The Need For Fiscal Responsibility In Canada's Vision

Table of Contents

The Current State of Canada's Finances

Canada's fiscal health is a complex issue. While boasting a relatively strong economy, the country faces significant challenges. The national debt continues to climb, fuelled by persistent deficits and increasing government spending. Understanding this reality is paramount to implementing effective solutions for improved fiscal responsibility in Canada.

- Current National Debt: As of [Insert most recent data on Canada's national debt], Canada's national debt stands at [Insert figure], representing a considerable percentage of the country's GDP. This figure requires careful monitoring and strategic management.

- Government Spending Breakdown: A large portion of government spending is allocated to essential social services such as healthcare ([Insert percentage]), education ([Insert percentage]), and social welfare programs ([Insert percentage]). While these are crucial, careful evaluation of their efficiency and potential for cost-saving measures is necessary. Defence spending accounts for approximately [Insert percentage].

- Tax Revenue Streams: Canada's tax system relies heavily on personal and corporate income taxes, as well as indirect taxes like the Goods and Services Tax (GST). The effectiveness of these revenue streams, particularly in the face of economic fluctuations and potential tax evasion, requires ongoing assessment and potential reform.

- International Comparison: Comparing Canada's debt-to-GDP ratio and fiscal deficit to other G7 nations provides valuable context. While Canada's situation isn't necessarily the worst, it warrants proactive steps to ensure its long-term fiscal sustainability.

Strategies for Achieving Fiscal Responsibility

Addressing Canada's fiscal challenges requires a multi-pronged approach encompassing targeted spending cuts, tax reforms, enhanced revenue collection, and investment in long-term economic growth. Implementing these strategies will be crucial for achieving sustainable fiscal responsibility in Canada.

- Targeted Spending Cuts and Prioritization: Identifying areas where government spending can be streamlined without compromising essential services is vital. This might include reducing administrative costs, improving procurement processes, and optimizing the delivery of existing programs. A careful review of departmental budgets and performance indicators is necessary to achieve this.

- Tax Reform: Reforming Canada's tax system could generate increased revenue and stimulate economic growth. Options include adjusting corporate tax rates, exploring a more effective carbon tax system, and reviewing the GST/HST structure to optimize its impact while minimizing its burden on lower-income households. Any reforms must be carefully considered to avoid negatively impacting economic activity.

- Improved Revenue Collection: Strengthening tax collection efforts to combat tax evasion and avoidance is crucial. This can involve investing in advanced technologies, enhancing auditing capabilities, and implementing stricter penalties for non-compliance. Transparency and accountability in tax administration build public trust and encourage compliance.

- Investing in Long-Term Economic Growth: Investing in areas such as infrastructure, education, and research and development fosters long-term economic growth, ultimately increasing tax revenues and reducing the reliance on debt. Strategic investments in these areas represent a significant investment in Canada's future fiscal health.

The Long-Term Benefits of Fiscal Responsibility

Implementing responsible fiscal policies yields numerous long-term benefits for Canada. Prioritizing responsible fiscal management in Canada leads to several key advantages:

- Improved Credit Rating and Reduced Borrowing Costs: A strong fiscal position enhances Canada's credit rating, allowing the government to borrow money at lower interest rates, saving taxpayers significant amounts of money over time.

- Increased Investor Confidence: A fiscally responsible government attracts foreign investment, fostering economic growth and job creation. Investor confidence is a key driver of economic expansion.

- Greater Capacity to Invest in Essential Public Services: A stronger fiscal position provides the government with greater capacity to invest in crucial public services like healthcare, education, and infrastructure, improving the quality of life for all Canadians.

- Enhanced Economic Stability and Reduced Vulnerability to Economic Shocks: A strong fiscal foundation provides a buffer against economic downturns, reducing the severity of recessions and protecting vulnerable populations.

- Stronger Social Safety Net: A healthy fiscal position allows for the preservation and enhancement of social programs, ensuring a robust social safety net for Canadians in times of need.

The Role of Transparency and Accountability

Transparency and accountability are cornerstones of effective fiscal management. Open access to government financial information, independent audits, and robust parliamentary oversight are essential for ensuring responsible spending and building public trust. Mechanisms like these are critical for achieving fiscal sustainability in Canada.

Securing Canada's Future through Fiscal Responsibility

Achieving a sustainable and prosperous future for Canada requires a firm commitment to fiscal responsibility in Canada. The strategies outlined—targeted spending, tax reform, improved revenue collection, and investment in long-term growth—are not mutually exclusive but rather complementary components of a comprehensive approach. Transparency and accountability are paramount to building public trust and ensuring the effectiveness of these measures.

Demand fiscal responsibility from your elected officials. Learn more about Canada's budget and advocate for a financially secure future. Visit the [link to relevant government website] and [link to another relevant resource] for more information. Let's work together to ensure a financially sound and prosperous future for Canada through responsible fiscal management.

Featured Posts

-

The Bold And The Beautiful Spoilers Liams Medical Emergency Whats Next

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Emergency Whats Next

Apr 24, 2025 -

Us Stock Futures Positive Reaction To Trumps Remarks On Fed Chair

Apr 24, 2025

Us Stock Futures Positive Reaction To Trumps Remarks On Fed Chair

Apr 24, 2025 -

Wednesday April 9 The Bold And The Beautiful Recap Icu Drama And Family Conflicts

Apr 24, 2025

Wednesday April 9 The Bold And The Beautiful Recap Icu Drama And Family Conflicts

Apr 24, 2025 -

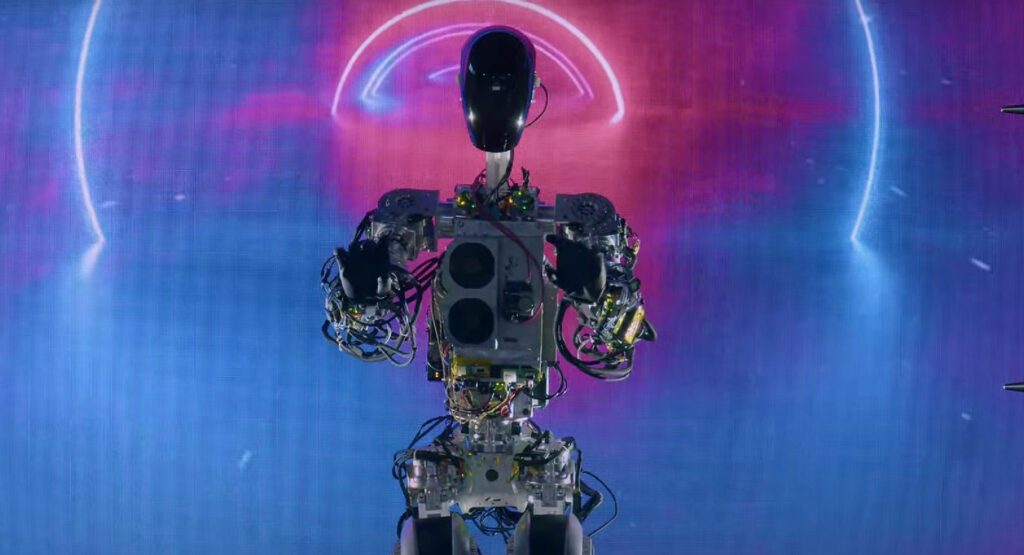

Rare Earth Supply Constraints Hamper Teslas Optimus Robot Project

Apr 24, 2025

Rare Earth Supply Constraints Hamper Teslas Optimus Robot Project

Apr 24, 2025 -

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025

Google Fis 35 Unlimited Plan A Detailed Review

Apr 24, 2025