Stock Market Valuation Concerns Addressed: A BofA Perspective

Table of Contents

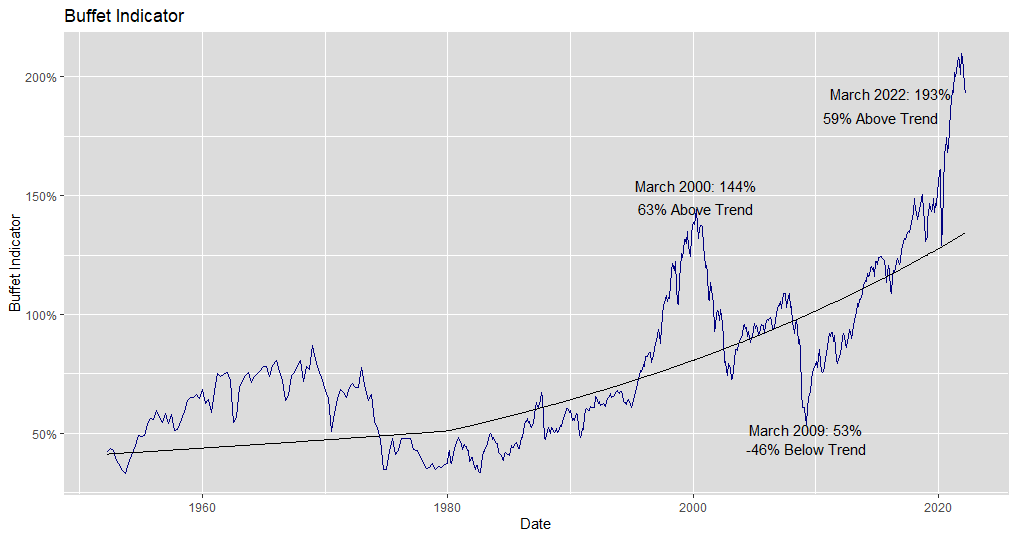

The current stock market presents investors with a critical question: are valuations justified, or are we headed for a correction? Concerns about stock market valuation are widespread, fueling uncertainty and impacting investment strategies. This article delves into Bank of America's (BofA) perspective on these concerns, offering insights into potential risks and opportunities. We'll analyze key valuation metrics, consider macroeconomic factors, and explore BofA's outlook to help you navigate the complexities of the current market.

BofA's Current Market Valuation Assessment:

BofA's stance on current market valuations has fluctuated, but generally leans towards cautious optimism. While not outright bearish, their recent reports highlight significant valuation risks in certain sectors. They emphasize the need for a nuanced approach, considering both the potential for further growth and the elevated risk of a correction. Their analyses often refer to historical comparisons and the influence of macroeconomic factors on future earnings potential.

Key Valuation Metrics Analyzed by BofA:

BofA's analysts utilize a range of key metrics to assess stock market valuation. These include:

-

Price-to-Earnings ratio (P/E): BofA examines the P/E ratio across different sectors and compares them to historical averages and industry benchmarks. High P/E ratios often suggest overvaluation, while low ratios may signal undervaluation, but this needs further analysis. Recent BofA reports have highlighted elevated P/E ratios in certain technology sectors.

-

Price-to-Sales ratio (P/S): This metric is particularly useful for evaluating companies with negative earnings. BofA considers P/S ratios alongside other metrics to get a more comprehensive view of a company's valuation. They have noted elevated P/S ratios in some growth stocks.

-

Cyclically Adjusted Price-to-Earnings ratio (CAPE): BofA uses the CAPE ratio, developed by Robert Shiller, to smooth out short-term earnings fluctuations and gain a longer-term perspective on valuation. The CAPE ratio helps contextualize current valuations within a longer historical context, assisting in determining whether the market is significantly overvalued or undervalued based on long-term earnings potential.

BofA's interpretation of these metrics considers current economic conditions, projected earnings growth, and interest rate environments. Discrepancies between different metrics are carefully analyzed, acknowledging that no single metric provides a definitive assessment of stock market valuation.

Macroeconomic Factors Influencing Stock Market Valuation:

Several macroeconomic factors significantly influence stock market valuation, and BofA closely monitors these:

Interest Rate Impacts:

BofA's analysis highlights the inverse relationship between interest rates and stock valuations. Rising interest rates generally lead to lower stock prices as investors shift towards higher-yielding bonds. Conversely, falling interest rates can boost stock valuations. BofA's predictions for interest rate hikes or cuts directly impact their forecasts for stock market performance and their valuation assessments. They carefully analyze the implications of Federal Reserve policy on market valuations.

Inflation and its Effect on Stock Prices:

BofA closely monitors inflation's impact on corporate earnings. High inflation can erode profit margins and reduce investor confidence, leading to lower stock valuations. Inflation also affects discounted cash flow models, crucial for valuation. BofA's inflation projections influence their outlook on stock prices and the overall stock market valuation. They specifically analyze the impact of inflation on the consumer discretionary sector, for example.

Geopolitical Risks and Their Influence:

Geopolitical events, such as trade wars or international conflicts, can significantly impact investor sentiment and stock valuations. BofA's analysis incorporates geopolitical risks into its valuation models. Unexpected events can create market volatility and affect investor confidence, leading to sudden shifts in valuations. BofA’s research often highlights the potential impacts of geopolitical instability on specific sectors, like energy or defense.

BofA's Investment Strategies and Recommendations Considering Valuation Concerns:

Sector-Specific Outlooks:

BofA's sector-specific outlooks are dynamic and reflect their ongoing valuation analysis. They typically identify sectors they deem overvalued, such as certain technology sub-sectors experiencing rapid growth, and those that are undervalued, possibly due to short-term market sentiment, offering opportunities for investors. Their recommendations are data-driven and backed by detailed research.

Portfolio Diversification Strategies:

BofA recommends diversified portfolios to mitigate risks associated with stock market valuation concerns. This involves investing across different asset classes, including stocks, bonds, and alternative investments. They may suggest varying allocations based on risk tolerance and specific market conditions, emphasizing the importance of not over-concentrating in any single sector or asset class.

Risk Management in a Volatile Market:

To address stock market valuation concerns, BofA suggests employing risk management strategies. These include:

- Hedging: Utilizing hedging strategies to protect against potential market declines.

- Stop-loss orders: Setting stop-loss orders to limit potential losses on individual investments.

- Diversification: As mentioned before, diversifying investments across multiple asset classes and sectors.

These strategies help investors to navigate market volatility and manage their exposure to potential valuation corrections.

Conclusion:

This article explored Bank of America's perspective on current stock market valuation concerns. By analyzing key valuation metrics, macroeconomic factors, and BofA's investment recommendations, we've gained valuable insights into navigating this complex market. While uncertainty remains, understanding BofA's analysis provides a framework for making informed investment decisions. To stay updated on the latest market trends and BofA's perspectives on stock market valuation, continue to monitor their research and reports. Remember, thoroughly researching and understanding your investment choices is crucial to mitigating risk and achieving your financial goals. Don't hesitate to seek professional financial advice before making any major investment decisions related to stock market valuation.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News A Deep Dive Into The January 6th Allegations

Apr 26, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News A Deep Dive Into The January 6th Allegations

Apr 26, 2025 -

California Now Fourth Largest Economy Leaving Japan Behind

Apr 26, 2025

California Now Fourth Largest Economy Leaving Japan Behind

Apr 26, 2025 -

White House Cocaine Incident Secret Service Releases Findings

Apr 26, 2025

White House Cocaine Incident Secret Service Releases Findings

Apr 26, 2025 -

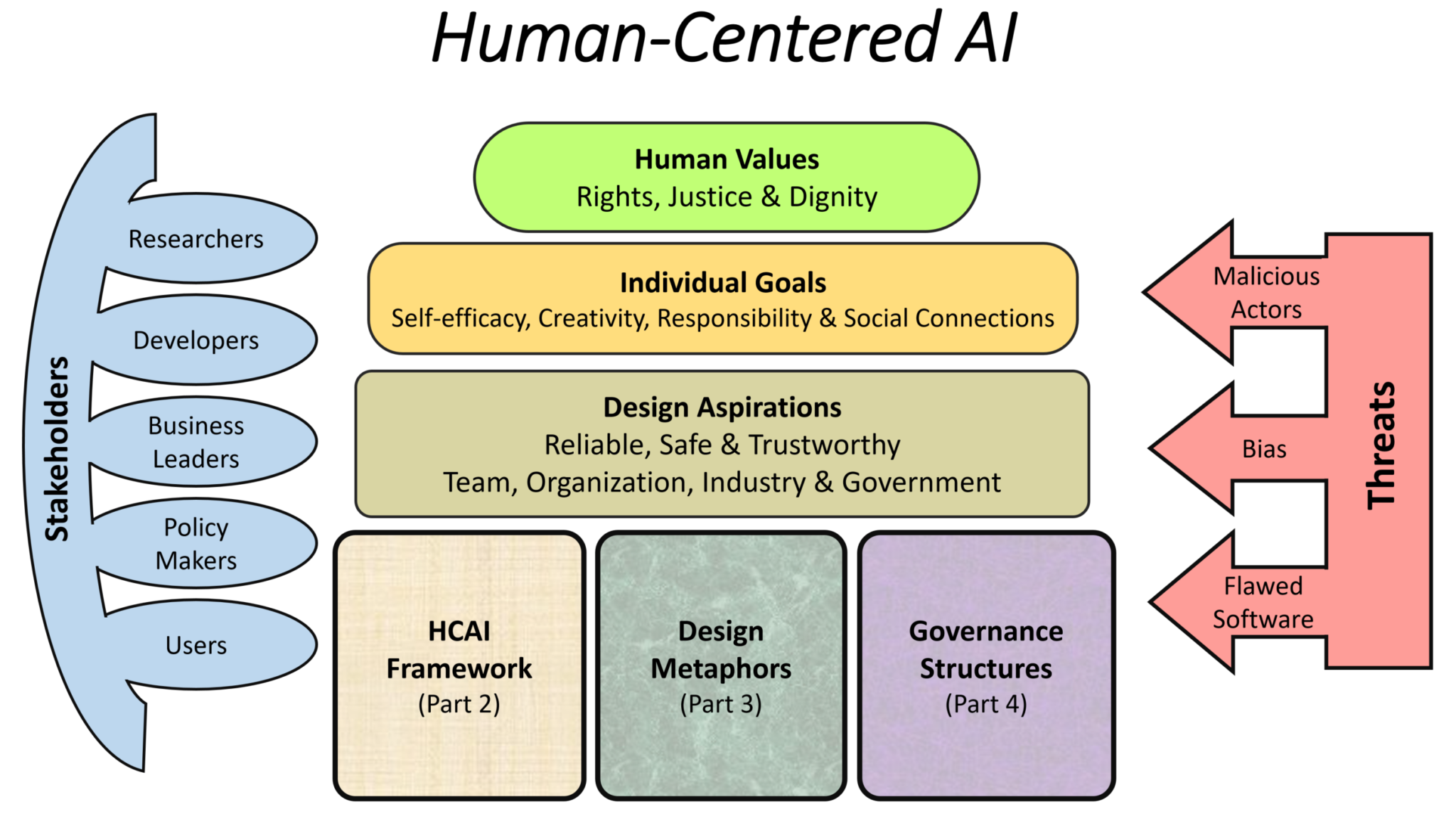

Human Centered Ai Design A Discussion With Microsofts Design Chief

Apr 26, 2025

Human Centered Ai Design A Discussion With Microsofts Design Chief

Apr 26, 2025 -

Economic Power Shift California Outpaces Japan In Global Rankings

Apr 26, 2025

Economic Power Shift California Outpaces Japan In Global Rankings

Apr 26, 2025