate: The unemployment rate provides insights into the health of the labour market and overall economic activity.

- GDP Growth: GDP growth figures offer a broader picture of the overall state of the Canadian economy.

Conclusion

The significant decline in Canadian retail sales, driven by persistent inflation, high interest rates, and external economic factors, has heightened expectations of a Bank of Canada interest rate reduction. While the exact timing and magnitude remain uncertain, the current economic climate strongly suggests a potential shift in monetary policy. Closely monitoring key economic indicators will be crucial in understanding the Bank of Canada's response to this retail sales decline and its ultimate impact on the Canadian economy. Stay informed about the latest developments concerning the Bank of Canada Interest Rate and the impact on Retail Sales Decline to make informed financial decisions. Understanding these interconnected factors is crucial for navigating the current economic landscape.

Featured Posts

-

Denny Hamlin Michael Jordans Support And The Power Of Criticism

Apr 28, 2025

Denny Hamlin Michael Jordans Support And The Power Of Criticism

Apr 28, 2025 -

Abwzby Kazakhstan Rhlat Jwyt Jdydt Me Tyran Alerbyt

Apr 28, 2025

Abwzby Kazakhstan Rhlat Jwyt Jdydt Me Tyran Alerbyt

Apr 28, 2025 -

Predicting The Mets Opening Day Roster A Spring Training Week 1 Analysis

Apr 28, 2025

Predicting The Mets Opening Day Roster A Spring Training Week 1 Analysis

Apr 28, 2025 -

Abwzby Mntda Alabtkar Fy Mjal Alhyat Alshyt Almdydt Yueqd

Apr 28, 2025

Abwzby Mntda Alabtkar Fy Mjal Alhyat Alshyt Almdydt Yueqd

Apr 28, 2025 -

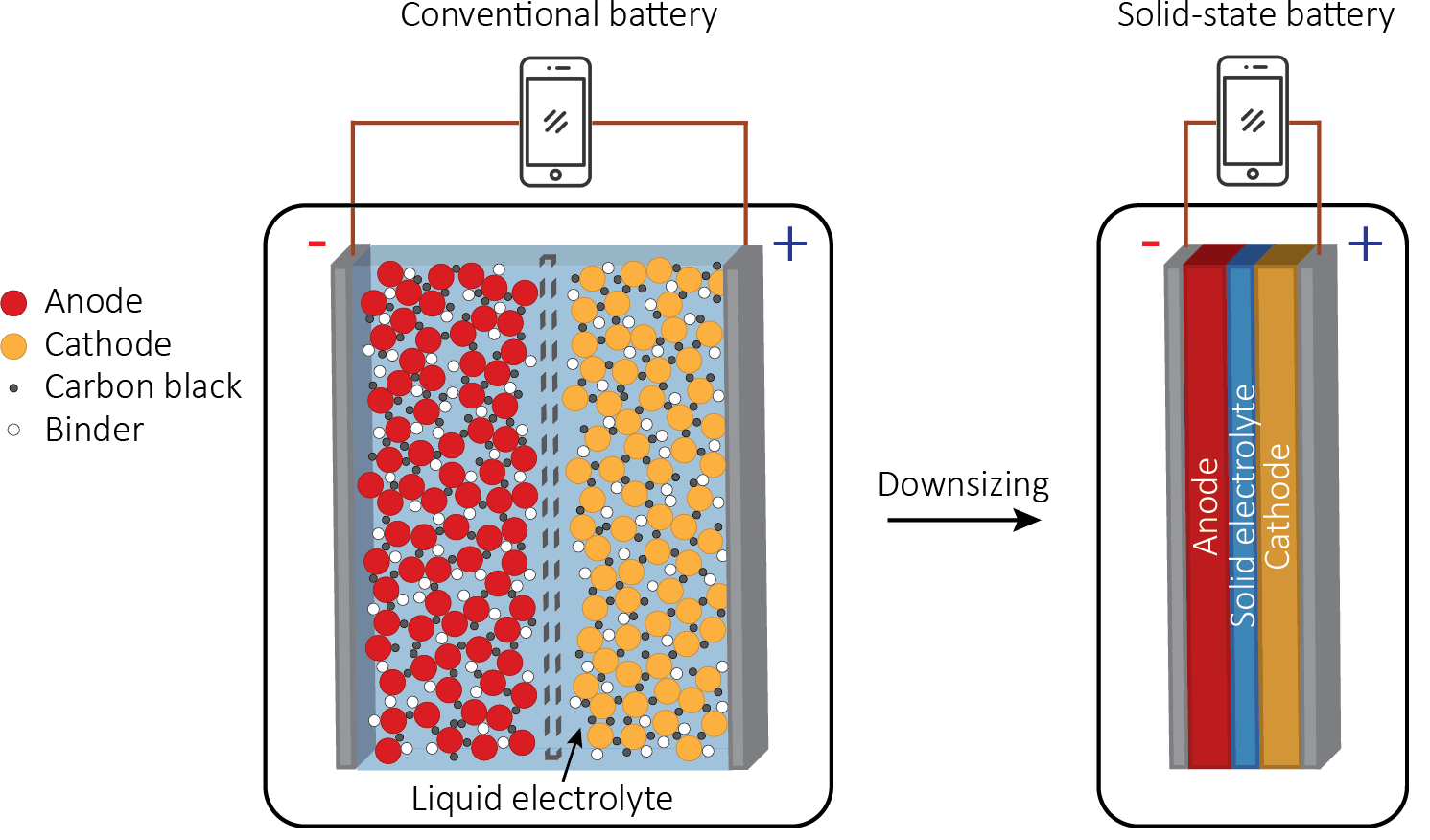

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025