Trump's Attack On Jerome Powell: Calls For Fed Chair's Termination

Table of Contents

Trump's Criticisms of Jerome Powell's Monetary Policy

Trump consistently voiced his displeasure with Powell's leadership of the Federal Reserve, largely focusing on monetary policy decisions. These criticisms significantly impacted market sentiment and fueled debates about the appropriate balance between political influence and the Fed's independence.

Interest Rate Hikes and Economic Growth

Trump frequently criticized Powell's decision to raise interest rates, arguing they hampered economic growth and jeopardized his reelection prospects. He viewed the rate hikes as an obstacle to his administration's economic agenda, which prioritized robust growth and job creation.

- Specific Rate Hikes: The Federal Reserve raised interest rates several times between 2017 and 2019, including increases in March, June, and December of 2018. These hikes were intended to combat inflation and maintain price stability.

- Trump's Public Statements: Trump frequently took to Twitter and other public forums to express his frustration with the Fed's actions. He labeled the rate increases as "crazy" and "unnecessary," arguing they were hindering economic progress. [Link to example news article criticizing Trump's statements].

- Economic Context: While the economy was experiencing job growth during this period, inflation was also beginning to rise, prompting the Fed's tightening of monetary policy. Unemployment rates were relatively low, but concerns existed about overheating. [Link to official Fed statement on economic conditions during that time].

Inflation and the Fight Against Rising Prices

Trump also blamed Powell for rising inflation, claiming the Fed's response was too slow and insufficient to curb price increases. This criticism overlooked the complexities of managing inflation and the inherent time lag between monetary policy changes and their effects on inflation.

- Inflation Rates: Inflation rates gradually increased during Trump's presidency, reaching levels that exceeded the Federal Reserve's 2% target. [Data source: Bureau of Labor Statistics CPI data].

- Fed's Response: The Fed's response to rising inflation involved a gradual increase in interest rates, a strategy aimed at preventing a rapid surge in prices that could disrupt the economy.

- Alternative Viewpoints: Economists hold differing views on the optimal approach to inflation control. Some argue for more aggressive measures to quickly address price increases, while others advocate for a more gradual approach to avoid unintended negative consequences on economic growth and employment. [Link to article on differing economic viewpoints on inflation].

The Implications for the Federal Reserve's Independence

Trump's unprecedented attacks on Powell raised significant concerns about the potential erosion of the Federal Reserve's independence, a cornerstone of a healthy and stable economy.

Political Interference in Monetary Policy

The Federal Reserve's independence is crucial for its ability to make objective decisions based on economic data and analysis, without political pressure or influence. Trump's actions undermined this principle, sparking debates about the appropriate limits of presidential power in influencing monetary policy.

- Importance of Independence: The Fed's independence safeguards it from short-term political pressures, allowing it to take a long-term view on economic stability. This protects the economy from potentially damaging political interference.

- Potential Consequences: Political interference in monetary policy decisions can lead to inflationary pressures, financial instability, and reduced credibility of the central bank.

- Historical Precedent: While there have been instances of past presidents expressing opinions about the Fed's actions, Trump's frequent and intense criticism was unprecedented in its scale and intensity. [Link to article on historical presidential influence on the Fed].

The Impact on Market Confidence

Trump's attacks on the Federal Reserve, and specifically Jerome Powell, had a palpable impact on market confidence, introducing volatility and uncertainty.

- Market Volatility: Trump's statements often caused immediate market reactions, with significant fluctuations in stock prices and bond yields.

- Impact on Dollar and Bond Yields: The uncertainty created by the president's actions affected the value of the dollar and interest rates on government bonds, impacting investor sentiment and market stability.

- Investor Reactions: Investor confidence was clearly shaken by the unpredictable nature of the relationship between the President and the Fed Chair, affecting investment decisions and overall market stability. [Link to data on market indices and investor confidence during this period].

The Broader Consequences for the US Economy

The conflict between Trump and Powell extended beyond immediate market reactions, creating uncertainty and influencing global economic dynamics.

Uncertainty and Economic Forecasting

The intense political pressure exerted on the Fed created considerable uncertainty that complicated economic forecasting and policy planning.

- Impact on Investment Decisions: Businesses and investors were reluctant to make long-term commitments due to the uncertainty surrounding economic policy.

- Unpredictable Nature of Administration: The unpredictability stemming from Trump's stance on the Fed made it more difficult to project future economic trends and risks.

- Long-Term Effects on Growth: This uncertainty could have potentially long-term consequences for economic growth and investor confidence.

Global Market Reactions to US-Fed Relations

The conflict between the US President and the Fed Chairman had a ripple effect, influencing international markets and currency exchange rates.

- International Market Reactions: International markets closely monitored the situation, reacting to news about Trump's statements and their potential impact on the US economy.

- Impact on US Dollar and Global Trade: The uncertainty surrounding US economic policy affected the value of the US dollar and influenced global trade patterns.

- International Analyst Quotes: Global economists and financial analysts expressed concerns about the potential damage to the US economy and the international financial system. [Links to statements/articles from international analysts].

Conclusion

Donald Trump's relentless attacks on Jerome Powell represent a significant episode in the history of US economic policy, highlighting the complex interplay between political pressure and the independence of the Federal Reserve. The episode raised critical questions about the appropriate level of political influence on monetary policy and its implications for market stability and economic growth.

Call to Action: Understanding the dynamics of Trump's attack on Jerome Powell is crucial for anyone following US economic policy and the future of the Federal Reserve's independence. Continue to stay informed about the ongoing debates surrounding the Federal Reserve, interest rates, and presidential influence on monetary policy to better understand the complexities of the US economy.

Featured Posts

-

Cory Provus Reflects On The Influence Of Bob Uecker

Apr 23, 2025

Cory Provus Reflects On The Influence Of Bob Uecker

Apr 23, 2025 -

Remembering Bob Uecker Cory Provuss Heartfelt Tribute

Apr 23, 2025

Remembering Bob Uecker Cory Provuss Heartfelt Tribute

Apr 23, 2025 -

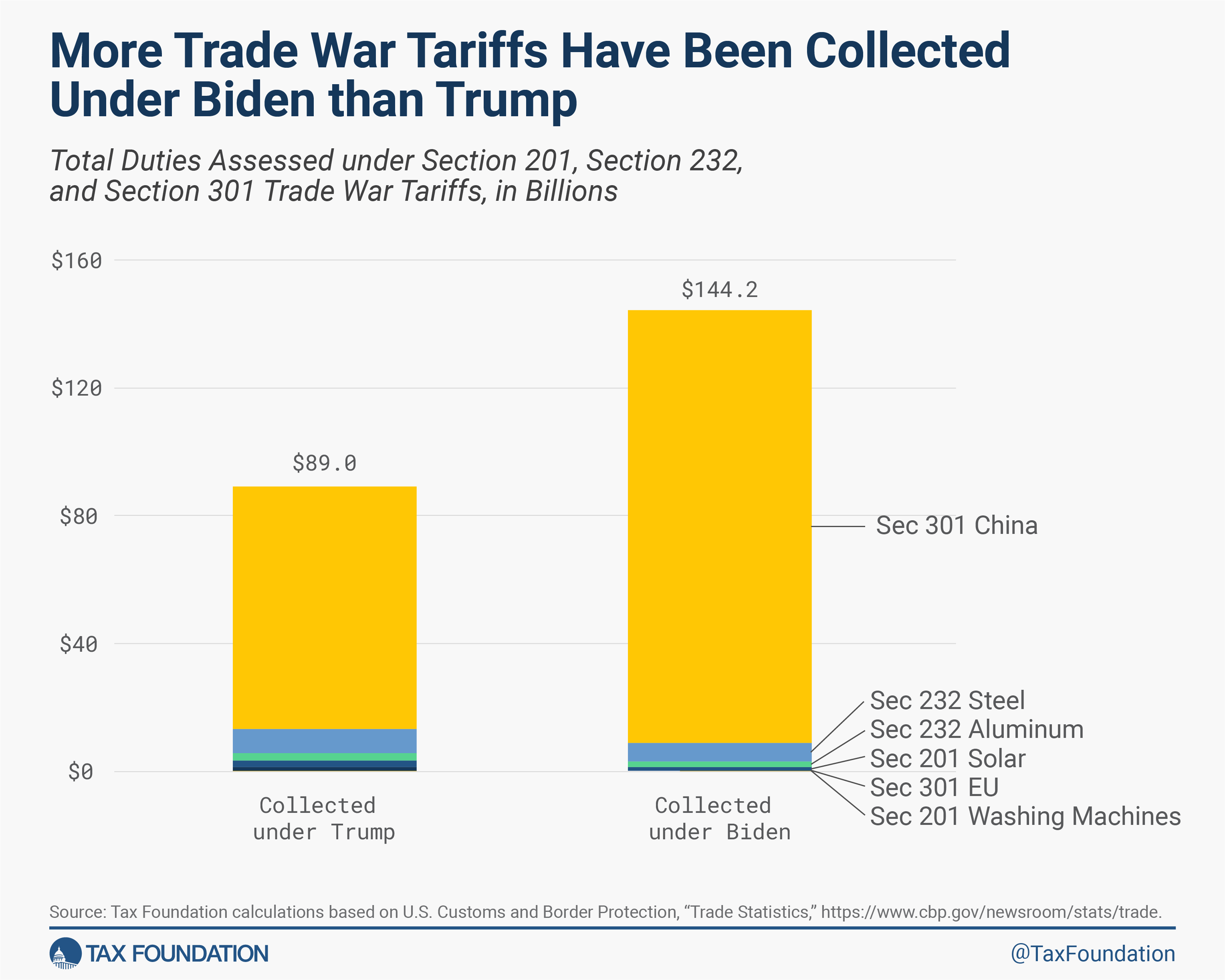

The High Cost Of Trade Wars Trumps Tariffs And Canadian Households

Apr 23, 2025

The High Cost Of Trade Wars Trumps Tariffs And Canadian Households

Apr 23, 2025 -

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025 -

Brewers Rout Rockies Chourios Homer And 5 Rbis Power Milwaukee

Apr 23, 2025

Brewers Rout Rockies Chourios Homer And 5 Rbis Power Milwaukee

Apr 23, 2025