Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Key Arguments for a Positive Stock Market Outlook

BofA's positive stock market outlook rests on several key pillars. Their market analysis suggests a more resilient market than many currently anticipate. This positive outlook is supported by several factors, impacting both overall equity valuations and sector-specific performance.

-

Resilient Corporate Earnings: BofA highlights the surprising resilience of corporate earnings despite significant economic headwinds. Many companies have demonstrated an ability to manage rising costs and maintain profitability, a crucial factor supporting current valuations. This resilience suggests that current P/E ratios may not be as overinflated as some fear.

-

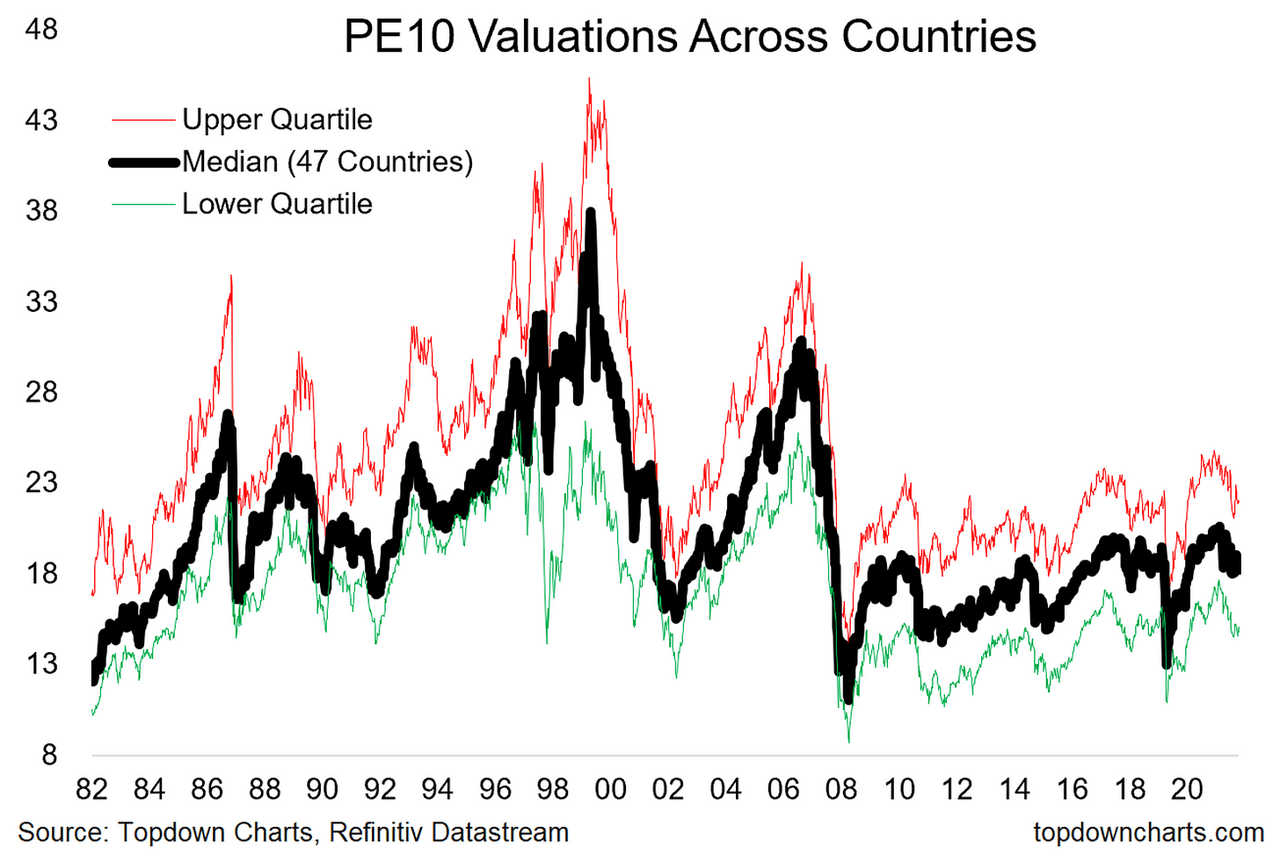

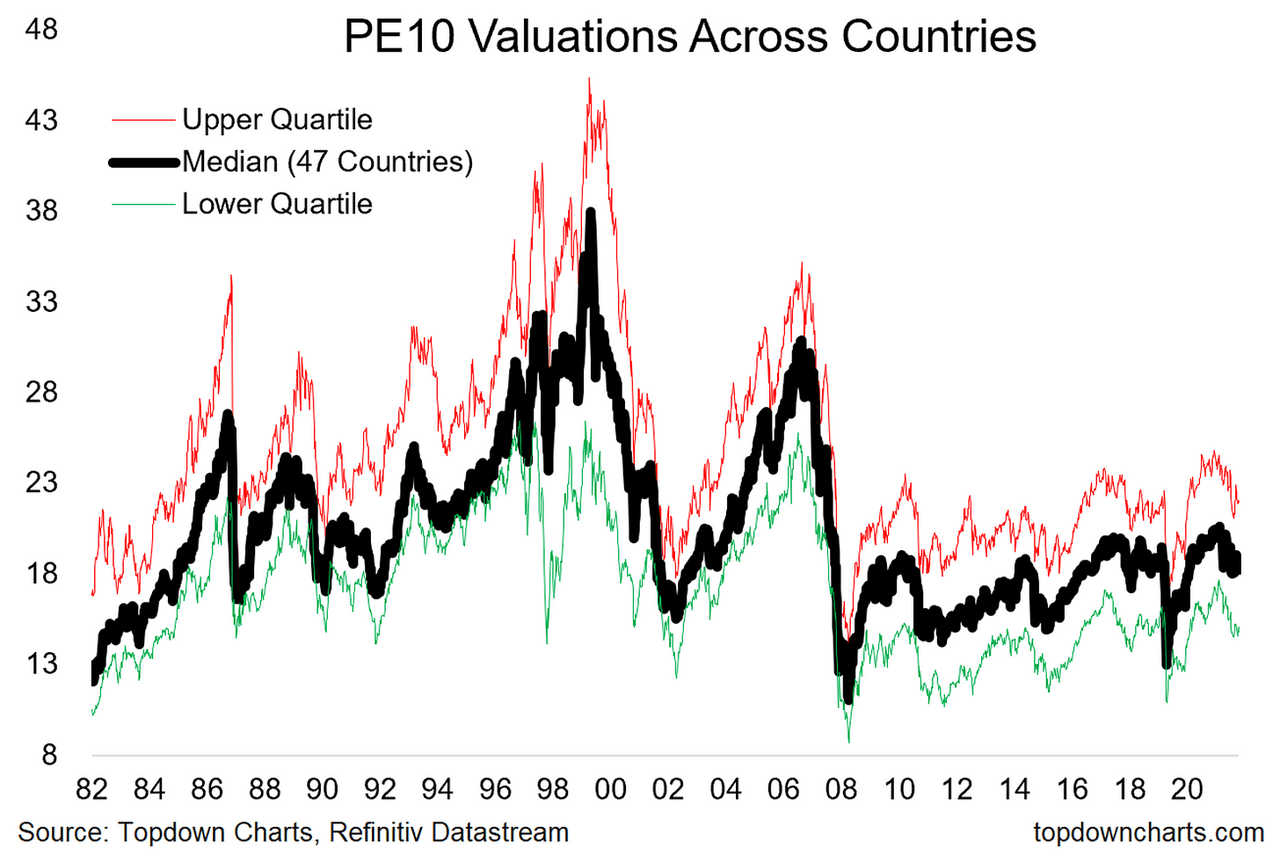

Price-to-Earnings (P/E) Ratio Analysis: BofA's assessment of current P/E ratios reveals a mixed picture. While some sectors show elevated valuations compared to historical averages, others appear more attractively priced. For instance, while the technology sector might show higher P/E ratios reflecting growth expectations, more cyclical sectors might offer comparatively lower valuations, representing potential value opportunities. This nuanced approach avoids blanket statements about overvaluation and allows for a more targeted investment strategy.

-

Projected Earnings Growth: BofA's projections for future earnings growth are a cornerstone of their positive outlook. While specific numbers vary by sector, their models generally predict continued, albeit potentially moderated, earnings growth over the next few years. This expectation of future growth helps justify current valuations and provides a basis for continued market strength.

-

Sector-Specific Valuations: BofA's analysis digs deeper than broad market indices, offering sector-specific valuation insights. They might identify sectors particularly well-positioned for growth (e.g., renewable energy) or sectors facing significant challenges (e.g., certain segments of the real estate market). This granular analysis empowers investors to make more informed decisions about asset allocation.

Understanding the Underlying Factors in BofA's Analysis

BofA's analysis doesn't exist in a vacuum; it's built upon a careful consideration of numerous macroeconomic and geopolitical factors. Their assessment incorporates a range of economic indicators and potential risks.

-

Macroeconomic Factors: BofA carefully considers inflation rates, interest rate projections from the Federal Reserve, and the potential for an economic slowdown. They weigh the impact of these factors on corporate profitability and investor sentiment. The analysis likely incorporates various economic models to predict future economic conditions.

-

Geopolitical Uncertainty: BofA acknowledges the significant impact of geopolitical risks, such as the ongoing war in Ukraine and other global tensions, on market volatility and stock market valuations. Their models likely incorporate scenarios accounting for different geopolitical outcomes and their potential impact on various sectors.

-

Impact of Rising Interest Rates: The analysis thoroughly addresses the impact of rising interest rates on company valuations. Higher interest rates increase borrowing costs, potentially impacting corporate profitability and investor appetite for riskier assets. BofA's models likely account for the varied impact on different sectors, depending on their capital structures and sensitivity to interest rate changes.

-

Incorporating Risk Factors: BofA's valuation models incorporate various risk factors, including inflation risk, interest rate risk, and geopolitical risk. This holistic approach provides a more robust and realistic assessment of market valuations.

Counterarguments and Potential Risks

While BofA presents a generally positive outlook, it's essential to acknowledge potential counterarguments and risks.

-

Criticisms of the Analysis: Some might criticize BofA's optimistic projections, arguing that they underestimate the potential severity of an economic slowdown or inflation's persistent impact. Different economic models and assumptions can lead to varying conclusions.

-

Potential Downsides: A sharper-than-expected economic slowdown, a significant escalation of geopolitical tensions, or unforeseen global events could negatively impact stock market valuations. These are inherent risks that investors must consider.

-

Importance of Diversification and Risk Management: Regardless of BofA's outlook, diversification and risk management remain crucial elements of any sound investment strategy. Investors should avoid concentrating their investments in any single sector or asset class.

Implications for Investors and Investment Strategies

BofA's analysis offers valuable insights for investors seeking to refine their strategies.

-

Portfolio Allocation: The analysis can inform portfolio allocation decisions. Investors might adjust their holdings based on BofA's sector-specific valuations, potentially increasing exposure to undervalued sectors while reducing exposure to overvalued ones.

-

Investment Styles: BofA's findings have implications for various investment styles. Value investors might find attractive opportunities in sectors identified as undervalued, while growth investors might focus on sectors with strong future growth potential.

-

Adjusting Strategies Based on Risk Tolerance: Investors should adjust their strategies based on their individual risk tolerance and investment goals. Conservative investors might maintain a more defensive portfolio, while those with higher risk tolerance might take on more exposure to growth sectors.

-

Specific Actions: Investors might consider rebalancing their portfolios to align with BofA's findings, potentially shifting assets toward sectors with more favorable valuations or investing in exchange-traded funds (ETFs) that track specific sectors.

Conclusion

This article explored Bank of America's recent analysis of stock market valuations, highlighting their generally positive outlook despite current economic uncertainty. We examined the key factors contributing to BofA's assessment, including corporate earnings resilience, projected earnings growth, and considerations of macroeconomic and geopolitical risks. While acknowledging potential downsides, the analysis provides a degree of reassurance for investors.

Understanding stock market valuations is crucial for effective investment decision-making. Stay informed on expert analyses like BofA's to refine your investment strategy and navigate the complexities of the market. Continue researching stock market valuations and stay updated on the latest market analyses to make informed decisions about your investments.

Featured Posts

-

The Future Of Google A Breakup On The Horizon

Apr 22, 2025

The Future Of Google A Breakup On The Horizon

Apr 22, 2025 -

E Bays Liability For Banned Chemical Listings A Section 230 Ruling

Apr 22, 2025

E Bays Liability For Banned Chemical Listings A Section 230 Ruling

Apr 22, 2025 -

A Timeline Of Karen Reads Murder Convictions And Appeals

Apr 22, 2025

A Timeline Of Karen Reads Murder Convictions And Appeals

Apr 22, 2025 -

The Unexpected Alliance Trump Obamacare And Rfk Jr S Political Future

Apr 22, 2025

The Unexpected Alliance Trump Obamacare And Rfk Jr S Political Future

Apr 22, 2025 -

Rapid Police Response Insufficient Fsu Security Breach Exacerbates Student Anxiety

Apr 22, 2025

Rapid Police Response Insufficient Fsu Security Breach Exacerbates Student Anxiety

Apr 22, 2025