TikTok's "Just Contact Us" Tariff Workarounds: A CNN Investigation

Table of Contents

The "Just Contact Us" Strategy: A Detailed Look

At the heart of the controversy lies TikTok's alleged reliance on an informal, undocumented process: contacting vendors directly to negotiate lower prices or avoid tariffs altogether. This “Just Contact Us” strategy, lacking transparency and formal documentation, provides a fertile ground for manipulation and abuse. This contrasts sharply with the standard, transparent procedures expected for importing goods into the US.

- Informal Process: Instead of adhering to established customs and import regulations, the CNN investigation suggests that TikTok leveraged personal contacts and informal negotiations to reduce or eliminate import duties on various goods. This involved bypassing official channels and documented procedures.

- Potential for Manipulation: The lack of formal documentation makes it incredibly easy to manipulate the process, potentially underreporting the value of goods or misclassifying them to lower tariffs. This alleged system inherently invites abuse and undermines the integrity of the import system.

- CNN Investigation Examples: The CNN investigation included specific examples, citing instances where TikTok allegedly negotiated favorable terms directly with vendors, significantly reducing the amount of import duties paid compared to what would be expected under standard procedures. These examples highlighted the ease with which the "Just Contact Us" strategy seemingly allowed TikTok to avoid proper import processes.

The Legal Implications of TikTok's Actions

The allegations against TikTok raise serious legal questions. The informal “Just Contact Us” approach potentially violates several US trade laws and regulations designed to ensure fair competition and the collection of appropriate import duties.

- Penalties for Tariff Evasion: The penalties for tariff evasion can be severe, ranging from significant financial fines to criminal charges, depending on the scale and nature of the violation. This includes potential back taxes on improperly declared goods.

- Relevant Legal Precedents: Several similar cases exist where companies faced legal repercussions for employing deceptive practices to evade import duties. These precedents highlight the seriousness of the allegations against TikTok and the potential legal consequences.

- Ramifications for TikTok: If found guilty of systematically avoiding import duties through the alleged "Just Contact Us" strategy, TikTok could face substantial financial penalties, reputational damage, and potential regulatory action, potentially impacting its operations within the US market.

The Impact on Competitors and the US Economy

TikTok’s alleged tariff avoidance creates an uneven playing field, providing it with an unfair competitive advantage over companies that comply with US import regulations.

- Negative Impact on US Companies: Legitimate businesses operating within the US face higher import costs due to tariffs. This puts them at a disadvantage compared to companies like TikTok that allegedly avoid these costs through informal methods.

- Market Distortion: The alleged practice of TikTok tariff evasion distorts the market, undermining fair competition and potentially harming the overall US economy. This unfair advantage allows TikTok to undercut competitors and potentially gain a larger market share.

- Long-Term Consequences: The long-term consequences could include reduced investment in US-based businesses, job losses, and a weakened US manufacturing sector. The sustained ability to avoid import duties could create a significant imbalance in the market.

Responses from TikTok and Relevant Authorities

At the time of writing, TikTok has yet to issue a comprehensive statement directly addressing the specific allegations outlined in the CNN investigation regarding the "Just Contact Us" tariff workarounds. However, [insert any official statements from TikTok here].

- US Trade Agency Responses: [Insert responses from relevant US trade agencies like the U.S. Customs and Border Protection (CBP) or the International Trade Administration (ITA) here]. These responses should be carefully analyzed for their implications and whether they indicate an ongoing investigation.

- Credibility of Responses: The credibility of any statements issued by TikTok or government agencies needs to be assessed based on the evidence presented and the transparency of their actions.

- Ongoing Investigations: The details of any ongoing investigations or legal proceedings should be mentioned, providing context and an indication of future developments.

Future Implications and Regulatory Changes

This controversy highlights the need for improved transparency and accountability within the import process to prevent similar occurrences in the future.

- Improved Import Process: Changes to the import process could include greater digitalization, more stringent documentation requirements, and stricter monitoring of import declarations to reduce the opportunity for manipulation.

- Accountability for Social Media Companies: Greater accountability should be demanded from large social media companies, ensuring compliance with import regulations and preventing the exploitation of loopholes.

- Stricter Enforcement: The enforcement of existing trade laws needs to be strengthened, with increased resources dedicated to identifying and prosecuting instances of tariff evasion.

Conclusion

The CNN investigation into TikTok's alleged use of "Just Contact Us" methods to bypass tariffs reveals a troubling potential loophole in US import regulations. The alleged practice of TikTok tariff evasion raises serious concerns about fair trade, economic competition, and the integrity of the US import system. The potential consequences for TikTok, its competitors, and the US economy are significant. The lack of transparency and potential for abuse highlighted by this investigation underscore the need for stricter regulations and increased accountability. Stay informed about the ongoing developments concerning TikTok's "Just Contact Us" tariff workarounds and the broader issue of fair trade practices. Further research into avoiding import duties and the legal ramifications of such practices is crucial to ensuring a level playing field for all businesses operating within the US market.

Featured Posts

-

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 22, 2025

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 22, 2025 -

Pope Francis Legacy The Conclaves Crucial Test

Apr 22, 2025

Pope Francis Legacy The Conclaves Crucial Test

Apr 22, 2025 -

The Deteriorating Us China Relationship Understanding The Risks Of A New Cold War

Apr 22, 2025

The Deteriorating Us China Relationship Understanding The Risks Of A New Cold War

Apr 22, 2025 -

Ukraine Under Fire Russia Launches New Aerial Attacks As Us Seeks Peace

Apr 22, 2025

Ukraine Under Fire Russia Launches New Aerial Attacks As Us Seeks Peace

Apr 22, 2025 -

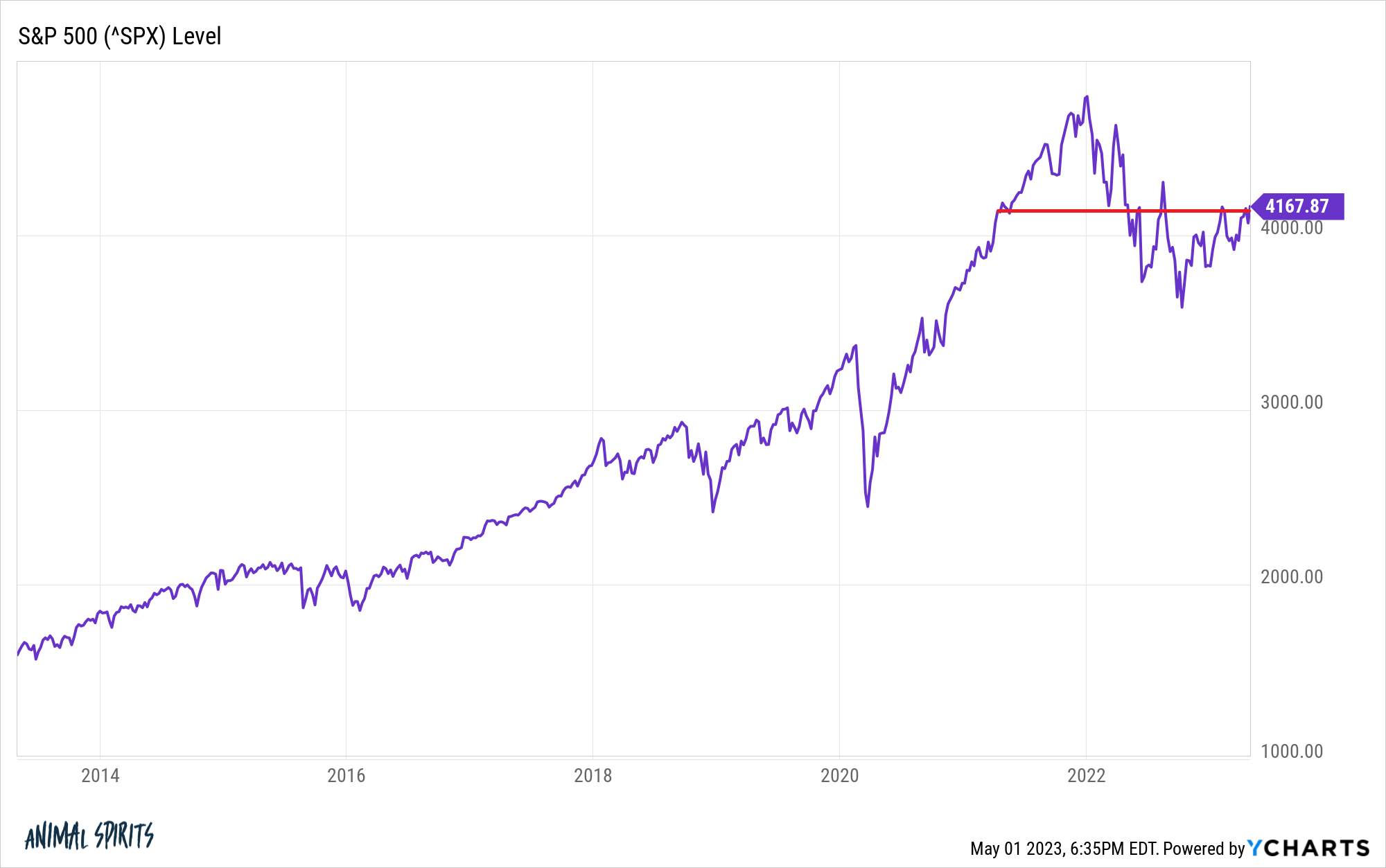

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025