The Role Of Tax Credits In Growing Minnesota's Film Industry

Table of Contents

Attracting Film Productions to Minnesota

Minnesota's competitive landscape for attracting film productions hinges on the effectiveness of its tax credit program. To remain competitive, the state must offer incentives comparable to neighboring states and other prominent filming locations.

Competitive Tax Credit Rates

Successfully attracting major productions requires a robust and competitive tax credit structure. Minnesota's rates need to be carefully analyzed and adjusted to remain appealing against competitors like Wisconsin, Illinois, and Iowa.

- Comparison to Neighboring States: A detailed comparison of Minnesota's film tax credit rates against Wisconsin's, Illinois', and Iowa's programs is crucial. This analysis should highlight any discrepancies and suggest potential adjustments to maintain competitiveness. For example, if Wisconsin offers a higher percentage rebate, Minnesota might need to consider increasing its own rate to remain attractive to major productions.

- Success Stories: Showcasing specific examples of productions that chose Minnesota because of the tax credits is essential to demonstrate their effectiveness. This could involve case studies of successful films or TV shows filmed in the state, highlighting the financial benefits received through the tax credit program.

- Impact of Credit Caps: Addressing the impact of any existing caps on the tax credits is crucial. Understanding the limitations and the potential for these caps to hinder the attraction of large-scale productions is key to evaluating the program's overall effectiveness. Analyzing whether these caps need adjustment to attract larger-budget projects would be beneficial.

Incentivizing Diverse Productions

The Minnesota film tax credit program should actively encourage a diverse range of productions beyond large-budget feature films. This includes supporting independent films, documentaries, commercials, and television series.

- Support for Independent Filmmakers: Highlighting specific provisions within the tax credit program that specifically benefit independent filmmakers and smaller productions is vital. This could include simplified application processes or tailored credit amounts designed to support emerging talent and diverse storytelling.

- Promoting Diverse Storytelling: The program should be structured to encourage productions that showcase diverse narratives and perspectives, reflecting the rich cultural tapestry of Minnesota. This will attract a wider range of talent and ensure the film industry's growth reflects the state's diversity.

- Local Talent Development: Emphasizing how the tax credits support local talent and crew members is crucial. A vibrant local film industry fosters a sense of community and creates a more sustainable ecosystem for filmmaking.

Boosting the Minnesota Economy

The economic benefits of a thriving film industry extend far beyond the immediate production. The influx of film productions creates numerous jobs and stimulates related industries, significantly contributing to the state's overall economic health.

Job Creation and Economic Impact

Film productions generate a substantial number of jobs, both directly and indirectly. This includes on-screen talent, crew members, catering services, transportation, and local businesses that provide goods and services.

- Direct and Indirect Employment Statistics: Providing concrete statistics about job creation in Minnesota's film industry is crucial. This could include data on the number of jobs created directly by film productions and the indirect jobs supported by related businesses.

- Economic Ripple Effect: Illustrating the economic ripple effect across various sectors of the Minnesota economy is vital. This could include examples of how local restaurants, hotels, and other businesses benefit from the increased activity brought by film productions.

- Case Studies: Providing case studies of specific productions and their associated economic impact on local communities would strengthen the argument for continued investment in the tax credit program.

Infrastructure Development

The increased activity in the film industry leads to a demand for enhanced infrastructure, encouraging investment in studios, soundstages, and post-production facilities.

- Need for Film-Friendly Infrastructure: Addressing the current needs and gaps in Minnesota's film-friendly infrastructure is important. Identifying areas where investment is needed (e.g., more soundstages, improved production facilities) helps justify the continuation and potential expansion of the tax credit program.

- Stimulating Private Investment: Highlighting how the tax credit program can incentivize private investment in film-related infrastructure is crucial. This demonstrates the program's role not only in attracting productions but also in building a sustainable film industry ecosystem.

- Successful Infrastructure Projects: Showcasing successful examples of infrastructure development spurred by the film industry's growth would demonstrate the program's effectiveness. This could include examples of newly built studios or expanded post-production facilities.

Supporting Local Talent and Businesses

The Minnesota film tax credit program is crucial in providing opportunities for local filmmakers, actors, and crew members to thrive. It also bolsters related industries, creating a robust and sustainable film ecosystem.

Opportunities for Minnesota Filmmakers

The tax credits create a significant boost for local talent, enabling them to participate in larger productions and gain valuable experience.

- Success Stories of Minnesotan Talent: Showcasing examples of Minnesota-based filmmakers, actors, and crew members who have benefited from working on productions attracted by the tax credit program is vital. This humanizes the impact of the program and demonstrates its role in nurturing local talent.

- Mentorship and Training Programs: Highlighting the importance of mentorship and training programs that support the development of local talent is critical. A skilled workforce is crucial for attracting high-quality productions and sustaining long-term growth.

Business Growth in Related Industries

The film industry provides substantial support for a network of related businesses, including equipment rental companies, catering services, and transportation providers.

- Examples of Local Business Success: Showcasing specific examples of local businesses that have experienced growth due to the increase in film production activity in Minnesota. This demonstrates the positive economic impact that extends beyond the direct film production.

- Supporting Local Suppliers: Emphasizing the importance of using local businesses for goods and services needed during film production. This helps build stronger local partnerships and fosters economic growth within the state.

Conclusion

Minnesota's film tax credit program has undeniably played a vital role in the growth and success of the state's film industry. By attracting productions, creating jobs, and boosting the economy, the program has proven to be a valuable investment. Its continued success hinges on maintaining competitive rates, fostering inclusivity across different types of productions, and actively supporting the growth of related industries and local talent.

To ensure the continued flourishing of Minnesota's film industry, ongoing investment and strategic improvements to the Minnesota film tax credits program are essential. Learn more about how these incentives are shaping the future of filmmaking in the state and actively support initiatives that champion this crucial economic driver.

Featured Posts

-

Germanys Stricter Border Controls Yield Lowest Post Covid Migration Numbers

Apr 29, 2025

Germanys Stricter Border Controls Yield Lowest Post Covid Migration Numbers

Apr 29, 2025 -

Adidas Anthony Edwards 2 Release Date Specs And Design Details

Apr 29, 2025

Adidas Anthony Edwards 2 Release Date Specs And Design Details

Apr 29, 2025 -

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025 -

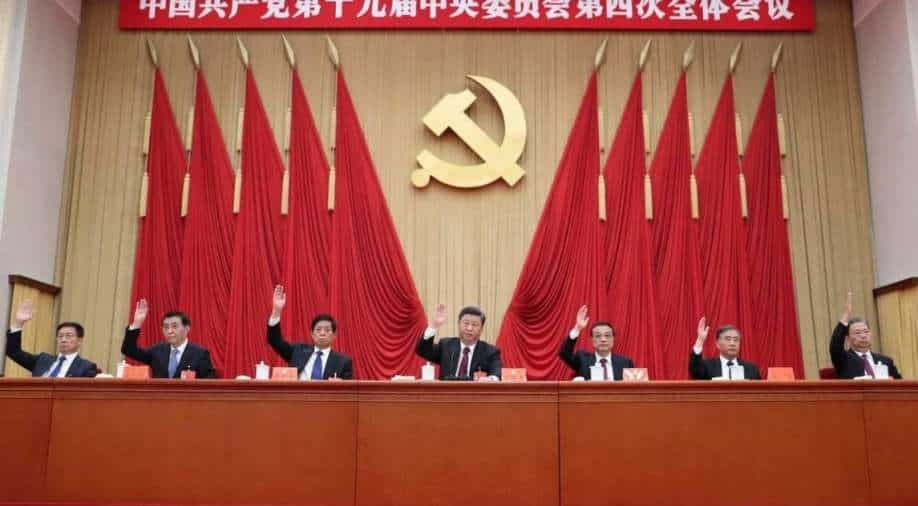

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025 -

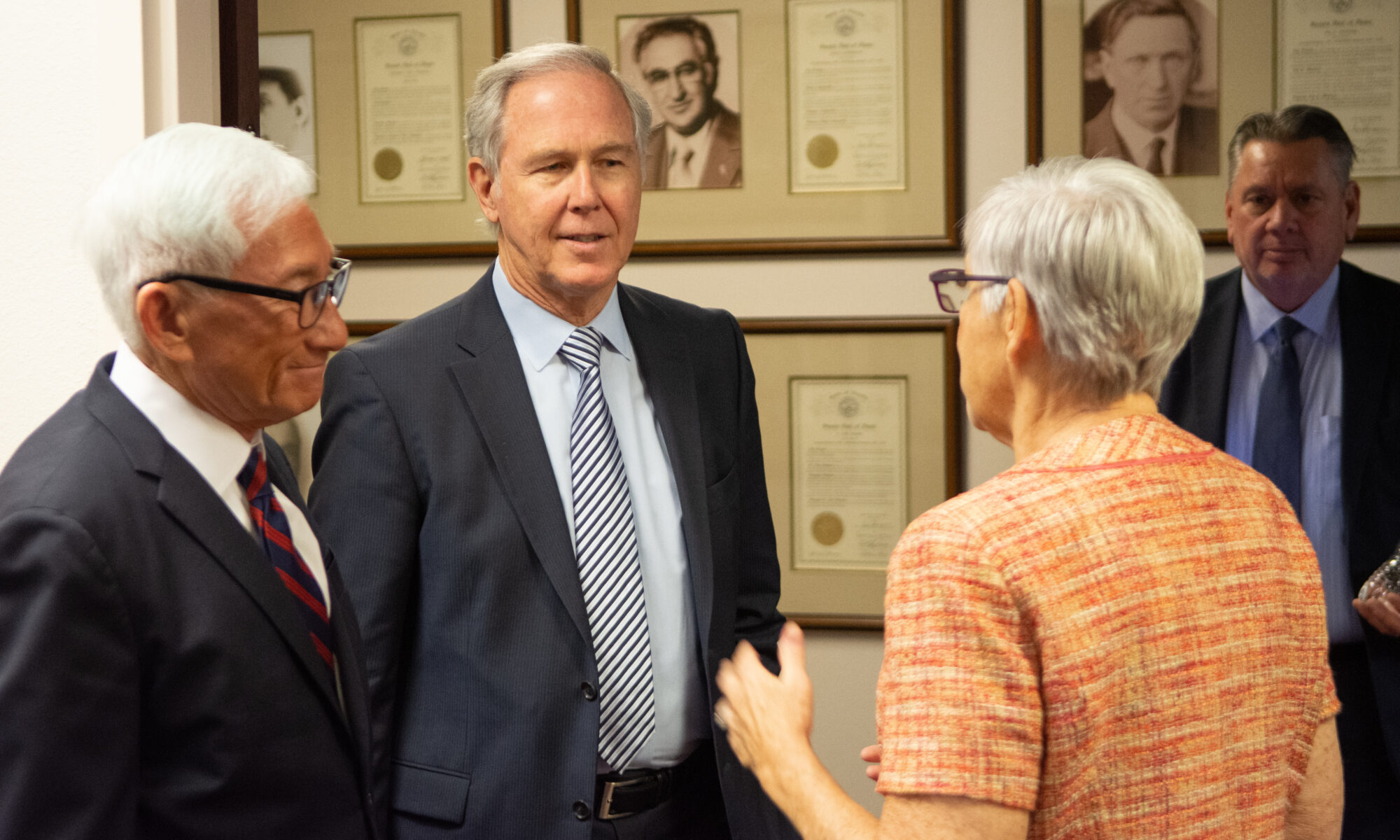

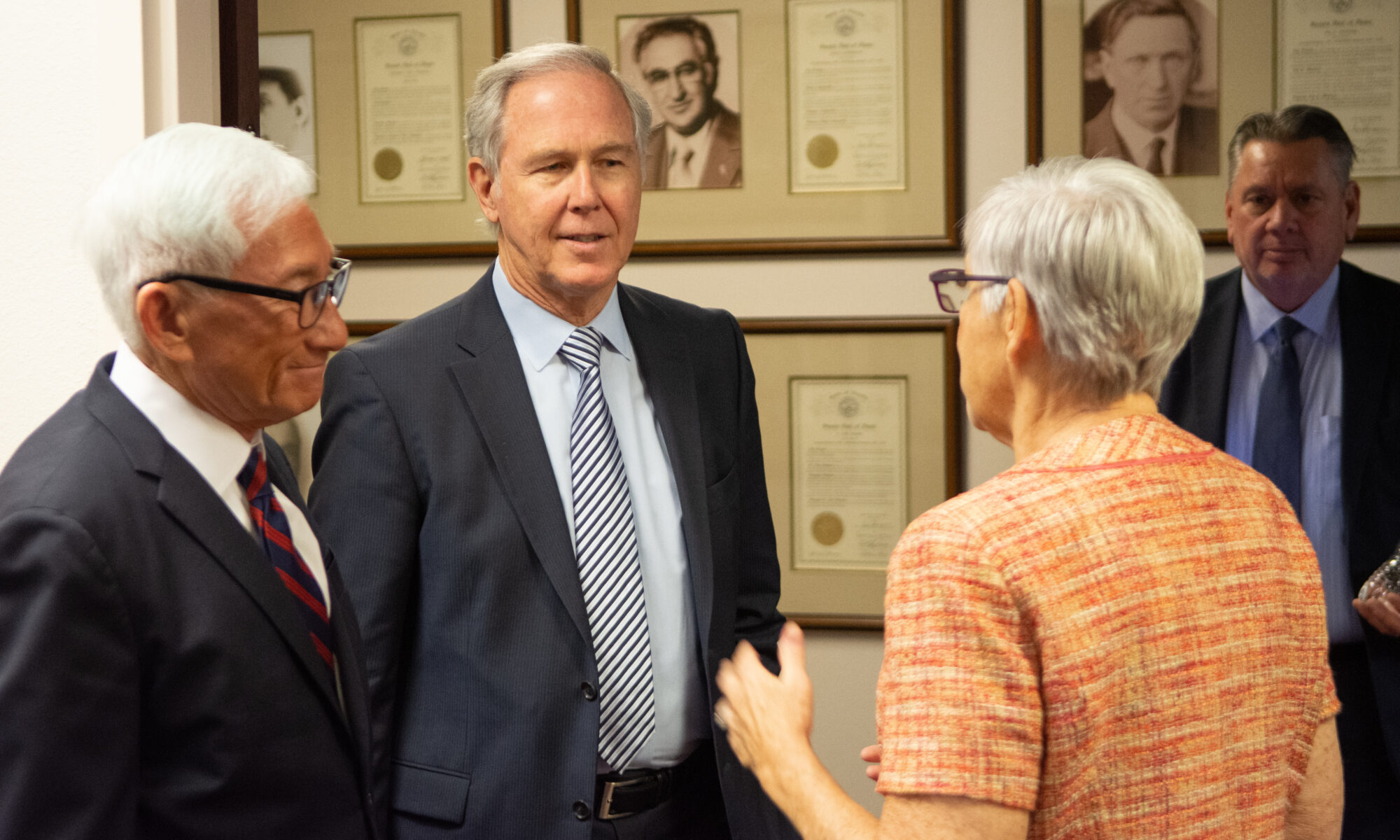

Legal Showdown Minnesota And The Trump Transgender Athlete Ban

Apr 29, 2025

Legal Showdown Minnesota And The Trump Transgender Athlete Ban

Apr 29, 2025