Tesla Q1 Earnings: Net Income Down 71% Amidst Political Headwinds

Table of Contents

Significant Drop in Net Income: A Deep Dive into the 71% Decline

Tesla's Q1 2024 financial statements paint a stark picture. The 71% plunge in net income compared to the previous quarter represents a substantial blow to profitability. This drastic reduction necessitates a detailed examination of the contributing factors.

- Comparison to Previous Quarters and Expectations: The Q1 results fell significantly short of analyst expectations, highlighting a more challenging operating environment than previously anticipated. A detailed comparison with Q4 2023 and Q1 2023 figures reveals the extent of the decline across key performance indicators.

- Revenue Stream Breakdown: Analyzing Tesla's revenue streams—including vehicle sales, energy generation and storage, and services—is crucial to understanding the specific areas contributing to the overall decline. Lower average selling prices likely played a significant role.

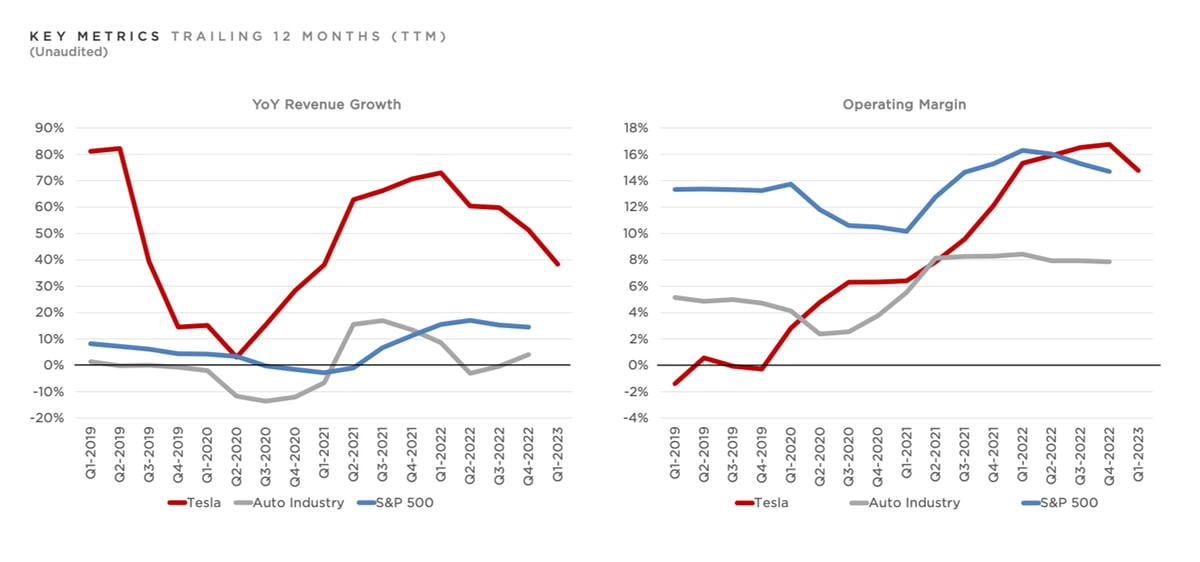

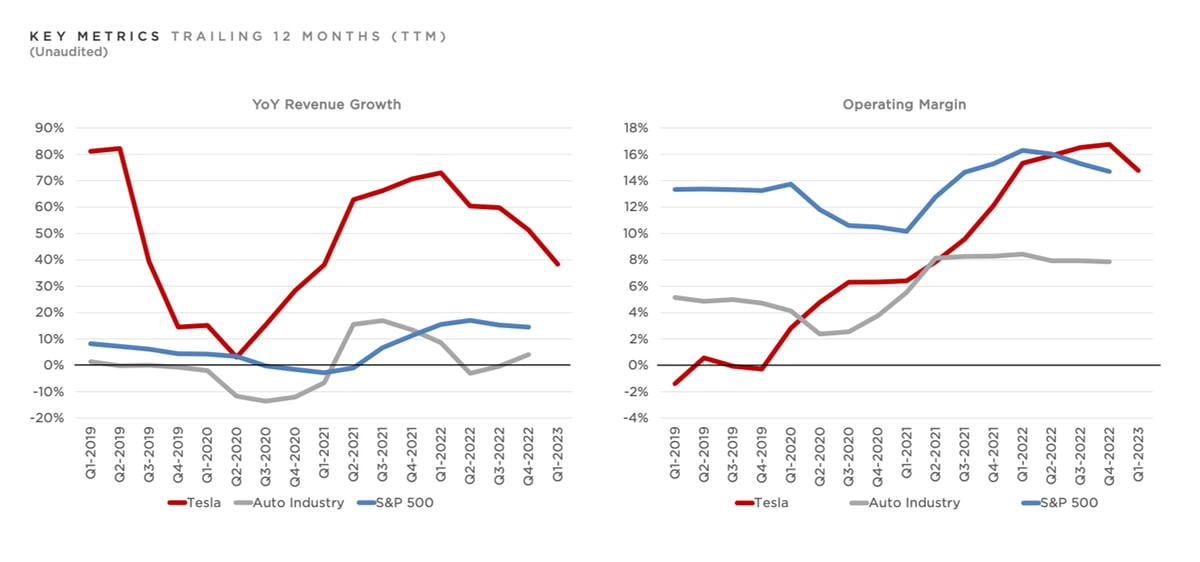

- Visualizing the Data: Charts and graphs illustrating the year-over-year and quarter-over-quarter changes in net income, revenue, and other key financial metrics provide a clear visual representation of the severity of the situation. This visual data will clearly show the impact of Tesla Q1 earnings report on the company's overall Tesla financial statements. The impact on Tesla revenue and Tesla profitability will be clearly demonstrated.

Price Cuts and Increased Competition: Impact on Profit Margins

Tesla's aggressive price cuts, implemented to boost sales volume and maintain market share, significantly impacted profit margins. This strategy, while potentially beneficial for long-term market dominance, has immediate consequences for short-term profitability.

- The Impact of Price Cuts: Detailed analysis will show the direct correlation between price reductions and the drop in net income. Specific examples of price changes for different Tesla models can illustrate this impact.

- Increased EV Competition: The EV market is becoming increasingly crowded. Competitors like BYD, Volkswagen, and others are launching competitive models, putting pressure on Tesla's market share and pricing strategies. Analyzing competitor strategies offers valuable insight into the competitive landscape affecting Tesla price cuts.

- Tesla's Long-Term Strategy: Examining Tesla's long-term strategic goals helps contextualize the price cuts within a broader plan for market share expansion and potential future profitability. This helps understand the rationale behind Tesla pricing strategy and its implications for Tesla market share within the electric vehicle market.

Political Headwinds: Geopolitical Risks and Regulatory Challenges

Tesla's global operations expose it to various political risks and regulatory challenges that significantly impact its financial performance.

- Geopolitical Events: Specific examples of geopolitical events, such as trade disputes or political instability in key markets, should be identified and analyzed for their impact on Tesla's supply chains and sales. The impact of these events on Tesla political risks must be analyzed.

- Regulatory Changes: Changes in regulations related to emissions standards, subsidies, or other relevant areas in different countries directly affect Tesla's manufacturing, sales, and overall profitability. Examining these challenges highlights Tesla regulatory challenges and their geopolitical impact on Tesla.

- Supply Chain Disruptions: Geopolitical tensions and regulatory changes often disrupt supply chains. Analysis of these disruptions and their effect on production and delivery schedules provides a clearer understanding of how these factors influence Tesla supply chain resilience and financial performance.

Macroeconomic Factors: Inflation and Economic Slowdown

Global macroeconomic conditions, including inflation and economic slowdown, exert significant pressure on consumer spending, directly impacting demand for EVs and Tesla's performance.

- Consumer Demand Sensitivity: Analyzing consumer behavior and spending patterns during periods of economic uncertainty illustrates the vulnerability of demand for luxury goods like Tesla vehicles to macroeconomic factors.

- Inflation's Impact: Rising inflation increases the cost of production and reduces consumer purchasing power, squeezing profit margins and affecting overall Tesla financial performance.

- Interest Rate Effects: Higher interest rates increase borrowing costs, impacting consumer financing options for EV purchases, and potentially slowing down investment in the EV sector. The interplay of inflation and interest rate increases on consumer demand for EVs will be crucial here.

Conclusion: Tesla's Q1 Earnings – Navigating a Stormy Landscape

Tesla's Q1 2024 earnings report reveals a significant drop in net income (71%), driven by a complex interplay of factors. Aggressive price cuts to maintain market share in the face of increased EV competition, alongside substantial political headwinds and adverse macroeconomic conditions, significantly impacted profitability. While the price cuts might be a long-term strategic play, the short-term impact on Tesla Q1 earnings is undeniable. The implications for Tesla's future financial performance and stock price remain uncertain, and investors will be closely watching future reports for signs of recovery. To stay informed about Tesla Q1 earnings and future financial updates, subscribe to our newsletter [link to newsletter signup]. Understanding these challenges is crucial for navigating the complexities of the evolving EV market and Tesla's position within it.

Featured Posts

-

Wednesday April 23 Bold And The Beautiful Spoilers Finn And Liam

Apr 24, 2025

Wednesday April 23 Bold And The Beautiful Spoilers Finn And Liam

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Rating A Statistical Analysis

Apr 24, 2025

John Travoltas Rotten Tomatoes Rating A Statistical Analysis

Apr 24, 2025 -

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025 -

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025 -

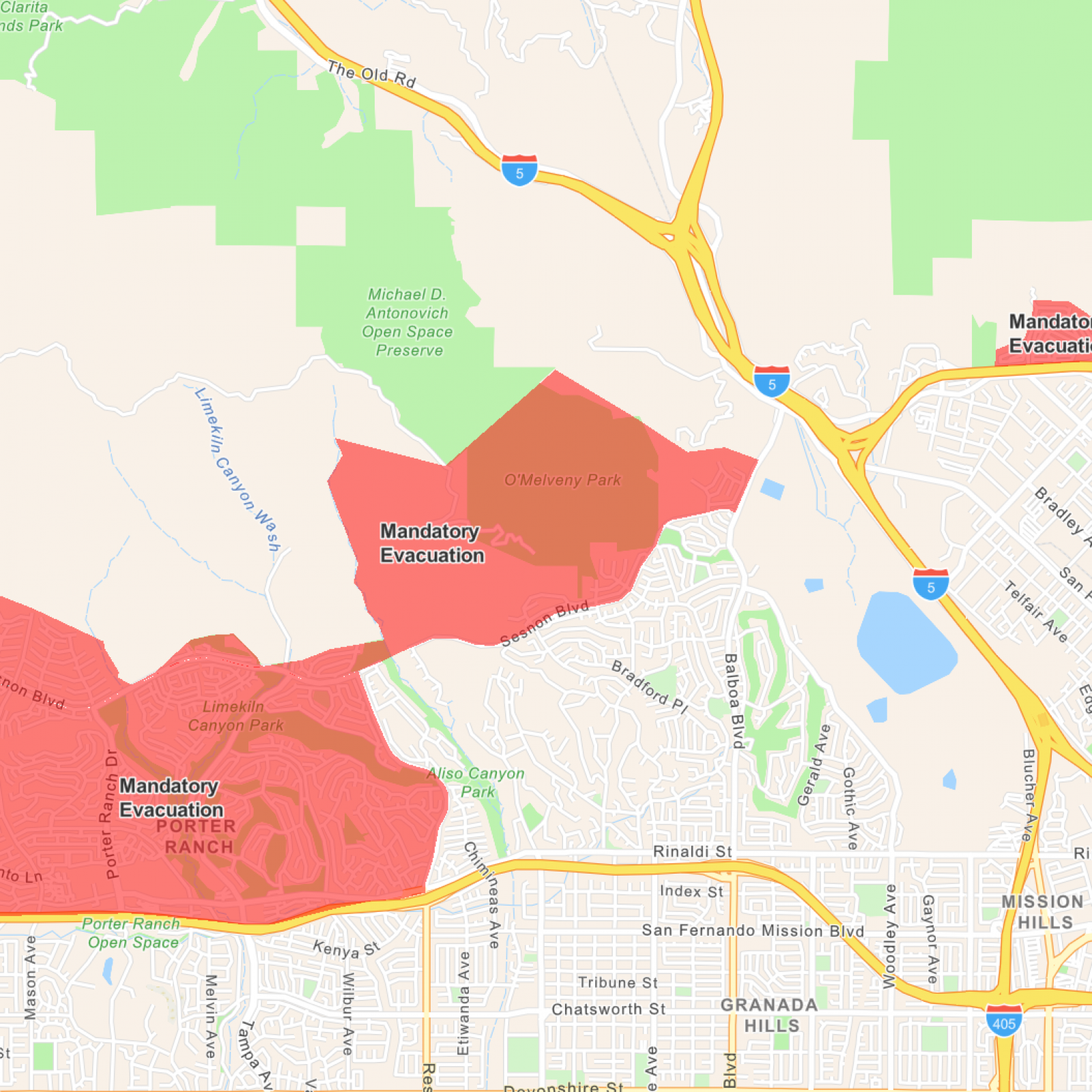

Los Angeles Palisades Fire A List Of Celebrities Who Lost Properties

Apr 24, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Properties

Apr 24, 2025