The Grim Truth About Retail Sales: Implications For Bank Of Canada Policy

Table of Contents

Declining Retail Sales: A Deeper Dive into the Data

Analyzing the Recent Retail Sales Figures

Statistics Canada's latest reports paint a concerning picture. Retail sales experienced a [Insert specific percentage]% month-over-month decline in [Insert month, year], following a [Insert specific percentage]% year-over-year decrease. This downturn is particularly pronounced in specific sectors.

- Specific data from Statistics Canada or other reliable sources: For example, "Clothing sales fell by X%, while furniture sales dropped by Y%." (Replace X and Y with actual data).

- Geographical variations in retail sales performance across Canada: "The decline in retail sales is not uniform across the country, with [Province/region] experiencing a more significant drop than [Province/region]."

- Comparison with previous economic downturns and recoveries: "This decline is comparable to the downturn observed during [Previous economic event], suggesting a potential for [Similar outcome/different outcome]."

Identifying the Contributing Factors

Several factors contribute to this weakening in retail sales.

- High inflation and its impact on consumer spending: Soaring inflation, particularly in food and energy prices, is significantly reducing consumer purchasing power, leaving less disposable income for discretionary spending.

- Rising interest rates and their effect on borrowing and consumer confidence: The Bank of Canada's recent interest rate hikes, aimed at curbing inflation, have increased borrowing costs for consumers, dampening consumer confidence and reducing spending on big-ticket items like houses and cars.

- Global economic uncertainty and its ripple effect on the Canadian economy: Global economic instability, including geopolitical tensions and supply chain disruptions, is creating uncertainty in the Canadian market, impacting both consumer and business confidence.

- Shifting consumer preferences and the rise of e-commerce: The continued shift towards online shopping and changing consumer preferences are also reshaping the retail landscape, forcing traditional brick-and-mortar stores to adapt or face decline.

The Bank of Canada's Response: Monetary Policy Considerations

Interest Rate Adjustments and Their Potential Impact

The Bank of Canada's response to these weakening retail sales figures will be crucial. The central bank faces a difficult balancing act.

- Analysis of the Bank of Canada's mandate and its inflation targets: The Bank of Canada's primary mandate is to control inflation. However, excessively aggressive interest rate hikes could trigger a recession.

- Discussion of the trade-off between inflation control and economic growth: Raising interest rates further could curb inflation but also risk slowing economic growth and increasing unemployment. Conversely, holding rates steady or cutting them might boost economic activity but could allow inflation to remain stubbornly high.

- Potential consequences of different monetary policy choices: A further interest rate hike might lead to a sharper contraction in consumer spending and a rise in unemployment, while rate cuts might fuel inflationary pressures.

Other Policy Tools and Their Effectiveness

Beyond interest rate adjustments, the Bank of Canada may employ other policy tools.

- Quantitative easing or other unconventional monetary policies: While less likely in the current environment, the Bank might consider unconventional monetary policies to stimulate the economy if the situation worsens significantly.

- Coordination with the federal government on fiscal policy measures: Close coordination with the federal government on fiscal policies, such as targeted tax cuts or infrastructure spending, could offer additional support to the economy.

- Communication strategy to manage expectations and maintain market confidence: Clear and consistent communication from the Bank of Canada is essential to manage market expectations and maintain investor confidence.

Long-Term Implications for the Canadian Economy

Potential Economic Scenarios

The future trajectory of the Canadian economy depends heavily on the Bank of Canada's response and evolving economic conditions.

- Best-case scenario: A swift recovery driven by government intervention or a rebound in consumer confidence, leading to a gradual increase in retail sales and economic growth.

- Worst-case scenario: A prolonged recession with higher unemployment and further economic contraction, necessitating significant government intervention and potentially long-term structural changes.

- Moderate scenario: A slow but steady recovery with adjustments to both monetary and fiscal policies, leading to gradual economic growth and a stabilization of retail sales.

Opportunities and Challenges for Businesses

Retail businesses need to adapt to this changing landscape.

- Strategies for improving efficiency and cost management: Implementing leaner operations, optimizing supply chains, and reducing overhead costs are critical for survival in a challenging economic climate.

- Importance of adapting to evolving consumer preferences: Understanding and catering to changing consumer preferences, embracing omnichannel strategies, and offering personalized experiences are crucial for maintaining competitiveness.

- Exploring new market segments and diversification strategies: Businesses should explore new market segments and diversify their product offerings to reduce their reliance on any single market or product.

Conclusion

The grim truth about current retail sales in Canada reveals a significant economic challenge. The interconnectedness of retail sales, consumer confidence, and overall economic health is undeniable. The Bank of Canada's response to this downturn will significantly impact the future trajectory of the Canadian economy. Understanding the current state of retail sales is crucial for navigating the complexities of the Canadian economy. Stay updated on the latest data and Bank of Canada announcements to make informed decisions regarding your investments and business strategies. Further research on retail sales in Canada, Bank of Canada monetary policy, and the Canadian economic outlook is highly recommended.

Featured Posts

-

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 28, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 28, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Acquisition

Apr 28, 2025

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Acquisition

Apr 28, 2025 -

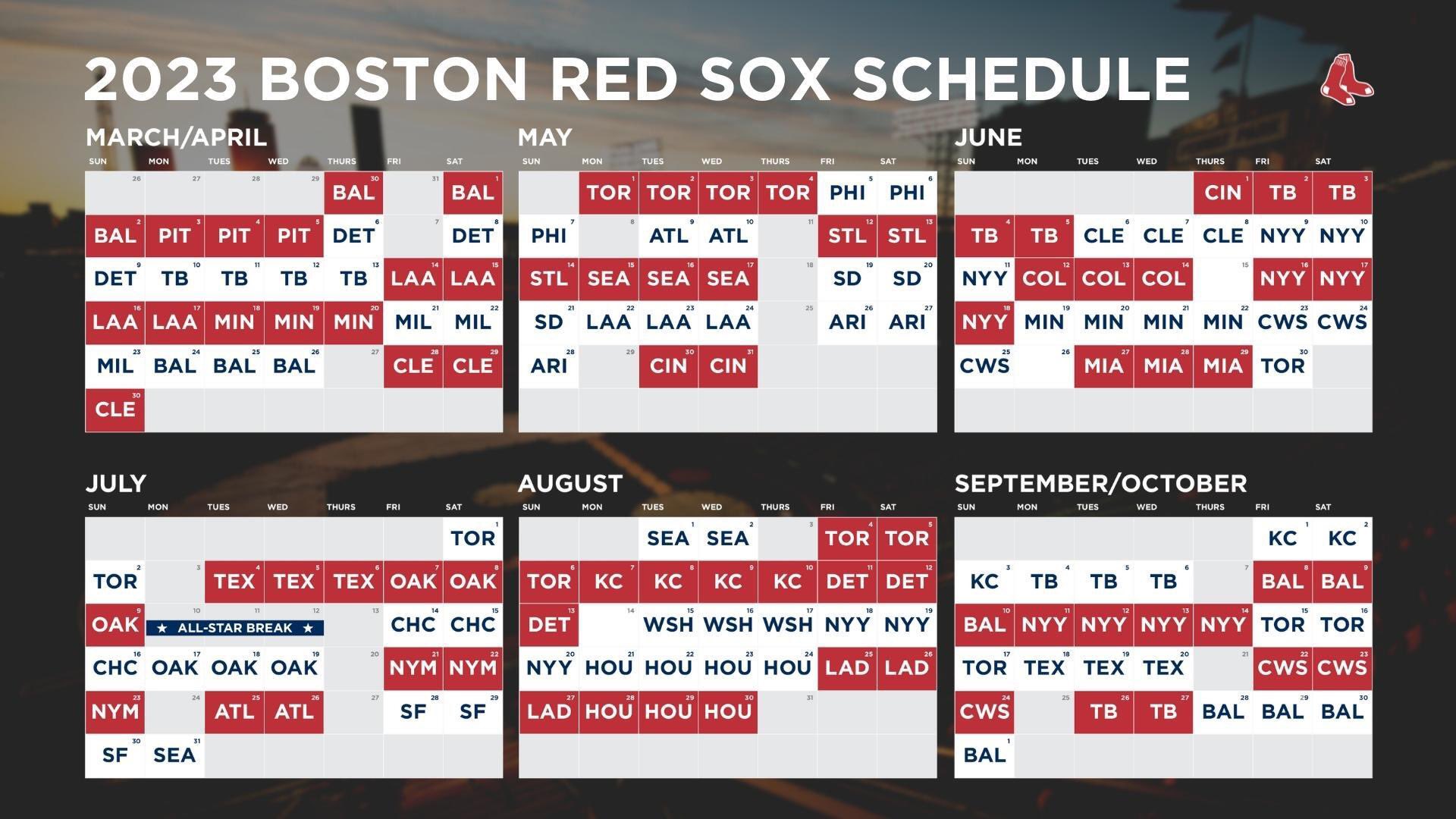

Addressing The O Neill Void Red Sox Roster Moves For 2025

Apr 28, 2025

Addressing The O Neill Void Red Sox Roster Moves For 2025

Apr 28, 2025 -

Mhrjan Abwzby 2024 Asatyr Almwsyqa Alealmyt Thtfl

Apr 28, 2025

Mhrjan Abwzby 2024 Asatyr Almwsyqa Alealmyt Thtfl

Apr 28, 2025 -

Red Sox 2025 Espns Outfield Lineup Projection

Apr 28, 2025

Red Sox 2025 Espns Outfield Lineup Projection

Apr 28, 2025