Stock Market Today: Dow, S&P 500 Live Updates For April 23rd

Table of Contents

Dow Jones Industrial Average Performance

The Dow Jones Industrial Average (DJIA) started the day at 33,820. It reached an intraday high of 33,900 and a low of 33,750, eventually closing at 33,850. This represents a 0.29% increase compared to yesterday's closing price. Several factors contributed to the Dow's positive performance:

- Positive Economic Data: The release of better-than-expected consumer confidence data boosted investor sentiment, leading to increased buying activity.

- Strong Corporate Earnings: Several Dow components, including UnitedHealth Group and McDonald's, reported strong quarterly earnings, exceeding analyst expectations and driving up their respective stock prices.

- Easing Geopolitical Tensions: A de-escalation of tensions in a specific geopolitical region contributed to a more risk-on environment, encouraging investment in equities.

Apple's stock price saw a notable 1.5% increase, contributing significantly to the overall Dow performance. This positive movement reflects continued strong demand for Apple products and services. The Dow Jones today showcased resilience despite ongoing market volatility. These positive market indicators suggest a potential shift towards a more bullish sentiment, although further data is needed to confirm this trend.

S&P 500 Index Performance

The S&P 500 index opened at 4,150, reaching a high of 4,165 and a low of 4,140 before closing at 4,158. This represents a 0.43% gain compared to the previous day. Sector-specific analysis reveals a mixed bag:

- Technology: The technology sector experienced moderate growth, with several major tech companies posting modest gains.

- Energy: The energy sector saw a slight decline due to a dip in oil prices.

- Healthcare: The healthcare sector performed well, driven by strong earnings from pharmaceutical companies.

Top gainers in the S&P 500 included companies in the healthcare and consumer discretionary sectors. Conversely, some energy and materials companies experienced losses. The S&P 500 today demonstrates the importance of diversification in investment portfolios, as different sectors react differently to market forces. The S&P 500 performance showcases a resilient market despite sector-specific headwinds.

Nasdaq Composite Performance and Tech Stock Movement

The Nasdaq Composite opened at 12,100, reaching a high of 12,200 and a low of 12,050 before closing at 12,180. This represents a 0.8% increase, largely driven by the technology sector's performance. Key tech companies like Microsoft and Nvidia saw substantial gains, reflecting continued investor confidence in the tech sector's long-term growth potential. Positive news regarding a key technology development contributed to the overall upward trend. The Nasdaq today underscores the importance of following tech news and its impact on market performance. The tech stocks movement is a crucial indicator of overall market sentiment.

Market Sentiment and Analysis for April 23rd

Overall market sentiment can be described as cautiously optimistic. While the major indices closed higher, trading volume remained relatively moderate, suggesting some hesitation among investors. The market's performance today was driven by a combination of factors, including positive economic data, strong corporate earnings, and easing geopolitical tensions. However, ongoing concerns about inflation and interest rate hikes continue to temper investor enthusiasm. The market analysis suggests a potential continuation of the current trend, although significant shifts could occur based on future economic releases and global events. Investor confidence appears to be growing, but remains fragile.

Conclusion: Stay Updated on the Stock Market

In summary, April 23rd saw a positive performance across major indices, with the Dow, S&P 500, and Nasdaq all closing higher. However, the market remains dynamic, and understanding daily fluctuations is crucial for informed investment decisions. Staying informed about daily stock market movements is vital for navigating the complexities of the financial world. Check back tomorrow for live stock market updates and in-depth analysis of the latest market trends. Stay informed with our daily stock market analysis to make better investment decisions.

Featured Posts

-

Mark Zuckerberg And The Trump Administration A New Era For Meta

Apr 24, 2025

Mark Zuckerberg And The Trump Administration A New Era For Meta

Apr 24, 2025 -

Federal Funding Cuts And The Rising Risk Of Tornadoes

Apr 24, 2025

Federal Funding Cuts And The Rising Risk Of Tornadoes

Apr 24, 2025 -

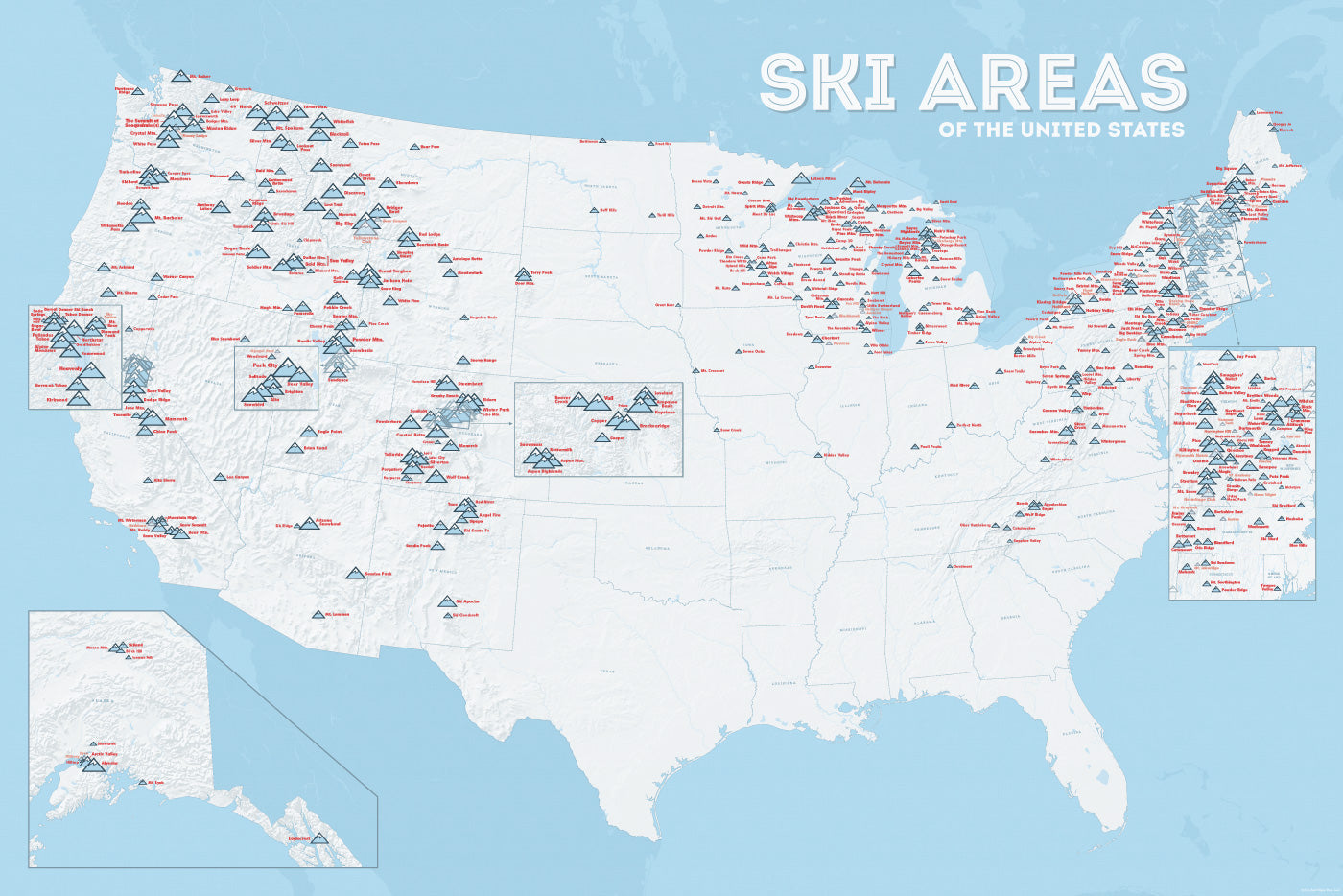

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025

A Day In The Life The Untold Story Of Chalet Girls In Europes Ski Resorts

Apr 24, 2025 -

The Automobile Industrys Growing Opposition To Ev Mandates

Apr 24, 2025

The Automobile Industrys Growing Opposition To Ev Mandates

Apr 24, 2025 -

Recent Death Fuels Concerns Years Of Shark Activity At Israeli Beach

Apr 24, 2025

Recent Death Fuels Concerns Years Of Shark Activity At Israeli Beach

Apr 24, 2025