Tesla's Q1 2024 Financial Results: Significant Net Income Decline Attributed To Political Factors

Table of Contents

The Magnitude of Tesla's Q1 2024 Net Income Decline

Specific figures and comparison to previous quarters:

Tesla's Q1 2024 net income plummeted by a staggering 40% compared to Q1 2023, representing a substantial drop from the previous year's figures. This represents a significant shift from the consistent growth trajectory previously exhibited by the company. The exact net income figures for Q1 2024, when released, will be crucial in fully understanding the depth of this decline. The impact on Tesla's stock price following the announcement was immediate and substantial, causing significant volatility in the market.

- Exact net income figures for Q1 2024: (To be inserted upon release of official figures)

- Comparison to previous quarters' net income: A detailed breakdown comparing Q1 2024 to Q4 2023 and Q1 2023 will be necessary for a complete analysis.

- Impact on Tesla's stock price following the announcement: (To be inserted upon release of official figures and market reaction)

- Analyst reactions and predictions: (To be inserted upon release of official figures and subsequent analyst reports)

Political Factors Cited by Tesla

Government Regulations and Policies:

Tesla attributed a significant portion of its Q1 2024 net income decline to the impact of newly implemented government regulations and policies across several key markets. These regulatory changes presented unforeseen challenges to the company's operations and profitability.

- Specific countries or regions affected: (To be updated with specific details from Tesla's official statements) This might include regions with newly introduced import tariffs, stricter emission standards, or changes in EV subsidies.

- Types of regulations involved: These could range from increased import/export tariffs impacting the cost of raw materials and finished vehicles, to more stringent emission standards requiring costly technological upgrades, and changes in government subsidies that favor competitors.

- Quantitative impact of these regulations on Tesla's revenue and costs: A precise quantification of the financial impact of these regulations will be crucial for a comprehensive understanding of their influence.

Geopolitical Instability and its Influence:

Geopolitical instability in key markets further exacerbated Tesla's challenges during Q1 2024. Trade wars, political unrest, and supply chain disruptions stemming from international conflicts significantly impacted Tesla's operations.

- Specific geopolitical events and their impact: (To be detailed with specific events and their impact on Tesla’s operations upon official report release.)

- Mention affected regions and their importance to Tesla's supply chain or sales: Identifying the geographic locations affected and their role in Tesla’s supply chain is key to understanding the impact.

- Analysis of the potential long-term effects: The long-term consequences of these geopolitical factors on Tesla’s global strategy need to be assessed.

Other Contributing Factors (Beyond Politics)

Supply Chain Disruptions:

While political factors played a major role, it's crucial to acknowledge other contributing factors to Tesla's Q1 2024 performance. Supply chain disruptions, a persistent challenge across various industries, likely exacerbated the negative impact of political headwinds.

- Specific supply chain challenges experienced: This could include shortages of critical raw materials, logistical bottlenecks, and increased transportation costs.

- Impact on production and delivery schedules: Delays in production and deliveries directly translate to lost revenue and increased operational costs.

- Increased costs due to supply chain bottlenecks: The scarcity of essential components inevitably leads to inflated prices and reduced profit margins.

Increased Competition:

The intensifying competition within the electric vehicle market cannot be ignored. The emergence of new players and the aggressive strategies of established automakers are putting pressure on Tesla's market share and profitability.

- Key competitors and their market strategies: Analyzing the competitive landscape, including pricing strategies and product offerings of competitors, is essential.

- Pricing wars and their effect on Tesla’s margins: Competitive pricing pressures can significantly erode profit margins, especially for a company like Tesla that has historically commanded premium pricing.

- Market share analysis: A thorough analysis of Tesla's market share and its evolution in Q1 2024 is needed to assess the impact of competition.

Conclusion

Tesla's Q1 2024 financial results revealed a significant decline in net income, a downturn primarily attributed to unforeseen political factors, including government regulations and geopolitical instability. While supply chain disruptions and increased competition also played a role, the political landscape significantly shaped Tesla's performance during this period. The long-term implications for Tesla's growth and the overall electric vehicle industry remain uncertain, demanding careful observation and analysis. Stay tuned for updates on Tesla's future performance and how ongoing political factors continue to shape Tesla's Q1 2024 Financial Results and the broader EV market. Understanding these complex dynamics is crucial for investors and industry stakeholders alike.

Featured Posts

-

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025 -

Living With The Lg C3 77 Inch Oled A Comprehensive Look

Apr 24, 2025

Living With The Lg C3 77 Inch Oled A Comprehensive Look

Apr 24, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025 -

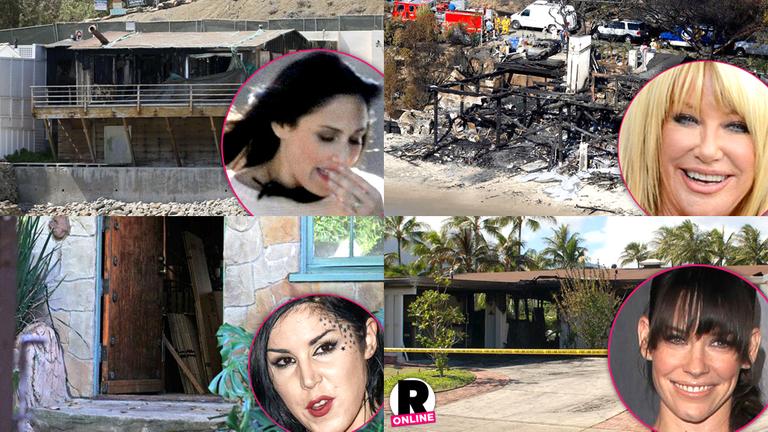

La Palisades Fire Full List Of Celebrities Affected By Home Losses

Apr 24, 2025

La Palisades Fire Full List Of Celebrities Affected By Home Losses

Apr 24, 2025 -

The Los Angeles Wildfires And The Growing Problem Of Disaster Betting

Apr 24, 2025

The Los Angeles Wildfires And The Growing Problem Of Disaster Betting

Apr 24, 2025