Tech Giants Boost U.S. Stocks: Tesla Leads The Charge

Table of Contents

Tesla's Dominance: Driving Stock Market Growth

Tesla's recent performance has been nothing short of spectacular, significantly impacting the broader market's positive trajectory. The company's influence on the tech stock surge is clear. This exceptional growth can be attributed to several key factors:

-

Strong Q[Quarter] Earnings Reports: Consistently exceeding expectations, Tesla's quarterly earnings reports have consistently fueled investor confidence and driven up the Tesla stock price. Strong revenue growth and increasing profitability are key elements influencing positive market sentiment surrounding Tesla earnings.

-

Innovative Product Launches and Announcements: Tesla's continuous innovation, including new vehicle models like the Cybertruck and advancements in its energy solutions (solar panels, Powerwall), keeps investor excitement high. These Tesla innovations continually attract new customers and investors, further boosting the Tesla stock.

-

Positive Investor Sentiment and Analyst Upgrades: Analysts' upgrades and overwhelmingly positive investor sentiment reflect confidence in Tesla's long-term growth potential. This positive Tesla investor sentiment is a major driver of the stock's performance and contributes to the overall market strength.

-

Increased Production and Delivery Numbers: Tesla's consistent increase in vehicle production and delivery numbers demonstrates its ability to meet growing demand, reassuring investors about its operational efficiency. This robust Tesla production translates into higher revenue and further enhances the company's stock value.

-

Expansion into New Markets: Tesla's global expansion into new markets signifies its ambition and growth potential. This expansion opens up lucrative new avenues for revenue generation and strengthens the company's position in the global automotive market, boosting the Tesla stock price.

Data shows a strong correlation between Tesla's stock price and the broader market indices. For example, [insert relevant data and statistics here, e.g., percentage increase in Tesla stock price compared to the S&P 500 over a specific period]. These figures highlight Tesla's significant contribution to the tech stock surge and the overall US stock market performance.

Other Tech Giants' Contributions to Market Strength

While Tesla's performance has been particularly striking, other tech giants have also significantly contributed to the overall market strength. Companies like Apple, Microsoft, Google/Alphabet, Amazon, and Meta have all reported strong financial results, driving up their stock prices and influencing related sectors.

-

Strong Financial Results: These tech giants consistently deliver strong financial results, showcasing their resilience and profitability. This positive performance strengthens investor confidence and fuels further market growth.

-

Positive Market Reactions to Announcements and Product Launches: New product launches, software updates, and positive announcements from these companies consistently generate positive market reactions, boosting their stock prices and contributing to the overall market's strength.

-

Impact on Related Sectors: The influence of these companies extends beyond their own sectors. For instance, Amazon's success has spurred growth in e-commerce and cloud computing, while Google's dominance impacts the advertising and search engine industries. These effects are evident in the rising stock prices of companies within these related sectors.

-

Specific Examples: [Insert specific examples of positive news from each company and its impact on their stock prices. For example: "Apple's latest iPhone sales exceeded expectations, leading to a significant jump in its stock price."] This demonstrates the powerful influence these companies exert on the US stock market. Keywords such as "Apple stock," "Microsoft stock," "Google stock," "Amazon stock," "Meta stock," "tech sector performance," and "market capitalization" are used throughout this section.

Factors Beyond Tech Giants Influencing Market Trends

While tech giants are a major driving force, it's crucial to acknowledge other factors influencing the overall market performance. These include:

-

Overall Economic Conditions: Factors like inflation rates and interest rates significantly impact investor sentiment and market behavior. High inflation can dampen investor enthusiasm, while interest rate changes affect borrowing costs for businesses and consumers.

-

Geopolitical Events: Geopolitical events, such as international conflicts or trade disputes, can introduce uncertainty and volatility into the market. These events can significantly impact investor confidence and market trends.

-

Changes in Consumer Spending Habits: Consumer confidence and spending patterns are crucial indicators of economic health. Changes in these habits directly impact various sectors, influencing stock market performance.

-

Government Policies and Regulations: Government policies, including tax laws and regulatory changes, can significantly influence business activity and investor sentiment, ultimately affecting stock market performance. Keywords such as "economic indicators," "inflation," "interest rates," "geopolitical risk," and "consumer confidence" are used here to enhance SEO.

Analyzing the Correlation Between Tech Giants and Stock Market Performance

A strong correlation exists between the performance of tech giants and the overall market performance. [Insert charts, graphs, or tables visualizing the correlation between the performance of major tech company stocks and relevant market indices, such as the S&P 500 or Nasdaq]. This analysis clearly demonstrates the significant influence of these companies on the overall health of the US stock market. Keywords such as "correlation analysis," "market indices," "stock market indices," and "sector performance" are incorporated here.

Conclusion: The Future of U.S. Stocks and the Continued Influence of Tech Giants

The significant role of tech giants, particularly Tesla, in boosting U.S. stock market performance is undeniable. Their innovative products, strong financial results, and positive investor sentiment are key drivers of market growth. While other factors influence market trends, the continued success of these tech companies will likely play a significant role in shaping the future of the U.S. stock market. Monitoring these tech giants is crucial for understanding future market movements.

Stay informed about the latest developments in the tech sector to make well-informed decisions regarding your investments in the U.S. stock market and benefit from the continued influence of tech giants like Tesla. Keywords such as "investment strategy," "stock market outlook," "Tesla investment," and "tech stock investment" are used here to reinforce the article's SEO.

Featured Posts

-

Uae Travel Sim Card 10 Gb Data 15 Abu Dhabi Discount

Apr 28, 2025

Uae Travel Sim Card 10 Gb Data 15 Abu Dhabi Discount

Apr 28, 2025 -

Baltimore Orioles Announcers Jinx Ends Historic Hit Streak

Apr 28, 2025

Baltimore Orioles Announcers Jinx Ends Historic Hit Streak

Apr 28, 2025 -

The Overseas Highway History And Beauty Of The Florida Keys

Apr 28, 2025

The Overseas Highway History And Beauty Of The Florida Keys

Apr 28, 2025 -

Ohio Train Disaster Months Long Persistence Of Toxic Chemicals In Structures

Apr 28, 2025

Ohio Train Disaster Months Long Persistence Of Toxic Chemicals In Structures

Apr 28, 2025 -

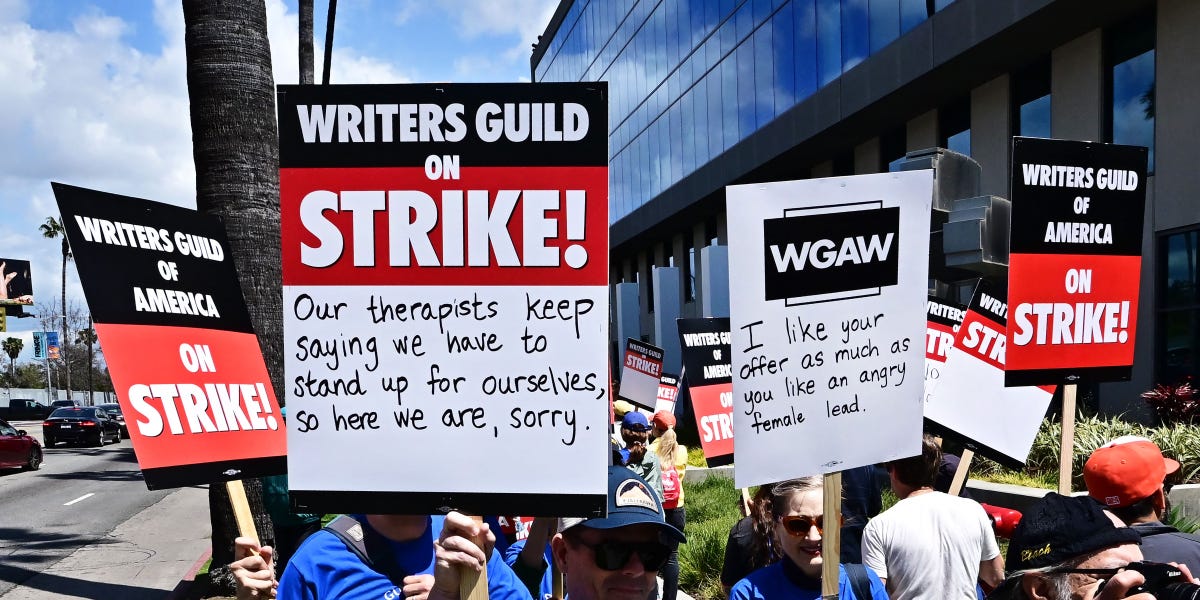

Hollywood Production Grinds To Halt As Actors Join Writers Strike

Apr 28, 2025

Hollywood Production Grinds To Halt As Actors Join Writers Strike

Apr 28, 2025