Tesla And Tech Drive U.S. Stock Market Surge

Table of Contents

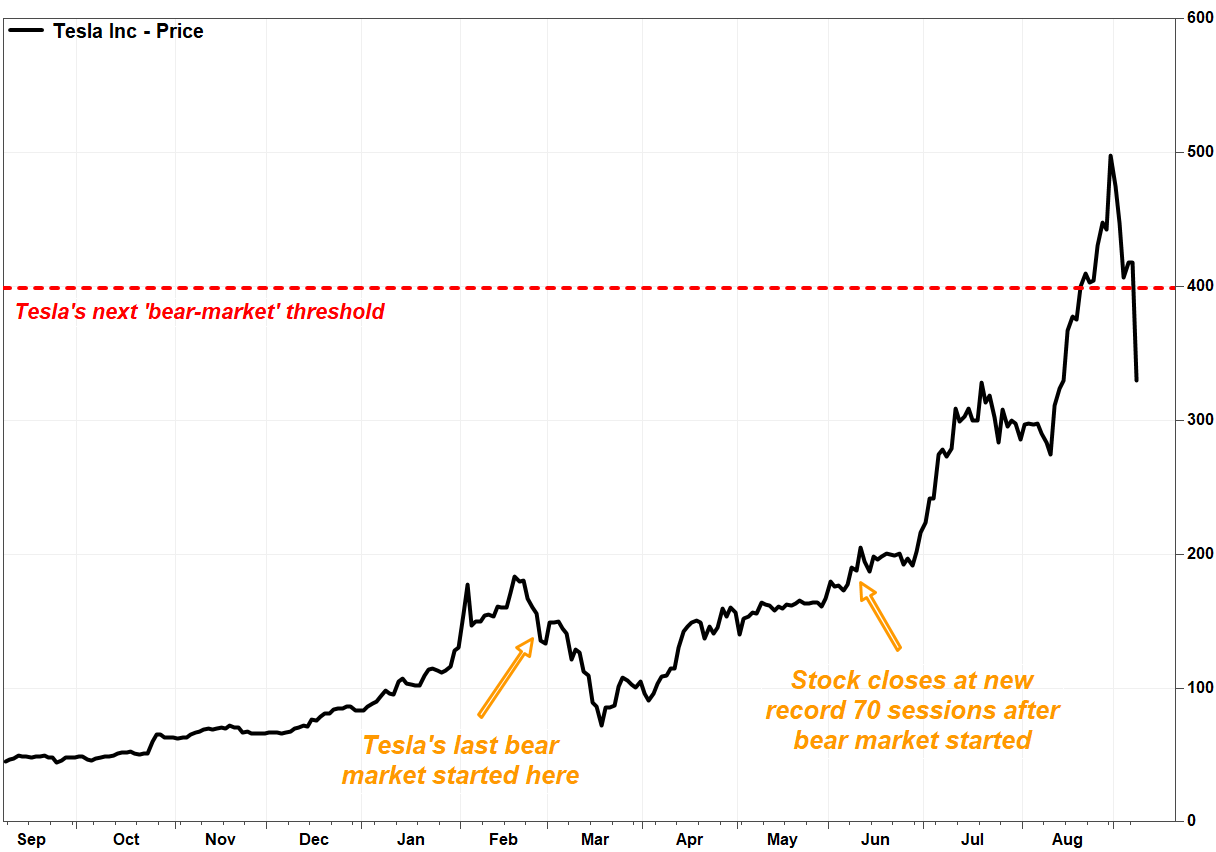

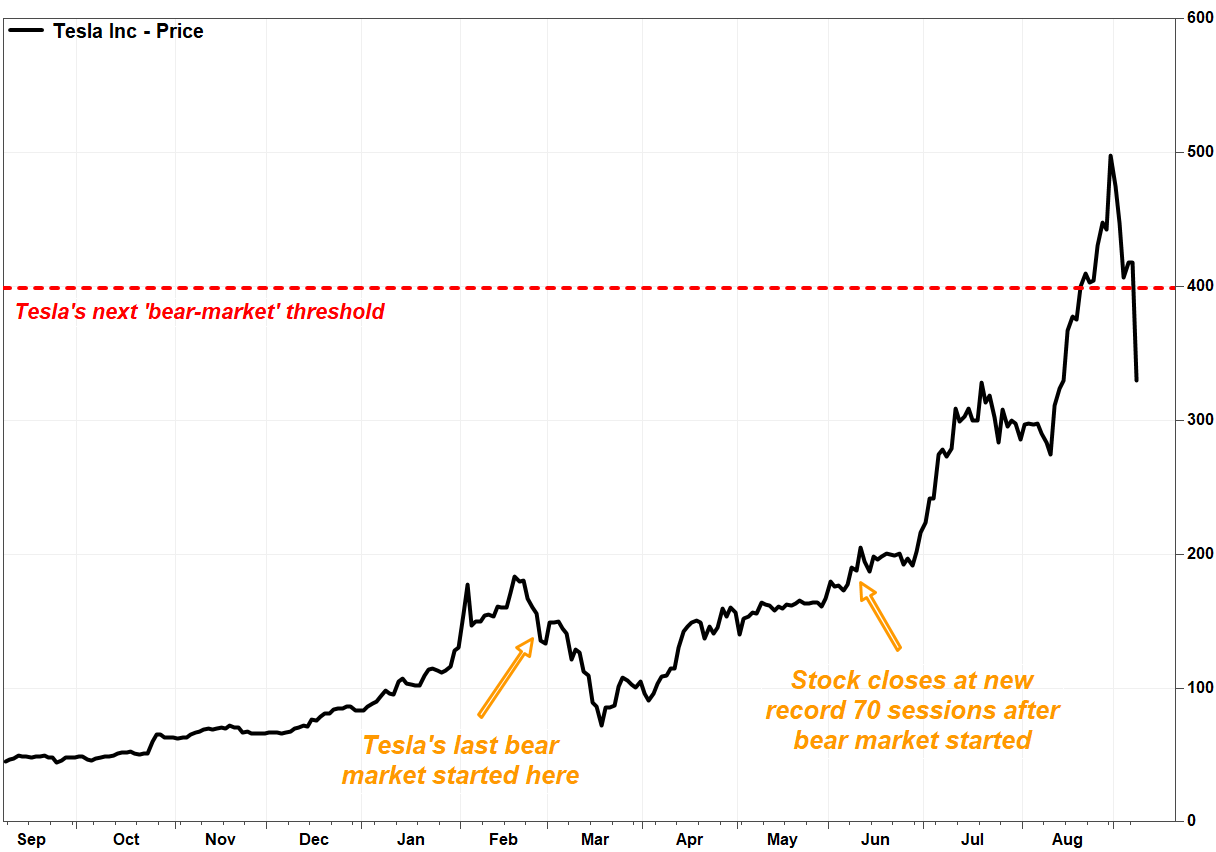

Tesla's Impact on Market Sentiment

Tesla's influence on market sentiment is undeniable. Its performance acts as a bellwether, not only for the electric vehicle (EV) industry but also for the broader technology sector.

Tesla's Strong Q[Quarter] Earnings and Future Projections

Tesla's recent quarterly earnings reports have consistently exceeded expectations, significantly boosting investor confidence. Strong growth in EV sales, coupled with expansion in its energy generation business (solar panels and energy storage), has fueled this positive momentum. For example, [Insert specific data point, e.g., "Q3 2023 saw a 30% increase in vehicle deliveries compared to Q2"]. This strong performance reinforces the company's position as a leader in innovation and sustainability.

- Increased production numbers across all vehicle lines

- Expanding Supercharger network, enhancing EV accessibility

- Successful launches of new products and software updates

The "Tesla Effect" on the broader EV sector

Tesla's success isn't limited to its own bottom line. The "Tesla effect" has a ripple effect, positively impacting other EV companies and the entire sector. This increased interest is driven by a number of factors:

- Increased investor interest in EV stocks, leading to higher valuations.

- Government incentives and regulations promoting EV adoption worldwide.

- Rapid technological advancements in battery technology and charging infrastructure.

Competitor stock prices often see a boost following strong Tesla performance, showcasing the interconnectedness of the EV market.

The Tech Sector's Resurgence

Beyond Tesla, the broader technology sector has experienced a significant resurgence, contributing substantially to the overall market surge.

Strong Earnings Reports from Major Tech Companies

Major tech companies, including Apple, Microsoft, Google, and others, have reported strong earnings, showcasing robust revenue growth and increased profit margins. This positive performance stems from several key factors:

- Strong revenue growth driven by increased demand for cloud computing services.

- Increased profit margins due to efficient operational strategies and pricing models.

- Successful new product launches that capture market share and enhance revenue streams. [Insert specific data, e.g., "Apple's iPhone sales exceeded analysts' predictions by 15%."]

Investor Confidence and Future Outlook

Investor sentiment towards the tech sector is largely positive, driven by the strong earnings reports and the belief in long-term growth potential. However, there are also concerns:

- Positive outlook on long-term tech growth fueled by AI, cloud computing, and other innovations.

- Concerns about inflation and rising interest rates potentially dampening future growth.

- Potential for further market corrections due to macroeconomic uncertainties.

The Interplay Between Tesla and the Tech Sector

The relationship between Tesla and the broader tech sector is synergistic. Both sectors rely heavily on technological innovation, attract similar investor bases, and significantly influence market sentiment. Tesla's advancements in battery technology, autonomous driving, and AI directly benefit the broader tech landscape, while the overall tech boom creates a fertile ground for Tesla's continued success.

- Shared reliance on technological innovation for growth and competitive advantage.

- Overlapping investor base, with many investors holding positions in both Tesla and other tech giants.

- Mutual influence on market sentiment; strong performance in one sector often boosts the other.

Conclusion: Tesla and Tech Drive Continued U.S. Stock Market Growth

In summary, the recent surge in the U.S. stock market is significantly attributable to the outstanding performance of Tesla and the robust resurgence of the tech sector. Tesla’s strong earnings, coupled with the positive performance of major tech companies, has fueled investor confidence and propelled the market upward. The intertwined nature of these sectors suggests that their continued success will likely be a key driver of future market growth. However, macroeconomic factors and potential market corrections remain important considerations. Stay tuned for further updates on the impact of Tesla and the tech sector on the U.S. stock market. Understanding the dynamics of Tesla and tech is crucial for navigating the market effectively.

Featured Posts

-

Mapping The Countrys Emerging Business Hotspots

Apr 28, 2025

Mapping The Countrys Emerging Business Hotspots

Apr 28, 2025 -

Espn Promotes Richard Jefferson Nba Finals Booth Still Unconfirmed

Apr 28, 2025

Espn Promotes Richard Jefferson Nba Finals Booth Still Unconfirmed

Apr 28, 2025 -

6 3 Victory For Twins Over Mets Series Continues

Apr 28, 2025

6 3 Victory For Twins Over Mets Series Continues

Apr 28, 2025 -

Hudsons Bay Liquidation Huge Markdowns In Final Stores

Apr 28, 2025

Hudsons Bay Liquidation Huge Markdowns In Final Stores

Apr 28, 2025 -

Is Kuxius Solid State Power Bank Worth The Price A Durability Review

Apr 28, 2025

Is Kuxius Solid State Power Bank Worth The Price A Durability Review

Apr 28, 2025