Tesla Q1 Earnings Drop: Musk's Role And Market Reaction

Table of Contents

Tesla Q1 Earnings: A Detailed Breakdown

Tesla Revenue and Profitability: A Concerning Trend

The Tesla Q1 earnings report revealed a significant decrease in both revenue and profitability compared to the previous quarter and analyst expectations. Key figures showed a notable decline in Tesla's profit margin, a worrying sign for investors.

- Revenue: [Insert actual Q1 2024 revenue figures here] – a [percentage]% decrease compared to Q4 2023 and [percentage]% below analyst projections.

- Net Income: [Insert actual Q1 2024 net income figures here] – showcasing a [percentage]% drop from the previous quarter.

- Profit Margin: [Insert actual Q1 2024 profit margin figures here] – significantly lower than the [previous quarter's margin]% and the projected [analyst projection]% margin.

This sharp decrease in Tesla revenue and the compressed profit margin signal potential challenges within the company's operational efficiency and pricing strategies. The discrepancy between actual performance and analyst expectations highlights a need for a deeper understanding of the underlying issues.

Sales Figures and Delivery Challenges: Bottlenecks and Headwinds

Tesla's Q1 sales figures also unveiled challenges in production and delivery. While the company delivered a substantial number of vehicles, [insert actual delivery numbers], this fell short of projections and indicated potential bottlenecks in the supply chain.

- Production Output: Factors impacting production included [mention specific challenges like chip shortages, supply chain disruptions, factory upgrades, etc.].

- Regional Sales Variations: Performance varied across regions, with [mention specific regions and their performance]. This suggests geographical market sensitivities and potential regional challenges.

- Delivery Delays: Many customers experienced delays in receiving their vehicles, impacting customer satisfaction and potentially future sales.

These delivery challenges directly impacted revenue and profitability, underlining the vulnerability of Tesla's business model to external factors and operational inefficiencies.

Elon Musk's Influence on Tesla's Performance

Leadership and Strategic Decisions: A Balancing Act?

Elon Musk's leadership style and strategic decisions have always been a double-edged sword for Tesla. His bold vision and innovative approach have fueled the company's growth, but his recent actions have also sparked concerns among investors.

- Controversial Tweets and Actions: Musk's involvement in various ventures, including Twitter, and his often controversial public statements, have created volatility in Tesla's stock price and potentially diverted management attention.

- Impact of Other Companies: His leadership responsibilities at SpaceX and his acquisition of Twitter have undoubtedly stretched his time and resources, potentially impacting Tesla's operational focus.

- Investor Confidence: These actions have directly impacted investor confidence, creating uncertainty about the company's long-term strategy and leadership direction.

Public Perception and Investor Sentiment: The Musk Factor

Elon Musk's public image and its impact on Tesla's stock are undeniable. Negative media coverage surrounding his actions often directly translates to fluctuations in the company’s valuation.

- Media Coverage: Extensive media coverage of Musk's controversies and their potential influence on Tesla has swayed investor sentiment.

- Social Media Influence: The power of social media to amplify both positive and negative narratives around Tesla, often driven by Musk's own tweets, is significant.

- Stock Market Analysis: Many analysts have linked the decline in Tesla’s stock price to investor concerns about Musk’s leadership and his attention being divided among various ventures.

Market Reaction to the Tesla Q1 Earnings Drop

Stock Price Volatility: A Rollercoaster Ride

The announcement of the Tesla Q1 earnings drop triggered immediate and significant volatility in the stock market.

- Stock Price Drop: The stock price experienced a sharp [percentage]% drop following the release of the earnings report, reflecting investor concern.

- Stock Price Charts: [Insert charts illustrating stock price fluctuations].

- Short-Term and Long-Term Implications: The short-term impact was a significant loss of market capitalization. The long-term implications depend on Tesla's ability to address the underlying issues and restore investor confidence.

Analyst Predictions and Future Outlook: A Divided Opinion

Analyst opinions on Tesla's future are diverse. While some maintain a positive outlook, citing the company's long-term potential in the EV market, others express caution due to the Q1 results and the ongoing challenges.

- Analyst Predictions: A range of forecasts exist, from optimistic projections that anticipate a recovery to more pessimistic predictions highlighting potential for further decline.

- Market Sentiment: Overall market sentiment towards Tesla remains mixed, with significant uncertainty surrounding the company's ability to navigate the current challenges.

- Diverse Perspectives: The diverse opinions reflect the complexity of Tesla's situation and the various factors impacting its future prospects.

Conclusion: Navigating the Tesla Q1 Earnings Drop and Beyond

The Tesla Q1 earnings drop is a significant event that highlights several challenges facing the company. Elon Musk's leadership style and strategic decisions, along with external factors such as supply chain disruptions, contributed to the decline in revenue and profitability. The market reacted swiftly, with a notable drop in the stock price reflecting investor concerns. Understanding these factors is crucial for investors and market watchers alike. To stay informed about future developments and the ongoing impact of this significant earnings report, continue following market analysis and upcoming Tesla earnings announcements related to the Tesla Q1 earnings drop and similar future events.

Featured Posts

-

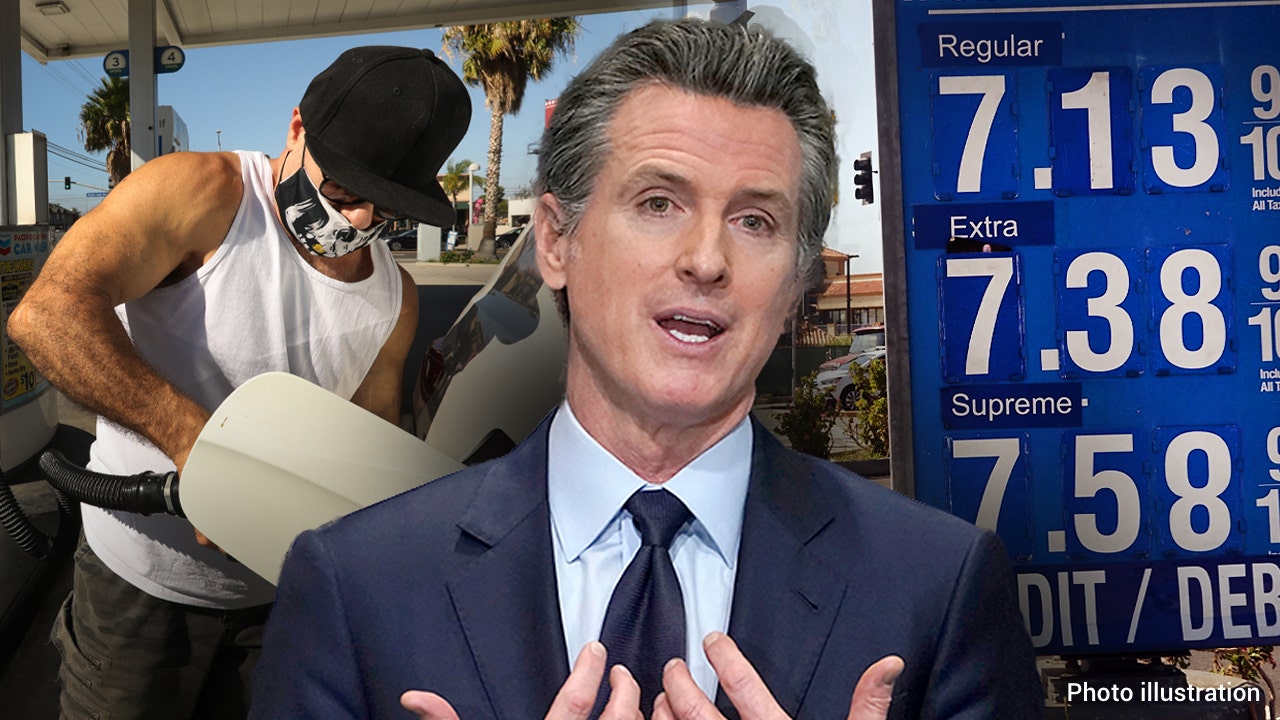

High Gas Prices In California Governor Newsoms Appeal To The Oil Industry

Apr 24, 2025

High Gas Prices In California Governor Newsoms Appeal To The Oil Industry

Apr 24, 2025 -

How Elite Universities Are Responding To Trump Era Funding Challenges

Apr 24, 2025

How Elite Universities Are Responding To Trump Era Funding Challenges

Apr 24, 2025 -

Chinas Auto Market Challenges And Opportunities For International Brands Including Bmw And Porsche

Apr 24, 2025

Chinas Auto Market Challenges And Opportunities For International Brands Including Bmw And Porsche

Apr 24, 2025 -

Increased Legal Scrutiny Of Trump Administrations Immigration Enforcement

Apr 24, 2025

Increased Legal Scrutiny Of Trump Administrations Immigration Enforcement

Apr 24, 2025 -

Oblivion Remastered Official Announcement And Release Date

Apr 24, 2025

Oblivion Remastered Official Announcement And Release Date

Apr 24, 2025